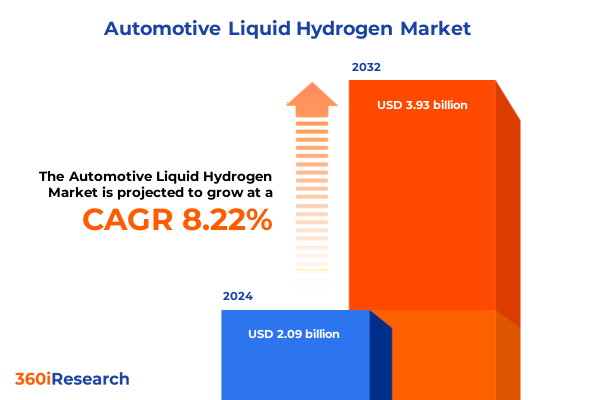

The Automotive Liquid Hydrogen Market size was estimated at USD 2.09 billion in 2024 and expected to reach USD 2.25 billion in 2025, at a CAGR of 8.22% to reach USD 3.93 billion by 2032.

Pioneering a New Era of Clean Mobility with Automotive Liquid Hydrogen Solutions Revolutionizing Vehicle Performance and Decarbonization Pathways

The automotive industry is at the cusp of a profound transformation driven by the imperative to decarbonize transportation and improve energy security. At the heart of this shift is liquid hydrogen, a fuel that offers high energy density, zero tailpipe emissions, and the potential to power vehicles across segments ranging from heavy-duty trucks to high-performance passenger cars. As a cryogenic fluid stored at temperatures near minus 253 degrees Celsius, liquid hydrogen enables longer driving ranges and faster refueling compared to its gaseous counterpart, making it an attractive solution for applications where frequent fueling stops or bulky storage tanks are impractical.

Moreover, recent advances in cryogenic storage materials and transfer technologies have reduced boil-off losses and improved on-board containment, while ongoing investments in hydrogen production from renewable electricity are enhancing supply chain sustainability. Consequently, leading automotive OEMs and system integrators are partnering with infrastructure providers to pilot liquid hydrogen fueling stations, while governments across major regions are launching incentive programs and regulatory frameworks to support early deployments. In parallel, safety standards are evolving to address the unique properties of liquid hydrogen, ensuring that industry adoption proceeds with rigor and confidence.

As a result, liquid hydrogen is transitioning from a niche experimental fuel to a viable pathway for large-scale decarbonization of road transport. This introduction outlines how automotive liquid hydrogen is poised to reshape mobility, setting the stage for deeper analysis of the transformative shifts, policy influences, segmentation dynamics, and strategic imperatives that define this emerging market.

Transformative Shifts Defining the Automotive Liquid Hydrogen Landscape as Regulatory Advances, Technological Breakthroughs, and Infrastructure Expansion Converge

In recent years, the convergence of stringent emissions regulations, escalating R&D investments, and cross-sector collaborations has propelled liquid hydrogen into the automotive spotlight. Regulatory bodies in Europe and Asia have set ambitious targets for zero-emission vehicles, prompting automakers to explore alternative fuels beyond battery electrification. Consequently, liquid hydrogen has gained traction for heavy-duty and long-haul applications where battery weight and charging times pose significant challenges.

At the same time, technological breakthroughs in cryogenic insulation, including vacuum-jacketed tanks and novel superinsulation materials, have extended storage durations and reduced thermal losses. These innovations have been complemented by advances in liquid hydrogen transfer and refueling systems that achieve high flow rates while maintaining safety margins. As a result, refueling station designs are evolving from low-capacity pilot facilities to modular, scalable architectures capable of serving regional fleets and public transit operators.

Furthermore, strategic partnerships between energy companies, OEMs, and government agencies have accelerated infrastructure rollout plans. In many regions, public-private partnerships are financing the construction of hydrogen corridors, while grants and tax credits are lowering the barriers to station deployment. Collectively, these transformative shifts are reshaping the landscape for liquid hydrogen mobility, creating a foundation for broader commercial adoption and driving down total cost of ownership through economies of scale.

Assessing the Cumulative Impact of 2025 United States Automotive and Carbon Border Adjustment Tariffs on the Emerging Liquid Hydrogen Market

In March 2025, the U.S. administration enacted a 25 percent tariff on imported passenger vehicles and light trucks under Section 232 of the Trade Expansion Act of 1962, aiming to protect domestic manufacturing capacity and address perceived national security risks associated with automotive supply chains. One month later, a complementary 25 percent duty on key automotive parts, including engines, transmissions, and electrical components, was scheduled to take effect, further altering cost structures for international OEMs and parts suppliers. These measures significantly increased the landed cost of imported fuel cell vehicles and related chassis, prompting many manufacturers to accelerate local assembly or secure tariff‐exempt status through certification of U.S. content under USMCA provisions.

