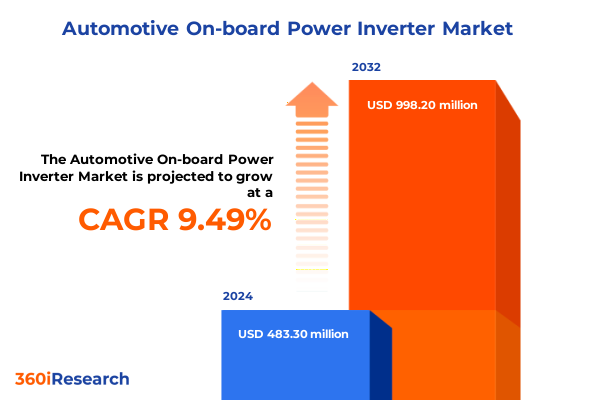

The Automotive On-board Power Inverter Market size was estimated at USD 525.20 million in 2025 and expected to reach USD 574.67 million in 2026, at a CAGR of 9.60% to reach USD 998.20 million by 2032.

Defining the Strategic Role and Growing Significance of On-board Power Inverters in Enabling Advanced Vehicular Electrification and In-Vehicle Electronics

The evolution of automotive on-board power inverters has transformed vehicles from purely mechanical machines into sophisticated mobile power platforms. Initially designed to convert direct current from vehicle batteries into alternating current for auxiliary devices, modern inverters have become pivotal in supporting the complex electrical demands of electric and hybrid vehicles. As consumers increasingly demand enhanced infotainment systems, advanced driver assistance features, and seamless connectivity, the inverter has emerged as a strategic enabler of high-performance vehicle architectures.

In parallel, evolving emission regulations and the global push for sustainability have accelerated the shift toward electrified drivetrains. This transition amplifies the role of on-board power inverters, positioning them as critical components for managing high-voltage power conversion, thermal efficiency, and electromagnetic compatibility. Consequently, understanding the foundational principles, emerging capabilities, and overarching significance of inverters in the automotive ecosystem is essential for stakeholders aiming to capitalize on the next wave of mobility innovations.

Exploring Breakthrough Semiconductor Advancements and Software-Integrated Architectures Shaping the Future of Automotive Inverters

In recent years, transformative shifts in semiconductor technologies have redefined the performance benchmarks for automotive power inverters. The emergence of wide bandgap materials, particularly gallium nitride and silicon carbide, has ushered in a new era of higher switching frequencies, reduced thermal losses, and miniaturized form factors. These improvements have unlocked unprecedented power densities, enabling inverter designs that occupy less space yet deliver superior efficiency compared to silicon-based predecessors.

Concurrently, automotive OEMs are integrating inverters more deeply into vehicle architecture, viewing them not only as standalone power conversion units but as intelligent modules capable of real-time diagnostics and adaptive control. This integration is facilitated by advancements in digital control units and embedded software algorithms, which allow continuous optimization of switching patterns and load management. As a result, the landscape of inverters has shifted from purely hardware-centric components to smart, software-driven systems that interact seamlessly with the vehicle’s central computing platform.

Moreover, the convergence of electrification and connected vehicle trends has elevated the significance of bi-directional inverter capabilities. The ability to support vehicle-to-grid applications, regenerative braking optimization, and energy sharing between onboard systems underscores a transformative departure from traditional one-way power conversion. This paradigm shift positions inverters at the heart of the ecosystem that will power tomorrow’s smart grids and autonomous mobility services.

Analyzing the 2025 United States Tariff Regime on Power Electronics and Its Strategic Impact on Supply Chain Localization and Cost Structures

In 2025, the United States implemented a new tariff regime on imported power electronics, including automotive on-board inverters, aimed at protecting domestic manufacturing and promoting strategic supply chain resilience. These measures introduced duties of up to 15 percent on components sourced from key foreign markets. The cumulative impact has been a notable increase in landed costs for OEMs that rely heavily on cross-border procurement of inverter modules and semiconductor substrates.

