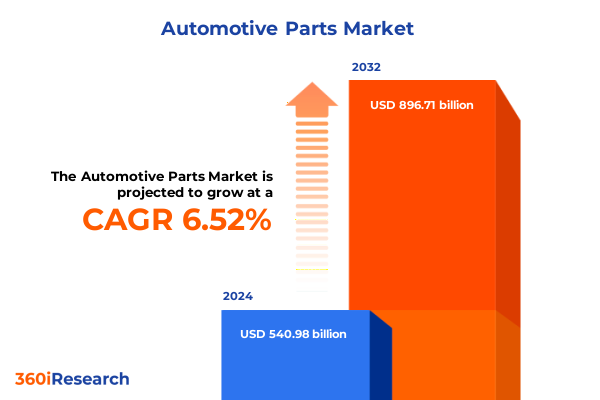

The Automotive Parts Market size was estimated at USD 573.65 billion in 2025 and expected to reach USD 609.34 billion in 2026, at a CAGR of 6.58% to reach USD 896.71 billion by 2032.

Setting the Stage for Strategic Insights into the Evolving Automotive Parts Market Amid Emerging Technologies and Regulatory Dynamics

In the face of rapid technological evolution and shifting regulatory landscapes, the automotive parts industry stands at a pivotal crossroads. Electrification, driven by stringent emissions mandates and growing consumer demand for sustainable mobility, now underpins strategic investments and reshapes product development priorities. Simultaneously, advances in connectivity and autonomous driving systems are elevating the role of electronics, sensors, and software, cementing their position as core components rather than ancillary add-ons.

Against this backdrop, supply chain resilience has emerged as a critical concern for manufacturers and suppliers alike. Geopolitical tensions, exemplified by trade disputes and fluctuating tariff regimes, have prompted a reassessment of sourcing strategies and manufacturing footprints. Companies are balancing the imperative for cost efficiency with the need to mitigate risk by diversifying suppliers and adopting nearshoring models. These twin forces of innovation and risk management are driving a fundamental redefinition of value creation across the automotive parts ecosystem.

As decision-makers navigate this evolving environment, a clear understanding of emerging trends and disruptive forces is essential. This introduction sets the stage for an in-depth exploration of transformative shifts, tariff impacts, segmentation nuances, regional dynamics, and strategic imperatives that will shape the automotive parts landscape in 2025 and beyond.

Exploring the Transformative Shifts Reshaping Competitive Dynamics and Driving Innovation across Automotive Component Segments Worldwide

Over the past several years, the integration of electrified powertrains has emerged as the most significant catalyst reshaping component engineering and manufacturing processes. Legacy powertrain suppliers have had to pivot from cast iron engine blocks and mechanical transmissions toward lighter materials and electric motor architectures, demanding new expertise in battery management and power electronics. This transition has fostered unprecedented collaboration between traditional automotive suppliers and advanced electronics firms as they jointly develop next-generation driveline systems.

Meanwhile, the proliferation of advanced driver assistance systems and increased functionality in infotainment platforms have intensified competition in the electrical and electronics segment. Sensor counts per vehicle have surged, driving growth for specialized semiconductor suppliers and software developers. As complexity heightens, companies are forging strategic alliances to combine hardware capabilities with algorithmic expertise, thus delivering integrated solutions that align with future vehicle architectures.

Concurrently, the aftermath of pandemic-related disruptions has refocused attention on supply chain agility. Organizations are embracing digital twins and predictive analytics to anticipate bottlenecks and optimize inventory buffers. Coupled with a growing appetite for lightweight composites and high-strength steels, these tools support the industry’s dual mandate to reduce vehicle weight for efficiency gains while maintaining robust production resilience. Through these transformative shifts, automotive parts stakeholders are redefining competitive dynamics and unlocking new pathways to innovation.

