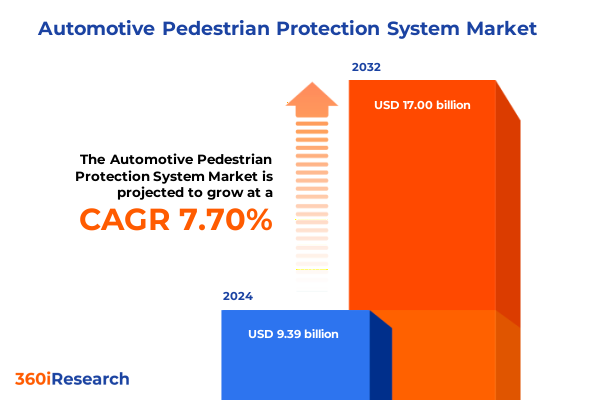

The Automotive Pedestrian Protection System Market size was estimated at USD 9.86 billion in 2025 and expected to reach USD 10.35 billion in 2026, at a CAGR of 8.09% to reach USD 17.00 billion by 2032.

Understanding the Growing Imperative for Advanced Pedestrian Protection Systems Amid Heightened Urban Vulnerabilities and Regulatory Pressures

Urban mobility continues to present one of the most pressing safety challenges of our era as millions of pedestrians navigate increasingly congested roadways alongside diverse vehicle fleets. In 2024, drivers struck and killed 7,148 people walking in the United States, signaling a slight decline of 4.3% compared with the previous year but still representing almost a 20% increase from 2016 levels. This sustained toll underscores the urgent need for integrated protection systems that can mitigate impact forces and prevent collisions before they occur.

The broader context of traffic safety offers a mixed picture: while overall roadway fatalities fell to 39,345 in 2024-the lowest number since 2019-this figure remains significantly above pre-pandemic norms, and vulnerable road user deaths continue to demand targeted interventions. Pedestrians, in particular, face elevated risks in high-speed crashes and locations lacking dedicated infrastructure, amplifying the stakes for more advanced in-vehicle protection solutions.

Against this backdrop, global regulatory frameworks have progressively focused on pedestrian injury mitigation. Since 2008, the United Nations Regulation No. 127 has required manufacturers to design softer bonnet hoods and bumpers to reduce head, chest, and leg injuries. Although this standard applies in regions such as Europe, China, India, Japan, and South Korea, it remains voluntary in the United States, creating both a safety gap and an opportunity for innovation.

As consumer awareness grows and regulatory scrutiny intensifies, automakers and suppliers are deploying advanced pedestrian protection systems that integrate a variety of sensor technologies, active braking interventions, and energy-absorbing structural components. This introduction lays the foundation for exploring the transformative shifts and strategic opportunities within this critical segment of automotive safety technology.

Embracing Transformative Technological Shifts Driving the Next Generation of Pedestrian Detection and Protection Capabilities

The landscape of pedestrian protection systems is undergoing a profound transformation driven by the rapid convergence of sensor technologies and artificial intelligence. Industry analysts report that LiDAR adoption is gaining momentum as autonomous driving features and logistics applications demand higher-resolution object mapping, while sophisticated fusion of radar, camera, and infrared data is enabling unprecedented accuracy in pedestrian detection.

One of the most significant shifts has emerged from Chinese lidar manufacturer Hesai, which became the first profitable lidar provider in 2024 and has announced plans to establish an overseas factory in 2026. This move is designed to mitigate geopolitical risks and tariff pressures, while underscoring the growing role of high-precision laser sensors in both passenger and commercial vehicle applications.

Meanwhile, European automakers are also expanding their sensor portfolios through strategic partnerships. Mercedes-Benz’s latest agreement with Luminar Technologies aims to co-develop the next-generation Halo lidar sensor, set for scalable integration across its global portfolio by 2026. This dual-supplier approach, which balances cost-effective Chinese units with advanced U.S. technologies, highlights the industry’s drive for resilience amid global trade uncertainties.