As a direct consequence, several Tier-1 suppliers have accelerated their efforts to localize production and qualify domestic foundries to mitigate tariff exposure. While some stakeholders have experienced higher component acquisition costs, the proactive pivot toward reshoring and nearshoring initiatives has created opportunities for regional players to capture incremental market share. Moreover, the tariff environment has fostered closer collaboration between automakers and semiconductor firms to co-invest in capacity expansions within the United States.

Furthermore, the new tariff framework has prompted manufacturers to reevaluate total cost of ownership and supply chain risk more holistically. By emphasizing vertical integration, strategic stockpiling, and dual-sourcing strategies, industry participants are building more robust procurement processes. Although the immediate effect has been an upward pressure on production expenses, the long-term outcome is expected to yield deeper domestic competencies, reduced geopolitical risk, and enhanced responsiveness to market fluctuations.

Revealing Multifaceted Segmentation Dynamics Across Inverter Types Materials Power Ratings Components Vehicle Types and Sales Channels

Dissecting the market based on inverter type reveals three distinct performance and application profiles. Modified sine wave solutions have traditionally catered to basic auxiliary loads, yet their lower cost and simpler design are now being reevaluated in light of growing efficiency expectations. Pure sine wave inverters, offering cleaner power output suitable for sensitive electronics and infotainment systems, have become the default choice for premium vehicle segments. Meanwhile, square wave inverters, while the most cost-effective, are increasingly confined to secondary, non-critical functions due to their limited waveform fidelity.

Turning to material categories, the emergence of gallium nitride-based devices has accelerated the transition toward smaller, lighter, and more energy-efficient inverters. These devices boast high switching speeds but currently face premium pricing. Conversely, silicon carbide-based categories strike a balance between performance and cost, making them attractive options for mainstream electrification platforms. As adoption matures, cost parity between these two materials is projected to narrow, stimulating broader market uptake.

Examining power ratings sheds light on divergent usage scenarios. Inverter ratings below 100 watts often serve low-load applications such as infotainment and charging ports. In the 100-150 watt band, systems typically address moderate accessory demands, bridging the gap between lightweight consumer electronics and core vehicular functions. Above 150 watts, devices are engineered to support high-demand scenarios, including onboard battery chargers and secondary drive assists, where sustained power delivery and thermal management become paramount.

Component-level insights highlight the critical role of capacitors, control units, inductors and transformers, and semiconductors in overall system performance. Capacitors dictate energy storage and ripple suppression, while control units govern adaptive switching logic. Inductors and transformers manage voltage isolation and current smoothing, and semiconductors, particularly power transistors and diodes, underpin the core conversion process. Each component subgroup faces unique reliability, cost, and supply chain considerations that shape supplier strategies.

Segmenting by vehicle type uncovers contrasting adoption curves. Passenger vehicles, with their emphasis on compact design and cost efficiency, have been early adopters of mid-range inverter solutions optimized for consumer convenience and safety features. In contrast, commercial vehicles prioritize durability and high-power capabilities to support auxiliary operations, demanding ruggedized, heavy-duty inverter configurations. As fleet electrification advances, these distinctions will evolve but remain critical for tailored product development.

Lastly, the sales channel lens differentiates the aftermarket opportunity from original equipment manufacturer pathways. Aftermarket segments benefit from extended vehicle life cycles and retrofitting trends, where ease of installation and cost flexibility are paramount. Original equipment manufacturer channels, by contrast, require rigorous qualification processes and tight integration with vehicle electronics, favoring suppliers with deep technical partnerships and compliance track records.

This comprehensive research report categorizes the Automotive On-board Power Inverter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Inverter Type

- Category

- Power Rating

- Component

- Vehicle Type

- Sales Channel

Delineating Regional Variations in Electrification Incentives Manufacturing Capacities and Market Adoption Trends Across Global Power Inverter Hubs

Regional dynamics reveal that the Americas remain a pivotal market, driven by substantial investments in North American manufacturing and favorable regulatory incentives for electrified vehicles. The proximity of key semiconductor fabs in the United States and Mexico enhances supply chain responsiveness, while automaker commitments to domestic EV production reinforce regional demand for advanced inverter technologies. Additionally, growing aftermarket retrofit activities across Latin America signal opportunities for tailored low-cost solutions.

