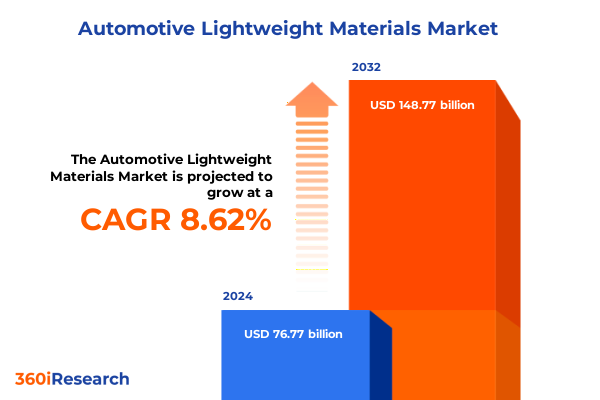

The Automotive Lightweight Materials Market size was estimated at USD 82.88 billion in 2025 and expected to reach USD 89.49 billion in 2026, at a CAGR of 8.71% to reach USD 148.77 billion by 2032.

Navigating the evolving automotive lightweight materials landscape with strategic insight to harness innovation and meet sustainability imperatives

The automotive industry stands at the intersection of technological innovation and sustainability imperatives, with lightweight materials emerging as a cornerstone of future mobility solutions. Across global markets, manufacturers are under mounting pressure to reduce vehicle weight in order to enhance fuel efficiency, lower emissions, and meet stringent regulatory standards. This evolution is particularly pronounced in the shift toward electric vehicles, where balancing battery weight with structural performance demands a holistic rethinking of material choices. Consequently, organizations must stay attuned to breakthroughs in composites, advanced metals, and engineered polymers to unlock performance gains without compromising safety or cost objectives.

Moreover, the strategic adoption of lightweight materials extends beyond mere weight reduction. It encompasses lifecycle considerations, from raw material sourcing to end-of-life recyclability, reflecting an industry-wide drive toward circularity. This report delves into the intricate factors driving material selection, covering performance metrics such as tensile strength, stiffness-to-weight ratio, and thermal stability, while also exploring economic dynamics, including production costs and supply chain resilience. By weaving together these diverse threads, the introduction sets the stage for an in-depth examination of how automotive lightweight materials are reshaping vehicle design, manufacturing, and market competition.

Understanding transformative shifts reshaping automotive lightweight materials adoption driven by electrification imperatives, regulatory pressures, and manufacturing breakthroughs

Over the past decade, the automotive sector has witnessed transformative shifts propelled by electrification, advanced manufacturing technologies, and escalating environmental mandates. As the global fleet transitions toward electric and hybrid powertrains, weight reduction has become a paramount design objective, compelling engineers and material scientists to optimize every component for performance and efficiency. In parallel, digital manufacturing breakthroughs, such as automated fiber placement and additive metal printing, have revolutionized production processes, enabling complex geometries and material gradations that were previously unattainable.

Furthermore, regulatory frameworks around the world have intensified, introducing tighter corporate average fuel economy (CAFE) standards and carbon dioxide emission targets. These requirements have accelerated investment in alternative materials that deliver high strength-to-weight ratios while ensuring crashworthiness. Additionally, the emergence of multi-material joining techniques and hybrid structures-combining composites with aluminum or high-strength steel-reflects a systemic shift toward integrated design philosophies. Consequently, original equipment manufacturers (OEMs) and Tier 1 suppliers are collaborating more closely than ever to co-develop tailored solutions that meet both performance and compliance benchmarks.

Analyzing the cumulative repercussions of United States 2025 tariffs on automotive lightweight materials supply chains, cost structures, and global sourcing dynamics

The imposition of new United States tariffs on key automotive lightweight materials in early 2025 has created a cascade of effects across global supply chains and cost structures. By targeting imported aluminum alloys, carbon fiber composites, and select polymer resins, these measures have prompted OEMs and suppliers to reassess sourcing strategies and explore alternative origins for critical feedstocks. In response, many stakeholders have accelerated the diversification of supplier bases, engaging with domestic producers and regional partners to mitigate tariff-related cost inflations and potential supply disruptions.

Consequently, some automakers have re-evaluated design specifications to accommodate locally sourced materials, even as they navigate the technical trade-offs associated with different grades and processing capabilities. Meanwhile, negotiations between trade representatives and industry associations continue to shape the evolving tariff landscape, with provisional exemptions and quota adjustments offering temporary relief for certain material categories. This dynamic environment underscores the importance of agile procurement strategies and proactive policy monitoring to safeguard both operational continuity and competitive positioning in the face of shifting economic headwinds.

