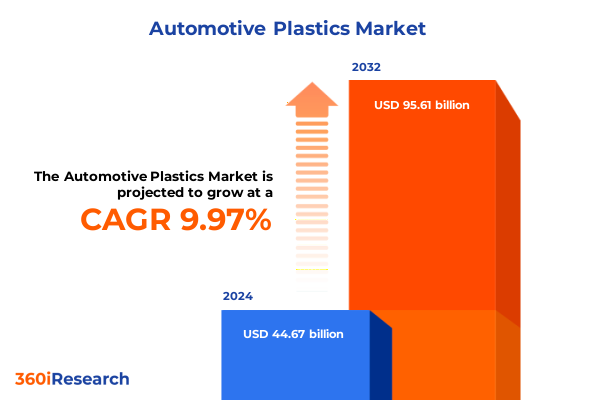

The Automotive Plastics Market size was estimated at USD 48.73 billion in 2025 and expected to reach USD 53.16 billion in 2026, at a CAGR of 10.10% to reach USD 95.61 billion by 2032.

How Advanced Plastics Are Revolutionizing Vehicle Design Through Lightweighting, Electrification Support, and Sustainable Manufacturing Practices

The automotive sector is undergoing a material revolution in which advanced plastics are emerging as indispensable enablers of vehicle performance, design flexibility, and sustainability objectives. As manufacturers strive to balance the weight added by electric powertrains and autonomy hardware, plastics offer high strength-to-weight ratios unmatched by traditional metals. In the context of electric vehicles, polymers like carbon fiber-reinforced composites and high-performance engineering plastics offset battery mass and extend driving range while meeting crash safety requirements. This combination of attributes has elevated the importance of plastics in modern vehicle architecture, driving deeper collaboration between OEMs and material suppliers to meet evolving performance specifications.

Examining the Transformative Trends Driving Automotive Plastics: Electrification Demands, Material Innovation, Digital Integration, and Circular Economy

Automotive plastics are positioned at the nexus of several industry-shaping trends that are redefining mobility. The rapid acceleration of electrification mandates the use of lightweight and thermally stable plastics for battery enclosures, power electronics housings, and thermal management components. Surging demand for these advanced polymers is rooted in their ability to reduce mass by up to 25 percent compared with metal alternatives, directly contributing to longer EV range and improved energy efficiency. Parallel to this, regulators across major markets are tightening emissions and recyclability requirements, compelling manufacturers to adopt bio-based and recycled resins to comply with stringent sustainability targets.

Digital integration and connected vehicle architectures are further driving plastics innovation, as sensor housings, wiring harness components, and electronic connectors require polymers with specialized dielectric properties and electromagnetic interference shielding. Concurrently, the circular economy paradigm is reshaping material selection, with additive technologies such as 3D printing enabling on-demand production of complex geometries while minimizing waste. Advanced manufacturing processes-ranging from high-precision injection molding to AI-driven process optimization-are elevating production efficiency and part quality, underscoring the transformative impact of materials innovation on both vehicle performance and cost structures.

Analyzing the Cumulative Effects of 2025 United States Automotive Tariffs on Costs, Supply Chains, and Opportunities for Domestic Plastics Processors

In 2025, the United States implemented a series of tariffs on imported vehicles and automotive parts that have reshaped supply chain strategies and cost structures across the plastics ecosystem. Beginning April 3, a 25 percent tariff under Section 232 on imported automobiles and light trucks was extended on May 3 to include key plastic-intensive components such as bumpers, headlamp housings, and sensor housings. At the same time, Section 301 duties on certain chemical intermediates imported from China maintained elevated costs for resin producers reliant on foreign raw materials. Together, these measures compounded into a multi-billion dollar burden for OEMs and tier suppliers, prompting near-term profit downgrades and accelerated plans for domestic capacity expansion.

