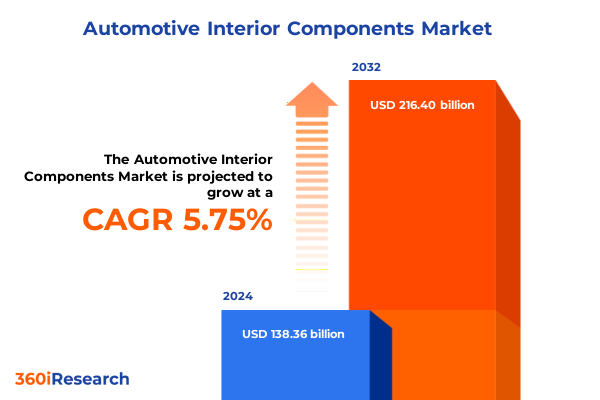

The Automotive Interior Components Market size was estimated at USD 146.34 billion in 2025 and expected to reach USD 153.99 billion in 2026, at a CAGR of 5.74% to reach USD 216.40 billion by 2032.

Unveiling the Evolution and Strategic Outlook of the Automotive Interior Components Market Amid Technological Advancements and Global Dynamics

The automotive interior components industry stands at a pivotal moment of transformation, shaped by rapid technological evolution and shifting consumer behaviours that demand heightened levels of comfort, convenience, and sustainability. In recent years, the integration of advanced materials and digital interfaces has fundamentally redefined how drivers and passengers experience the cabin environment. This executive summary provides a foundational overview of the core forces influencing the market, setting the stage for deeper exploration of tariff implications, segmentation dynamics, regional variations, and competitive strategies.

As stakeholders navigate this dynamic environment, an appreciation of the interplay between emerging innovations and regulatory frameworks becomes essential. From the increasing role of lightweight composites enhancing fuel efficiency to the proliferation of smart surfaces enabling intuitive controls, automotive interiors are no longer mere enclosures but dynamic ecosystems that respond to user preferences. Moreover, the accelerating shift towards electrification has prompted a rethinking of traditional design approaches, placing greater emphasis on acoustic comfort and sustainable materials to meet evolving regulatory and consumer expectations.

Against this backdrop, the following analysis delves into transformative market shifts, the ripple effects of recent tariff measures, and granular insights derived from component type, material choices, vehicle category, and distribution channel segmentation. By synthesizing these perspectives, this summary aims to equip decision-makers with a comprehensive view of the landscape and a robust framework for strategic planning.

Navigating the Paradigm Shifts Driving Innovation in Vehicle Interiors Through Electrification Connectivity and Sustainable Material Adoption

The landscape of automotive interior components has undergone a series of transformative shifts driven by broader trends in mobility and consumer demands. At the forefront is the surge in digital integration, as touch-sensitive interfaces and ambient lighting systems converge to create more intuitive and immersive cabin environments. The blending of software with traditional hardware underscores a transition toward experience-centric design, where personalization and connectivity sit at the core of product innovation.

Simultaneously, the pursuit of sustainability has become a powerful catalyst for change in material development. Manufacturers are increasingly incorporating recycled fabrics and bio-based polymers to reduce ecological footprints, while still delivering the durability and comfort that end-users expect. This dual imperative of performance and environmental responsibility is reshaping procurement strategies and forging new partnerships across the value chain.

Concurrently, the rise of electric vehicles has accelerated demands for noise reduction and thermal management within the cabin. As powertrains evolve, considerations such as acoustical insulation and modular flooring systems have gained prominence, compelling suppliers to retool production facilities and adapt design methodologies. In parallel, the trend toward autonomous driving is redefining seating architectures and headliner configurations, motivating designers to envision interiors as multifunctional spaces for work, relaxation, and entertainment.

These converging forces illustrate a market in flux, where technological prowess, ecological stewardship, and the redefining of vehicle use cases collectively underpin a new era of innovation in automotive interiors.