Simultaneously, enhancements in infrared detection are expanding after-sunset performance, while neural-network–driven predictive algorithms are improving system responsiveness in complex urban environments. Together, these innovations are redefining the technical boundaries of pedestrian protection, paving the way for systems that not only withstand impacts but actively anticipate and prevent collisions.

Exploring the Ripple Effects of 2025 United States Automotive Tariffs on Pedestrian Protection System Supply Chains and Costs

In April 2025, the United States invoked Section 232 of the Trade Expansion Act to impose a 25% tariff on imported light-duty vehicles and key automotive parts, a measure designed to safeguard national security interests and bolster domestic manufacturing. The proclamation extended to essential pedestrian protection components, introducing new cost pressures across global supply chains. Automakers assembling vehicles in the U.S. were offered limited offsets for parts content, but the resulting complexity has reverberated through production and procurement strategies.

The financial impact has been immediate and substantial. Ford Motor Company warned of a $1.5 billion hit to operating profits in 2025 due to the new automotive tariffs, prompting the suspension of its full-year financial guidance. The company cited heightened uncertainty around tariff implementation, potential increases, and cross-border supply chain disruptions as primary risks to its financial outlook.

General Motors similarly reported a $1.1 billion reduction in second-quarter operating income attributed to tariff costs. This setback contributed to a 35% year-over-year decline in net income, underscoring the broader implications of sustained duties on foreign vehicles and parts. GM’s efforts to relocate production and enhance U.S. content remain nascent, suggesting that margin recovery may be a multiyear endeavor.

Meanwhile, U.S. automakers have raised concerns about uneven tariff treatment under recent trade agreements. The administration’s deal with Japan reduced tariffs on Japanese auto imports to 15%, while maintaining a 25% levy on Canadian and Mexican vehicles, triggering criticism from domestic manufacturers over competitive imbalances. This dynamic has intensified debate over the cumulative effects of tariff stacking and the need for cohesive trade policy that aligns with domestic industry goals.

Uncovering Critical Segmentation Insights Defining Market Dynamics Across Vehicle Types Technologies System Types ADAS Tiers and Distribution Channels

Market participants have segmented the pedestrian protection system space along multiple dimensions to tailor product development and commercial strategies. Vehicle types present distinct requirements: heavy commercial vehicles rely on robust sensor arrays capable of detecting pedestrians at elevated bumper heights and in varied loading conditions, whereas passenger cars prioritize compact, discreet modules engineered for aesthetic integration. Light commercial vehicles bridge these needs, demanding adaptable detection algorithms that account for mixed cargo profiles and frequent stop-start operation in urban deliveries.

Pedestrian detection technologies themselves span a wide spectrum. Camera-based solutions, ranging from monocular lenses to stereo rigs, deliver rich visual contextualization in clear environments, while infrared systems-employing both far and near infrared sensors-excel in low-light and nighttime scenarios. LiDAR units, available in mechanical and solid-state formats, offer precise three-dimensional scanning critical for high-speed and complex traffic environments, and radar sensors, from long- to short-range configurations, ensure reliable performance under adverse weather conditions.

System architectures diverge between active and passive protection strategies. Active components such as autonomous emergency braking and pre-crash braking systems engage proactively by detecting potential pedestrian collisions and executing automated interventions. Passive measures, including energy absorbing bumpers and hood lift mechanisms, are engineered to deform or elevate upon impact, thereby reducing the force transmitted to a struck pedestrian’s head and torso.

Final adoption models align with advanced driver assistance system (ADAS) tiers, from Level 1 basic assistance to Level 4+ highly automated functionalities, influencing sensor quantity and computational capacity. Distribution channels further differentiate market approaches, with original equipment manufacturers integrating systems at the assembly line and aftermarket suppliers offering replacement sensors and retrofit kits to extend collision mitigation capabilities across existing vehicle fleets.