Unveiling segmentation insights across material types, manufacturing processes, application domains, vehicle classifications, and distribution pathways to inform strategic decision making

Insight into market segmentation reveals a multilayered landscape where material type, manufacturing processes, application domains, vehicle classifications, and distribution avenues each play a critical role in shaping competitive dynamics. Within the material spectrum, composites-comprising carbon fiber and glass fiber variants-offer unparalleled stiffness-to-weight ratios for high-performance structural components, while metals such as aluminum, magnesium, and titanium balance lightweight credentials with proven metallurgical reliability. Engineered polymers, including polyamide, polyethylene, and polypropylene, deliver cost-effective weight savings in non-structural applications and facilitate intricate geometries through injection molding.

Transitioning to process-based segmentation, casting and extrusion remain foundational for high-volume aluminum parts, with forging and composite molding advancing the capabilities of structural elements requiring superior mechanical properties. Injection molding continues to dominate polymer component production due to its flexibility and scalability. Application-wise, lightweight solutions have become integral to modern body structures, chassis frames, interior assemblies, and powertrain enclosures. Meanwhile, distinctions between commercial and passenger vehicle segments reflect divergent design priorities: heavy and light commercial vehicles prioritize payload efficiency and durability, whereas passenger vehicles emphasize ride comfort and safety. Finally, distribution channels span traditional offline networks and emerging online platforms, each facilitating distinct buyer journeys and service models that influence adoption rates and aftersales engagement.

This comprehensive research report categorizes the Automotive Lightweight Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Process

- Application

- Vehicle Type

- Distribution Channel

Examining regional dynamics in the Americas, Europe Middle East Africa, and Asia Pacific shaping automotive lightweight materials adoption and strategic investment priorities

Regional dynamics exert a profound influence on the trajectory of automotive lightweight materials adoption and investment. Across the Americas, a robust base of aluminum smelters and emerging carbon fiber capacity in North America has spurred collaborations between OEMs and domestic suppliers, fostering integrated supply chains that reduce lead times and logistical complexity. Latin American markets, though more cost-sensitive, are increasingly exploring polymer composites for light commercial vehicles, driven by urban transit needs and improving manufacturing infrastructures.

In Europe, Middle East, and Africa, stringent Union-wide emissions targets and high consumer expectations for premium driving experiences have positioned advanced composites at the forefront of lightweighting strategies. The region’s mature automotive hubs continue to invest in next-generation processes, such as reactive extrusion for polymer-metal hybrids, while Middle Eastern initiatives seek to leverage local feedstocks for cost-competitive production. Conversely, in Asia-Pacific, burgeoning automotive production centers in China, India, and Southeast Asia emphasize scale and cost efficiency, prompting widespread polymer adoption and an uptick in aluminum extrusion facilities. Japanese and South Korean OEMs are at the vanguard of integrating magnesium alloys and carbon fiber composites into mass-market powertrain modules, showcasing the region’s ability to blend innovation with high-volume manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Automotive Lightweight Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading companies driving technological innovation in automotive lightweight materials through strategic partnerships, R&D investments, and digital integration efforts

Industry-leading companies continue to define the competitive landscape through targeted investments and strategic partnerships. Global carbon fiber producers have partnered with leading OEMs to co-develop proprietary fiber architectures, optimizing stiffness and impact resistance for electric vehicle frames. Aluminum specialists are collaborating with process innovators to refine high-pressure die casting and low-pressure sand casting techniques, achieving thinner wall sections without sacrificing crash performance. Polymer manufacturers have intensified R&D efforts in high-performance polyamides and reinforced polypropylene compounds, responding to OEM demand for materials that enhance both cabin comfort and thermal management.

Moreover, joint ventures between material suppliers and automotive suppliers are becoming more prevalent, facilitating the seamless integration of lightweight solutions into existing assembly lines. Strategic acquisitions of niche technology firms have enabled some market players to expand their capabilities in automated composite layup and digital quality control. As competition intensifies, companies are leveraging data analytics and digital twins to simulate material behavior under real-world operating conditions, accelerating development timelines and reducing costly physical prototyping. This constellation of initiatives underscores how leading organizations are aligning corporate strategy with technological innovation to maintain leadership in the lightweight materials domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Lightweight Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcoa Corporation

- Constellium N.V.

- Covestro AG

- Evonik Industries AG

- Hexcel Corporation

- LyondellBasell Industries N.V.

- Magna International Inc.

- Mitsubishi Chemical Holdings Corporation

- Novelis Inc.

- SGL Carbon SE

- Solvay S.A.

- Teijin Limited

- Toray Industries, Inc.

