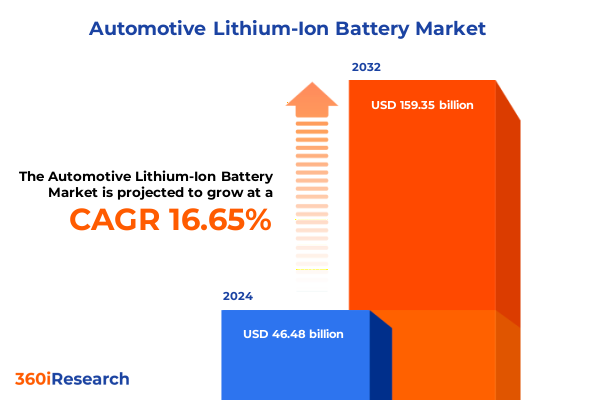

The Automotive Lithium-Ion Battery Market size was estimated at USD 53.45 billion in 2025 and expected to reach USD 61.77 billion in 2026, at a CAGR of 16.88% to reach USD 159.35 billion by 2032.

Navigating the Transformative Rise of Automotive Lithium-Ion Batteries Amid Global Electrification, Regulatory Shifts, and Supply Chain Realignment

The automotive sector is undergoing an unprecedented shift toward electrification, with lithium-ion batteries at the forefront of this transformation. As global electric vehicle (EV) stock surges, battery technology has evolved from a cost and performance trade-off into a core competitive differentiator. Industry data illustrates that electric car battery demand grew by over 30% in China and by 20% in the United States in 2024, underscoring the accelerating momentum of EV adoption worldwide. Meanwhile, manufacturers are racing to optimize cell chemistries and formats, balancing energy density, safety, and cost to meet diverse market needs.

Mapping the Pivotal Technological, Regulatory and Industrial Shifts Redefining the Automotive Lithium-Ion Battery Sector in 2025

Technological innovation, regulatory pressure, and evolving business models are reshaping the automotive lithium-ion battery landscape. Leading battery suppliers like CATL are extending beyond traditional cell production, developing integrated energy solutions ranging from modular EV platforms to grid-scale storage systems. CATL’s “panshi” platform is designed to democratize vehicle development, lowering barriers for new OEMs while signaling a shift toward holistic energy services. Concurrently, automakers such as BMW have announced “Neue Klasse” vehicles featuring next-generation cells that promise 20% more energy density and faster charging cycles, highlighting the critical role of chemistry and cell design in future EV competitiveness.

Analyzing the Comprehensive Effects of U.S. Tariff Escalations on Electric Vehicle Battery Imports and Critical Raw Materials by 2025

Policy interventions are exerting growing influence on global battery supply chains. In April 2025, the U.S. raised Section 301 tariffs on imported EV battery cells from 7.5% to 25%, layered on a universal 10% duty and additional reciprocal levies, driving total effective rates toward 64.9% today and projected to climb above 82.4% by 2026. These measures aim to incentivize domestic production under the Inflation Reduction Act, yet they also pose cost pressures for OEMs reliant on imported cells. Furthermore, proposed universal duties could extend to 35% on all Chinese-made batteries, signaling a potential escalation in trade defenses.

Uncovering Key Segmentation Perspectives Across Battery Chemistries, Propulsion Modes, Cell Formats, Capacity Ranges, Voltage Classes, Vehicle Categories, Distribution Channels, End Uses, and Applications

Diverse battery chemistries are catering to specialized performance and cost requirements. Lithium-iron-phosphate (LFP) batteries have surged due to superior safety, longer cycle life, and reduced reliance on cobalt and nickel, capturing nearly half of global EV battery production in 2024. Meanwhile, high-energy-density NMC and NCA cells remain preferred for premium segments, offering extended range and power, even as alternative sodium-ion chemistries emerge for cost-sensitive low-range applications.

This comprehensive research report categorizes the Automotive Lithium-Ion Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Battery Type

- Propulsion

- Cell Format

- Capacity Range

- Voltage Capacity

- Vehicle Type

- Distribution Channel

- End Use

- Application

Delving into Regional Dynamics Shaping the Automotive Lithium-Ion Battery Market Across the Americas, EMEA, and Asia-Pacific Regions in 2025

Regional dynamics continue to shape investment and innovation trajectories. In the Americas, U.S. battery demand neared parity with the European Union in 2024, driven by robust EV incentives and battery pack sizes roughly 25% larger per vehicle than in Europe. European policymakers have enacted stringent regulations under the EU Battery Regulation, mandating recycled content, “battery passports,” and carbon footprint disclosures by 2025, spurring advancement in circular supply chains. Asia-Pacific remains the epicenter of production and consumption, with China dominating over two-thirds of global lithium-ion capacity and scaling both LFP and NMC output to meet burgeoning domestic and export demand.