Assessing the Cumulative Economic and Supply Chain Impacts of United States Tariffs Imposed on Automotive Parts in 2025

The United States’ decision to extend and recalibrate tariffs on key automotive parts in early 2025 has generated notable cost pressures throughout the value chain. Import levies on body panels, chassis frames, and advanced electrical modules have incrementally elevated procurement expenses for domestic assemblers. As these added duties compound existing supply constraints, many OEMs have faced a direct hit to their margins, compelling them to adjust pricing strategies and negotiate new long-term agreements with suppliers.

In response to the tariff environment, numerous tier-one and tier-two suppliers have accelerated efforts to localize production within North America. This shift has involved capital investment in regional manufacturing hubs and joint ventures with domestic fabricators to circumvent duty liabilities. Despite these efforts, lead times have remained volatile due to ongoing equipment commissioning and workforce ramp-up challenges. The combination of heightened import costs and transitional inefficiencies has underscored the importance of agile procurement planning.

Beyond direct financial implications, the cumulative tariff landscape has influenced strategic roadmaps, prompting a reassessment of global sourcing networks. Organizations are increasingly weighing the trade-offs between duty avoidance and scale economics, with some electing to maintain a hybrid approach that balances near-sourced components with offshore manufacturing for non-tariffed products. Through this recalibrated supply chain architecture, companies aim to achieve a more resilient posture amid an uncertain trade policy outlook.

Unveiling Key Segmentation Insights to Understand Market Behavior across Product Types Materials Vehicle Types Sales Channels and Distribution Models

A granular examination of market behavior reveals that product type segmentation profoundly influences strategic priorities across the automotive component spectrum. Bodies and chassis offerings, encompassing body panels, body-in-white, chassis frames, steering systems, and suspension assemblies, are under intense scrutiny as manufacturers pursue lightweighting through advanced composites and high-strength alloys. Driveline and powertrain components, particularly engines and transmission systems, are gradually giving way to electric motor modules, necessitating new supply chain collaborations and skill sets.

In parallel, electrical and electronics segments have undergone rapid expansion, with driver assistance systems, engine control units, infotainment platforms, and an array of sensors becoming essential differentiators. Interiors and exteriors-spanning instrument clusters, control interfaces, lighting assemblies, and seating solutions-are likewise evolving to incorporate digital displays, smart materials, and ergonomic enhancements. Even traditionally stable wheel and tire offerings, which include brake systems, rims, tires, and wheel bearings, are seeing incremental innovation through smart tire technologies and adaptive braking modules.

Material segmentation further underscores divergent investment patterns: composites are ascending in bodies and chassis for weight optimization, while glass components are refined to integrate heads-up display capabilities. Metallic materials such as aluminum, cast iron, and steel continue to play pivotal roles, with aluminum favored for its strength-to-weight ratio and steel for cost-effective structural integrity. Plastics and rubber remain indispensable across interiors, seals, and mounting systems, highlighting the enduring importance of polymer science.

Vehicle type considerations add additional nuance, as commercial vehicles-including both heavy and light commercial applications-prioritize durability and regulatory compliance, while passenger cars across hatchbacks, sedans, and SUVs demand a balance of comfort, performance, and aesthetic appeal. Sales type dynamics reveal distinct trajectories for aftermarket channels versus original equipment manufacturer partnerships. Finally, distribution through both offline outlets-such as authorized distributors, brick-and-mortar retailers, and company showrooms-and online platforms, including manufacturer websites and e-commerce marketplaces, shapes accessibility and customer engagement strategies across the value chain.

This comprehensive research report categorizes the Automotive Parts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Vehicle Type

- Sales Type

- Sales Channel

Highlighting Region-Specific Trends and Market Drivers in the Americas Europe Middle East Africa and Asia-Pacific Automotive Components Landscape

Regional disparities in automotive parts dynamics are increasingly pronounced, driven by unique economic, regulatory, and infrastructural factors. In the Americas, North American manufacturing centers remain focal points for both legacy powertrain components and emerging electric driveline modules. The proximity to major OEM assembly plants, coupled with supportive government incentives for nearshoring, reinforces a landscape where regional supply chains continue to deepen and diversify.