Assessing the Far-Reaching Consequences of the 2025 United States Tariff Measures on Automotive Interior Supply Chains and Material Sourcing

The introduction of updated United States tariff measures in 2025 has exerted multifaceted pressures on the automotive interior components supply chain, reverberating across material sourcing and cost structures. By imposing additional duties on imports of certain polymers and textile inputs, these measures have compelled procurement teams to reassess supplier portfolios and explore alternative sourcing geographies. The resulting recalibration has accelerated domestic manufacturing initiatives, as stakeholders seek to mitigate elevated landed costs and ensure continuity of supply.

Beyond direct cost implications, the tariffs have influenced material innovation trajectories by incentivizing a shift toward domestically produced alternatives. Research and development efforts have intensified around advanced thermoplastics and engineered textiles sourced from local feedstocks, with the dual aim of maintaining performance standards while adhering to revised trade policies. This dynamic has nurtured closer collaboration between raw material producers and component fabricators, fostering a more integrated ecosystem that emphasizes supply chain resilience.

Furthermore, the ripple effects of the tariff adjustments have extended to logistics and inventory management practices. Companies have implemented more granular demand forecasting and buffer stocking strategies to anticipate tariff-induced fluctuations, thereby fortifying operational agility. Simultaneously, pricing models have been restructured to distribute additional duty costs across contracts and end-use agreements, ensuring transparency and stability in customer relationships.

As regulatory environments continue to evolve, the 2025 tariff actions stand as a defining inflection point, underscoring the imperative for strategic flexibility and proactive supplier engagement to navigate an increasingly complex trade landscape.

Revealing Market Dynamics Through Detailed Analysis of Component Material and Vehicle Type Segmentation and Their Influence on Distribution Channels

An in-depth focus on market segmentation reveals critical insights into how component type, material selection, vehicle classification, and distribution pathways influence competitive positioning and profitability. When examining dashboards, door panels, floor mats, headliners, instrument clusters, seat coverings, and steering assemblies, it becomes evident that each component category commands distinct engineering requirements, cost considerations, and innovation cycles. For instance, instrument clusters must accommodate rapid shifts toward digital displays and haptic feedback, whereas seat coverings prioritize comfort, durability, and aesthetic versatility.

Material type further delineates market opportunities, as fabric, foam, genuine and synthetic leather, plastic composites, and vinyl demonstrate varied performance characteristics and price profiles. Nylon-based textiles and polyester variants continue to serve as workhorse materials for high-wear applications, while ABS and polypropylene composites gain traction in structural overlays and decorative trims. At the same time, the evolution of synthetic leather formulations has opened avenues for premium interiors that resonate with sustainability-driven consumers.

Vehicle type segmentation underscores divergent demand patterns across commercial fleets, battery electric and plug-in hybrid platforms, and traditional passenger segments such as hatchbacks, sedans, and sport utility vehicles. Commercial applications prioritize ruggedness and cost efficiency, whereas electrified models emphasize weight reduction, acoustic refinement, and modular flooring solutions. Passenger cars, in turn, present opportunities for personalization packages and upscale materials to capture shifting consumer preferences.

Sales channels-encompassing original equipment manufacturers and aftermarket retailers-round out the segmentation framework, highlighting the varied go-to-market strategies required to serve end users and service networks. Together, these segmentation insights provide a nuanced foundation for portfolio prioritization and targeted innovation roadmaps.

This comprehensive research report categorizes the Automotive Interior Components market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Material Type

- Vehicle Type

- Sales Channel

Evaluating Regional Variations and Growth Drivers for Automotive Interior Components Across the Americas EMEA and Asia-Pacific Markets

Regional dynamics continue to shape the competitive environment for interior components, with each geographic cluster displaying unique drivers and constraints. In the Americas, a mature automotive industry benefits from well-established supplier networks and regulatory incentives that bolster electrification efforts. This environment fosters innovation in acoustical treatments and modular dashboard designs tailored to evolving consumer expectations, while supportive policies encourage local content increases and advanced manufacturing investments.

In Europe, Middle East & Africa, the convergence of stringent emissions standards and consumer demands for premium interiors has driven advancements in lightweight composites and high-grade upholstery. The push toward circular economy principles has further accelerated uptake of recyclable materials, reinforcing a market ethos centered on sustainability. Regional integration between European design hubs and production facilities in Eastern markets underpins a dynamic exchange of technology and expertise.