Simultaneously, the proposed 2025 Foreign Pollution Fee Act sought to impose carbon‐adjusted tariffs on imports of hydrogen, among other goods, to incentivize lower lifecycle emissions from global supply chains. The legislation’s escalating tariff framework would levy an average duty of up to 15 percent on hydrogen imports, with surcharges scaling to 40 percent for supplies exhibiting higher carbon intensity than their U.S.‐produced equivalents. By differentiating duties based on greenhouse gas footprints, this approach aims to level the playing field for domestically generated renewable hydrogen while discouraging reliance on carbon‐intensive production methods.

Taken together, these policy levers have raised the cost of imported vehicles, components, and hydrogen feedstock, compelling OEMs, fuel suppliers, and infrastructure developers to realign sourcing strategies toward domestic production or low‐carbon import streams. In response, alliances have formed to secure North American liquefaction capacity and to invest in electrolyzer projects that can deliver renewable liquid hydrogen at competitive duty‐inclusive prices. These cumulative impacts underscore how tariff regimes are reshaping the economic calculus of automotive liquid hydrogen adoption in the United States.

Illuminating Key Market Dynamics through Segmentation Insights Spanning Vehicle Types, Applications, Distribution Channels, End Users, and Technologies

A nuanced understanding of market segmentation is essential to grasp the demand drivers and operational dynamics within the automotive liquid hydrogen ecosystem. Across vehicle types, heavy-duty trucks and commercial fleet applications exhibit early adoption potential due to their extended range requirements and centralized refueling operations. Passenger cars, particularly sedans and SUVs, are exploring liquid hydrogen as an alternative to battery electric models for consumers prioritizing rapid refueling and minimal vehicle downtime. Urban transit and bus operators similarly recognize the value of high-density fueling for continuous service schedules.

From an application standpoint, mobile power use cases such as on-road freight haulers and off-road mining or construction equipment leverage the compact energy storage and quick turnaround fueling of liquid hydrogen to maintain operational efficiency. In contrast, stationary power installations-ranging from backup generators for critical infrastructure to remote off-grid power units-capitalize on the fuel’s long-term storability and rapid start-up capabilities. These diverse applications inform the design parameters for refueling stations and influence the spatial distribution of supply networks.

Distribution channels reflect both traditional and emerging pathways. Independent dealers have begun integrating liquid hydrogen vehicle offerings alongside established fuel cell and battery electric options, while OEM direct sales channels support volume orders for commercial fleet operators seeking turnkey fueling solutions. Online platforms are also emerging as hubs for hydrogen subscription services, offering fleet managers remote monitoring and scheduling tools that streamline operations.

Finally, the interplay of technology segments-from cryogenic storage tanks and insulated Dewars to advanced refueling dispensers-underscores the importance of system interoperability and safety certification. Innovations in vacuum-jacketed tanks and high-flow transfer systems are converging to meet the performance requirements of end users, including automotive OEMs, commercial fleets, and specialized government and defense applications. This holistic segmentation insight illuminates the evolving value chain and directs strategic investment toward high-impact areas.

This comprehensive research report categorizes the Automotive Liquid Hydrogen market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Hydrogen Form

- Storage Technology

- Refueling Infrastructure

- Vehicle Type

- Application

- End User

Unveiling Regional Dynamics Shaping the Adoption of Automotive Liquid Hydrogen across the Americas, Europe Middle East and Africa, and Asia Pacific

Regional dynamics are reshaping the automotive liquid hydrogen market as each major geography leverages its policy framework, infrastructure investments, and industry partnerships to drive adoption. In the Americas, the United States and Canada are aligning federal incentives and state-level grant programs to accelerate the build-out of hydrogen corridors along key freight routes. Private investment in liquid hydrogen production facilities is complemented by infrastructure grants for modular refueling stations, focusing initial deployments in high-traffic urban and industrial hubs.

Across Europe, the Middle East, and Africa, the European Union’s Renewable Hydrogen Strategy has catalyzed investment in electrolyzer capacity and developed standards for cryogenic transport. European OEMs and utilities are piloting cross-border liquid hydrogen shipping routes that connect northern production centers with southern ports. Concurrently, Middle East producers with abundant renewable energy resources are exploring export opportunities, while select African nations are assessing hydrogen export as part of broader economic diversification efforts.

