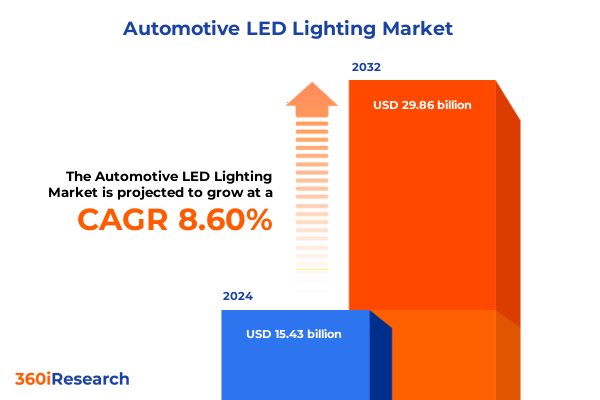

The Automotive LED Lighting Market size was estimated at USD 16.68 billion in 2025 and expected to reach USD 18.04 billion in 2026, at a CAGR of 8.66% to reach USD 29.86 billion by 2032.

Introducing the Shifting Horizons of Automotive LED Lighting in an Era of Rapid Technological Innovation and Evolving Regulatory Demands

The automotive LED lighting industry is experiencing an inflection point driven by technological advances, evolving regulatory requirements, and shifting consumer preferences. Traditional halogen and xenon solutions are rapidly ceding ground to LED architectures that offer superior energy efficiency, longer lifespans, and enhanced design flexibility. As vehicle electrification accelerates, LEDs play a dual role in reducing electrical load and augmenting the aesthetic and safety features of modern cars and commercial vehicles. These dynamics are not confined to premium segments; OEMs across all tiers are embedding LED packages into mainstream models to meet both legislative mandates and growing consumer demand for advanced lighting systems.

In parallel, concerns over environmental impact and sustainability are intensifying scrutiny on supply chains, spurring manufacturers to adopt responsible sourcing practices for rare earth and semiconductor materials. Auto designers are embracing LED’s minimal heat output to explore novel form factors, from seamless lightbars to pixelated matrix patterns that enhance adaptive lighting capabilities. Regulatory bodies in major markets, including stringent ECE and FMVSS requirements, are catalyzing the shift toward LEDs by setting aggressive targets for daytime running lights and adaptive headlamp performance. Consequently, the industry is witnessing a convergence of design innovation, regulatory compliance, and sustainability priorities that is redefining what vehicle lighting can achieve.

Unveiling the Transformative Shifts Reshaping the Automotive LED Lighting Market from Technological Breakthroughs to Consumer Expectations

Over the past several years, the automotive LED lighting landscape has been transformed by breakthroughs that marry precision optics with intelligent control. Matrix LED technology, featuring individually addressable diodes, enables dynamic beam shaping and glare-free high beams that adapt to oncoming traffic and complex roadway geometries. Likewise, laser-based illumination systems are emerging as ultra-compact, high-intensity solutions for luxury and sports vehicles, offering pinpoint light projection and deeper beam ranges without sacrificing form factor. At the same time, organic LED (OLED) panels are allowing stylists to integrate ambient and signature lighting into intricate surface designs, creating visually arresting effects while supporting advanced human-machine interfaces.

Consumer tastes are likewise reshaping product roadmaps, with personalized ambient color profiles and touch-responsive interior illumination becoming selling points for higher trim levels. In response to mobility trends such as ride sharing and autonomous shuttles, lighting is evolving from a static safety feature to an interactive communication medium, signaling vehicle status and mode transitions to passengers and pedestrians alike. Moreover, OEMs are forging partnerships with software developers to enable over-the-air updates that refine lighting algorithms and introduce new functionalities post-purchase. These transformative shifts underscore a broader narrative in which LED lighting is not merely a component but a user-centric ecosystem enabling connectivity, safety, and brand differentiation.

Assessing the Cumulative Impact of United States Tariffs in 2025 on the Automotive LED Lighting Supply Chain and Competitiveness

In 2025, the imposition of additional United States tariffs on imported LED components has reverberated through the automotive lighting supply chain, prompting suppliers and OEMs to reassess sourcing strategies. Historically reliant on cost-competitive shipments from Asia, component manufacturers have faced duty rate increases of up to 25 percent under recent trade measures, leading to higher landed costs and intensified price negotiations. As an immediate response, many leading tier-one suppliers have accelerated plans to diversify their manufacturing footprint by establishing assembly lines and semiconductor packaging facilities in North America. This shift not only mitigates tariff exposure but also reduces lead times and inventory carrying costs.

