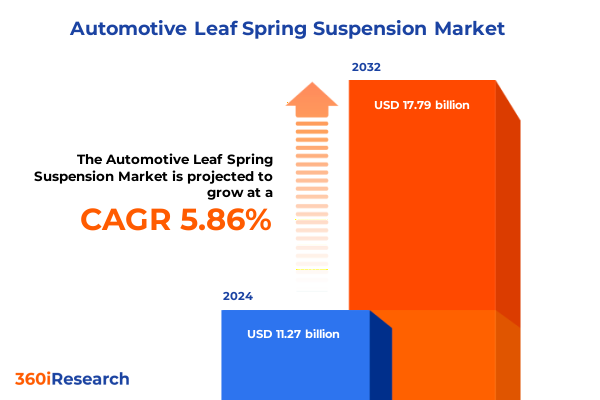

The Automotive Leaf Spring Suspension Market size was estimated at USD 11.91 billion in 2025 and expected to reach USD 12.58 billion in 2026, at a CAGR of 5.90% to reach USD 17.79 billion by 2032.

Comprehensive Overview of Automotive Leaf Spring Suspension Principles Innovations and Strategic Importance in Modern Vehicle Architecture

The automotive leaf spring suspension system remains a foundational technology that has supported vehicle load management and ride comfort for over a century. This report opens with a thorough exploration of the historical evolution of leaf springs, tracing their origins from simple metal assemblies in early horseless carriages to today’s sophisticated multi-leaf and composite architectures. Emphasizing both form and function, the introduction frames the leaf spring as more than a mechanical element: it is a critical enabler of vehicle safety, durability, and efficiency. In modern commercial fleets and passenger cars alike, suspension performance directly influences fuel consumption, axle articulation, and occupant comfort. By understanding these core principles, stakeholders can better appreciate how incremental design enhancements and material substitutions have unlocked new performance thresholds.

Building on this foundational understanding, the introduction also previews the study’s central themes: technological innovation, tariff-driven market dynamics, and segmentation strategies. It outlines how recent regulatory changes and material science breakthroughs intersect to reshape supply chains and sourcing decisions. Furthermore, the introduction sets the stage for an in-depth evaluation of regional variations and competitive landscapes. With this context in place, readers are equipped to delve into the subsequent analyses, gaining clarity on the forces driving the leaf spring suspension market and the strategic imperatives for industry participants.

Identifying Transformative Technological Shifts Redefining the Competitive Landscape of Leaf Spring Suspension Systems in Commercial and Passenger Vehicles

As the automotive industry accelerates towards electrification, lightweighting, and enhanced safety standards, the leaf spring suspension sector is experiencing transformative shifts that extend beyond mere component tweaks. Contemporary advancements in composite materials, including carbon fiber and glass fiber-reinforced polymers, are enabling designers to reduce unsprung mass without compromising load-bearing capabilities. These material innovations have been complemented by computational modeling techniques that optimize spring curvature, thickness gradients, and interleaf friction characteristics for specific vehicle profiles.

Concurrently, regulatory pressures are redefining competitive dynamics. Emission targets in key markets have driven OEMs to prioritize mass reduction at every possible node, elevating the role of leaf springs in broader sustainability agendas. Meanwhile, trade policy adjustments have intensified the focus on localized sourcing, prompting manufacturers to reconfigure their supply networks. Emerging players in Asia-Pacific are leveraging cost advantages and nimble production methodologies to challenge established incumbents, while North American and European suppliers are investing heavily in next-generation coating technologies to extend fatigue life and corrosion resistance. These converging technological and regulatory forces are forging a new landscape in which agility, material diversity, and digital design validation are paramount.

Looking ahead, the integration of smart sensor arrays within leaf spring assemblies promises to deliver real-time condition monitoring, enabling predictive maintenance and adaptive suspension tuning. Such innovations signal a shift from static load support to dynamic performance management, underscoring the leaf spring’s evolving role in the era of connected and autonomous vehicles.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Supply Chains and Strategic Sourcing Practices for Leaf Spring Suspension Components

In 2025, the United States implemented a series of targeted tariffs on imported steel and composite raw materials that underpin the manufacture of leaf spring suspensions. These tariff measures have had a cumulative impact across the value chain, elevating input costs and prompting recalibration of procurement strategies. Domestic spring manufacturers have responded by negotiating longer-term contracts with steel mills and exploring alternative composite suppliers to insulate themselves from price volatility. At the same time, some OEMs have engaged in vertical integration efforts, acquiring minority stakes in raw material processors to secure supply continuity and cost visibility.

