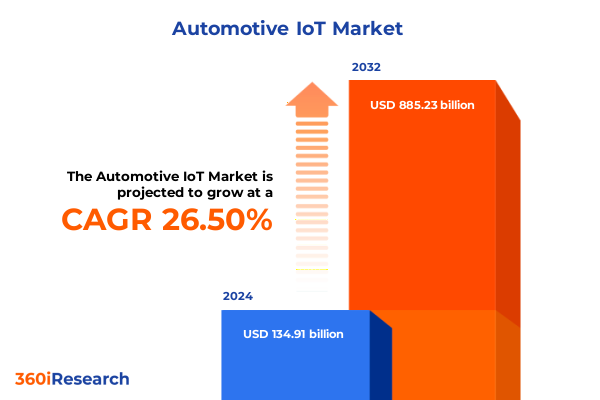

The Automotive IoT Market size was estimated at USD 168.67 billion in 2025 and expected to reach USD 211.76 billion in 2026, at a CAGR of 26.72% to reach USD 885.23 billion by 2032.

A Comprehensive Overview of the Automotive IoT Revolution Driving Connectivity Efficiency and Safety in Modern Mobility Ecosystems

The automotive industry has entered a new era defined by the pervasive integration of internet-enabled systems. Connected cars are delivering real-time navigation, telematics, and over-the-air software updates, transforming how vehicles interact with drivers and infrastructure. At recent auto exhibitions, leading manufacturers showcased seamless infotainment, remote diagnostics, and V2X communication as emblematic features of this revolution, leveraging advanced networks to enhance safety and reliability while harnessing AI-driven predictive maintenance capabilities.

Alongside these developments, 5G connectivity and edge computing have pushed the transition from conceptual trials to large-scale rollouts by enabling ultra-low latency data exchanges essential for autonomous driving and remote vehicle monitoring. According to the Ericsson Mobility Report, cellular IoT connections are poised to reach three billion by 2029, growing at a 12% annual rate, which underscores the rapid expansion of the automotive IoT ecosystem and its foundational role in supporting next-generation mobility applications.

Key Technological and Market Dynamics Redefining the Automotive IoT Landscape with 5G Edge AI and Evolving Cybersecurity Imperatives

The automotive IoT landscape is being reshaped by transformative technological and market dynamics. Foremost among these is the convergence of 5G and edge AI, which is redefining the speed and intelligence of data processing within vehicles. The deployment of 5G-enabled infrastructure supports real-time V2X communication, enabling cars to exchange critical information with adjacent vehicles and road infrastructure. Industry estimates indicate that the share of value attributable to 5G and edge computing in the automotive sector will rise from 5% in 2020 to roughly 30% by 2030, driving an unprecedented wave of new use cases from collision avoidance to predictive maintenance.

As vehicles evolve toward higher levels of autonomy, AI-driven algorithms are becoming integral to safety-critical systems. Edge AI deployments in electric and autonomous fleets underscore the importance of on-device processing for latency-sensitive applications, with manufacturers embedding neural processing units and specialized sensors to facilitate rapid decision-making in dynamic driving environments. This shift not only improves performance but also mitigates risks associated with cloud-dependent architectures, establishing a framework for more resilient and responsive in-vehicle systems.

Concurrently, cybersecurity and data privacy have emerged as paramount concerns. Regulatory bodies, including the U.S. Commerce Department’s Bureau of Industry and Security, have enacted rules banning imports of connected vehicle components from high-risk jurisdictions, reflecting growing attention to national security and supply chain integrity. Despite heightened regulation, the frequency and sophistication of cyberattacks on automotive systems continue to escalate, with recent reports revealing that incidents affecting millions of assets more than tripled in 2024. These trends underscore the imperative for a proactive, security-by-design approach across the entire vehicle lifecycle.

Analyzing the Ripple Effects of 2025 United States Tariffs on Automotive IoT Supply Chains Component Sourcing and Cost Structures

In 2025, the cumulative effect of U.S. trade measures has introduced significant cost and strategic considerations for automotive IoT stakeholders. Under the latest Section 301 rulings, semiconductor imports faced a tariff increase to 50% effective January 1, 2025, directly impacting critical components such as processors, memory modules, and connectivity chipsets that underpin modern telematics, ADAS, and V2X platforms. This elevated duty structure has compelled original equipment manufacturers and tier-one suppliers to evaluate alternative sourcing strategies and accelerate in-country assembly initiatives to mitigate cost escalations and supply chain disruption.

Moreover, electric vehicle hardware experienced punitive measures, including a 100% tariff on EVs and associated lithium-ion battery components that took effect in 2024. These levies have prompted a pronounced shift toward regional production hubs, with leading OEMs expanding partnerships in Southeast Asia, Mexico, and Europe to circumvent U.S. duties and maintain competitive pricing. The impact on aftermarket and software service providers has been pronounced, as increased hardware costs cascade into subscription and maintenance models, triggering a reevaluation of value propositions and business cases across the IoT service ecosystem.

