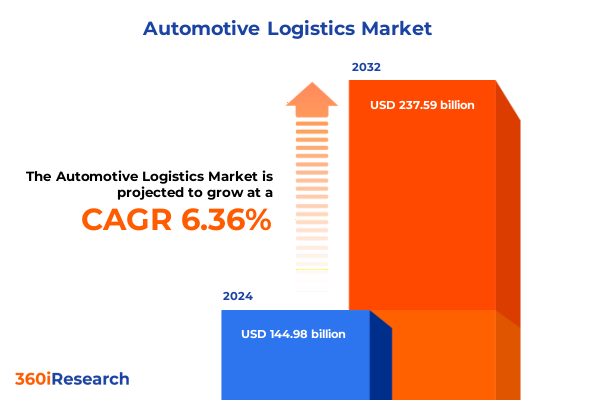

The Automotive Logistics Market size was estimated at USD 154.23 billion in 2025 and expected to reach USD 163.35 billion in 2026, at a CAGR of 6.36% to reach USD 237.59 billion by 2032.

Understanding the Critical Role of Advanced Logistics Strategies in Powering Tomorrow’s Automotive Supply Chains Amidst Rapid Industry Evolution

The global automotive logistics environment is experiencing an unprecedented convergence of technological innovation, policy shifts, and evolving consumer demands. As manufacturers accelerate the transition to electric and autonomous vehicles, logistics networks must adapt to accommodate new charging infrastructure, battery handling protocols, and real-time routing requirements. Simultaneously, digital platforms empowered by artificial intelligence and blockchain are redefining visibility, traceability, and collaboration across international supply chains.

Against this backdrop, stakeholders face the dual challenge of enhancing operational efficiency while managing risk amid geopolitical tensions and regulatory changes. The need for agile, resilient logistics strategies has never been more acute, as disruptions such as semiconductor shortages and port congestions continue to reverberate through manufacturing schedules. This introduction lays the foundation for exploring how leading organizations are pivoting to embrace data-driven decision-making, modular transportation solutions, and strategic partnerships to maintain competitive advantage.

By examining key transformative shifts, tariff impacts, segmentation insights, regional dynamics, and best practices, this executive summary equips decision-makers with a holistic understanding of the market’s current state and future trajectory. Whether you are a logistics manager, supply chain director, or C-suite executive, the insights presented here will guide your strategic planning and operational investments for the road ahead.

Navigating Disruption Through Electrification Digitalization and Autonomous Innovation Redefining Automotive Logistics for Unprecedented Operational Efficiency

Over the past two years, the automotive logistics landscape has been reshaped by the widespread adoption of electrification and the maturation of digital freight ecosystems. Companies are integrating predictive analytics to forecast demand fluctuations, optimize route planning, and dynamically allocate resources across networks. Autonomous yard management and platooning trials are transitioning from pilot stages to early commercial deployments, promising substantial reductions in dwell time and fuel consumption.

In parallel, sustainability imperatives are driving investments in low-emission modes and green corridors, with carriers retrofitting fleets with battery-electric and hydrogen fuel cell powertrains. Collaborative platforms now enable multimodal switching, seamlessly connecting express air cargo with last-mile road shipments and port-to-rail intermodal flows. This interoperability is underpinned by standardized digital documentation and blockchain-powered provenance tracking, reducing manual errors and enhancing cargo security.

Regulatory developments, such as stricter emissions standards in North America and Europe, are accelerating fleet modernization and incentivizing modes like rail transportation for bulk shipments. The integration of advanced telematics and digital twins allows real-time simulation of logistics scenarios, enabling rapid response to bottlenecks and demand surges. Together, these transformative shifts are constructing a new paradigm of agility, transparency, and sustainability in automotive logistics operations.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Automotive Logistics Pricing and Global Supply Chain Dynamics

In early 2025, the United States imposed a revised set of tariffs targeting imported automotive components and finished vehicles in an effort to bolster domestic manufacturing. Logistics providers and OEMs have been compelled to reevaluate sourcing strategies and network configurations to mitigate added cost pressures. Carriers handling inbound shipments of raw materials and spare parts now face elevated duties that translate directly into higher landed costs and contractual renegotiations with suppliers.