Over in Europe, stringent emissions standards and the European Green Deal have galvanized investment in zero-emission powertrains and advanced driver assistance components. Middle Eastern markets, buoyed by diversification initiatives away from hydrocarbon dependence, are beginning to embrace broader electrification, while African automotive ecosystems remain challenged by infrastructural limitations yet present untapped potential in aftermarket services and commercial vehicle fleets.

Meanwhile, the Asia-Pacific region stands at the forefront of electrified mobility, with China’s expansive EV rollout driving demand for battery packs, power electronics, and intelligent charging infrastructure components. Indian automotive players are balancing cost sensitivity with gradual adoption of higher-value features, and Japan’s established supplier networks continue to innovate in precision engineering and robotics integration. These region-specific patterns underscore the importance of tailored strategies that align with local regulatory drivers, consumer preferences, and manufacturing capabilities.

This comprehensive research report examines key regions that drive the evolution of the Automotive Parts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Positioning Product Portfolios and Innovative Capabilities of Leading Automotive Parts Manufacturers

A comparative analysis of leading industry participants reveals divergent strategies in capturing growth and sustaining competitive advantage. Established suppliers with broad product portfolios have leveraged scale economies to fund research in advanced materials and electrification technologies, focusing on modular platforms that can be rapidly adapted to varying vehicle architectures. Meanwhile, specialized manufacturers in the electrical and electronics domain have pursued partnerships with semiconductor innovators to secure critical IP for driver assistance and connectivity systems.

Strategic alliances and joint ventures have become commonplace among major players seeking to integrate end-to-end solutions, spanning from battery cells to integrated control units. At the same time, visionary start-ups and nimble mid-tier suppliers are capitalizing on niche opportunities in sensor fusion, thermal management, and digital manufacturing, often entering into collaborative testbeds with OEMs to validate novel concepts in real-world environments.

Amid these developments, manufacturing footprint optimization remains a central theme. Industry leaders are rationalizing their global networks by consolidating production in high-value regions for emerging technologies, while maintaining cost-focused operations in established hubs. This dual-track approach is supported by digital transformation initiatives, including smart factory deployments and additive manufacturing trials, that promise to enhance both flexibility and operational efficiency across diverse product lines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Parts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient PLC

- Aisin Corporation

- Akebono Brake Industry Co., Ltd.

- American Axle & Manufacturing Holdings, Inc.

- Aptiv PLC

- BENTELER International AG

- BorgWarner Inc.

- Brembo N.V.

- Bridgestone Corporation

- Continental AG

- Cummins Inc.

- Dana Incorporated

- DENSO Corporation

- Dorman Products, Inc.

- Faurecia SE

- Flex-N-Gate Corporation

- Ford Motor Company

- Freightliner by Daimler Truck AG

- General Motors Company

- HASCO Hasenclever GmbH + Co KG

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Kyocera Corporation

- Lear Corporation

- Magna International Inc.

- Mahle GmbH

- Marelli Holdings Co., Ltd.

- Michelin Group

- Mitsubishi Heavy Industries, Ltd.

- OPmobility SE

- PACCAR Inc.

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Samvardhana Motherson International Limited

- Schaeffler AG

- STMicroelectronics International N.V.

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

- Tenneco Inc.

- Tesla, Inc.

- ThyssenKrupp AG

- Toyoda Gosei Co., Ltd.

- Toyota Industries Corporation

- Valeo

- Visteon Corporation

- Weichai Power Co., Ltd.

- Yazaki Corporation

- ZF Friedrichshafen AG

Formulating Actionable Strategies and Operational Initiatives for Industry Leaders to Navigate Disruption and Capitalize on Emerging Opportunities

Industry incumbents and challengers alike can enhance their competitive positioning by embracing a series of targeted operational and strategic initiatives. First, accelerating the integration of digital supply chain systems-such as predictive analytics, real-time inventory tracking, and blockchain-enabled provenance-will bolster resilience and transparency, enabling rapid response to tariff fluctuations and geopolitical disruptions.