Delivering actionable recommendations for industry leaders to accelerate sustainable lightweight materials integration and capitalize on evolving market opportunities

To capitalize on the rapid evolution of lightweight materials and maintain a competitive edge, industry leaders must adopt a multifaceted approach that blends technological agility with strategic foresight. First, deep collaboration with OEMs and Tier 1 suppliers is essential to co-develop materials tailored to specific performance and regulatory requirements; early-stage involvement can streamline certification processes and accelerate time-to-market. Simultaneously, diversifying supply chains-by qualifying alternate domestic and regional suppliers-can insulate operations from tariff fluctuations and geopolitical uncertainties.

Equally important is the integration of digital tools, including materials informatics and simulation platforms, which enable precise modeling of composite layup, metal forming, and polymer behavior. By leveraging predictive analytics, organizations can optimize material selection and processing parameters, reducing scrap rates and shortening development cycles. To address sustainability goals, investing in recyclable and bio-based polymer formulations, as well as closed-loop metal recycling systems, will align product portfolios with emerging circular economy mandates. Finally, proactive engagement with trade associations and policy forums can inform future tariff negotiations and certification standards, ensuring that material innovations continue to meet both performance benchmarks and compliance obligations.

Detailing the comprehensive research methodology integrating secondary and primary data sources, expert interviews, and analytical frameworks to ensure robust insights

This research report is underpinned by a rigorous methodology that combines both secondary and primary data sources, ensuring a comprehensive and reliable analysis. The secondary research phase included detailed reviews of industry publications, technical journals, patent databases, and publicly available corporate filings. These insights were further enriched by trade association reports and regulatory filings, which provided clarity on emission standards, tariff structures, and certification requirements.

Primary research comprised in-depth interviews and surveys with key stakeholders across the value chain, including material suppliers, OEMs, Tier 1 manufacturers, and industry experts. This engagement yielded firsthand perspectives on emerging technologies, procurement strategies, and regional nuances. Quantitative data was triangulated through a structured process, correlating shipment volumes, capacity expansions, and pricing trends to validate findings and address discrepancies. Analytical frameworks such as SWOT and PESTEL were employed to contextualize market dynamics and assess the implications of geopolitical and economic forces. Quality checks and peer reviews were conducted throughout the research lifecycle to maintain objectivity and accuracy, resulting in an authoritative resource for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Lightweight Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Lightweight Materials Market, by Material Type

- Automotive Lightweight Materials Market, by Process

- Automotive Lightweight Materials Market, by Application

- Automotive Lightweight Materials Market, by Vehicle Type

- Automotive Lightweight Materials Market, by Distribution Channel

- Automotive Lightweight Materials Market, by Region

- Automotive Lightweight Materials Market, by Group

- Automotive Lightweight Materials Market, by Country

- United States Automotive Lightweight Materials Market

- China Automotive Lightweight Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding reflections on the intersection of innovation, policy, and market dynamics shaping the future of automotive lightweight materials

The evolving automotive lightweight materials landscape reflects a convergence of technological innovation, regulatory imperatives, and shifting market demands. As vehicles across powertrain types embrace lighter, stronger, and more sustainable materials, stakeholders must navigate a complex web of material choices, processing methods, and geopolitical factors. The 2025 tariff developments in the United States highlight the criticality of agile supply chain management, while regional divergences underscore the need for tailored strategies that leverage local capabilities and market conditions.

Ultimately, success in this domain hinges on an integrated approach that aligns R&D efforts with end-market requirements, fosters close collaboration across the value chain, and embraces digital transformation. By synthesizing segmentation insights, regional dynamics, and competitive intelligence, organizations can identify high-impact opportunities and mitigate risks. With the right blend of strategic partnerships, proactive policy engagement, and advanced analytics, manufacturers and material suppliers are well-positioned to redefine vehicle performance, sustainability, and cost efficiency for the next generation of mobility solutions.

Engage with Ketan Rohom for customized market intelligence and strategic advantage in automotive lightweight materials research and application

For organizations seeking to gain a competitive edge in automotive lightweight materials, connecting directly with Ketan Rohom can unlock tailored insights and strategic guidance. As the Associate Director of Sales & Marketing, Ketan brings extensive expertise in market dynamics, industry trends, and data-driven analysis. By engaging with Ketan, stakeholders can explore how to leverage our comprehensive research findings to inform product development roadmaps, optimize supply chain strategies, and navigate regulatory landscapes. Whether the goal is to deepen understanding of regional variations in material adoption, assess the financial and operational impacts of tariffs, or refine segmentation strategies for targeted innovation, Ketan can provide personalized consultations that translate high-level insights into actionable plans. To accelerate your organization’s journey toward sustainable, high-performance lightweight solutions, reach out to Ketan Rohom today and secure your copy of the full report to drive transformative decision-making and long-term success in the evolving automotive materials arena.

- How big is the Automotive Lightweight Materials Market?

- What is the Automotive Lightweight Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?