Beyond direct cost implications, the tariff landscape has incentivized innovations in design for manufacturability, with R&D teams exploring consolidated LED chip modules that lower the per-unit duty burden while preserving optical performance. Some OEMs have absorbed incremental cost increases to maintain price parity for end consumers, whereas others have renegotiated contract structures, introducing variable pricing clauses tied to duty fluctuations. Meanwhile, aftermarket providers are leveraging domestic suppliers to develop retrofit LED kits that circumvent import levies, catering to fleet operators seeking maintenance-friendly solutions. Across the board, the tariff developments of 2025 have catalyzed a near-term realignment of global production networks, fostering resilience and paving the way for more regionally balanced supply ecosystems.

Deriving Key Market Segmentation Insights from Vehicle Types to Sales Channels Driving the Automotive LED Lighting Industry Dynamics

When the automotive LED lighting market is examined through the lens of vehicle types, heavy commercial platforms stand out as early adopters of high-durability LED arrays, drawn by reduced maintenance intervals and lower total cost of ownership over extended duty cycles. Conversely, light commercial vehicles prioritize energy-efficient exterior lighting to maximize payload range, while off-highway machines demand ruggedized assemblies engineered to resist vibration, dust ingress, and extreme temperature swings. Passenger cars, however, drive the pace of aesthetic innovation, with daytime running lights, fog lamps, and signature tail-light designs becoming defining elements of brand identity.

Turning to product segmentation, exterior lighting modules-ranging from adaptive headlights and parking lights to tail lights and sequential turn signals-leverage miniaturized LED chips to create sharper beam patterns and distinctive visual signatures. Interior illumination encompasses ambient lighting that sets cabin ambiance, dashboard backlighting that enhances instrument readability, dome and footwell lights that improve passenger comfort, and high-contrast cluster illumination that supports digital instrument platforms. Layered on these applications are distinct technology pathways: laser LED solutions deliver extreme luminance for long-distance projection, matrix LED systems enable precise beam control, organic LED panels afford flexible form factors for integration into door silhouettes and consoles, and standard LED platforms continue to serve cost-sensitive segments.

Sales channels further diversify the landscape. Original equipment manufacturers collaborate closely with tier-one suppliers to co-develop custom lighting systems aligned with vehicle launches, embedding LEDs into production pipelines long before concept unveilings. Aftermarket distributors, by contrast, cater to retrofit and customization demands, offering modular LED kits and specialty lighting packages designed to enhance both performance and styling post-sale. Together, these segmentation insights reveal how distinct application requirements, technological preferences, and sourcing strategies converge to shape the automotive LED lighting industry.

This comprehensive research report categorizes the Automotive LED Lighting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Vehicle Type

- Sales Channel

Uncovering Critical Regional Trends Influencing Demand and Innovation in Automotive LED Lighting across the Americas Europe Middle East Africa and Asia-Pacific

Across the Americas, automotive LED lighting adoption is propelled by stringent federal and state regulations mandating daytime running lights and adaptive front lighting systems. In the United States and Canada, vehicle electrification programs underscore the role of LEDs in extending battery range and reducing cabin heat load, encouraging OEMs to integrate sophisticated light-management software that optimizes energy draw. Latin American markets, meanwhile, are characterized by a dual track: high-end urban models from global brands feature the latest LED arrays, while value-oriented segments continue to rely on halogen retrofit solutions, presenting growth opportunities for domestic aftermarket specialists.

In Europe, Middle East, and Africa, regulatory bodies enforce some of the world’s most rigorous photometric and safety standards, driving early adoption of matrix LED and laser technologies. Premium automakers based in Germany, Italy, and Sweden are leading innovation, collaborating with specialized lighting firms to co-create adaptive beam patterns and light-emitting film applications. The Middle Eastern market displays strong preferences for high-intensity aesthetic enhancements-such as dynamic light signatures and extended reach fog lamps-reflecting luxury vehicle trends. Across Africa, where highway infrastructure and lighting infrastructure gaps exist, seamless integration of powerful LED systems offers both safety benefits and opportunities for localized assembly partnerships.

