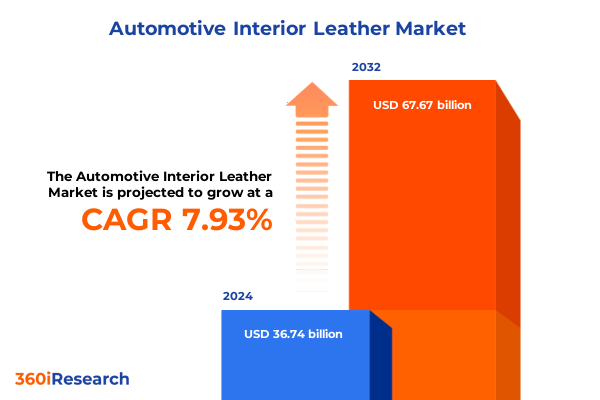

The Automotive Interior Leather Market size was estimated at USD 39.54 billion in 2025 and expected to reach USD 42.56 billion in 2026, at a CAGR of 7.97% to reach USD 67.67 billion by 2032.

Establishing the Strategic Importance of Automotive Interior Leather in Shaping Passenger Comfort and Brand Differentiation Across Global Markets

The automotive interior leather segment occupies a unique position at the intersection of human experience, luxury perception, and corporate identity. As the touchpoint between occupants and the vehicle environment, leather surfaces not only deliver tactile comfort but also communicate brand values and quality standards in an increasingly discerning marketplace. Over decades, leather has evolved from a purely functional upholstery choice to a central element of design language, distinguishing models across segments from entry-level SUVs to flagship sedans.

In recent years, consumer expectations have grown beyond traditional notions of softness and durability. The integration of digital interfaces, haptic feedback, and smart sensors into cabin elements has prompted a reevaluation of leather’s role, demanding materials that support advanced functionalities without compromising on aesthetic or ergonomic attributes. Concurrently, legislative pressures and environmental considerations have intensified scrutiny around raw material sourcing and processing methods, placing responsibility on manufacturers to demonstrate transparency and adopt sustainable practices.

This introduction lays the groundwork for understanding the pivotal dynamics redefining automotive interior leather. It outlines the converging imperatives of luxury, technology integration, and ecological stewardship that underpin strategic decisions in design, supply chain management, and brand positioning. Through this lens, stakeholders can contextualize the transformative developments addressed in subsequent sections.

Uncovering the Disruptive Trends Driving Innovation in Leather Interiors Through Electrification Sustainability Circularity and Premium Craftsmanship

The automotive interior leather landscape has undergone profound shifts driven by the global push toward electrification, where electric powertrains demand lighter, more sustainable materials to maximize range and efficiency. As original equipment manufacturers accelerate EV rollouts, leather suppliers are innovating to reduce material density and incorporate recycled content, ensuring that premium tactile experiences align with zero-emission goals. Simultaneously, regulatory frameworks worldwide are tightening limits on volatile organic compounds (VOCs) during tanning and finishing, prompting the adoption of water-based dyes and solvent-free processes.

At the same time, the premiumization trend has intensified, with consumers expecting bespoke cabin environments that reflect personal values and lifestyle aspirations. This has catalyzed collaborations between automakers, luxury brands, and artisan tanneries to offer exclusive leather grains, nuanced color palettes, and artisanal embossing techniques. These co-branding initiatives not only elevate brand equity but also reinforce emotional connections through differentiated textures and storytelling rooted in heritage craftsmanship.

Moreover, the rise of circular economy principles has reshaped material sourcing strategies and end-of-life considerations. Leading manufacturers are implementing traceability programs that map hides from farm to factory, ensuring ethical supply chains and reducing environmental footprints. This shift is complemented by advances in biodegradable tanning agents and recycled leather composites, which deliver comparable durability to traditional hides while closing the loop on waste.

Evaluating the Far Reaching Consequences of the 2025 United States Tariff Adjustments on Automotive Leather Supply Chains and Cost Structures

The 2025 United States tariff regime has created a significant inflection point for automotive interior leather supply chains. On March 26, 2025, a Presidential Proclamation announced a 25% ad valorem tariff on imported automobiles, effective April 3, 2025, with a parallel 25% levy on select auto parts scheduled for May 3, 2025. These measures, implemented under Section 232 of the Trade Expansion Act and Section 301 actions, have directly impacted the landed cost of leather-clad components, spurring OEMs to reassess sourcing strategies and accelerate domestic partnerships.