The ripple effects on logistics have also been significant. Increased duties on certain imported alloys have led to a resurgence of North American processing facilities, but at the same time have elevated lead times due to capacity constraints. Some global tier-one suppliers have rediverted production to Southeast Asia and Latin America, where tariff exposure is minimized through free trade agreements. These shifts have necessitated a reexamination of total landed cost models, with companies increasingly factoring in cross-border duty differentials, currency fluctuations, and inland transportation bottlenecks.

Strategically, the tariff environment has accelerated efforts to diversify material portfolios. Several innovators are trialing hybrid spring architectures that combine lower-cost glass fiber composites with high-strength steel inserts, striking a balance between performance and cost. As a result, the 2025 tariff landscape has acted not only as a cost headwind but also as a catalyst for supply chain resilience and material innovation.

Unveiling Key Segmentation Dynamics Driving Diversification across Product Types Materials Axle Positions Vehicle Categories and End Users

A nuanced understanding of market segmentation reveals significant performance differentials and strategic opportunities across distinct categories. Leaf spring designs vary dramatically by product type: full-elliptical assemblies provide exceptional articulation for heavy-duty applications, whereas mono leaf springs offer a streamlined approach for lighter vehicles seeking aerodynamic benefits. Multi-leaf configurations remain prevalent among commercial fleets due to their robustness under cyclic loading, while quarter-elliptical and three-quarter elliptical variants cater to specialty suspension systems in niche off-road and military vehicles. Semi-elliptical springs achieve a balance of load capacity and ride compliance, and transverse leaf springs are finding renewed interest in sports cars as designers explore chassis packaging efficiencies.

Material type further refines the value proposition. Traditional steel springs continue to dominate cost-sensitive applications, but composite alternatives-particularly those leveraging carbon fiber composites for premium performance and glass fiber composites for cost-effective durability-are gaining traction. As composite processing technologies mature, manufacturers can optimize fiber orientation and resin matrices to tailor stiffness and damping characteristics precisely to axle loads.

Axle position informs spring geometry and load distribution, with front axle applications emphasizing ride comfort and steering stability, and rear axle springs designed for towing capacity and cargo support. Vehicle type delineation underscores divergent priorities: heavy commercial vehicles demand extreme resilience and lifetime durability, while light commercial vehicles and passenger segments such as hatchbacks, sedans, and SUVs value a combination of cost efficiency, NVH suppression, and responsive handling. Finally, end user segmentation distinguishes aftermarket channels-where serviceability and retrofit ease are paramount-from original equipment manufacturer supply, which prioritizes engineering validation, volume consistency, and OEM approval processes.

This comprehensive research report categorizes the Automotive Leaf Spring Suspension market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Axle Position

- Vehicle Type

- End User

Highlighting Regional Dynamics Affecting Adoption of Leaf Spring Suspension Systems across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics continue to shape the adoption curves and innovation priorities for leaf spring suspension systems. In the Americas, historical reliance on heavy-duty truck fleets and agricultural vehicles has driven demand for steel-based multi-leaf assemblies with proven longevity. However, the rising presence of urban logistics carriers has introduced a growing interest in weight-saving composite options to enhance fuel efficiency and reduce total cost of ownership. Regional steel tariffs have prompted manufacturers to localize production closer to key OEM clusters in the Midwest and Gulf Coast, reinforcing domestic supply resilience.

In Europe, Middle East & Africa, stringent CO2 emission regulations and urban emission zones are accelerating the shift towards lightweight materials and advanced coatings. European OEMs are collaborating closely with material science startups to co-develop glass fiber composite springs that meet both durability standards and sustainability mandates. At the same time, growing military procurement in Middle Eastern markets is sustaining demand for robust elliptical designs suited to high-mobility armored vehicles, while North African logistics operators are investing in aftersales networks for steel spring maintenance.

Asia-Pacific represents the fastest-growing frontier, driven by rapid expansion of commercial vehicle fleets in India and Southeast Asia, and rising SUV penetration in China. Localized composite manufacturing hubs are emerging along established automotive corridors, supported by government incentives for advanced materials industries. This region’s blend of cost-sensitive markets and ambitious infrastructure development makes it a testing ground for hybrid spring solutions that marry steel backbones with composite overlays, demonstrating a unique fusion of traditional and next-generation approaches.