This comprehensive research report examines key regions that drive the evolution of the Automotive Lithium-Ion Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Strategic Alliances, and Competitive Positioning in the Global Automotive Lithium-Ion Battery Ecosystem

Market leadership is concentrated among a handful of vertically integrated giants. CATL continues to expand its global footprint, backing new manufacturing hubs in Europe and partnerships with major OEMs for both automotive and grid-scale applications. Tesla’s gigafactories in Nevada, Texas, and Shanghai underpin its strategy of cell-to-pack integration, ensuring supply resilience despite expanding U.S. tariffs on Chinese 공급s. Traditional battery firms like Panasonic, LG Energy Solution, and Samsung SDI are securing multi-year supply agreements with Ford, Volkswagen, and Stellantis, while startups such as Romeo Systems and Sila Nanotechnologies are advancing silicon-anode and solid-state prototypes to challenge incumbent chemistries.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Lithium-Ion Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Battery Solutions Inc.

- Automotive Cells Company

- Automotive Energy Supply Corporation

- Blue Energy Co. Ltd.

- BYD Company Ltd.

- CBAK Energy Technology Inc.

- Comtemporary Amperex Technology Ltd.

- Dragonfly Energy Corp.

- Electrovaya Inc.

- Enertron by Dyna Energy

- EVE Energy Co., Ltd

- EXIDE TECHNOLOGIES

- Grinntech Motors & Services Pvt. Ltd.

- GS Yuasa Corporation

- Karacus Energy Pvt. Ltd.

- LG Chem Ltd.

- Lithium Werks

- Okaya Power Private Limited

- Panasonic Corporation

- Samsung SDI Co. Ltd.

- Sanyo Chemical Industries, Ltd.

- TDK Corporation

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Tianneng Power International Ltd.

- Toshiba Corporation

Strategic Recommendations to Empower Industry Leaders to Navigate Tariff Challenges, Accelerate Technological Adoption, and Secure Sustainable Battery Supply Chains

Industry leaders must pursue strategic partnerships to diversify sourcing and mitigate tariff exposure by investing in local cell manufacturing and raw-material processing. Executives should accelerate R&D collaboration on next-generation chemistries-particularly solid-state and silicon-enabled anodes-to secure long-term performance advantages. Strengthening circularity through joint ventures in recycling and second-life applications will unlock cost efficiencies and align with tightening sustainability mandates. Moreover, proactive engagement with policymakers to shape supportive trade and incentive frameworks will be critical in balancing competitive dynamics against national security concerns.

Detailing a Rigorous Mixed-Methods Research Methodology Integrating Primary Stakeholder Interviews, Secondary Data Analysis, and Expert Validation Processes

This analysis integrates a mixed-methods approach to ensure robustness and validity. Primary research comprised in-depth interviews with senior executives from OEMs, battery suppliers, and material processors across North America, Europe, and Asia-Pacific, capturing real-time strategic intent and operational insights. Secondary data were sourced from authoritative industry reports, peer-reviewed publications, and policy documents, with careful exclusion of proprietary vendor forecasts to maintain objectivity. Quantitative market metrics were triangulated through supply-chain mapping and publicly disclosed capacity expansions. Findings were further vetted in expert workshops to harmonize interpretations and test scenario sensitivities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Lithium-Ion Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Lithium-Ion Battery Market, by Battery Type

- Automotive Lithium-Ion Battery Market, by Propulsion

- Automotive Lithium-Ion Battery Market, by Cell Format

- Automotive Lithium-Ion Battery Market, by Capacity Range

- Automotive Lithium-Ion Battery Market, by Voltage Capacity

- Automotive Lithium-Ion Battery Market, by Vehicle Type

- Automotive Lithium-Ion Battery Market, by Distribution Channel

- Automotive Lithium-Ion Battery Market, by End Use

- Automotive Lithium-Ion Battery Market, by Application

- Automotive Lithium-Ion Battery Market, by Region

- Automotive Lithium-Ion Battery Market, by Group

- Automotive Lithium-Ion Battery Market, by Country

- United States Automotive Lithium-Ion Battery Market

- China Automotive Lithium-Ion Battery Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings to Highlight Opportunities and Challenges Defining the Future Trajectory of the Automotive Lithium-Ion Battery Market

The automotive lithium-ion battery market stands at a pivotal juncture, marked by intensifying trade dynamics, rapid technological breakthroughs, and evolving regulatory landscapes. While tariffs challenge established supply chains, they also catalyze domestic capacity and local value-chain resilience. The convergence of incremental chemistry enhancements, format diversification, and circular economy imperatives will define competitive advantage. Stakeholders who adeptly integrate policy foresight, technological agility, and sustainable practices will be poised to lead the next chapter of electric mobility.

Connect with Our Associate Director to Unlock In-Depth Market Intelligence and Drive Strategic Growth in the Automotive Lithium-Ion Battery Space

For comprehensive market intelligence tailored to the evolving automotive lithium-ion battery landscape, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, and discover how our insights can power your strategic decisions. Engage with Ketan to explore bespoke data, unlock proprietary analysis, and secure a competitive edge in this dynamic market. Your next growth opportunity in battery innovation starts with a conversation-contact Ketan Rohom today to transform insights into action.

- How big is the Automotive Lithium-Ion Battery Market?

- What is the Automotive Lithium-Ion Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?