Compounding these levies, a universal 10% baseline tariff on all trade partners, effective April 5, 2025, has introduced an additional layer of cost pressure across the value chain. At the same time, the elimination of de minimis treatment for shipments from China and Hong Kong, effective May 2, 2025, combined with a new 34% reciprocal tariff on Chinese goods, has complicated vendor qualification processes and elevated logistical complexity for small-batch leather imports.

Offsetting some of these constraints, the United States-Mexico-Canada Agreement (USMCA) provisions allow certain automotive parts to qualify for preferential treatment until content valuation systems are fully implemented. Nevertheless, the cumulative effect of these concurrent tariff adjustments has compelled interior leather stakeholders to prioritize supply chain resilience, optimize inventory management, and explore value engineering to preserve margin integrity in a higher-cost environment.

Illuminating Segmentation Dimensions in the Automotive Interior Leather Market Highlighting Material Type Price Range Vehicle Class and Application Dynamics

A nuanced understanding of automotive interior leather performance begins with the type of leather selected. Genuine leather encompasses full-grain, split, and top-grain variants, each offering distinct attributes in durability, finish, and breathability. Full-grain hides deliver unmatched resilience and depth of patina, making them the material of choice for flagship models, while split leather balances cost efficiency with acceptable wear resistance in high-traffic zones. Top-grain leather, prized for its uniform aesthetic, is often specified where consistent appearance and dye uptake are prioritized over maximum toughness. Alongside these natural variants, synthetic options such as polyurethane and polyvinyl chloride leather have emerged to serve mid-market and entry-level applications, combining ease of maintenance with broad color offerings and cost control.

Raw material sourcing further refines these distinctions. Hides graded as full-grain provide the highest tear strength and natural grain texture, whereas split hides are engineered for volume and consistency. Top-grain hides undergo surface refinement to ensure smoothness and remove imperfections, making them well-suited for visible trim elements. This granularity in raw material selection allows OEMs to calibrate performance against budget constraints and application-specific demands.

In parallel, price range segmentation delineates economy, mid-range, and premium tiers that guide procurement and design decisions. Economy interiors often rely on PVC leather for durability and simplicity, mid-range cabins leverage polyurethane blends to blend tactile appeal with affordability, and premium cabins demand genuine full-grain hides coupled with advanced finishing techniques.

Vehicle type considerations layer additional complexity. Commercial vehicles typically require split or PU leather for rugged use and straightforward cleaning, whereas off-road models prioritize stain-resistant composites and robust stitch reinforcement. Passenger cars span the full spectrum, from cost-sensitive hatchbacks to bespoke luxury sedans, driving demand for an array of leather grades.

Finally, application-specific requirements shape the final material choice. Door panels integrate leather overlays for visual continuity and enhanced touchpoints, while seats require thick, resilient hides that resist wear and offer ergonomic comfort. Gear knobs must sustain frequent handling with minimal degradation, and steering wheels demand specialized coatings to maintain grip and feel under varied environmental conditions. Understanding these segmentation layers ensures that each leather application aligns with functional objectives and brand positioning.

This comprehensive research report categorizes the Automotive Interior Leather market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Leather Type

- Raw Material

- Price Range

- Vehicle Type

- Application

Examining Regional Variations in Automotive Interior Leather Demand and Innovation Across the Americas EMEA and Asia Pacific Markets for Strategic Alignment

The Americas region presents a dynamic landscape shaped by strong consumer demand for premium and sustainable interiors. In North America, regulatory emphasis on reduced emissions and increased vehicle electrification has led OEMs to prioritize lightweight leather composites and certified eco-tanning processes. Latin America, while still price sensitive, is witnessing gradual adoption of higher-grade materials as urbanization and income growth fuel an appetite for mid-range and premium cabin offerings. This bifurcation underscores the need for flexible production strategies that cater to diverse market tiers within the hemisphere.

