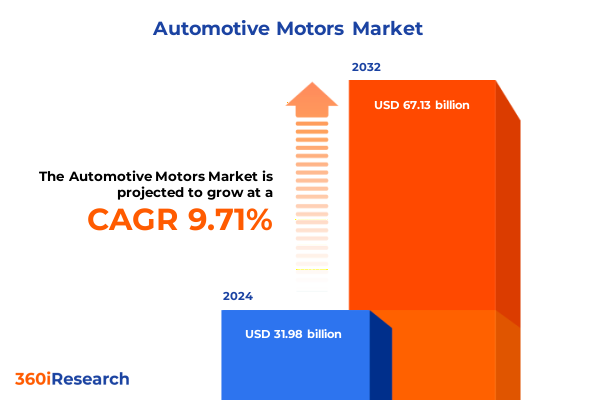

The Automotive Motors Market size was estimated at USD 34.98 billion in 2025 and expected to reach USD 38.27 billion in 2026, at a CAGR of 9.75% to reach USD 67.13 billion by 2032.

Introduction to the Automotive Motor Market’s Emerging Dynamics and Strategic Imperatives for Industry Stakeholders in a Rapidly Evolving Landscape

The automotive motor market is experiencing a period of profound change driven by technological innovation, shifting regulatory landscapes, and evolving consumer expectations. In recent years, breakthroughs in electric propulsion, materials science, and power electronics have converged to redefine performance benchmarks and sustainability aspirations. Stakeholders across the value chain-from component manufacturers to vehicle OEMs-are reassessing strategic priorities as they confront the dual imperatives of carbon reduction and cost containment. Consequently, the industry is witnessing accelerated collaborations, from cross-sector research alliances to integrated supply partnerships, each aimed at de-risking investments in next-generation motor technologies.

Amid this backdrop, decision-makers are seeking clarity and foresight regarding which developments will deliver the greatest competitive advantage. Questions around motor topology optimization, rare earth material sourcing, and digital integration remain at the forefront of strategic agendas. Meanwhile, geographic considerations are intensifying, as manufacturers evaluate how regional policies and infrastructure readiness will influence adoption rates across key markets. By exploring the convergence of innovation, policy, and market dynamics, this executive summary sets the stage for a nuanced discussion of the automotive motor landscape, equipping leaders with the insights necessary to navigate disruption and capture emerging opportunities.

Critical Technological and Market Forces Driving a Fundamental Transformation in Automotive Motor Architecture Performance and Sustainability Practices

Automotive motors are no longer merely functional components but pivotal drivers of value creation and differentiation. The transition from mechanical complexity to intelligent electrification has catalyzed a paradigm shift, transcending traditional performance metrics to encompass software-enabled control, predictive maintenance, and system-level optimization. On the technological front, the maturation of permanent magnet synchronous motor designs and the resurgence of advanced induction architectures are fostering a competitive balance between efficiency and cost. Simultaneously, power electronics have become integral to motor performance, with silicon carbide and gallium nitride semiconductors enabling higher switching frequencies and thermal resilience.

Beyond hardware evolution, the market landscape is also undergoing a business model transformation. The emergence of motor-as-a-service offerings and subscription-based electrification platforms underscores a shift toward outcome-oriented engagements, where uptime guarantees and lifecycle management are monetized. Furthermore, digital twin capabilities are reshaping product development cycles, enabling real-time simulation and rapid iteration that accelerate time to market. As a result, traditional OEMs are forging alliances with software specialists and semiconductor innovators, creating ecosystems that meld mechanical expertise with advanced analytics. These converging forces are fundamentally redefining how automotive motors are designed, manufactured, and serviced, heralding a new era of strategic complexity and opportunity.

Assessment of the Cumulative Impact of United States Tariffs on the Automotive Motor Supply Chain and Cost Structures Through 2025

The introduction of incremental U.S. tariffs on automotive motor imports in early 2025 has reverberated across global supply chains, prompting a reallocation of sourcing strategies and cost structures. Manufacturers reliant on imported components have been compelled to reevaluate supplier partnerships, accelerating the development of domestic production capabilities to mitigate tariff exposure. This rebalancing has manifested in both near-term operational adjustments, such as inventory stockpiling ahead of tariff hikes, and longer-term investments in localized winding and magnetizing processes.

Moreover, the tariff regime has imposed upward pressure on end-product pricing, with some OEMs absorbing marginal cost increases in the interest of preserving competitiveness. Others have explored design simplifications and material substitutions to offset added duties, leading to intensified research into alternatives to rare earth heavy magnet technologies. As automotive electrification progresses, the regulatory environment continues to evolve, and stakeholders must anticipate further policy shifts that could influence cross-border flows. Consequently, agility in supply chain configuration and strategic foresight in procurement are now indispensable components of motor business models. Through understanding the cumulative impact of these tariffs, leaders can better position their organizations to respond dynamically to changing trade policies.