Across Asia-Pacific, the rapid expansion of vehicle production, especially in emerging hubs, has created a fertile landscape for scale economies and cost-competitive sourcing. Suppliers in this region leverage advanced polymer processing capabilities and a deep labor pool to deliver competitively priced components. Simultaneously, the burgeoning adoption of electric powertrains has spurred demand for specialized interior modules that address new requirements in acoustics and thermal comfort.

Collectively, these regional profiles illuminate where innovators can align product development with localized market needs, regulatory frameworks, and consumer trends to establish differentiated positions and drive long-term growth.

This comprehensive research report examines key regions that drive the evolution of the Automotive Interior Components market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Their Strategies Collaborations and Innovations Shaping the Future of Vehicle Interior Component Market

Within the automotive interior components sector, leading enterprises are distinguished by their strategic commitments to research partnerships, vertical integration, and digital transformation. Several top tier entities have forged alliances with material science firms and academic institutions to co-develop next-generation polymers and fabric treatments, accelerating time-to-market for advanced surface solutions. These collaborations have yielded breakthroughs in flame-retardant textiles and lightweight composite substrates that address both performance and regulatory compliance.

At the same time, an emphasis on operational excellence has driven key players to invest in smart factory initiatives, where data analytics and automation converge to optimize production throughput and quality assurance. By deploying sensor networks and predictive maintenance algorithms, manufacturers have reduced downtime and enhanced consistency across high-volume lines, thereby strengthening supply reliability.

Equally important are strategic maneuvers in M&A and joint ventures, which have enabled companies to broaden their geographic footprints and diversify component portfolios. Such corporate actions not only facilitate access to emerging markets but also create synergies in procurement and technology integration. Furthermore, a growing number of industry leaders are integrating customer co-creation frameworks, inviting automaker design teams to participate in early-stage ideation sessions that ensure alignment with brand-specific interior philosophies.

These multidimensional efforts underscore the value of combining innovation, operational rigor, and collaborative engagement as competitive differentiators in a rapidly evolving market landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Interior Components market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient plc

- Brose Fahrzeugteile GmbH & Co. KG

- Compagnie Plastic Omnium SE

- Continental AG

- DENSO Corporation

- DRÄXLMAIER Group

- Faurecia SE

- Grammer AG

- Grupo Antolin

- Haartz Corporation

- Huayu Automotive Systems Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Lear Corporation

- Lumax Industries Limited

- Magna International Inc.

- Minda Corporation Limited

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Samvardhana Motherson International Limited

- Seoyon E-Hwa Automotive Slovakia s.r.o.

- Tata AutoComp Systems Limited

- Toyota Boshoku Corporation

- Valeo SA

- Visteon Corporation

- Yanfeng Automotive Interiors

Strategic Imperatives and Best Practice Recommendations for Industry Leaders to Enhance Competitiveness and Drive Growth in Interior Components

To thrive amid accelerating change, industry leaders should adopt a forward-looking posture that balances innovation with resilience. Prioritizing flexible manufacturing platforms capable of handling diverse material sets and evolving design specifications will enable rapid response to emerging consumer and regulatory requirements. By embracing modular architectures, companies can streamline production complexity while maintaining the ability to introduce feature enhancements with minimal retooling.

In parallel, forging deeper partnerships with raw material innovators and technology providers can catalyze co-development of next-generation interior solutions. Engaging in collaborative R&D consortia not only distributes development risk but also accelerates access to cutting-edge advancements in lightweight composites, bio-based polymers, and digital interface integration.

Moreover, organizations should reinforce supply chain agility by implementing tiered supplier assessment frameworks and dual-sourcing strategies. This approach ensures continuity of supply for critical materials while safeguarding against trade policy disruptions and logistical bottlenecks. Investment in advanced planning and scheduling systems will further refine inventory management, allowing for more precise alignment between demand signals and production outputs.

Finally, cultivating customer-centric innovation through design thinking workshops and immersive prototyping labs will yield interior concepts that resonate strongly with end users. By prioritizing user experience research and iterative validation cycles, companies can deliver differentiated cabin environments that enhance brand loyalty and unlock new premium revenue streams.