Europe, the Middle East & Africa (EMEA) region is characterized by some of the world’s most stringent environmental regulations, which have accelerated the adoption of solvent-free tanning and full traceability programs among European OEMs. Luxury automakers headquartered in Germany, Italy, and the UK continue to refine bespoke leather treatments, often in partnership with heritage tanneries, to maintain differentiation. Meanwhile, emerging markets in the Gulf states are driving demand for high-spec interior finishes, including perforated and ventilated leather, aligned with consumers’ increasing expectations for comfort in extreme climates.

In the Asia-Pacific region, rapid growth in automotive production hubs such as China and India has been matched by advancements in synthetic leather technology aimed at local cost requirements. While mass-market vehicles frequently utilize PU alternatives, a premium segment has emerged in metropolitan centers, favoring genuine full-grain hides and premium finishing. Additionally, Australia’s mature off-road vehicle culture has spurred demand for weather-resistant leather composites, integrating UV stabilizers and antimicrobial coatings to withstand rigorous outdoor conditions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Interior Leather market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Moves and Innovation Portfolios of Leading Automotive Interior Leather Suppliers Shaping the Competitive Frontier in 2025

Leading suppliers in the automotive interior leather space have pursued multifaceted strategies to maintain competitiveness and respond to evolving OEM requirements. Adient has expanded its portfolio by integrating digitally embossed leather surfaces and advanced coating systems to meet growing demand for haptic feedback integration. Lear Corporation has deepened partnerships with sustainable tanneries, securing limited-edition hides certified under global eco-label standards, while simultaneously scaling production of engineered PU leather for high-volume segments.

Faurecia, now operating under its interior systems division, has invested heavily in research facilities dedicated to next-generation tanning methods that eliminate heavy metals and reduce water usage. Its collaboration with automotive OEMs on prototype smart leather applications-incorporating touch-sensitive controls and thermal management-demonstrates a forward-looking approach to cabin interfaces. Magna Interiors, leveraging its modular architecture expertise, offers plug-and-play leather trim assemblies that streamline supplier complexity and accelerate time to market.

Toyota Boshoku has distinguished itself by adopting blockchain-based traceability solutions, guaranteeing provenance and quality compliance for premium hides used in its luxury sub-brand models. Meanwhile, smaller specialized tanneries have found growth opportunities by offering artisanal leather treatments and low-volume customization, catering to niche high-end manufacturers and aftermarket retrofit markets. These diverse company approaches illustrate the competitive frontier, where innovation portfolios and strategic alliances define long-term positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Interior Leather market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient plc

- Alphaline Auto Leather

- Bader GmbH & Co. KG

- Benecke‑Kaliko AG

- Boxmark Leather GmbH & Co. KG

- D.K. Leather Corporation

- Dani S.p.A.

- Eagle Ottawa LLC

- Elmo Sweden AB

- Faurecia SE

- GST AutoLeather Inc.

- Hyosung Corporation

- JBS Couros S.A.

- Katzkin Leather Inc.

- KURARAY Co., Ltd.

- Lear Corporation

- Leather Resource of America, Inc.

- Mayur Uniquoters Limited

- Scottish Leather Group Limited

- Toyota Boshoku Corporation

- Wollsdorf Leder Schmidt & Co. Ges.m.b.H.

Formulating Actionable Strategies for Automotive Interior Leather Leaders to Capitalize on Sustainability Electrification and Premium Customer Experience Trends

To capitalize on the shifting automotive interior leather landscape, industry leaders must proactively diversify their raw material sourcing strategies. Establishing strong partnerships across multiple regions mitigates geopolitical and tariff-related disruptions, ensuring consistent hide quality and supply continuity. Concurrently, investing in sustainable tanning and finishing technologies will not only meet rising environmental standards but also resonate with eco-conscious consumers, enhancing brand loyalty and pricing power.

As electrification gains momentum, manufacturers should prioritize lightweight composite leather solutions that support range optimization without compromising on tactile authenticity. Collaborations with material science experts and tiered testing protocols can accelerate the validation of novel resin-infused and microfiber-reinforced variants. In addition, embedding digital functionalities-such as embedded haptic sensors or conductive threading-into leather surfaces will create new interactive touchpoints and justify premium positioning.