This comprehensive research report examines key regions that drive the evolution of the Automotive Leaf Spring Suspension market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Leadership Strategies and Innovation Profiles of Major Manufacturers Pioneering Advances in Leaf Spring Suspension Technology and Supply Chains

The competitive arena for leaf spring suspension systems is anchored by a mix of global conglomerates and specialized innovators that have carved out leadership through organic growth and strategic acquisitions. Tenneco, with its deep expertise in ride control and emission technologies, has leveraged digital prototyping to reduce development cycles and enhance spring fatigue life. Its recent launch of sensor-integrated steel leaf springs underscores its commitment to predictive maintenance solutions. Meanwhile, Hendrickson has doubled down on heavy commercial vehicle platforms, investing in high-strength steel alloys and automated welding lines to support next-generation trucking fleets.

Mubea has emerged as a pioneer in composite leaf spring manufacturing, scaling carbon fiber production capacity for both European passenger vehicles and North American medium-duty trucks. Its proprietary resin transfer molding techniques allow for intricate fiber profiling that optimizes load distribution. Similarly, SAF-Holland has strategically expanded its footprint in emerging markets by partnering with regional tier-two suppliers, enabling local assembly of semi-elliptical and three-quarter elliptical springs to meet cost and lead time requirements.

In parallel, mid-sized players such as KYB and Super Springs Specialty have differentiated through aftermarket innovation, introducing plug-and-play composite modules designed for rapid retrofit on light trucks and SUVs. This broad spectrum of capabilities-from heavy-duty steel expertise to advanced composite processing-illustrates how key companies are aligning their R&D investments and operational footprints to capture growth opportunities across segments and geographies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Leaf Spring Suspension market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Al‑Ko Kober Group

- Atlas Spring & Axle Co., Inc.

- Betts Spring Manufacturing

- Dendoff Springs Ltd.

- Dongfeng Motor Suspension Spring Co., Ltd.

- Eagle Suspensions

- Eaton Detroit Spring, Inc

- Eibach Industries GmbH

- Emco Industries

- Felling Trailers, Inc.

- General Spring Co.

- Hendrickson USA, L.L.C

- HUAYU / Sichuan Huayu Vehicle Leaf Spring Co., Ltd.

- Infinito Auto Industries LLP

- McAllister Spring Ltd.

- Mitsubishi Steel Mfg. Co.

- Mubea Inc.

- NHK Spring Co., Ltd.

- Olgun Çelik A.S

- San Luis Rassini, S.A. de C.V.

- Sogefi Group

- Standen’s LP

- Sterling Spring

- STL Spring Company

- Triangle Suspension Systems

- ZF Friedrichshafen AG

Strategic Roadmap for Industry Leaders to Optimize Production Efficiency Enhance Material Selection and Strengthen Supply Resilience in Leaf Spring Suspension

To capitalize on emerging opportunities, industry leaders must pursue a multi-pronged strategy that strengthens material flexibility, enhances digital integration, and fortifies supply resilience. First, companies should establish cross-functional material councils that bring together design, procurement, and production teams to evaluate steel, carbon fiber, and glass fiber composites against evolving vehicle performance requirements. Embedding material selection criteria early in the design cycle will reduce downstream change orders and accelerate time to market.

Second, manufacturers must expand their digital toolsets by integrating advanced finite-element analysis with real-time sensor feedback loops. Deploying smart leaf springs equipped with onboard condition-monitoring electronics enables predictive maintenance programs and aftermarket revenue streams. These insights can also feed into continuous improvement processes, enabling rapid iteration on spring geometry and interleaf frictions.

Third, supply chain networks must be diversified to mitigate tariff and geopolitical exposures. Establishing dual-sourcing agreements for raw steel and composite feedstocks, combined with judicious investment in regional processing hubs, will ensure consistent capacity and cost control. Furthermore, forging collaborative partnerships with specialized material suppliers can unlock joint development agreements, yielding customized resin chemistries and surface treatments that extend service life and corrosion resistance.

By executing these recommendations, industry leaders will be well-positioned to deliver next-generation suspension solutions that balance performance, sustainability, and resilience in an increasingly complex automotive landscape.