Comprehensive Research Framework Outlining Data Acquisition Analytical Techniques and Segmentation Criteria for Robust Market Insights

This study employs a robust research framework that integrates primary and secondary data sources, ensuring comprehensive coverage of market dynamics. Primary insights are derived from interviews with industry executives, design engineers, and procurement managers, offering direct perspectives on innovation roadmaps, material sourcing challenges, and regulatory influences. These qualitative inputs are systematically validated through secondary research encompassing trade publications, patent filings, and technical whitepapers to substantiate emerging trends.

Quantitative analysis is supported by a detailed segmentation approach that examines automotive interior component categories-ranging from dashboards to steering systems-across material types, including fabric variations, foam grades, leather grades, plastic composites, and vinyl. Further granularity is achieved by mapping these segments to vehicle categories such as commercial fleets, electrified models, and core passenger vehicles, as well as distribution pathways spanning original equipment manufacturing and aftermarket channels.

Regional analysis synthesizes macroeconomic indicators, regulatory landscapes, and consumption patterns across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. Key performance metrics and operational benchmarks are evaluated to identify regional strengths, cost centers, and growth catalysts. A multi-layered triangulation technique merges qualitative expert opinions, industry benchmarks, and contextual market intelligence to reinforce the study’s validity.

Throughout the research process, rigorous data integrity protocols and cross-verification methods have been employed to ensure accuracy and reliability of findings. This structured methodology provides stakeholders with a transparent and reproducible foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Interior Components market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Interior Components Market, by Component Type

- Automotive Interior Components Market, by Material Type

- Automotive Interior Components Market, by Vehicle Type

- Automotive Interior Components Market, by Sales Channel

- Automotive Interior Components Market, by Region

- Automotive Interior Components Market, by Group

- Automotive Interior Components Market, by Country

- United States Automotive Interior Components Market

- China Automotive Interior Components Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Insights Integrating Key Trends Market Forces and Strategic Considerations for Sustainable Success in Automotive Interiors

In conclusion, the automotive interior components sector is experiencing a convergence of innovation vectors driven by digitalization, sustainable materials, and evolving mobility patterns. The interplay of these dynamics, coupled with recent trade policy adjustments, underscores the need for agile strategies that integrate design ingenuity with resilient supply chain models. Segmentation analysis across component types, materials, vehicle classes, and sales channels reveals nuanced demand signals and highlights areas for targeted investment.

Regional insights demonstrate that while established markets in the Americas and Europe, Middle East & Africa excel in premium and advanced-material solutions, the Asia-Pacific region leads in scalability and cost competitiveness. Understanding these regional distinctions is vital for aligning manufacturing footprints and distribution networks with market-specific value propositions. Furthermore, the competitive landscape showcases that leading organizations are those that successfully blend R&D partnerships, smart manufacturing, and customer co-creation to accelerate product development and differentiate their offerings.

Looking ahead, the imperative for industry participants is to harness these insights to drive continuous innovation, foster collaborative ecosystems, and maintain operational agility. By doing so, companies can not only navigate current market complexities but also position themselves to capitalize on emerging opportunities in an increasingly electrified and connected automotive world.

Engage with Associate Director Sales & Marketing to Unlock In-Depth Insights and Empower Strategic Decisions in Automotive Interior Components

For organizations seeking to gain a competitive edge through unparalleled insights, engagement with the Associate Director of Sales & Marketing offers a direct pathway to unlocking comprehensive analysis and bespoke strategic support. By connecting with Ketan Rohom, businesses can tap into deep domain expertise that aligns market intelligence with organizational goals, ensuring that every decision is informed by rigorous research and tailored recommendations. This personalized interaction not only expedites the procurement process but also facilitates a collaborative environment in which questions are addressed promptly and specific requirements are incorporated effectively. Prospective clients are invited to explore detailed discussions around project customization, data segmentation, and delivery formats that best suit their operational needs, thereby maximizing the return on investment in market intelligence. Reach out today to transform these insights into actionable strategies that bolster your market positioning and drive long-term growth in the automotive interior components landscape.

- How big is the Automotive Interior Components Market?

- What is the Automotive Interior Components Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?