In the Asia-Pacific region, early leadership from Japan and South Korea is evident in coordinated government-industry R&D consortia focused on next-generation cryogenic materials and high-pressure refueling protocols. China’s robust manufacturing base and aggressive hydrogen strategy have spurred domestic production of storage vessels and refueling equipment at scale, while Australia’s renewable energy projects aim to supply liquid hydrogen for both regional consumption and export to key Asian markets.

These regional insights highlight how policy incentives, renewable energy endowments, and strategic trade relationships shape the velocity of liquid hydrogen mobility adoption. As a result, global collaboration on safety standards and supply chain interoperability is becoming increasingly critical to unlock economies of scale and foster international hydrogen trade.

This comprehensive research report examines key regions that drive the evolution of the Automotive Liquid Hydrogen market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Positioning of Leading Companies Propelling the Automotive Liquid Hydrogen Ecosystem Forward

Leading corporations across the automotive and energy sectors are establishing pivotal roles in the evolving liquid hydrogen ecosystem through strategic partnerships, technology investments, and pilot deployments. Global automakers renowned for fuel cell innovation have initiated joint ventures with industrial gas providers to develop integrated liquefaction and distribution solutions. These collaborations enable the co-location of hydrogen production units with hydrogen refueling infrastructure, streamlining logistics and reducing boil-off during transit.

Energy infrastructure companies, leveraging decades of experience in cryogenic gas handling, are adapting vacuum-insulated tanker designs and high-throughput transfer systems to meet the rigorous safety standards demanded by the automotive sector. Simultaneously, specialized equipment manufacturers are refining cryogenic storage tanks by integrating composite materials and active cooling technologies that preserve liquid hydrogen integrity over extended periods.

Furthermore, government agencies and research institutes have partnered with industry leaders to validate second-generation refueling station architectures capable of supporting simultaneous high-flow fills for heavy-duty vehicles. This collaborative framework extends to joint safety demonstrations, certification testing, and workforce training programs aimed at building the technical expertise necessary for widespread adoption.

These strategic company initiatives underscore a broader trend toward ecosystem convergence, in which vehicle OEMs, energy producers, and equipment suppliers co-develop end-to-end solutions. By aligning R&D roadmaps and scaling demonstration projects, these leading players are laying the groundwork for commercial viability, risk-sharing, and the acceleration of liquid hydrogen technology maturation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Liquid Hydrogen market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products and Chemicals, Inc.

- Ballard Power Systems Inc.

- BP p.l.c.

- Chart Industries, Inc.

- Daimler Truck AG

- ENEOS Corporation

- Fabrum Solutions Limited

- First Hydrogen Corp.

- FirstElement Fuel Inc.

- Hydrogenious LOHC Technologies

- Hyundai Motor Group

- INOX India Private Limited

- Iwatani Corporation

- Kawasaki Heavy Industries Ltd.

- Lhyfe

- Linde PLC

- L’AIR LIQUIDE S.A.

- Messer SE & Co. KGaA

- Nikkiso Co., Ltd.

- OPW by Dover Corporation

- Plug Power Inc.

- TOYOTA MOTOR CORPORATION

- Universal Hydrogen Co.

Actionable Strategic Recommendations for Industry Leaders to Accelerate Adoption and Infrastructure Development of Automotive Liquid Hydrogen Solutions

Industry leaders seeking to capitalize on the promise of automotive liquid hydrogen must embrace a coordinated strategy that aligns technology development, infrastructure investment, and policy engagement. First, companies should prioritize partnerships with renewable hydrogen producers and electrolyzer manufacturers to secure low-carbon feedstock, thereby safeguarding against carbon‐adjusted tariffs and volatile energy markets. By collaborating early in the supply chain, OEMs and fleet operators can negotiate long-term offtake agreements that stabilize pricing and ensure throughput at nascent refueling hubs.

In parallel, stakeholders should invest in modular refueling station designs that can be deployed incrementally to match local demand growth. This phased approach minimizes capital exposure while enabling rapid scaling as usage patterns become more predictable. Complementing infrastructure investment, companies must also engage proactively with regulatory agencies and standards bodies to advocate for harmonized safety protocols, certification processes, and incentives that reflect the unique properties of liquid hydrogen.

