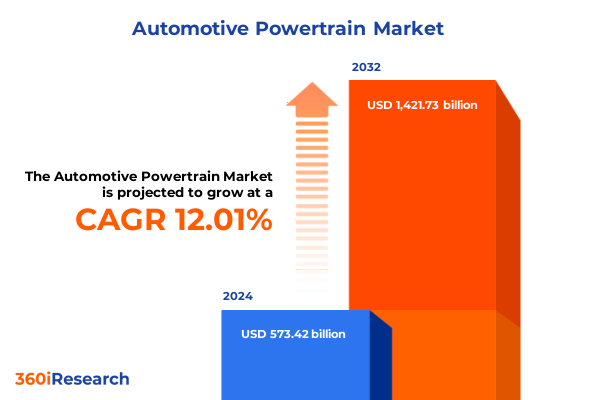

The Automotive Powertrain Market size was estimated at USD 636.24 billion in 2025 and expected to reach USD 705.95 billion in 2026, at a CAGR of 12.17% to reach USD 1,421.73 billion by 2032.

Navigating the Evolution of Automotive Powertrains with a Focus on Innovation Dynamics, Regulatory Pressures, and Strategic Market Drivers

The automotive powertrain landscape is undergoing a transformative phase driven by technological breakthroughs, shifting regulatory regimes, and evolving consumer expectations. As the industry transitions from traditional internal combustion engines toward a diverse mix of electrified solutions, stakeholders must navigate a multifaceted ecosystem defined by innovation, policy interventions, and competitive dynamics. Emerging technologies such as advanced battery chemistries, hydrogen fuel cells, and next-generation transmissions are redefining performance benchmarks while regulatory frameworks-spanning emissions targets, safety mandates, and trade measures-continue to shape strategic imperatives. Consequently, decision-makers must maintain rigorous attention to the convergence of engineering advancements, sustainability mandates, and geopolitical influences to identify growth pathways and mitigate risks.

Moreover, the proliferation of electric vehicles, driven by declining battery costs and increasing charging infrastructure, has intensified pressure on incumbent suppliers to adapt or face displacement. Meanwhile, legacy powertrain platforms are being optimized for efficiency through hybridization and lightweight materials, creating interim solutions that address both demand for cleaner mobility and existing manufacturing capacities. In this evolving context, a holistic understanding of market drivers-ranging from total cost of ownership considerations to urbanization trends and energy security priorities-is essential for guiding investments and strategic partnerships. As industry leaders embark on this journey, balancing short-term operational resilience with long-term innovation roadmaps becomes the cornerstone of sustainable success.

Identifying Transformative Shifts Reshaping Powertrain Technologies from Electrification to Hydrogen Adoption and Enhanced Efficiency

The powertrain sector has witnessed unprecedented shifts over the past decade, marked by a surge in electrification initiatives and the rapid maturation of related technologies. First, the rise of battery electric vehicles has disrupted established supply chains and triggered significant capacity expansions in battery gigafactories. Simultaneously, governments worldwide have accelerated investments in hydrogen infrastructure, signaling the potential of fuel cell electric vehicles to address long-range transport challenges. Beyond these headline trends, incremental enhancements to hybrid powertrains and advanced combustion engines continue to push efficiency frontiers, reflecting a dual-track approach where transitional technologies bridge legacy platforms with fully zero-emission alternatives.

In parallel, software-defined powertrain architectures are enabling greater integration between vehicle controls and energy management systems, enhancing responsiveness and user experience. These innovations are spurring collaborations between OEMs, semiconductor firms, and software developers, broadening the competitive landscape beyond traditional automotive players. At the same time, digital tools such as virtual modeling and artificial intelligence are streamlining powertrain design and validation processes, reducing time to market and development costs. Taken together, these transformative shifts are reshaping product strategies and investment priorities, compelling stakeholders to realign value chains, forge strategic alliances, and reevaluate legacy business models in pursuit of resilience and growth.