This comprehensive research report categorizes the Automotive Pedestrian Protection System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pedestrian Detection Technology

- System Type

- ADAS Tier

- Vehicle Type

- Distribution Channel

Revealing Key Regional Market Differentiators Shaping Pedestrian Protection System Adoption Across the Americas EMEA and AsiaPacific

Regional divergences in regulation, consumer preferences, and infrastructure investments have created distinct trajectories for pedestrian protection system adoption. In the Americas, federal safety mandates and consumer advocacy have propelled active protection features into standard equipment for passenger vehicles, while Tier 1 suppliers have strengthened local manufacturing footprints to navigate tariff regimes and enhance supply chain resilience.

Across Europe, the Middle East, and Africa, harmonized adoption of United Nations pedestrian protection regulations has leveled performance requirements for new vehicle models. Incentive programs tied to vehicle safety ratings and the proliferation of retrofit directives in mature European markets have also catalyzed aftermarket growth, particularly in regions undergoing rapid fleet renewal.

In the Asia-Pacific region, urbanization rates and government initiatives in China, Japan, India, and South Korea are driving the fastest commercial uptake of integrated protection systems. Local suppliers and ODMs have leveraged government-backed smart city programs to embed sensor networks into infrastructure, augmenting onboard detection with roadside data. OEM partnerships and a dynamic landscape of retrofit services further underscore this region’s role as a proving ground for next-generation pedestrian protection solutions.

This comprehensive research report examines key regions that drive the evolution of the Automotive Pedestrian Protection System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Shaping the Future of Pedestrian Protection Systems Through Strategic Partnerships and Innovation Leadership

The competitive landscape in pedestrian protection systems is shaped by the strategic investments and partnerships of major technology and automotive players. Robert Bosch GmbH and Continental AG continue to dominate through comprehensive radar-camera fusion modules that prioritize cost-efficiency and scalable integration across multiple vehicle platforms.

Valeo SA and ZF Friedrichshafen AG have distinguished themselves with advanced infrared sensing and passive hood lift designs, aligning their product pipelines with evolving pedestrian safety mandates in Europe and Asia. Their combined strength in thermal imaging technologies addresses a critical gap in low-light pedestrian detection.

LiDAR specialists have also gained prominence as automakers seek to elevate detection granularity. Hesai Technology’s decision to open an overseas factory in 2026 reflects both its profitability and the viability of its mechanical and solid-state lidar offerings for global markets. Simultaneously, Luminar’s collaboration with Mercedes-Benz to co-develop the Halo sensor underscores the strategic importance of aligning next-generation lidar innovation with premium vehicle brands.

Beyond hardware, semiconductor and software providers like NVIDIA Corporation and Texas Instruments Incorporated are embedding AI accelerators into central electronic control units, enabling real-time processing of complex pedestrian recognition models. These partnerships underscore the shift toward software-defined safety architectures that can evolve over the vehicle lifecycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Pedestrian Protection System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Autoliv, Inc.

- Continental AG

- Denso Corporation

- Ford Motor Company

- General Motors Company

- Gentex Corporation

- Hella GmbH & Co. KGaA

- Honda Motor Co., Ltd.

- Hyundai Mobis Co., Ltd.

- Jaguar Land Rover Limited

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

Delivering Actionable Recommendations to Empower Automotive Stakeholders to Advance Pedestrian Protection System Strategies and Growth Initiatives

To capitalize on emerging opportunities and address evolving safety requirements, industry leaders should prioritize multilateral sensor fusion strategies that seamlessly integrate camera, radar, LiDAR, and infrared inputs. This holistic approach enhances detection accuracy across diverse environmental conditions and reduces false-positive rates, bolstering both consumer confidence and regulatory compliance.

Manufacturers can further mitigate tariff exposure by localizing production and securing United States-Mexico-Canada Agreement content certifications. By qualifying components for offset programs and establishing nearshore facilities, stakeholders can accelerate supply continuity and achieve more stable cost management amid shifting trade policies.

Forging collaborative partnerships with municipal agencies, technology firms, and regulatory bodies will be essential to shaping performance standards and unlocking incentive programs. Joint pilot initiatives and data-sharing consortia can drive the iterative validation of system efficacy, ultimately accelerating widespread deployment and adoption.