Illuminating Market Segmentation of Automotive Plastics by Application, Material, Process, Vehicle Type, and End Use to Enhance Strategic Market Clarity

A nuanced understanding of the automotive plastics market emerges through multiple segmentation lenses that illuminate unique growth drivers and technical requirements. When viewed by application, the electrical and electronic domain-encompassing connectors, sensor housings, and wiring harness components-demands high-precision thermoplastics with superior heat tolerance and low flammability. Exterior components such as bumpers, grilles, and mirror housings leverage blow-molded and injection-molded plastics for impact resistance and aesthetic versatility, while interior dashboards, door panels, and seating components prioritize materials engineered for tactile quality and durability. Lighting systems including headlamp, indicator, and taillight housings rely on optical-grade polycarbonate blends, and under-the-hood assemblies such as air intake and cooling modules employ polyamides and high-heat ABS variants to withstand temperature extremes.

Material type segmentation underscores distinct performance profiles: high-heat ABS and standard ABS cater to exterior and interior surfaces; polyamides such as PA12, PA6, and PA66 furnish under-hood resilience; polycarbonate blends balance impact strength and optical clarity; polypropylene copolymers and homopolymers offer cost-effective, lightweight solutions for nonstructural parts; and both flexible and rigid PVC find roles in interior trim and protective tubing. Process insights highlight that advanced injection molding-both conventional and high-precision-dominates production volumes for intricate components, whereas extrusion, blow molding, compression molding, and thermoforming each serve specialized use cases, from fluid channels to large-format body panels. Consideration of vehicle type reveals divergent material preferences between commercial vehicles-buses, trucks, and light commercial vans-and passenger cars across coupes, hatchbacks, sedans, and SUVs, while end use segmentation differentiates the OEM pipeline for new vehicles from the aftermarket’s requirements for replacement parts and repair kits.

This comprehensive research report categorizes the Automotive Plastics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Process Type

- Vehicle Type

- Application

- End Use

Exploring Regional Dynamics in Automotive Plastics Demand and Innovation Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in determining the competitive landscape and investment priorities within automotive plastics. The Americas, buoyed by reshoring efforts and favorable trade policy, are witnessing an uptick in new injection molding and compounding facilities to mitigate tariff impacts and shorten lead times. In Europe, Middle East & Africa, stringent Euro 7 emissions regulations and emerging sustainability mandates are driving OEMs to adopt recycled and bio-based polymers, with significant R&D activity centered in Germany, Italy, and the United Kingdom. Conversely, Africa remains at an early stage of plastics infrastructure development, though partnerships with European and North American investors are beginning to seed capacity for basic molding and recycling operations.

Meanwhile, the Asia-Pacific region continues to lead global production volumes, anchored by large-scale manufacturing hubs in China, Japan, South Korea, and India. Rapid electrification rollouts across China and India are catalyzing demand for specialized resins and conductive plastics, while supportive government policies in key markets like Thailand and Vietnam are attracting tier-supplier expansions. Notably, APAC’s well-established supply chains for polyolefins and engineering plastics provide a robust base for export-oriented OEM and tier operations, even as trade tensions and supply security concerns prompt diversification efforts into Southeast Asia and Australia.

This comprehensive research report examines key regions that drive the evolution of the Automotive Plastics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players Driving Innovation, Sustainability, and Growth in the Global Automotive Plastics Ecosystem Through Strategic Initiatives

Leading chemical and materials companies are doubling down on automotive plastics innovation to capture rising demand and support OEM sustainability goals. BASF has unveiled a reduced carbon footprint portfolio-rPCF and ZeroPCF engineering plastics-alongside advanced battery demonstrators that showcase lightweight, flame-retardant solutions for eMobility applications. Covestro, in turn, has introduced TÜV Rheinland-certified post-consumer recycled polycarbonates sourced from end-of-life headlamps, validated by Volkswagen and NIO, as part of its closed-loop material initiatives. DuPont remains a key player in high-performance polyamides, leveraging its global manufacturing footprint to deliver temperature-resistant components for under-hood and electrical applications. Meanwhile, LyondellBasell and SABIC are aggressively expanding compounding capacity in North America and Asia, respectively, to strengthen regional supply and tailor polypropylene and polyamide formulations for specific OEM requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Plastics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AkzoNobel N.V.

- Arkema SA

- BASF SE

- Celanese Corporation

- Covestro AG

- DSM Engineering Plastics B.V.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Grupo Antolin S.A.

- Hanwha Azdel Inc.

- Johnson Controls International plc

- Lanxess AG

- Lear Corporation

- LyondellBasell Industries N.V.

- Magna International Inc.