In-Depth Exploration of Automotive Motor Market Segmentation Revealing Nuanced Insights Across Multiple Motor and Vehicle Classifications

The market for automotive motors can be examined through various lenses, each revealing unique value pools and innovation imperatives. Motor type segmentation highlights a contrast between alternating current and direct current frameworks, where induction motor platforms benefit from established manufacturing scale while permanent magnet synchronous motors capture interest for their superior torque density and efficiency; within direct current variants, brushed systems have ceded ground to brushless architectures that offer lower maintenance and enhanced controllability. Propulsion type further differentiates requirements, as fully electric systems demand high-power density motors optimized for continuous output, hybrids leverage modular sub-motors to balance efficiency with packaging, and internal combustion engine applications retain traditional torque delivery profiles.

From an application perspective, auxiliary motor use cases such as cabin ventilation and coolant circulation prioritize reliability and compactness, whereas drive motor solutions-spanning inverter-integrated and traction configurations-emphasize high-voltage compatibility and software integration. Vehicle segment considerations yield additional perspectives: commercial vehicle deployments demand ruggedized designs capable of extended duty cycles in heavy- and light-duty trucks, whereas passenger cars require a focus on noise-vibration-harshness performance and cost sensitivity. Finally, sales channel distinctions underscore divergent go-to-market approaches; aftermarket channels emphasize retrofit compatibility and serviceability, while OEM channels focus on collaborative development and just-in-time delivery. Synthesizing these segmentation dimensions provides a holistic view of the motor landscape, fostering the identification of tailored strategies for each value chain intersection.

This comprehensive research report categorizes the Automotive Motors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Motor Type

- Propulsion Type

- Application

- Vehicle Type

- Sales Channel

Comprehensive Regional Analysis Highlighting Distinctive Trends Shaping Automotive Motor Demand Across the Americas EMEA and Asia-Pacific Territories

Regional dynamics underscore the heterogeneous pace of automotive motor adoption and innovation. In the Americas, policy incentives and expanding charging infrastructure in key jurisdictions have fueled the advancement of electric motor technologies, while domestic content requirements under trade agreements have incentivized local manufacturing investments. Despite geographic diversity, North and South American markets share a growing emphasis on resilience, with manufacturers diversifying production footprints to hedge against regional disruptions.

Across Europe, the Middle East, and Africa, stringent emissions mandates and ambitious decarbonization roadmaps are exerting significant influence over motor technology roadmaps. European OEMs are accelerating the integration of high-efficiency motor architectures to comply with CO₂ targets, while Middle East initiatives are exploring renewable energy integration to power industrial motor facilities. In emerging markets within Africa, electrification is still nascent, but targeted pilot programs in urban mobility and off-grid applications are laying groundwork for broader adoption.

The Asia-Pacific region remains the epicenter of motor manufacturing capacity, blending established facilities with greenfield investments across Southeast Asia and India. A confluence of government subsidies, favorable labor dynamics, and robust electronics ecosystems has sustained leadership in mass production, yet there is a parallel drive toward value-added capabilities in motor control software and advanced materials. By understanding these regional variations, stakeholders can align their investment and partnership strategies with localized growth trajectories and regulatory expectations.

This comprehensive research report examines key regions that drive the evolution of the Automotive Motors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Illustrating Strategic Initiatives Competitive Positioning and Collaborative Efforts in the Automotive Motor Domain

A diverse set of companies is shaping the automotive motor ecosystem through complementary strengths in engineering, manufacturing, and digital innovation. Incumbent industrial giants leverage decades of motor expertise to optimize production lines for both traditional and electric propulsion applications, often integrating advanced automation and quality control systems. Simultaneously, agile newcomers are challenging orthodoxies by introducing modular motor platforms, open-architecture control systems, and machine learning-driven performance enhancements, accelerating the pace of technology diffusion.

Strategic partnerships are also a defining feature of the competitive landscape, as semiconductor suppliers collaborate with motor houses to co-develop integrated inverter-motor assemblies and high-bandwidth communication protocols. Likewise, alliances between material science leaders and magnet producers are focusing on reducing critical mineral dependencies through alternative alloy formulations. In addition, software firms are carving out adjacent roles by providing cloud-based analytics for predictive maintenance and lifetime optimization. Collectively, these corporate initiatives reflect an ecosystem in which cross-industry collaboration is essential to achieving performance, cost, and sustainability targets. Understanding each player’s unique value proposition and strategic intent is critical for identifying alliance opportunities and competitive advantages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Motors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ametek Inc.

- Borgwarner Inc.

- Bühler Motor GmbH

- Continental AG

- Denso Corporation

- Hitachi Ltd.

- Nidec Corporation

- Nissan Motor Co., Ltd.

- Renault S.A.