These cumulative tariff measures have incentivized companies to shift a portion of their high-value, high-sensitivity inbound freight from air transportation to rail and sea, where duty deferral programs and bond financing can alleviate upfront cash flow impacts. Simultaneously, bulk component movements are increasingly routed via rail intermodal solutions, leveraging volume-driven efficiencies and reduced overland haul distances. Road transportation of finished vehicles has seen adjustments in cross-border corridor utilization, with carriers optimizing load consolidation to spread tariff burdens.

On the outbound side, fleets transporting finished passenger and commercial vehicles to export markets are integrating streamlined customs clearance protocols and harmonized documentation to avoid delays. The reshaped tariff landscape has underscored the importance of flexible, multimodal networks that can quickly pivot in response to regulatory cost fluctuations. As a result, strategic warehousing and regional distribution hubs within the Americas have gained prominence, serving as buffering points against tariff volatility and enhancing supply chain resilience.

Uncovering the Strategic Advantages Across Transport Modes Service Types Vehicle Categories and End Users to Drive Precision in Logistics Planning

Transportation modes in the automotive logistics market reflect a nuanced balance between speed, cost, and capacity requirements. Air transportation services, segmented into express and standard cargo tiers, cater to time-sensitive components and just-in-time assembly schedules, while rail transportation accommodates both bulk raw materials through dedicated unit trains and intermodal movements that link ports to inland distribution centers. Road transportation offers full truckload and less-than-truckload solutions, providing the flexibility to optimize route density for finished vehicles or expedited spare parts shipments. Sea transportation remains the backbone for container shipping of high-volume assemblies and roll on roll off services designed for fully built vehicles, supporting large-scale exports and imports.

Service types further refine this landscape, distinguishing inbound logistics activities that manage the flow of component logistics and raw material supplies from outbound logistics operations focused on finished vehicle delivery and spare parts distribution. Each service type demands distinct inventory visibility tools, reverse logistics processes, and network synchronization to ensure seamless handoffs between manufacturing plants and end-user locations.

Vehicle type segmentation shapes asset utilization strategies, as heavy commercial carriers are calibrated to transport bus and truck chassis over long hauls, while light commercial fleets provide the agility required for regional distribution of vans and small trucks. Passenger vehicle transportation splits between sedans and SUVs, each presenting unique loading configurations and securement requirements to prevent damage during transits.

End users, comprising aftermarket channels and OEM customers, drive distinct facility and service expectations. Aftermarket shipments destined for e-commerce platforms and retail stores require rapid, parcel-like delivery speeds and advanced tracking, whereas assembly and manufacturing plants demand inbound sequencing precision and dedicated dock scheduling. By leveraging these segmentation insights, logistics planners can tailor their modality mixes, operational protocols, and technology investments to address the specific needs of every cargo profile.

This comprehensive research report categorizes the Automotive Logistics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mode Of Transport

- Service Type

- Vehicle Type

- End User

Regional Dynamics Shaping the Competitive Landscape Across Americas Europe Middle East Africa and Asia Pacific in Automotive Logistics

Each global region presents distinct opportunities and challenges that shape automotive logistics performance. In the Americas, expansive land borders and established rail corridors facilitate cross-country movements for both finished vehicles and heavy components, yet infrastructure bottlenecks around major port gateways continue to drive investment in inland depots and distribution hubs. Regulatory cohesion across North American trade agreements promotes modal shifts to rail and road linkages, while last-mile networks in urban centers are increasingly adopting electric vehicles to meet emissions targets.

In Europe, Middle East, and Africa, densely interconnected rail systems and maritime channels support the transshipment of parts between manufacturing clusters, but varying customs protocols and regional conflicts can introduce operational complexity. The European Union’s Green Deal and carbon border adjustment mechanisms are compelling logistics providers to decarbonize fleets, invest in alternative fuels, and deploy digital freight corridors. In regions of North Africa and the Middle East, port expansion projects and rail modernization programs are unlocking new inland logistics options for automotive manufacturers.