- Mitsubishi Chemical Corporation

- Mitsubishi Chemical Corporation

- Owens Corning Inc.

- Quadrant AG

- Saudi Basic Industries Corporation (SABIC)

- Solvay S.A.

- Teijin Limited

- The Dow Chemical Company

- Toray Industries, Inc.

Providing Targeted Strategies for Industry Leaders to Navigate Complexity, Foster Innovation, and Capitalize on Opportunities Across Automotive Plastics

Industry leaders are advised to adopt a multipronged strategy that combines supply chain resiliency, material diversification, and digital integration. Prioritizing regional manufacturing footprints can mitigate trade uncertainties and reduce transportation lead times, while strategic partnerships with local resin producers ensure reliable access to high-performance polymers. Investing in R&D for bio-based and chemically recycled polymers will address tightening sustainability mandates and position companies as preferred suppliers to OEMs targeting carbon neutrality.

Concurrently, scaling advanced manufacturing capabilities-such as high-precision injection molding, additive production, and AI-enabled process monitoring-will optimize production efficiency and quality. Leaders should also integrate end-to-end digital tools, from digital twins for molding lines to blockchain-based traceability solutions, to enhance transparency across the value chain. By aligning these initiatives with evolving regulatory frameworks and consumer preferences for sustainable mobility, automotive plastics suppliers and OEMs can unlock new revenue streams and secure long-term competitive advantage.

Detailing the Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Quantitative and Qualitative Techniques

This report synthesizes insights drawn from an extensive research framework combining primary and secondary data sources. Primary research encompassed in-depth interviews with senior executives across OEMs, tier-one suppliers, resin manufacturers, and industry associations to capture real-time perspectives on material trends, supply chain shifts, and innovation priorities. Secondary research involved a thorough review of industry publications, patent filings, regulatory registers, and company disclosures to establish a robust baseline of technical specifications, policy contexts, and competitive activity.

Quantitative analysis leveraged proprietary databases and public trade statistics to map regional production volumes, trade flows, and import-export dynamics. Qualitative assessments utilized scenario planning and SWOT analysis to evaluate potential market disruptions and strategic imperatives. Data triangulation and cross-verification ensured accuracy and consistency, forming the foundation for actionable insights and strategic recommendations tailored to stakeholders across the automotive plastics value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Plastics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Plastics Market, by Material Type

- Automotive Plastics Market, by Process Type

- Automotive Plastics Market, by Vehicle Type

- Automotive Plastics Market, by Application

- Automotive Plastics Market, by End Use

- Automotive Plastics Market, by Region

- Automotive Plastics Market, by Group

- Automotive Plastics Market, by Country

- United States Automotive Plastics Market

- China Automotive Plastics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Summarizing Key Takeaways on How Automotive Plastics Are Poised to Drive Innovation, Sustainability, and Competitive Advantage in a Rapidly Evolving Industry

The landscape for automotive plastics is rapidly evolving as electrification, sustainability mandates, and digital integration converge to redefine material requirements and supply chain structures. Advanced polymers are no longer just cost-effective substitutes for metal-they are foundational enablers of vehicle efficiency, safety, and design innovation. With regional trade policies and tariff regimes influencing sourcing strategies, the industry is poised for continued realignment toward localized, circular supply chains.

By integrating segmentation insights, regional dynamics, and competitive strategies, stakeholders can navigate complexity and capitalize on growth opportunities in lightweighting, electrification support, and sustainable manufacturing. The insights presented in this report underscore the imperative for proactive investment in material innovation, advanced production capabilities, and collaborative partnerships that will determine leadership in the next generation of mobility.

Engaging with Associate Director Ketan Rohom to Secure the Comprehensive Automotive Plastics Market Research Report

For enterprises seeking to solidify their competitive edge and unlock comprehensive market intelligence, connecting with Associate Director Ketan Rohom represents the gateway to the full breadth of insights contained within this automotive plastics research report. His expertise in articulating the report’s strategic implications will ensure that your organization gains tailored guidance on leveraging plastics innovations across product development, supply chain optimization, and sustainability initiatives. Reach out to discuss how access to this report can accelerate your decision-making and inform your roadmap for growth in the dynamic automotive plastics landscape.

- How big is the Automotive Plastics Market?

- What is the Automotive Plastics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?