Actionable steps also include developing modular trim platforms that can be customized for diverse vehicle classes, reducing tooling complexity and time-to-market. Embracing predictive analytics for demand forecasting and inventory management will further enhance agility in responding to sudden shifts in tariff structures or consumer preferences. By aligning R&D investments with emerging regulatory trends and consumer expectations, leadership teams can drive profitable growth while future-proofing their leather interior portfolios.

Detailing a Rigorous Mixed Methodology Combining Primary Interviews Secondary Research and Data Triangulation to Ensure Comprehensive Market Analysis

This analysis is underpinned by a rigorous mixed-methodology framework combining primary interviews with executive leadership teams at OEMs, tier-one suppliers, and specialized tanneries, alongside in-depth secondary research of regulatory filings, patent databases, and industry white papers. Data triangulation was achieved by cross-referencing insights from expert panels, financial disclosures, and proprietary surveys of design studios to validate emerging trends and technology adoption rates.

Quantitative assessments of raw material flows, import-export statistics, and tariff schedules were integrated with qualitative evaluations of sustainability certification processes and consumer sentiment analyses. Key informant interviews provided granular perspectives on supply chain bottlenecks, while workshops with design engineers helped surface technical requirements for next-generation leather functionalities. This balanced approach ensures that conclusions reflect both macroeconomic influences and micro-level innovations, delivering a comprehensive market understanding.

Finally, iterative peer reviews with subject-matter experts in material science, regulatory affairs, and automotive design refined the narrative and highlighted potential blind spots. This methodology guarantees that findings are robust, actionable, and grounded in real-world evidence, equipping stakeholders with the intelligence required to navigate the evolving automotive interior leather environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Interior Leather market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Interior Leather Market, by Leather Type

- Automotive Interior Leather Market, by Raw Material

- Automotive Interior Leather Market, by Price Range

- Automotive Interior Leather Market, by Vehicle Type

- Automotive Interior Leather Market, by Application

- Automotive Interior Leather Market, by Region

- Automotive Interior Leather Market, by Group

- Automotive Interior Leather Market, by Country

- United States Automotive Interior Leather Market

- China Automotive Interior Leather Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Strategic Implications to Conclude the Automotive Interior Leather Report with Insightful Perspectives and Future Considerations

This executive summary has outlined the foundational importance of automotive interior leather as a differentiator in modern vehicles, driven by consumer expectations for comfort, luxury, and technological interoperability. It has identified transformative market shifts, including the pressures of electrification and sustainability mandates, that are reshaping material innovation and supplier strategies. The cumulative impact of the 2025 U.S. tariff adjustments has underscored the criticality of supply chain resilience and agile procurement models.

Segmentation insights revealed how leather type, raw material grade, price tier, vehicle classification, and application context interplay to guide design and sourcing decisions. Regional analysis highlighted distinct market drivers across the Americas, EMEA, and Asia-Pacific, each presenting unique opportunities and regulatory considerations. Company-level intelligence demonstrated that leading suppliers are forging partnerships, investing in eco-friendly processes, and piloting smart leather solutions to stay ahead of the curve.

Finally, actionable recommendations have been provided to help industry leaders diversify sourcing, integrate digital capabilities, and optimize modular production frameworks. By combining cutting-edge material science with strategic foresight, stakeholders can capitalize on emerging trends and maintain a competitive advantage. This consolidated perspective serves as a strategic blueprint for informed decision-making in the rapidly evolving automotive interior leather landscape.

Encouraging Engagement with Our Comprehensive Market Insights Through Direct Collaboration with Ketan Rohom to Elevate Strategic Leather Interior Decisions

For decision-makers seeking to translate deep market insights into measurable outcomes, a personalized dialogue is the most direct path to clarity and strategic impact. Engaging with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, provides an opportunity to explore bespoke solutions, clarify nuances in segmentation, and align on the precise deliverables that will elevate your leather interior initiatives. Whether optimizing supply chains in response to tariff shifts or innovating with sustainable finishes, this tailored conversation will accelerate your team’s ability to act with confidence. Reach out today to schedule a consultation and secure access to the full report, ensuring you remain at the forefront of interior leather innovation and maintain a competitive advantage in a rapidly evolving market.

- How big is the Automotive Interior Leather Market?

- What is the Automotive Interior Leather Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?