Second, intensifying R&D investments in lightweight composites and next-generation alloys will unlock performance gains in both traditional powertrains and electric driveline components. Coupling these material innovations with smart manufacturing techniques, including robotics and additive processes, will further drive production efficiency and enable rapid prototyping.

Third, forging collaborative ecosystems through strategic partnerships with technology firms and start-ups will accelerate time-to-market for advanced electronics and software solutions. By co-developing integrated packages for driver assistance, connectivity, and energy management, suppliers can deliver higher value propositions to OEM customers.

Finally, strengthening omnichannel distribution strategies is essential. Enhancing digital customer interfaces, while optimizing offline service networks, will expand aftermarket reach and deepen brand loyalty. Collectively, these actionable recommendations provide a roadmap for industry leaders to navigate disruption and capitalize on emerging opportunities.

Detailing Rigorous Methodological Approaches and Data Collection Frameworks Underpinning the Automotive Parts Market Research Analysis

This analysis is grounded in a rigorous methodological framework designed to ensure comprehensive coverage and data integrity. Primary research entailed in-depth interviews with senior executives across the automotive value chain, including OEM procurement heads, tier-one suppliers, and aftermarket distributors. These qualitative insights were complemented by structured surveys capturing emerging priorities and pain points among component manufacturers.

Secondary research encompassed a thorough review of publicly available regulatory filings, patent databases, technical whitepapers, and industry association publications. This multi-source approach facilitated the identification of technological trends, policy shifts, and competitive dynamics. Data triangulation protocols were applied to validate findings, ensuring consistency between primary feedback and secondary intelligence.

Quantitative analyses leveraged robust databases of trade flows, tariff schedules, and material price indices, focusing on the period through December 2024. Statistical techniques, including trend mapping and correlation studies, underpinned the examination of tariff impacts and segmentation performance. All data underwent stringent quality assurance processes, including expert panel reviews and cross-functional validation, to uphold the highest standards of research integrity and analytical precision.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Parts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Parts Market, by Product Type

- Automotive Parts Market, by Material

- Automotive Parts Market, by Vehicle Type

- Automotive Parts Market, by Sales Type

- Automotive Parts Market, by Sales Channel

- Automotive Parts Market, by Region

- Automotive Parts Market, by Group

- Automotive Parts Market, by Country

- United States Automotive Parts Market

- China Automotive Parts Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Drawing Comprehensive Conclusions on Market Dynamics Strategic Imperatives and Long-Term Outlook for Automotive Parts Industry Stakeholders

In summary, the automotive parts industry is navigating a period of profound transformation, driven by the convergence of electrification, digitalization, and shifting trade policies. The imposition of new tariffs in 2025 has underscored the importance of agile supply chain strategies and regional production footprints, as companies seek to mitigate cost pressures while maintaining access to critical components.

Segmentation analysis highlights divergent growth trajectories across bodies and chassis, powertrain, electronics, interior, and wheel systems, each shaped by material innovations and evolving vehicle architectures. Regional insights further illuminate how economic incentives, regulatory frameworks, and consumer preferences diverge between the Americas, EMEA, and Asia-Pacific, demanding bespoke market approaches.

Leading suppliers are responding through strategic investments in R&D, digital transformation, and collaborative partnerships, thereby positioning themselves to capture value in an increasingly complex ecosystem. As industry stakeholders look ahead, the ability to integrate advanced materials, leverage smart manufacturing, and anticipate policy shifts will be paramount to sustaining competitive advantage and driving long-term growth.

Take the Next Step Today and Connect with Ketan Rohom Associate Director for Sales and Marketing to Access the Automotive Parts Market Report

To explore how this comprehensive market analysis can empower your strategic planning and drive tangible results, reach out to Ketan Rohom Associate Director for Sales and Marketing at 360iResearch today. Engage directly to obtain full access to in-depth insights covering product innovations, tariff impacts, regional dynamics, and competitive strategies. Secure your copy of the automotive parts market report and position your organization at the forefront of industry transformation.

- How big is the Automotive Parts Market?

- What is the Automotive Parts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?