Assessing the Collective Economic and Operational Consequences of United States 2025 Automotive Tariffs on Manufacturers and Supply Chains

In 2025, the imposition of 25 percent tariffs on automotive imports and parts has resulted in pronounced economic and operational repercussions for manufacturers and suppliers. Leading global automakers reported substantial tariff-related losses, with Volkswagen disclosing a €1.3 billion impact in the first half of the year, prompting a revision of full-year profit margin forecasts downward and triggering intensified cost control measures among its peers. As these additional levies became embedded in price structures, vehicle affordability faced renewed pressure, leading industry analysts to project annual sales declines in the range of one to two million units across North America and Canada.

Beyond outright volume reductions, the tariff regime has disrupted established supply chains by incentivizing OEMs to reconfigure production footprints, with some facilities in Mexico and Canada idled or repurposed to mitigate duty exposure. This realignment has reverberated through tier-1 and tier-2 suppliers, many of which are grappling with elevated costs for imported components-particularly batteries and power electronics-resulting in margin compression and deferred investment decisions. Furthermore, electric vehicle manufacturers have begun recalibrating pricing strategies and product offerings, as illustrated by LG Energy Solution’s anticipated slowdown in battery demand and strategic pivot toward energy storage systems in response to tariff-driven market headwinds. Collectively, these developments underscore the multidimensional impact of trade policy on powertrain economics, supply chain resilience, and long-term strategic planning.

Illuminating Critical Market Segmentation Insights Across Powertrain Types, Vehicle Categories, Components, and Application Channels

A granular examination of powertrain market segmentation reveals nuanced performance drivers and investment focal points. Considering the range of powertrain types, the market encompasses battery electric vehicles, fuel cell electric vehicles, hybrid electric vehicles, and internal combustion engine platforms. Within the electric vehicle category, distinctions between lithium iron phosphate and nickel manganese cobalt chemistries inform cost and performance trade-offs, while fuel cell applications draw on proton exchange membrane and solid oxide technologies to address different operating environments. Hybrid solutions further diversify through parallel, series, and series-parallel configurations, and conventional engines remain relevant through advanced diesel and gasoline variants optimized for emissions compliance and efficiency.

Turning to vehicle classifications, the spectrum extends from heavy and light commercial vehicles to passenger cars. Rigid trucks and tractors dominate heavy duty applications that demand high torque and durability, whereas panel vans and pickups serve light commercial segments. Passenger mobility is segmented among hatchbacks, sedans, and sport utility vehicles, each of which carries unique powertrain integration requirements driven by consumer preferences and urban infrastructure.

When assessing component specialization, the market features batteries, electric motors, engines, power electronics, and transmissions. Battery technologies range from legacy lead-acid systems to advanced lithium-ion and nickel-metal-hydride chemistries, while transmission architectures encompass automatic, continuously variable, dual clutch, and manual offerings tailored to diverse torque delivery strategies. Finally, applications bifurcate between aftermarket and original equipment channels, spanning parts replacement and service interventions, alongside manufacturer-led supply for commercial and passenger segments. These layered segmentation lenses provide critical insights for aligning product roadmaps with evolving customer, regulatory, and technological imperatives.

This comprehensive research report categorizes the Automotive Powertrain market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Powertrain Type

- Vehicle Type

- Component

- Application

Unveiling Distinct Regional Dynamics Influencing Powertrain Adoption Patterns and Infrastructure Development Worldwide

Regional analysis highlights divergent powertrain adoption trajectories shaped by policy priorities, infrastructure readiness, and industry capacity. In the Americas, sustained incentives under federal programs such as the U.S. Inflation Reduction Act and targeted state initiatives have catalyzed electric vehicle uptake, prompting automakers to scale domestic battery manufacturing and charging networks. At the same time, cross-border trade realignments driven by tariff policy have accelerated near-shoring trends, with original equipment suppliers expanding North American operations to preserve market access and cost structures. Although consumer demand remains robust, affordability challenges persist, incentivizing uptake of hybrid powertrains as transitional solutions.