In Europe, the Middle East, and Africa cluster, stringent emissions targets and robust incentives for electric mobility bolster growth trajectories. European OEMs’ emphasis on technological differentiation has spurred widespread adoption of high-efficiency inverters, supported by established renewable energy infrastructures that enable vehicle-to-grid initiatives. Meanwhile, in Middle Eastern markets, nascent electrification policies and significant resource wealth present nascent demand, whereas in Africa, electrification adoption remains uneven, offering long-term potential contingent on infrastructure development.

Asia-Pacific continues to lead in manufacturing scale and technological innovation, underpinned by large domestic EV markets in China, Japan, and South Korea. Aggressive government subsidies and clear decarbonization roadmaps have propelled inverter suppliers to expand local production capacities and R&D centers. Southeast Asian nations are emerging as critical assembly hubs, benefiting from cost-effective labor and evolving trade agreements. Collectively, these regional distinctions underscore diverse growth pockets and competitive landscapes across the global inverter market.

This comprehensive research report examines key regions that drive the evolution of the Automotive On-board Power Inverter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Alliances and Innovation Leadership Among Semiconductors Tier-1 Suppliers and Specialized Power Electronics Firms

A cohort of leading technology and automotive suppliers is shaping the trajectory of on-board power inverter innovation. Major semiconductor manufacturers are forging strategic alliances with OEMs to co-develop next-generation wide bandgap devices, prioritizing scalability and reliability under automotive-grade specifications. Tier-1 electronic suppliers are integrating system-level software functionalities to differentiate their inverter modules, embedding diagnostic and prognostic features that elevate overall vehicle health monitoring.

Furthermore, niche specialists focusing on thermal management and electromagnetic interference mitigation are gaining traction as critical enablers within the inverter value chain. These companies collaborate closely with power transistor and capacitor vendors to refine package designs, achieving compact footprints while maintaining stringent automotive reliability standards. At the same time, software-centric firms are introducing advanced control algorithms and cybersecurity features, anticipating the integration of inverters into broader vehicle networking systems.

Collectively, these players are investing in global production expansions, center-of-excellence R&D facilities, and joint ventures that enhance their end-to-end capabilities. Their competitive strategies converge on delivering high-efficiency solutions at scale, underpinned by robust qualification processes and deep domain expertise across materials science, power electronics, and software integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive On-board Power Inverter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Continental AG

- Delta Electronics, Inc.

- DENSO Corporation

- Eaton Corporation

- Hitachi Automotive Systems Ltd

- Infineon Technologies AG

- Lear Corporation

- LG Magna e-Powertrain Co., Ltd.

- Magnum Dimensions by Sensata Technologies Holding plc

- Marelli Corporation

- Marelli Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Samlex America Inc.

- Schneider Electric SE

- Schumacher Electric Corp.

- Stanley Black & Decker

- STMicroelectronics N.V.

- Sunpower Group Holdings Ltd.

- TOSHIBA Electronic Devices & Storage Corporation

- Toyota Industries Corp.

- Tycorun Energy Co.,Ltd.

Outlining Critical Collaborative Development and Supply Chain Diversification Strategies to Secure Competitive Advantage in a Dynamic Electrification Environment

To maintain leadership in the evolving on-board inverter market, industry participants should prioritize co-development initiatives that align semiconductor roadmaps with vehicle electrification plans. By forging deeper partnerships between OEMs and wide bandgap semiconductor innovators, companies can accelerate product qualification timelines and optimize cost trajectories.

In parallel, investing in scalable manufacturing lines with built-in flexibility for material substitutions will help mitigate tariff-induced supply chain disruptions. Establishing dual-sourcing arrangements across multiple geographies, combined with strategic buffer stocking, ensures uninterrupted component flow amid trade policy fluctuations.