- Robert Bosch GmbH

- Siemens AG

- Valeo SA

- ZF Friedrichshafen AG

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Complexities in the Evolving Automotive Motor Sector

Industry leaders should prioritize a balanced approach that aligns advanced motor development with holistic sustainability goals. Companies are advised to invest in cross-functional teams that bridge mechanical engineering, power electronics, and software development to accelerate the delivery of integrated motor solutions. In parallel, cultivating supplier ecosystems that emphasize material traceability and circularity can mitigate risks associated with rare earth sourcing and regulatory scrutiny. By establishing collaborative innovation hubs-co-located near major OEM facilities and academic institutions-organizations can foster rapid prototyping and knowledge exchange, shortening development cycles.

Moreover, enhancing digital capabilities is imperative for unlocking new value streams. Implementing cloud-connected motor monitoring platforms enables real-time performance optimization and predictive maintenance, creating service-based revenue opportunities. At the same time, scenario modeling tools should be deployed to simulate tariff impacts, logistics disruptions, and policy shifts, supporting more resilient supply chain configurations. Finally, industry leaders must engage proactively with regulatory bodies and standardization committees to influence emerging guidelines on motor efficiency and electromagnetic compatibility. Through these concerted actions, organizations can position themselves at the forefront of innovation, delivering differentiated products while navigating the complexities of an increasingly dynamic marketplace.

Rigorous Research Methodology Underpinning Automotive Motor Market Analysis Ensuring Data Integrity and Analytical Transparency

This analysis is underpinned by a multi-method research framework that integrates primary interviews, secondary literature reviews, and real-time data validation. Primary inputs were obtained through structured discussions with motor design engineers, supply chain executives, and policy experts across key markets, ensuring a diverse range of perspectives on technology trends, regulatory impacts, and commercial strategies. Secondary sources included technical white papers, patent filings, and industry association publications, which were cross-referenced to validate emerging patterns and innovations.

Quantitative insights were derived from a proprietary database of motor shipments and trade flows, enriched by customs records and tariff schedules to assess the impact of U.S. policy changes. Qualitative analysis leveraged scenario planning workshops and expert panels to forecast potential technology adoption pathways, while data triangulation methods were employed to enhance accuracy. Throughout the process, rigorous quality controls, including peer-review checkpoints and methodological audits, ensured analytical transparency and robustness. This comprehensive approach provides a reliable foundation for understanding the multifaceted dynamics of the automotive motor market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Motors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Motors Market, by Motor Type

- Automotive Motors Market, by Propulsion Type

- Automotive Motors Market, by Application

- Automotive Motors Market, by Vehicle Type

- Automotive Motors Market, by Sales Channel

- Automotive Motors Market, by Region

- Automotive Motors Market, by Group

- Automotive Motors Market, by Country

- United States Automotive Motors Market

- China Automotive Motors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Conclusive Synthesis of Key Findings Emphasizing Strategic Imperatives and Outlook for Stakeholders in the Global Automotive Motor Sector

The automotive motor sector stands at a pivotal crossroads where innovation, regulatory pressures, and market expectations intersect. Key findings reveal that the integration of power electronics and motor control systems will be instrumental in meeting performance and efficiency benchmarks, while supply chain agility has become a strategic imperative in light of tariff fluctuations. Segmentation analysis underscores that diverse motor types and applications will continue to coexist, demanding tailored strategies that address distinct performance, cost, and regulatory requirements across vehicle classes and sales channels.

Regional variations highlight the importance of localized approaches: North American policies are driving domestic capability building, Europe’s stringent emissions standards are steering high-efficiency motor development, and Asia-Pacific remains a manufacturing powerhouse while increasingly investing in advanced electronics and software. Companies that succeed will be those that balance technical differentiation with collaborative ecosystems, leveraging open innovation frameworks to co-develop durable solutions. As the industry advances, ongoing dialogue with regulatory stakeholders and continuous refinement of sustainability practices will be crucial. Overall, this research offers a cohesive synthesis of current trends and strategic imperatives that will guide decision-makers toward resilient and growth-oriented pathways.

Engage with Ketan Rohom to Access Comprehensive Market Intelligence and Strategic Guidance for Informed Decision-Making in the Automotive Motor Industry

Partner with Ketan Rohom to unlock tailored market insights and strategic support that empower your organization to make high-impact decisions. With extensive expertise in automotive motor research and a deep understanding of current industry dynamics, this collaboration will provide you with actionable intelligence to outpace competitors. Benefit from a comprehensive market research report, enriched with qualitative analysis and regional perspectives, that illuminates critical trends and transformative forces shaping the sector. Engage in a personalized consultation to explore bespoke recommendations, clarify complex regulatory impacts, and align your product and commercialization strategies with future developments. Don’t miss the opportunity to transform data into actionable strategies-reach out today to initiate a dialogue with an industry specialist who will guide you through the nuances of automotive motor advancements. Secure your access to premium market intelligence and gain the confidence to drive your organization’s growth trajectory with precision and foresight.

- How big is the Automotive Motors Market?

- What is the Automotive Motors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?