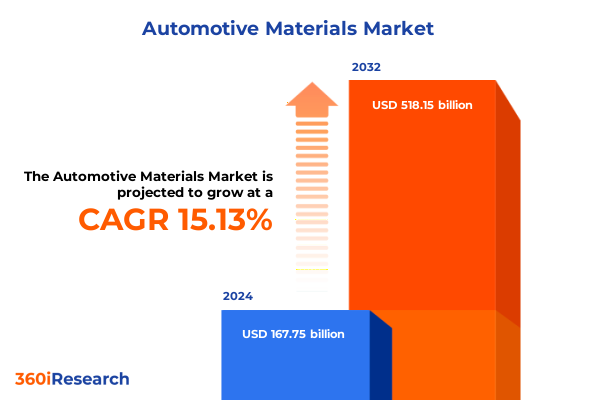

The Automotive Materials Market size was estimated at USD 192.97 billion in 2025 and expected to reach USD 218.83 billion in 2026, at a CAGR of 15.15% to reach USD 518.15 billion by 2032.

Discover the Fundamental Role of Advanced Automotive Materials in Shaping Next-Generation Vehicle Performance and Sustainability

Automotive materials represent the foundational elements that define vehicle performance, safety, cost efficiency, and sustainability As global OEMs and suppliers navigate increasingly stringent emissions standards, electrification mandates, and consumer demands, materials innovation has become a strategic imperative rather than a technical afterthought Modern automotive design relies on advanced constituents that deliver elevated strength, weight reduction, thermal stability, and aesthetic versatility in equal measure

As we embark on this executive summary, it is crucial to recognize that materials selection influences every aspect of vehicle architecture From the high-temperature resistance required in powertrain components to the acoustic damping characteristics vital for cabin comfort, material choices dictate engineering possibilities Moreover, environmental considerations such as end-of-life recyclability and reduced carbon footprint are reshaping the competitive landscape, positioning lightweight composites, next-generation polymers, and bio-based elastomers at the forefront of development By framing the market in terms of these critical drivers, this introduction sets the stage for a deeper exploration into the major forces reshaping automotive materials today

Exploring Transformative Shifts Altering the Automotive Materials Landscape from Electrification to Circularity and Lightweight Design Adoption

The past decade has witnessed seismic shifts in the automotive materials arena, driven by an industry-wide pivot toward electrified propulsion and the pursuit of life-cycle sustainability Whereas traditional steel and cast iron once dominated structural and engine components, the proliferation of electric vehicles has catalyzed the adoption of lightweight composites and high-strength alloys to offset battery weight and maximize driving range

Concurrently, a circular economy ethos has spurred the integration of recycled polymers and renewable natural fibers into interior and underbody applications, reflecting a broader shift from cradle-to-cradle design principles Rather than incremental product refinements, these transformative shifts have redefined supply chains, demanding new sourcing strategies and collaborative innovation models between OEMs, tier-1 suppliers, and specialty material manufacturers Furthermore, advances in additive manufacturing, multi-material joining techniques, and in-situ property monitoring are enabling bespoke part geometries and on-demand production, thereby accelerating time-to-market and intensifying competitive pressure across the value chain

Analyzing the Far-Reaching Effects of United States Tariff Measures Implemented in 2025 on Various Automotive Material Supply Chains and Costs

Beginning in early 2025, newly enacted United States tariff measures targeting a range of imported materials have introduced fresh complexities across the automotive supply matrix These levies, applied to select aluminum, magnesium, and specialty polymer imports, have elevated input costs and prompted many manufacturers to reevaluate sourcing footprints and engage in nearshoring initiatives to maintain margin objectives

Over time, the cumulative impact of these tariffs has manifested in greater volatility for raw material procurement as buyers contend with customs delays, added administrative requirements, and shifting trade agreements While some OEMs and suppliers have absorbed higher duties through internal cost-optimization and product redesign, others have accelerated partnerships with domestic producers capable of delivering equivalent performance grades By reshaping the import-export dynamics, these measures are influencing long-term planning, underscoring the vital importance of supply chain resilience and diversified procurement strategies within the automotive materials domain

Illuminating Critical Segmentation Insights Across Material Types, Applications, Vehicle Categories, and Propulsion Strategies Fueling Market Dynamics