Detailed Research Methodology Integrating Primary and Secondary Data Sources Analytical Frameworks and Validation Protocols for Leaf Spring Suspension Analysis

This study employs a rigorous research methodology designed to ensure transparency, reproducibility, and actionable insight. Primary research components include in-depth interviews with OEM design engineers, supply chain managers, and material science experts across North America, Europe, and Asia-Pacific. These conversations have provided direct input on emerging material trends, tariff mitigation tactics, and regional production practices. Supplemental to primary data, a comprehensive review of technical white papers, trade association reports, and patent filings has been conducted to identify the latest advancements in composite processing, coating technologies, and sensor integration within leaf spring systems.

Analytical frameworks applied in the study encompass comparative cost-benefit analyses, scenario modeling for tariff impacts, and cross-regional adoption mapping. Cost modeling integrates raw material pricing, duty differentials, and logistics overhead to produce a normalized comparison across sourcing strategies. Scenario planning exercises evaluate the potential outcomes of regulatory shifts, material supply disruptions, and technological breakthroughs. Validation protocols include triangulation of interview insights with publicly disclosed company financials and third-party certification data on fatigue and corrosion performance.

Throughout the research cycle, quality assurance measures-such as peer review workshops and validation calls with industry stakeholders-have been employed to verify assumptions and refine predictive scenarios. This methodological rigor ensures that the findings and recommendations presented in this report are grounded in both qualitative expertise and quantitative analysis, providing stakeholders with a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Leaf Spring Suspension market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Leaf Spring Suspension Market, by Product Type

- Automotive Leaf Spring Suspension Market, by Material Type

- Automotive Leaf Spring Suspension Market, by Axle Position

- Automotive Leaf Spring Suspension Market, by Vehicle Type

- Automotive Leaf Spring Suspension Market, by End User

- Automotive Leaf Spring Suspension Market, by Region

- Automotive Leaf Spring Suspension Market, by Group

- Automotive Leaf Spring Suspension Market, by Country

- United States Automotive Leaf Spring Suspension Market

- China Automotive Leaf Spring Suspension Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Critical Insights and Strategic Imperatives Guiding the Future Development and Adoption of Advanced Leaf Spring Suspension Systems Worldwide

As the automotive industry advances into an era defined by electrification, autonomy, and heightened sustainability standards, leaf spring suspension systems remain a vital component of vehicle performance and reliability. The synthesis of insights presented throughout this report underscores several strategic imperatives: the imperative to adopt lightweight composite materials judiciously, the necessity of diversifying supply networks to navigate tariff uncertainties, and the value of digital integration for next-generation condition monitoring. By aligning design and procurement teams early in product development cycles, organizations can accelerate innovation while mitigating downstream cost overruns.

Moreover, regional dynamics highlight that market leaders must tailor their approaches to distinct geographic contexts. In established markets of the Americas and EMEA, emphasis on regulatory compliance and aftersales serviceability demands a balanced portfolio of steel and advanced composite springs. Conversely, Asia-Pacific’s rapid fleet expansions and infrastructure growth require scalable low-cost solutions that can be localized efficiently. Strategic partnerships and joint ventures emerge as effective vehicles for bridging capability gaps and accessing new end-user segments.

Looking forward, the convergence of smart suspension technologies with electrified powertrains presents fresh avenues for differentiation. Sensor-enabled leaf springs that feed into vehicle control algorithms can elevate ride comfort, load balancing, and energy efficiency. Ultimately, companies that master the intersection of material science, digital innovation, and strategic sourcing will secure a leadership position in the dynamic leaf spring suspension market.

Engage with Ketan Rohom to Access Comprehensive Market Research Report Securing Strategic Insights and Customized Support for Leaf Spring Suspension Stakeholders

To explore the full depth of insights on the leaf spring suspension market and secure tailored strategic advice, engage with Ketan Rohom, Associate Director of Sales & Marketing. By partnering directly, stakeholders can access customized research summaries, gain comparative analyses of material innovations, and receive targeted guidance on navigating tariff implications, regional opportunities, and segmentation strategies. Ketan’s expertise ensures that each discussion is aligned with your unique supply chain challenges and growth ambitions. Reach out to arrange a personalized briefing that unlocks the strategic roadmap needed to optimize your operations, strengthen supplier relationships, and capitalize on emerging trends in the leaf spring suspension landscape.

- How big is the Automotive Leaf Spring Suspension Market?

- What is the Automotive Leaf Spring Suspension Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?