Additionally, workforce development is critical. Organizations should implement specialized training programs in cryogenic handling and emergency response, partnering with vocational institutes and certification authorities to build a skilled talent pool. Finally, to foster market confidence, industry players should commit to transparent reporting on safety performance and environmental outcomes, leveraging third-party audits to validate claims and drive continuous improvement.

By executing these actionable recommendations in concert, industry leaders can mitigate commercialization risks, accelerate infrastructure deployment, and establish a resilient foundation for sustainable mobility powered by liquid hydrogen.

Transparent Research Methodology Underpinning the Comprehensive Analysis of the Automotive Liquid Hydrogen Market and Emerging Industry Trends

This research integrates primary and secondary data sources to deliver a comprehensive analysis of the automotive liquid hydrogen landscape. Primary insights were gathered through in-depth interviews with executives from automotive OEMs, hydrogen producers, infrastructure developers, and policy makers across major regions. Complementary field visits to pilot refueling stations and production facilities provided empirical observations of equipment performance, safety protocols, and operational challenges.

Secondary research involved a systematic review of regulatory documents, incentive program guidelines, and technical standards issued by authorities in North America, Europe, and Asia-Pacific. Academic journals and industry white papers were leveraged to assess breakthroughs in cryogenic materials, transfer technologies, and fuel cell efficiency. Furthermore, company press releases and financial disclosures were analyzed to map strategic partnerships, investment trends, and project timelines.

Qualitative data was triangulated with quantitative metrics related to infrastructure capacity, refueling throughput, and supply chain logistics to identify key adoption drivers and bottlenecks. All findings underwent validation through expert workshops and peer-review sessions, ensuring methodological rigor and impartial interpretation. By combining rigorous data collection with collaborative vetting, this methodology delivers robust, actionable insights tailored to stakeholders advancing automotive liquid hydrogen solutions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Liquid Hydrogen market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Liquid Hydrogen Market, by Hydrogen Form

- Automotive Liquid Hydrogen Market, by Storage Technology

- Automotive Liquid Hydrogen Market, by Refueling Infrastructure

- Automotive Liquid Hydrogen Market, by Vehicle Type

- Automotive Liquid Hydrogen Market, by Application

- Automotive Liquid Hydrogen Market, by End User

- Automotive Liquid Hydrogen Market, by Region

- Automotive Liquid Hydrogen Market, by Group

- Automotive Liquid Hydrogen Market, by Country

- United States Automotive Liquid Hydrogen Market

- China Automotive Liquid Hydrogen Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Conclusion Reflecting the Strategic Imperatives and Future Outlook for a Decarbonized Automotive Landscape Driven by Liquid Hydrogen Innovations

The analysis demonstrates that automotive liquid hydrogen is moving from conceptual exploration to practical deployment, driven by advances in storage, transfer, and refueling technologies alongside supportive regulatory frameworks. As vehicles across heavy-duty, commercial, and passenger segments increasingly demand zero-emission alternatives, liquid hydrogen stands out for its high energy density and rapid fueling capabilities, positioning it as a complementary solution to battery electrification.

Regional initiatives, from hydrogen corridors in the Americas to electrolyzer scaling in Europe and Asia-Pacific consortia, underscore the global momentum behind this fuel pathway. Strategic collaborations among automakers, energy companies, and equipment providers have forged an ecosystem capable of addressing both technical and commercial hurdles. However, policy uncertainty-particularly related to tariffs on hydrogen imports and automotive components-highlights the importance of proactive engagement with trade regulators and standardization bodies.

Looking ahead, the alignment of supply chain investments, safety regulations, and workforce training programs will determine the pace at which liquid hydrogen mobility becomes mainstream. By following the strategic imperatives outlined, industry participants can de-risk their portfolios, harness economies of scale, and accelerate the transition to a decarbonized automotive future.

Engage with Associate Director Ketan Rohom to Secure Your Exclusive Automotive Liquid Hydrogen Market Research Report and Propel Your Strategic Advantage

We invite you to empower your strategic planning and industry foresight by securing your exclusive copy of the comprehensive Automotive Liquid Hydrogen market research report. Engage with Associate Director Ketan Rohom to access in-depth insights, actionable intelligence, and critical analyses tailored for decision-makers seeking a competitive edge in the evolving clean mobility landscape. Connect directly with Ketan Rohom today to transform your hydrogen strategy into sustainable growth opportunities.

- How big is the Automotive Liquid Hydrogen Market?

- What is the Automotive Liquid Hydrogen Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?