Segmenting the automotive materials market by intrinsic characteristics and end uses reveals nuanced demand patterns that guide R&D investments and strategic positioning From the standpoint of material type, advanced ceramics excel in thermal management and wear resistance, while traditional ceramics offer cost-effective solutions for braking systems and electronic substrates Within composites, carbon fiber continues to lead in high-end sport applications, whereas glass fiber, hybrid combinations, and emerging natural fibers find uses ranging from reinforcing chassis components to interior trim elements

Looking at applications, body panels require materials that balance formability with crash performance, whereas chassis and powertrain systems prioritize fatigue resistance and thermal conductivity Leading elastomers such as ethylene propylene diene monomer, natural rubber, and styrene butadiene variants underpin sealing and vibration isolation across myriad systems On the metals side, aluminum and high-strength steel alloys remain indispensable for structural frameworks, while copper alloys facilitate electrical conductivity in electronic modules The polymer segment spans engineering grades like polyamide and polyurethane to commodity resins including polypropylene and polyvinyl chloride, each tailored to deliver specified mechanical and chemical attributes

Vehicle type segmentation further clarifies the landscape as passenger cars drive volume demand for cost-efficient polymers and high-strength steel, light commercial vehicles emphasize payload optimization with lightweight metals, and heavy commercial and off-road applications leverage specialized composites for durability under extreme conditions Finally, propulsion type segmentation underscores electric and hybrid platforms exerting outsized influence on material selection, particularly in battery enclosures, thermal interface materials, and lightweight chassis components to maximize overall system efficiency

This comprehensive research report categorizes the Automotive Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Propulsion Type

- Vehicle Type

- Application

Highlighting Regional Dynamics and Emerging Opportunities in the Americas, EMEA, and Asia-Pacific Automotive Materials Markets

Regional analysis of the automotive materials arena reveals distinct innovation hubs and regulatory environments that shape demand trajectories In the Americas, a strong automotive manufacturing heritage converges with federal incentives for electric vehicle adoption, driving robust investment in lightweight metals, high-performance elastomers, and next-generation polymers Domestic players are increasingly focusing on localized production of magnesium and specialty aluminum grades to mitigate the effects of import tariffs and leverage proximity to OEM assembly plants

Across Europe, the Middle East, and Africa, stringent emissions targets and circular economy mandates have spurred intense R&D in bio-based composites, advanced ceramics, and recyclable polymer formulations European OEMs are pioneering integrated material recovery frameworks, ensuring that end-of-life vehicles contribute to closed-loop supply chains Meanwhile, Middle Eastern investments in downstream polymer processing capacity and African expansions in natural fiber cultivation for composite reinforcement highlight the region’s broadened participation in global materials sourcing

The Asia-Pacific landscape remains a powerhouse for raw material production and processing, with leading suppliers of carbon fiber precursors, synthetic rubbers, and specialty plastics headquartered in East Asia Southeast Asian facilities serve as critical production nodes for elastomers and intermediate polymers, while India’s burgeoning automotive sector fuels demand for cost-efficient steel grades and locally produced ceramics

This comprehensive research report examines key regions that drive the evolution of the Automotive Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations Defining Innovation and Competitive Advantage in Automotive Materials Sector

Within the competitive arena of automotive materials, leading corporations are forging collaborative ecosystems to accelerate innovation and secure market leadership Global chemical giants are investing in proprietary resin chemistries and nanocomposite platforms optimized for electric vehicle thermal management and structural applications Specialty fiber producers are entering joint development agreements with OEMs to co-design carbon fiber grades that deliver targeted strength-to-weight ratios and cost profiles for premium vehicle segments Concurrently, alliances between elastomer manufacturers and sensor technology providers are enabling smart sealing systems capable of real-time monitoring of pressure, temperature, and wear indicators

Beyond product innovation, vertical integration strategies are becoming more prevalent as major suppliers look to internalize upstream polymerization or downstream component molding to capture greater value and enhance supply security Diversification into recycling ventures and renewable feedstocks further demonstrates commitment to sustainability imperatives, positioning these companies to meet evolving regulatory and consumer expectations As these strategic initiatives unfold, competitive differentiation increasingly hinges on the ability to blend deep materials science expertise with agile supply chain management and forward-looking sustainability roadmaps

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient plc

- Aisin Corporation

- Aptiv PLC

- BorgWarner Inc.

- Bridgestone Corporation

- Contemporary Amperex Technology Co., Limited

- Continental AG

- Denso Corporation

- Faurecia SE

- Goodyear Tire & Rubber Company

- Hitachi, Ltd.