Finally, sustained investment in real-world data acquisition and machine learning model refinement will enhance predictive braking algorithms and reduce system intervention latency. Continuous improvement processes-including over-the-air software updates-will ensure that protection systems maintain optimal performance throughout a vehicle’s lifespan.

Detailing Rigorous Research Methodology Combining Primary Interviews Secondary Data Analysis and Triangulation for Comprehensive Market Insights

Our research harnessed a dual-track methodology combining primary and secondary sources to deliver robust and actionable market insights. Primary research included in-depth interviews and roundtable discussions with product development leaders at original equipment manufacturers, engineering executives at Tier 1 suppliers, and regulatory advisors specializing in automotive safety standards.

Secondary research encompassed a comprehensive review of government publications, including White House fact sheets, NHTSA traffic fatality estimates, Governors Highway Safety Association reports, and industry analyses from leading financial and trade publications. We also examined corporate announcements, technology roadmaps, and peer-reviewed journal articles to contextualize innovation trajectories.

To ensure the validity of our findings, we applied rigorous data triangulation techniques, cross-referencing interview feedback with quantitative public data and third-party market intelligence. Case studies of real-world deployments provided empirical evidence to support strategic recommendations.

Our analytical framework was further reinforced by peer reviews from academic experts and seasoned safety practitioners, with iterative revisions reflecting the latest regulatory updates and emerging technology developments. This systematic approach ensures that our conclusions remain relevant, credible, and aligned with dynamic industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Pedestrian Protection System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Pedestrian Protection System Market, by Pedestrian Detection Technology

- Automotive Pedestrian Protection System Market, by System Type

- Automotive Pedestrian Protection System Market, by ADAS Tier

- Automotive Pedestrian Protection System Market, by Vehicle Type

- Automotive Pedestrian Protection System Market, by Distribution Channel

- Automotive Pedestrian Protection System Market, by Region

- Automotive Pedestrian Protection System Market, by Group

- Automotive Pedestrian Protection System Market, by Country

- United States Automotive Pedestrian Protection System Market

- China Automotive Pedestrian Protection System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding with Strategic Perspectives That Reinforce the Imperative for Collaboration Innovation and Safety in Pedestrian Protection Systems

The convergence of regulatory imperatives, technological breakthroughs, and trade policy shifts has repositioned pedestrian protection systems at the forefront of automotive safety innovation. As vulnerable road user fatalities remain elevated compared with pre-pandemic levels, the imperative for more effective collision avoidance and impact mitigation capabilities has never been clearer.

Advancements in sensor fusion, AI-driven predictive algorithms, and structural design enhancements are creating a new paradigm for how vehicles interact with pedestrians in urban environments. Yet the full potential of these technologies will only be realized through coordinated efforts across OEMs, suppliers, regulators, and local authorities.

Navigating the complexities of tariffs and trade agreements requires agile supply chain strategies that leverage domestic content certifications and regional manufacturing hubs. Meanwhile, harmonized global standards offer a pathway to consistent system performance and streamlined compliance across disparate markets.

In conclusion, the evolution of pedestrian protection systems presents both a challenge and an opportunity. Stakeholders who embrace collaborative innovation, data-centric refinement, and strategic localization will unlock significant safety gains while establishing a competitive edge in an increasingly safety-focused automotive landscape.

Take Immediate Action by Connecting with Ketan Rohom Associate Director Sales Marketing to Secure Your Comprehensive Pedestrian Protection System Market Report

To gain an in-depth understanding of the forces shaping the pedestrian protection system landscape and to access a comprehensive suite of actionable data and analysis, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at our firm. His expertise in guiding decision-makers through the intricacies of advanced automotive safety research will ensure you receive a tailored package that aligns with your strategic priorities. Reach out to Ketan Rohom to secure your access to the full market research report and to unlock exclusive insights that can drive innovation and competitive advantage in pedestrian protection system development.

- How big is the Automotive Pedestrian Protection System Market?

- What is the Automotive Pedestrian Protection System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?