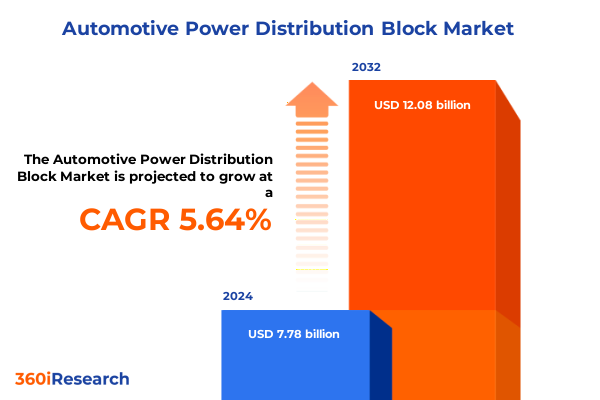

The Automotive Power Distribution Block Market size was estimated at USD 8.16 billion in 2025 and expected to reach USD 8.57 billion in 2026, at a CAGR of 5.74% to reach USD 12.08 billion by 2032.

Positioning power distribution blocks at the forefront of automotive electrification with emerging technologies transforming vehicle power management strategies

At the core of modern vehicle architecture lies the power distribution block, a pivotal component responsible for channeling electrical energy from the primary source to multiple subsystems. Traditionally associated with conventional internal combustion vehicles, this element has evolved rapidly under the weight of automotive electrification. As manufacturers accelerate the shift toward battery electric vehicles and hybrid platforms, power distribution blocks are undergoing significant re-engineering to accommodate higher voltages, greater thermal loads, and more compact form factors.

With electrification redefining powertrain design, distribution blocks are increasingly integrated with sensors and communication modules, allowing real-time monitoring of current flow and predictive fault diagnostics. These advancements not only bolster safety and reliability but also enable over-the-air updates and enhanced vehicle connectivity. Furthermore, material innovations, such as the adoption of high-strength metal alloys coupled with advanced thermoplastics, are optimizing thermal management and weight reduction without compromising durability.

Against this backdrop, the industry is confronting new challenges and opportunities, spanning stringent regulatory requirements, shifting consumer expectations for eco-friendly mobility, and the imperative to streamline production costs. Consequently, stakeholders across the value chain-from raw material suppliers to OEMs-are compelled to align investment and R&D strategies with emerging electric vehicle architectures and the broader transition to sustainable mobility.

Uncovering the transformative shifts driving the power distribution block market amid digitalization, modular architectures, sustainability and advancing autonomy

The automotive power distribution block landscape is undergoing a profound metamorphosis driven by digitalization, modularity, and sustainability imperatives. Digital integration has ushered in a new era where blocks are no longer passive conduits of electricity but active nodes within the vehicle’s electronic network. Embedded microcontrollers and diagnostics enable real-time health monitoring and fault prediction, significantly improving maintenance cycles and reducing downtime risks.

Simultaneously, modular architectures are facilitating rapid platform convergence across vehicle segments. Standardized interfaces allow power distribution systems to be tailored swiftly to both passenger cars and heavy commercial vehicles, driving economies of scale while preserving design flexibility. Sustainability pressures have also catalyzed a shift toward recyclable and bio-based materials, with thermoplastic housings replacing metal enclosures in applications where weight and end-of-life recyclability are paramount.

Moreover, as vehicles grow ever more autonomous, distribution blocks must accommodate the power demands of advanced driver assistance systems, lidar units, and computational modules. This convergence of high-voltage distribution and digital complexity necessitates collaborative innovation between electrical engineers, software developers, and materials scientists. Accordingly, new partnerships and cross-industry ecosystems are emerging to co-develop holistic solutions that will define the next generation of smart, sustainable mobility.

Assessing the cumulative impact of evolving US tariffs on automotive power distribution block cost structures, procurement strategies, and global sourcing in 2025

The cumulative effect of newly imposed and sustained US tariffs in 2025 has reshaped cost structures and sourcing strategies for power distribution block manufacturers. Section 232 levies on steel and aluminum continue to exert upward pressure on raw material costs, compelling suppliers to pursue alloy alternatives and invest in process optimization. At the same time, Section 301 duties on imports from select countries maintain a 25% surcharge on finished components, significantly affecting manufacturers dependent on global supply chains.

These trade measures have motivated organizations to re-evaluate procurement footprints. Some have shifted toward nearshoring in North America to mitigate tariff exposure and improve lead times, despite facing higher labor and operational expenses. Others have explored duty mitigation strategies such as tariff engineering-redesigning components or splitting assembly processes across tariff thresholds to reduce effective duty rates.

Consequently, many stakeholders are balancing total landed costs against supply security. While some capital investments are directed toward automation and vertical integration to maintain margin targets, others are exploring collaborative approaches with customs advisors and logistics firms to optimize import classifications. This dynamic environment underscores the need for agile sourcing models capable of responding swiftly to policy shifts, ensuring continuous access to critical materials and components without unduly inflating production costs.