Amid this environment, industry participants are diversifying supplier networks and repatriating critical manufacturing capabilities as a hedge against future tariff volatility. Collaborative ventures between automakers, chipmakers, and technology firms are emerging to establish localized micro-factories, standardize compliance processes, and optimize total cost of ownership. These strategic realignments are setting the stage for a more resilient automotive IoT supply chain landscape in the years ahead.

Strategic Insights into Automotive IoT Market Segmentation by Component Connectivity Application Vehicle Type and End User Dynamics

The automotive IoT market is characterized by intricate segmentation that spans multiple interrelated dimensions. From a component perspective, the ecosystem is structured around hardware, services, and software domains. Hardware encompasses communication modules, gateways, processors, and sensor arrays that capture and transmit vehicular data, while service offerings extend across managed and professional service frameworks designed to support deployment, maintenance, and optimization. Software platforms integrate advanced analytics, application suites, and middleware layers to enable data orchestration and real-time insights.

Connectivity modalities further diversify the landscape, with cellular technologies-spanning LTE and increasingly pervasive 5G networks-enabling broad-area coverage and high throughput. Satellite links provide redundancy and global reach for remote operations, while short-range protocols such as Bluetooth and Wi-Fi facilitate in-vehicle device pairing and edge node interaction. The multi-channel connectivity architecture supports a wide array of telematics, infotainment, and safety services designed to operate seamlessly across diverse network conditions.

Application use cases drive growth across autonomous driving, fleet management, infotainment, predictive maintenance, safety and security, telematics, and V2X communication. Infotainment systems blend navigation and in-vehicle entertainment, predictive maintenance solutions monitor battery health and vehicle condition, and safety modules encompass advanced driver assistance and automated emergency response. Telematics implementations serve both fleet tracking and insurance telematics needs, while V2X frameworks span vehicle-to-grid, infrastructure, network, and vehicle-to-vehicle interactions.

Vehicle type segmentation distinguishes between commercial and passenger platforms, with heavy and light commercial vehicles configured for logistics and transport applications, while passenger vehicles range from hatchbacks and sedans to SUVs adapted for consumer mobility. End-user engagement is bifurcated between OEMs, deploying IoT solutions for factory-built connectivity, and the aftermarket ecosystem where retrofit modules and subscription services extend capabilities to in-service vehicles.

This comprehensive research report categorizes the Automotive IoT market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity

- Application

- Vehicle Type

- End User

Regional Perspectives on Automotive IoT Adoption Trends and Growth Drivers Across the Americas EMEA and Asia Pacific Markets

Regional dynamics have become a critical determinant of automotive IoT adoption and innovation trajectories. In the Americas, robust telematics infrastructure, early 5G network deployments, and stringent vehicle safety regulations have fostered a mature market environment. Leading OEMs and fleet operators are leveraging telematics for real-time analytics, while aftermarket service providers offer over-the-air updates and remote diagnostics solutions to enhance vehicle uptime and operational efficiency.

Europe, Middle East & Africa exhibit a diverse landscape driven by regulatory harmonization under UNECE frameworks and ambitious smart city initiatives. European manufacturers are integrating IoT for V2X and advanced driver assistance to meet evolving CO₂ and safety mandates, while Middle East governments are piloting connected mobility projects to optimize urban transit. African markets, though nascent, are witnessing the emergence of telematics for fleet management in mining and logistics sectors, supported by satellite connectivity to bridge terrestrial network gaps.

Asia-Pacific stands out for rapid electric vehicle adoption, government incentives, and aggressive technology investments. China’s expansive 5G rollout has underpinned large-scale V2X trials, while Japan and South Korea drive edge computing and AI integration within connected vehicle programs. Southeast Asian economies are advancing smart infrastructure deployments that facilitate dynamic traffic management and mobility-as-a-service offerings, positioning the region as a global innovation hub for automotive IoT solutions.

This comprehensive research report examines key regions that drive the evolution of the Automotive IoT market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global and Emerging Players Shaping the Automotive IoT Ecosystem through Technological Innovations Strategic Partnerships and Competitive Differentiation

The competitive landscape of automotive IoT is defined by a mix of established technology giants, traditional automotive suppliers, and agile software innovators. Semiconductors and chipset leaders are investing heavily in custom silicon optimized for harsh vehicular environments and AI inferencing at the edge, while telecom operators are forging private 5G networks tailored to connected car use cases. Infotainment specialists and middleware providers are evolving to deliver modular platforms that support rapid feature deployment and flexible integration with third-party services.

Automotive OEMs are collaborating with cloud hyperscalers and system integrators to co-develop V2X and OTA software stacks, enabling continuous software delivery and robust cybersecurity measures. Tier-one suppliers are expanding beyond mechanical components to offer end-to-end IoT systems, bundling hardware, connectivity, and value-added analytics under managed service agreements. Innovative startups are disrupting conventional value chains by introducing blockchain-enabled data marketplaces and AI-powered safety radios that enhance trust and transparency across the mobility ecosystem.

Strategic alliances and joint ventures are becoming commonplace as companies seek to combine core competencies and accelerate time-to-market. Cross-sector partnerships between automakers, energy utilities, and smart city platforms illustrate the convergence of transportation and digital infrastructure. These synergistic relationships are instrumental in shaping the next generation of mobility services, enabling differentiated offerings and new revenue models across the automotive IoT spectrum.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive IoT market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Apple, Inc.