- Hyundai Mobis Co., Ltd.

- Lear Corporation

- Magna International Inc.

- Mahle GmbH

- Michelin Group

- Robert Bosch GmbH

- Sumitomo Electric Industries, Ltd.

- Tenneco Inc.

- Valeo SA

- Weichai Power Co., Ltd.

- Yanfeng Automotive Interiors

- Yazaki Corporation

- ZF Friedrichshafen AG

Outlining Actionable Recommendations for Industry Leaders to Navigate Supply Disruptions, Technological Shifts, and Regulatory Complexities

In light of the dynamic forces at play, industry leaders must adopt a multi-pronged approach to maintain resilience and capitalize on emerging trends First, strengthening supplier relationships through long-term partnerships and joint development agreements will enable shared risk mitigation and faster access to breakthrough materials technologies Second, investing in digital supply chain tools that provide end-to-end visibility and predictive analytics can proactively identify potential disruptions and facilitate agile procurement decisions rather than reactive sourcing

Moreover, embedding sustainability into core material strategies-from leveraging recycled polymers to integrating bio-based composites-will address tightening regulatory mandates and resonate with environmentally conscious consumers Third, accelerating internal R&D pipelines by adopting modular testing platforms and collaborative innovation labs can shorten product development cycles, ensuring that next-generation elastomers, ceramics, and polymer blends reach application platforms in record time Finally, diversifying manufacturing footprints to include nearshore or reshored facilities will further buffer against tariff-induced cost pressures and logistics bottlenecks, guaranteeing consistent supply and reinforcing brand reliability

Detailing a Rigorous Research Methodology Combining Primary Interviews, Secondary Data, and Quantitative Validation to Ensure Robust Insights

This research exercise combined a robust blend of primary and secondary methodologies to yield comprehensive insights into the automotive materials landscape Initially, a series of in-depth interviews with C-level executives, lead engineers, and procurement specialists at OEMs and tier-1 suppliers provided qualitative perspectives on emerging material priorities and supply chain bottlenecks Concurrently, technical workshops with material scientists and end-use component developers surfaced granular performance requirements and application-specific challenges

Secondary research entailed systematic review of industry white papers, patent filings, and regulatory announcements to map macro-level trends in tariffs, sustainability mandates, and trade policies Additionally, a proprietary materials performance database and cross-referencing of import-export statistics underpinned quantitative validation without relying on single-source estimations Data triangulation across these avenues ensured that conclusions reflect a balanced synthesis of market realities, technological pathways, and strategic imperatives within the automotive materials domain

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Materials Market, by Material Type

- Automotive Materials Market, by Propulsion Type

- Automotive Materials Market, by Vehicle Type

- Automotive Materials Market, by Application

- Automotive Materials Market, by Region

- Automotive Materials Market, by Group

- Automotive Materials Market, by Country

- United States Automotive Materials Market

- China Automotive Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Key Takeaways and Strategic Implications for Stakeholders in the Rapidly Evolving Automotive Materials Ecosystem

As automotive platforms evolve toward electrification, autonomy, and connectivity, materials innovation will remain the linchpin that unlocks next-level performance and sustainability outcomes Organizations that embrace collaborative R&D ecosystems, reinforce supply chain resilience, and integrate circular economy principles stand to capture disproportionate value amid industry disruption The interplay of tariff environments, regional regulatory frameworks, and propulsion-driven material demands underscores the need for a holistic, forward-looking materials strategy rather than isolated product improvements

Ultimately, decision-makers equipped with an in-depth understanding of segmentation dynamics across material types, application areas, vehicle categories, and propulsion systems can anticipate shifts in demand and position their portfolios accordingly By aligning innovation initiatives with tangible business and environmental objectives, stakeholders will be well-positioned to thrive as the automotive industry charts its course toward a more efficient, sustainable, and technologically advanced future

Connect with Ketan Rohom to Unlock Comprehensive Market Insights and Customize Your Automotive Materials Research Solution Today

Are you ready to transform your strategic planning with unparalleled insights into automotive materials innovations and market dynamics Delivered by an industry veteran, this comprehensive market research report will equip your team with the in-depth understanding needed to stay ahead of competition Harness these critical findings and connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch to secure your organization’s access to market intelligence that drives smarter investments and fuels long-term growth

- How big is the Automotive Materials Market?

- What is the Automotive Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?