Revealing critical segmentation perspectives that illuminate material selection, sales channels, vehicle categories, product configurations, and current rating dimensions

Insight into material selection reveals that manufacturers are capitalizing on the complementary benefits of metal alloys and thermoplastics. High-conductivity alloys ensure low electrical resistance and robust heat dissipation, while thermoplastic housings deliver weight savings along with superior insulation properties, offering a balanced approach to performance and cost. This fusion of materials caters to the varied demands of both conventional and electrified powertrains.

When examining sales channels, original equipment manufacturers continue to dominate initial system integration, leveraging long-term partnerships to secure custom distribution block configurations. Meanwhile, the aftermarket segment is gaining momentum, driven by retrofitting initiatives in commercial fleets and the increasing availability of plug-and-play modules, which offer fleet managers the flexibility to upgrade existing vehicles with enhanced power distribution solutions.

A closer look at vehicle categories highlights distinct growth dynamics. Passenger cars demand compact, low-profile blocks that seamlessly integrate within tight engine bays or battery compartments. Off-highway vehicles prioritize ruggedness to withstand harsh environmental conditions, whereas commercial vehicles-split between heavy and light classes-require high-current blocks capable of managing substantial energy flows for propulsion and auxiliary systems.

Product configurations further differentiate market offerings. Fused blocks incorporating blade fuses, cartridge fuses, and thermal circuit breakers deliver layered protection and ease of maintenance, whereas non-fused solutions, such as bus bar links and solid links, offer streamlined designs for high-reliability applications. Finally, current rating considerations span from units serving up to 60 amps in light-duty circuits through mid-range blocks rated at 61–200 amps, up to robust assemblies exceeding 200 amps for heavy-duty demands.

This comprehensive research report categorizes the Automotive Power Distribution Block market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Vehicle Type

- Product Type

- Current Rating

- Sales Channel

Highlighting regional dynamics across Americas, Europe Middle East & Africa, and Asia Pacific to uncover geographical drivers and adoption patterns

In the Americas, the market benefits from proactive regulatory frameworks and robust investments in electric vehicle charging infrastructure. Automakers and suppliers are collaborating closely to meet evolving safety standards and to integrate advanced distribution blocks into next-generation vehicle platforms. Additionally, near-term reshoring initiatives are reinforcing local supply chains, enhancing responsiveness to demand fluctuations.

Within Europe, Middle East, and Africa, stringent emissions targets and upcoming regulatory milestones have elevated the importance of efficient power distribution. Leading OEMs in Western Europe are integrating smart distribution modules into electric and hybrid models to optimize energy usage. Concurrently, emerging markets across the Middle East are investing in electrified transport corridors, while select African regions are piloting micro-mobility projects that require compact, reliable distribution solutions.

Asia-Pacific remains a powerhouse of demand, underpinned by vast electrification programs in China and ambitious rollout plans in India and Southeast Asia. Domestic manufacturers are innovating around localized material sourcing to manage cost and regulatory compliance. Japan’s long-standing expertise in precision engineering continues to propel high-performance distribution blocks, supporting both passenger vehicles and off-highway machinery.

This comprehensive research report examines key regions that drive the evolution of the Automotive Power Distribution Block market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting leading industry participants’ strategic maneuvers, partnerships, product innovations, and competitive positioning within the power distribution block arena

Leading players in the power distribution block arena are deploying differentiated strategies to solidify their market positions. One established supplier has introduced a modular micro-distribution system that offers scalable configurations across multiple voltage domains, effectively targeting both passenger car and light commercial segments. Another prominent manufacturer has forged strategic alliances with Tier 1 EV integrators to co-develop blocks with embedded diagnostics and over-molding technologies.

Several innovators have accelerated R&D investments, filing patents for hybrid material assemblies that combine high-strength alloys with advanced polymer composites to reduce weight while enhancing thermal resilience. Partnerships between electrical component specialists and software providers are ushering in blocks with integrated communication protocols, enabling seamless integration into vehicle control networks. Additionally, some firms are pursuing acquisitions of niche boutique suppliers to expand product portfolios and access specialized manufacturing capabilities.

Amidst competitive pressure, a few agile newcomers are carving out white-space opportunities by focusing on ultra-high current applications and customizable form factors for off-highway and commercial fleets. Their lean operational models and rapid prototyping cycles allow them to respond swiftly to bespoke customer requirements, challenging established incumbents and driving overall market innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Power Distribution Block market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amphenol Corporation

- Aptiv PLC

- Belden Inc.

- Eaton Corporation plc

- Furukawa Electric Co., Ltd.