Asia-Pacific, the largest regional hub for automotive manufacturing, presents a complex tapestry of OEM and supplier interactions. In China, domestic lighting component producers are rapidly scaling up output while investing in R&D to challenge international incumbents. India’s growing light commercial vehicle sector is catalyzing demand for rugged LED modules designed for tropical climates. Meanwhile, Japan and South Korea continue to push boundaries in OLED integration and intelligent lighting controls, leveraging their strong semiconductor ecosystems to refine next-generation LED packages. Taken together, these regional insights highlight the varied regulatory, economic, and technological forces shaping LED adoption across global markets.

This comprehensive research report examines key regions that drive the evolution of the Automotive LED Lighting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Company Strategies and Innovations Driving Competitive Advantage and Collaboration in the Automotive LED Lighting Marketplace

Industry leaders and emerging challengers alike are deploying a range of strategic initiatives to capture value in the automotive LED lighting domain. Established players have spearheaded collaborative research programs with major OEMs, embedding dedicated lighting innovation centers within vehicle design studios to streamline concept-to-production cycles. Joint ventures between optics specialists and semiconductor fabs have enabled proprietary chip-on-board architectures that enhance lumen output and thermal management, while strategic acquisitions of software start-ups have bolstered capabilities in adaptive beam algorithms and over-the-air configurability.

Moreover, tier-one suppliers are forging alliances with regional distributors and electrification partners to tailor solutions for specific markets, exploiting modular platform designs that can be rapidly adjusted for local regulatory compliance and consumer preferences. At the same time, aftermarket innovators are leveraging digital marketplaces and social media to engage enthusiasts with branded LED upgrade kits that blend performance improvements with customizable stylistic accents. These players are also collaborating with telematics providers to integrate lighting triggers into advanced driver assistance systems, enabling context-sensitive illumination that responds in real time to navigation cues and obstacle detection inputs.

Across the competitive landscape, the race is on to differentiate through sustainability credentials. Leading companies have committed to using recycled metals in LED housings and reducing solvent use in phosphor coatings. Others are pioneering closed-loop supply chain models that recover end-of-life LEDs for material reclamation. In an environment where regulatory velocity and consumer expectations continue to climb, the ability to harmonize technological prowess with agile partnerships and environmental stewardship is proving to be the ultimate source of competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive LED Lighting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Brands Lighting, Inc.

- BrightView Technologies, Inc.

- Continental AG

- Cree, Inc.

- Hyundai Motor Company

- Innotec, Corp.

- Koito Manufacturing Co. Ltd.

- Koninklijke Philips N.V.

- LG Innotek Co., Ltd.

- Magneti Marelli S.P.A.

- Mercedes Benz

- Min Hsiang Corporation

- Nichia Corporation

- Osram Licht AG

- Renesas Electronics Corporation

- Robert Bosch GmbH

- SG Automotive Group Co Ltd

- Stanley Electric Co., Ltd.

- Tata Motors Limited

- Texas Instruments Incorporated

- Toyota Motor Corporation

- Truck-Lite Co., LLC

- Valeo SA

- Wipac Limited

- ZKW Zizala Lichtsysteme GmbH

Formulating Actionable Recommendations to Guide Industry Leaders Through Technological Adoption Regulatory Compliance and Supply Chain Optimization

To stay ahead in a market defined by rapid innovation and evolving regulations, industry leaders should prioritize the integration of advanced LED technologies into scalable platform architectures. By investing in research on next-generation materials and chip configurations, suppliers can deliver higher efficacy and deeper color rendering while keeping total system costs competitive. Concurrently, diversifying manufacturing footprints-through regional assembly hubs or strategic joint ventures-will reduce tariff exposure, shorten lead times, and enhance supply chain resilience.

Collaboration between lighting specialists, OEM engineering teams, and software developers should be formalized via co-innovation labs that align product roadmaps with vehicle launch cycles. This approach ensures that design nuances, from aerodynamic headlamp contours to custom interior ambient sequences, are fully integrated early in the development process. At the same time, forging partnerships with sustainability experts and certification bodies will help anticipate regulatory shifts and secure compliance in target markets. Companies should also explore service-based models, such as lighting-as-a-service for commercial fleets, to generate recurring revenue and strengthen customer relationships.