Asia-Pacific remains the fastest-growing automotive manufacturing hub, driven by robust production in countries such as China, Japan, South Korea, and India. Port electrification, automated terminal operations, and digital customs reforms are enhancing throughput, yet the sheer volume of inbound and outbound flows demands advanced capacity planning and collaborative vendor integration. Across Southeast Asia, emerging cross-border rail networks and highway expansions are creating fresh opportunities for intermodal consolidation, while inland container depots are proliferating to reduce reliance on congested coastal terminals.

Understanding these regional nuances allows logistics leaders to strategically align network design, mode selection, and technology deployments to local infrastructure capabilities, regulatory landscapes, and sustainability objectives.

This comprehensive research report examines key regions that drive the evolution of the Automotive Logistics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Key Industry Players Leveraging Innovation Partnerships and Operational Excellence to Dominate the Automotive Logistics Sector

Leading global logistics providers have distinguished themselves through targeted investments in digital platforms, network capacity, and strategic alliances. Major freight forwarders have rolled out single-window portals that unify tracking, scheduling, and customs documentation, enabling OEMs to achieve end-to-end visibility. Several companies have also pursued joint ventures with technology startups to pilot autonomous yard operations, leveraging robotics and AI to streamline container handling and chassis positioning.

In the realm of sea transportation, forwarders are securing long-term charter agreements for specialized roll on roll off vessels to guarantee capacity for high-demand shipping lanes. On the road transportation front, carriers are optimizing cross-docking facilities and leveraging telematics-based predictive maintenance to minimize downtime for heavy commercial fleets. Rail operators, meanwhile, are collaborating with port authorities to introduce double-stack intermodal services, increasing payload efficiency and reducing greenhouse gas emissions per ton-kilometer.

Some industry frontrunners have adopted decarbonization roadmaps, committing to net-zero emissions targets and integrating battery-electric yard tractors and hydrogen fuel cell trucks. Others are enhancing their aftermarket distribution networks by deploying micro-fulfillment centers near urban hubs to expedite spare parts delivery. Partnerships between OEM assembly plants and logistics providers have evolved into cohesive digital supply chain ecosystems, where real-time data exchange facilitates synchronized production scheduling and inbound transportation planning.

Through a combination of innovation, scalability, and customer-centric service models, these key players are defining the competitive benchmarks for reliability, sustainability, and cost-effectiveness in automotive logistics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Logistics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AM Cargo Logistics

- Autologistics GmbH

- BLG Logistics Group AG & Co. KG

- CEVA Logistics AG

- DHL International GmbH

- DSV A/S

- FedEx Supply Chain

- GEFCO Automotive UK Ltd.

- Gefco S.A.

- Hitachi Transport System Ltd.

- IAC Group

- Inform GmbH

- Jack Cooper Holdings Corp.

- Kuehne + Nagel International AG

- Mitsubishi Logistics Corporation

- Nippon Express Co. Ltd.

- Penske Logistics Inc.

- Ryder System Inc.

- Schenker AG

- STVA S.A.

- Toyota Tsusho Corporation

- XPO Logistics Inc.

Implementing Proactive Strategies Integrating Technology Sustainability and Risk Mitigation to Enhance Resilience in Automotive Logistics Operations

Industry leaders should prioritize the integration of advanced data analytics and machine learning to enhance demand forecasting and route optimization. By building digital twins of logistics networks, executives can simulate disruption scenarios and evaluate mitigation strategies before applying them in live operations. Implementing blockchain-based documentation platforms will reduce paperwork overhead and bolster cargo security, while robotic automation in warehousing can accelerate order fulfilment and reverse logistics processes.

To fortify resilience against policy changes and tariff fluctuations, organizations must diversify sourcing locations and adopt flexible multimodal contracts that allow swift rerouting from air to rail or sea. Strategic partnerships with local carriers can provide critical last-mile coverage in regions where infrastructure gaps persist. Investing in renewable energy-powered assets and green corridor certifications will not only reduce carbon footprints but also align companies with tightening emissions regulations globally.