- Hella GmbH & Co. KGaA

- Leoni AG

- Mitsubishi Electric Corporation

- Molex, LLC

- Robert Bosch GmbH

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

- Yazaki Corporation

Empowering industry leaders with actionable tactics for supply chain resilience, cost optimization, technological differentiation, and regulatory compliance in distribution blocks

To navigate the evolving landscape, industry leaders should prioritize diversification of raw material sources and cultivate dual-sourcing relationships to hedge against tariff volatility and supply disruptions. Investing in advanced material research-such as lightweight thermoplastic composites-can yield substantial gains in performance and regulatory compliance, especially for electric vehicle applications. Additionally, companies should integrate digital monitoring and predictive analytics into block designs to offer value-added services that extend beyond hardware sales.

Cost optimization can be further achieved through tariff mitigation strategies, including regional assembly and tariff engineering. Strategic collaboration with logistics experts and customs consultants will enable precise management of classification and duty scenarios. At the same time, proactive engagement with regulatory bodies can ensure early insight into evolving standards, providing a competitive edge in product certification and homologation processes.

Collaborative innovation is also paramount. Forming cross-functional alliances with OEMs and software developers will accelerate the integration of smart distribution blocks into vehicle ecosystems, unlocking new revenue streams. Lastly, establishing robust feedback loops with end users-such as fleets and maintenance providers-will inform continuous product refinement, ensuring that future iterations align with real-world performance requirements.

Detailing rigorous research methodologies encompassing primary engagements, secondary validation, expert interviews, and structured analytical frameworks deployed in this study

The insights presented in this report stem from a meticulously designed research framework combining primary and secondary methodologies. Primary engagements included in-depth interviews with senior engineers, procurement heads, and strategic planners from leading vehicle manufacturers and component suppliers across North America, Europe, and Asia-Pacific. These discussions provided granular perspectives on design criteria, supply chain dynamics, and emerging application needs.

Secondary analysis encompassed a comprehensive review of technical whitepapers, regulatory documentation, and patent filings to validate trends in material innovation, tariff structures, and regional policy developments. Trade data and customs records were examined to trace shifts in import and export patterns, offering empirical support for observed sourcing realignments.

Data triangulation was achieved by cross-referencing interview insights with documented market activities, ensuring consistency and reliability of findings. Structured analytical frameworks, including SWOT and value chain analysis, were applied to distill actionable intelligence, while scenario modeling was employed to assess the potential impact of policy changes and technological breakthroughs on the industry’s trajectory.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Power Distribution Block market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Power Distribution Block Market, by Material Type

- Automotive Power Distribution Block Market, by Vehicle Type

- Automotive Power Distribution Block Market, by Product Type

- Automotive Power Distribution Block Market, by Current Rating

- Automotive Power Distribution Block Market, by Sales Channel

- Automotive Power Distribution Block Market, by Region

- Automotive Power Distribution Block Market, by Group

- Automotive Power Distribution Block Market, by Country

- United States Automotive Power Distribution Block Market

- China Automotive Power Distribution Block Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding with strategic reflections on market trajectories, innovation imperatives, and future outlook for power distribution blocks in evolving automotive ecosystems

The automotive power distribution block sector stands at a critical juncture, poised between established legacy designs and rapidly emerging electrified architectures. As regulatory demands intensify and consumer expectations evolve, manufacturers must embrace agility in both product development and supply chain management. The convergence of digital functionalities with traditional electrical distribution has opened avenues for enhanced safety, predictive maintenance, and over-the-air updates, underscoring the strategic value of integrated hardware-software solutions.

Looking ahead, collaboration across the value chain will be a decisive factor. Those who invest in cross-sector partnerships, advanced material research, and tariff mitigation strategies will not only navigate policy headwinds but also set benchmarks for performance and reliability. Ultimately, success will be defined by the ability to deliver customizable, future-proof distribution blocks that meet the diverse requirements of passenger cars, commercial fleets, and off-highway machinery. By aligning innovation imperatives with operational resilience, industry stakeholders can chart a course toward sustainable growth in this dynamic market environment.

Driving your next strategic decision with exclusive insights—connect with Ketan Rohom to secure comprehensive automotive power distribution block market intelligence

Ready to transform your strategic roadmap with unparalleled depth, you are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Leveraging his extensive experience in translating complex research into actionable strategies, Ketan will guide you through the comprehensive market intelligence compiled in this report. Whether your objective is to refine supply chain approaches, accelerate product innovation, or navigate regulatory landscapes, this call will equip you with the insights necessary to drive decisive action.

By partnering with Ketan, you gain personalized access to granular data, expert analysis, and tailored recommendations that align with your organization’s unique priorities. Seize the opportunity to secure a competitive advantage and chart a course for sustainable growth in the dynamic automotive power distribution block sector. Reach out today to schedule your consultation and embark on a journey toward informed decision-making and market leadership.

- How big is the Automotive Power Distribution Block Market?

- What is the Automotive Power Distribution Block Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?