Moreover, embedding advanced diagnostic and prognostic software within inverter platforms can unlock new revenue streams through value-added services and enhance aftermarket differentiation. Companies should develop modular architectures that support over-the-air updates, enabling continuous performance enhancements and cybersecurity safeguards.

Finally, cultivating region-specific go-to-market strategies will be essential. Tailoring product configurations to local regulatory frameworks and infrastructure capabilities-such as vehicle-to-grid readiness in Europe or retrofit-friendly designs in Latin America-will position suppliers to capture emerging demand pockets with precision.

Demonstrating a Multi-Source Analytical Approach Integrating Desk Research Expert Interviews Surveys and Data Triangulation for Comprehensive Insights

Our research framework combines a rigorous review of public domain sources, expert interviews, and primary industry surveys to ensure a 360-degree market perspective. Initially, we conducted a comprehensive synthesis of technical literature, regulatory filings, and patent databases to map emerging inverter technologies and material innovations. This desk research phase identified key developments in gallium nitride and silicon carbide applications.

Subsequently, we engaged in structured interviews with senior executives from OEMs, Tier-1 suppliers, and semiconductor manufacturers to gain insights into strategic priorities, investment plans, and risk management practices. These dialogues were complemented by an online survey targeting design engineers and procurement managers, capturing real-time feedback on performance criteria, sourcing preferences, and cost considerations.

Data triangulation was achieved by cross-referencing our primary insights with financial disclosures, trade data, and localized policy announcements. This approach enabled validation of qualitative responses against quantitative indicators such as production capacity expansions and tariff impact assessments. Finally, our analysts synthesized these findings into a robust narrative, ensuring that each key insight was grounded in multiple corroborative data points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive On-board Power Inverter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive On-board Power Inverter Market, by Inverter Type

- Automotive On-board Power Inverter Market, by Category

- Automotive On-board Power Inverter Market, by Power Rating

- Automotive On-board Power Inverter Market, by Component

- Automotive On-board Power Inverter Market, by Vehicle Type

- Automotive On-board Power Inverter Market, by Sales Channel

- Automotive On-board Power Inverter Market, by Region

- Automotive On-board Power Inverter Market, by Group

- Automotive On-board Power Inverter Market, by Country

- United States Automotive On-board Power Inverter Market

- China Automotive On-board Power Inverter Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Strategic Implications of Technological Innovations Trade Dynamics and Market Segmentation for Forward-Looking Electrified Mobility Solutions

As the automotive industry continues its historic journey toward electrification, on-board power inverters stand as critical enablers of advanced mobility features and sustainable transportation goals. Recent semiconductor breakthroughs, coupled with evolving trade policies, have accelerated the imperative for agile supply chains and strategic partnerships. The nuanced segmentation across inverter types, materials, and regional markets underscores the importance of tailored solutions that align with specific performance, cost, and regulatory requirements.

Looking ahead, the convergence of material innovations, digital control capabilities, and regional manufacturing strategies will define market leadership. Organizations that embrace collaborative development, diversify their supply bases, and prioritize customer-centric architectures will be best positioned to navigate the complexities of the electrified landscape. Ultimately, the insights presented in this executive summary offer a roadmap for informed decision-making, guiding stakeholders to unlock new opportunities and drive enduring value creation.

Unlock Comprehensive Automotive On-board Power Inverter Market Intelligence Today by Engaging with Our Subject Matter Expert for a Tailored Report

With the automotive industry accelerating toward electrification at an unprecedented pace, on-board power inverter solutions are now at the epicenter of future vehicle performance and customer satisfaction. Ketan Rohom (Associate Director, Sales & Marketing) invites you to leverage this comprehensive research report to gain in-depth knowledge of market dynamics, emerging technologies, and actionable insights that will empower your organization to maintain a competitive edge. Reach out today to secure your copy and drive your strategic decision-making with confidence

- How big is the Automotive On-board Power Inverter Market?

- What is the Automotive On-board Power Inverter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?