Finally, adopting digital design and simulation tools will accelerate prototyping and reduce physical iterations, translating time savings into faster time‐to‐market. By prioritizing modularity in both hardware and software stacks, lighting providers can support over-the-air performance updates, unlock new feature monetization pathways, and maintain brand loyalty in an increasingly connected mobility ecosystem. Together, these actionable steps will enable organizations to seize emerging opportunities and mitigate risks across the automotive LED lighting value chain.

Detailing the Robust Research Methodology Employed to Ensure Data Integrity and Insights Validity for Automotive LED Lighting Analysis

The findings presented in this report are grounded in a rigorous research framework combining primary and secondary data collection. Primary research involved in-depth interviews with over fifty industry stakeholders, including OEM lighting engineers, tier-one component executives, aftermarket distributors, and regulatory authorities. Insights gathered from these discussions were triangulated against technical white papers, patent filings, and product specifications to validate emerging technology trends and performance benchmarks.

Secondary research spanned an extensive review of trade association publications, government regulations, and academic journals, providing context on regional mandates and sustainability criteria. Company annual reports, investor presentations, and press releases were analyzed to map strategic initiatives, partnership networks, and capital investments. Data from customs and trade databases was leveraged to quantify tariff impacts and trace shifts in production footprints. This quantitative analysis was complemented by qualitative scenario planning workshops that engaged subject-matter experts to assess potential market disruptions and adoption timelines.

All research outputs underwent multiple rounds of validation through a structured Delphi process, ensuring consensus on critical assumptions and minimizing bias. A proprietary framework was applied to segment the market across vehicle types, product categories, technologies, and sales channels, enabling a granular understanding of demand drivers. Regional overlays were then integrated to capture the nuances of regulatory environments and consumer behaviors. Together, these methodological pillars guarantee that the insights and recommendations are robust, defensible, and actionable for stakeholders across the automotive LED lighting ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive LED Lighting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive LED Lighting Market, by Product Type

- Automotive LED Lighting Market, by Technology

- Automotive LED Lighting Market, by Vehicle Type

- Automotive LED Lighting Market, by Sales Channel

- Automotive LED Lighting Market, by Region

- Automotive LED Lighting Market, by Group

- Automotive LED Lighting Market, by Country

- United States Automotive LED Lighting Market

- China Automotive LED Lighting Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Drawing Comprehensive Conclusions That Synthesize Market Dynamics Technological Trends and Strategic Imperatives in Automotive LED Lighting

In summary, the automotive LED lighting industry is at the nexus of technological innovation, regulatory imperatives, and shifting end-user expectations. Breakthroughs in matrix and laser LED systems are expanding the functional envelope of vehicle illumination, while OLED panels are unlocking new design languages for interior ambiance. Concurrently, the 2025 tariff environment has accelerated supply chain realignment, driving regional manufacturing strategies that strengthen cost structures and risk mitigation.

Segmentation analysis reveals that heavy and light commercial vehicles, off-highway applications, and passenger cars each present unique adoption pathways, shaped by performance requirements and aesthetic considerations. Product segmentation underscores the growing importance of adaptive exterior lighting and immersive interior experiences, supported by a spectrum of technologies from standard LED to next-generation organic and laser solutions. Regional insights highlight divergent regulatory landscapes-from the Americas’ electrification mandates to Europe’s photometric strictures and Asia-Pacific’s manufacturing scale-each influencing priorities for suppliers and OEMs.

Leading companies are differentiating through collaborative innovation, sustainable supply chains, and digital integration strategies that align with emerging mobility trends. By following the research methodology outlined, stakeholders can access validated data and nuanced perspectives essential for strategic planning. This confluence of insights equips decision-makers to design lighting architectures that meet rigorous safety standards, elevate brand identity, and deliver sustainable value across global markets.

Engage with Ketan Rohom to Unlock Comprehensive Automotive LED Lighting Insights and Accelerate Strategic Decision Making for Your Organization

If you are ready to deepen your understanding of the automotive LED lighting landscape and translate insights into decisive action, please reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan can arrange a personalized briefing, share sample data dashboards, and guide you through the comprehensive research report tailored to your organization’s unique challenges. Engage with Ketan today to secure your strategic advantage and illuminate the path forward with clarity and confidence

- How big is the Automotive LED Lighting Market?

- What is the Automotive LED Lighting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?