- AT&T Inc.

- Audi AG by Volkswagen Group

- BlackBerry Limited

- BMW AG

- Cisco Systems, Inc.

- Continental AG

- Daimler Ag

- Ericsson AB

- Ford Motor Company

- General Motors

- Google LLC by Alphabet Inc.

- Google LLC by Alphabet Inc.

- Honda Motor Co., Ltd.

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Nvidia Corporation

- NXP Semiconductors N.V.

- Qualcomm Incorporated

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Siemens AG

- Texas Instruments Inc.

- Thales SA

- TomTom International BV

- Toyota Motor Corporation

- Verizon Communications Inc.

- Visteon Corporation

- Vodafone Group

Actionable Strategic Recommendations for Automotive Industry Leaders to Capitalize on IoT Innovations and Drive Sustainable Competitive Advantage

To capture the full potential of automotive IoT, industry leaders should prioritize a three-pronged strategic approach. First, accelerate investments in resilient, localized manufacturing and supply chain diversification to buffer against tariff fluctuations and geopolitical risks. Establishing regional micro-factories and fostering domestic component ecosystems will safeguard continuity and cost predictability.

Second, champion a rigorous security-by-design framework that spans hardware, software, and connectivity layers. Implement end-to-end encryption, zero trust architectures, and blockchain-enabled data integrity protocols to safeguard telematics, V2X communications, and remote update channels. Align development and compliance processes with emerging international standards to anticipate regulatory changes and minimize future rework.

Third, cultivate cross-industry ecosystems by forging alliances with telecom operators, energy providers, and smart city initiatives. Leverage open platforms and standardized APIs to accelerate feature rollout, foster service innovation, and unlock new monetization pathways. By integrating IoT capabilities within broader mobility and infrastructure networks, organizations can create seamless, multi-modal experiences that resonate with both commercial and consumer stakeholders.

Detailed Research Methodology and Analytical Framework Employed to Uncover Actionable Insights into the Automotive IoT Market Dynamics

The research methodology underpinning this analysis combines comprehensive primary and secondary research with robust quantitative and qualitative techniques. Primary data were obtained through structured interviews with C-level executives, product managers, and strategic leads at leading OEMs, tier-one suppliers, and telematics service providers. These discussions provided firsthand insights into investment priorities, technology adoption challenges, and anticipated market shifts.

Secondary research encompassed a wide range of publicly available sources, including regulatory filings, patent databases, industry white papers, and reputable news outlets. This secondary intelligence facilitated the validation of primary inputs, triangulation of market trends, and contextual understanding of macroeconomic and geopolitical influences.

Quantitative modeling involved segment-level analysis across component, connectivity, application, vehicle type, and end-user dimensions, ensuring that insights reflect nuanced market structures. Data triangulation was employed to reconcile vendor-reported figures with independent industry data, refining the accuracy and credibility of the findings. The analytical framework also incorporated scenario analysis to assess the impacts of tariff changes, regulatory shifts, and technology inflection points, enabling decision-makers to evaluate strategic contingencies with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive IoT market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive IoT Market, by Component

- Automotive IoT Market, by Connectivity

- Automotive IoT Market, by Application

- Automotive IoT Market, by Vehicle Type

- Automotive IoT Market, by End User

- Automotive IoT Market, by Region

- Automotive IoT Market, by Group

- Automotive IoT Market, by Country

- United States Automotive IoT Market

- China Automotive IoT Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesis of Key Findings and Strategic Imperatives Guiding Decision Makers in the Evolving Automotive IoT Landscape for Sustainable Growth

Throughout this executive summary, we have traced the rapid evolution of automotive IoT-from the foundational rollout of 5G and edge compute architectures to the strategic realignments prompted by U.S. tariffs and cybersecurity imperatives. The segmentation analysis revealed a diverse landscape of hardware, connectivity, software, and services converging to meet the demands of a digitally enabled mobility ecosystem. Regional insights highlighted divergent adoption patterns, underscoring the importance of tailored strategies across the Americas, EMEA, and Asia-Pacific.

Leading companies are navigating this complexity through targeted innovation, strategic partnerships, and dynamic supply chain approaches. The recommendations offered herein serve as a blueprint for industry participants to bolster resilience, accelerate secure feature deployment, and forge new value networks. By adhering to a security-by-design ethos, localizing critical manufacturing, and embracing cross-sector collaboration, organizations can unlock the transformative potential of automotive IoT and secure a sustainable competitive advantage in a rapidly shifting environment.

Connect with Ketan Rohom to Unlock In-Depth Automotive IoT Market Insights and Propel Your Strategic Growth

To explore how these comprehensive insights can fuel your strategic initiatives, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan specializes in translating market intelligence into actionable roadmaps, ensuring your organization harnesses the full potential of automotive IoT innovations. Reach out today to secure your copy of the detailed Automotive IoT Market Research Report and gain a competitive edge through data-driven decision-making.

- How big is the Automotive IoT Market?

- What is the Automotive IoT Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?