Sustainability should be embedded in network design through the selection of low-emission transport modes for core routes and the optimization of load consolidation. Cross-functional collaboration between procurement, manufacturing, and logistics teams will enable the early identification of potential supply chain bottlenecks and facilitate joint initiatives to improve material flow. Regular scenario planning exercises and tabletop drills can strengthen crisis management capabilities and ensure rapid response to unforeseen events.

By fostering a culture of continuous improvement, leveraging emerging technologies, and embedding sustainability principles, industry leaders can transform their automotive logistics operations into agile, future-ready networks that deliver both cost efficiency and environmental stewardship.

Detailing Rigorous Research Processes and Data Validation Techniques Utilized to Ensure Credibility and Depth in Automotive Logistics Market Analysis

This research relied on a comprehensive methodology combining primary interviews and secondary data sources to ensure rigor and relevance. Experts from leading OEMs, Tier 1 suppliers, and third-party logistics providers were interviewed to capture firsthand perspectives on emerging challenges, strategic priorities, and technology adoption. These insights provided the qualitative backbone for understanding shifting stakeholder requirements and operational pain points.

Secondary research included the evaluation of industry white papers, government regulations, trade association publications, and publicly available logistics performance data. Cross-referencing multiple sources enabled the triangulation of key trends and the validation of anecdotal findings. Data cleansing processes were applied to remove inconsistencies and ensure the reliability of comparative analyses across regions and transport modes.

Quantitative inputs were subjected to statistical validation checks, including outlier detection and normalization, to support robust segmentation analysis. A panel of independent supply chain academics and industry veterans reviewed preliminary conclusions to challenge assumptions and refine strategic implications. Throughout this process, adherence to stringent ethical standards and confidentiality agreements guaranteed the integrity of proprietary information.

By blending qualitative insights with quantitative rigor and expert validation, the research methodology delivers a high degree of confidence in the findings and strategic recommendations for automotive logistics stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Logistics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Logistics Market, by Mode Of Transport

- Automotive Logistics Market, by Service Type

- Automotive Logistics Market, by Vehicle Type

- Automotive Logistics Market, by End User

- Automotive Logistics Market, by Region

- Automotive Logistics Market, by Group

- Automotive Logistics Market, by Country

- United States Automotive Logistics Market

- China Automotive Logistics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Summarizing Critical Findings and Highlighting Strategic Imperatives to Propel Decision Making in the Ever-Evolving Automotive Logistics Environment

This executive summary has highlighted how rapid technological advancements, regulatory shifts, and sustainability imperatives are reshaping automotive logistics. From the integration of digital freight platforms and autonomous operations to the strategic responses to 2025 tariff changes, the market demands agile network designs and data-driven decision-making. Segmentation insights reveal the critical role of matching transport modes, service types, vehicle categories, and end-user needs, while regional analysis underscores the importance of infrastructure maturity and regulatory alignment.

Leading companies have set new benchmarks through their investments in decarbonization, digitalization, and strategic partnerships. Their practices demonstrate the value of diversified sourcing, flexible multimodal contracts, and advanced analytics. Actionable recommendations emphasize the necessity of digital twins, blockchain documentation, and green corridor certifications to achieve operational excellence and resilience.

Stakeholders equipped with these insights can prioritize targeted technology deployments, forge high-impact collaborations, and build robust risk management frameworks. As the market continues to evolve, the ability to anticipate disruptions and adapt logistics strategies will determine competitive advantage. This summary provides a roadmap for navigating the complexities of the current environment and steering towards a more efficient, sustainable future in automotive logistics.

Strengthening Your Competitive Edge with Expert Insights Unlock Access to Exclusive Automotive Logistics Intelligence from Ketan Rohom

To gain a deeper understanding of the trends and forces shaping the automotive logistics market, secure your copy of the comprehensive research report today. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss tailored insights and strategic packages that will empower your organization’s growth and resilience. Elevate your decision-making with authoritative data and expert analysis that only this report can provide.

- How big is the Automotive Logistics Market?

- What is the Automotive Logistics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?