In Europe, the Middle East, and Africa region, stringent CO₂ emissions targets have propelled a diverse mix of electrified powertrains. The European Union’s tightening regulatory framework fosters rapid growth in battery electric and plug-in hybrid models, while select Middle Eastern markets invest heavily in hydrogen infrastructure to leverage their resource endowments for fuel cell vehicle trials. Meanwhile, Africa presents both obstacles and opportunities: limited charging infrastructure constrains mass electric mobility, yet potential for renewable energy-driven supply chains is gaining traction among development agencies.

Asia-Pacific remains a dynamic arena where China’s leadership in lithium-ion battery production, domestic OEM partnerships, and supportive subsidies have driven BEV market penetration to global highs. Japan continues to champion hydrogen fuel cell innovation alongside hybrid strength, while India’s burgeoning market prioritizes cost-efficient internal combustion and small-format electrified solutions to meet large-scale mobility needs. Collectively, these regional distinctions underscore the importance of tailored strategic approaches to powertrain deployment worldwide.

This comprehensive research report examines key regions that drive the evolution of the Automotive Powertrain market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Automotive Powertrain Suppliers and OEMs to Highlight Innovation Strategies and Competitive Positioning

Industry leaders are pursuing differentiated powertrain strategies to secure competitive advantage. Toyota remains synonymous with hybrid technology mastery, leveraging decades of experience to optimize fuel economy and total cost of ownership, while its development of solid-state batteries promises to advance electric range and safety performance. Volkswagen Group has doubled down on its modular electric drive matrix platform, standardizing BEV architectures to achieve economies of scale, and has outlined plans to electrify its entire passenger fleet by the end of the decade. Tesla continues to disrupt through vertical integration of cell production, deployment of its 4680 form factor, and software-driven energy management, setting aggressive targets for battery cost reduction and charging interoperability.

General Motors has embraced its Ultium battery system to underpin a broad portfolio of cross-brand electric SUVs and trucks, while orchestrating strategic partnerships to secure raw material supply. Hyundai-Kia’s E-GMP platform has delivered market-leading packaging efficiency and rapid charging capabilities, and the group’s investment in hydrogen fuel cell modules positions it to address heavy-duty transport segments. Stellantis is advancing a multi-powertrain roadmap that balances BEV rollouts with extended support for hybrid and internal combustion applications, while forging alliances across battery supply and software connectivity domains. These competitive approaches illustrate the imperative for manufacturers to align technology investment with brand positioning, supply chain resilience, and regulatory compliance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Powertrain market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- BorgWarner Inc.

- BYD Company Ltd.

- Continental AG

- Cummins Inc.

- Daimler AG

- Dana Incorporated

- Denso Corporation

- Eaton Corporation

- Ford Motor Company

- General Motors Company

- GKN Automotive Limited

- Hitachi Automotive Systems, Ltd.

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Magna International Inc.

- Mahle GmbH

- Mitsubishi Electric Corporation

- Nissan Motor Co., Ltd.

- Robert Bosch GmbH

- Schaeffler AG

- Toyota Motor Corporation

- Valeo SA

- ZF Friedrichshafen AG

Formulating Actionable Strategic Recommendations to Accelerate Powertrain Innovation, Enhance Resilience, and Sustain Competitive Advantage

Industry executives should accelerate investments in next-generation battery chemistries, prioritizing cathode and anode materials that reduce dependency on constrained critical minerals while enhancing energy density. Furthermore, forging strategic alliances across the value chain-spanning raw material producers, cell manufacturers, and software integrators-will mitigate supply risk and drive collaborative innovation. Simultaneously, companies must diversify powertrain portfolios by enhancing hybrid and fuel cell offerings to address markets where full electrification may lag due to infrastructure limitations.

To bolster resilience against policy shifts and trade disruptions, organizations should pursue adaptive localization strategies that balance global scale with regional agility. This entails optimizing production footprints, relocating key components to tariff-exempt zones, and leveraging near-shore partnerships. In parallel, embedding digital engineering and predictive analytics into powertrain development will compress design cycles and enable real-time performance optimization. Finally, businesses ought to expand stakeholder engagement-working with regulators, utilities, and infrastructure developers-to co-create charging and hydrogen refueling ecosystems, ensuring demand aligns with capacity expansions.

Detailing a Robust Research Methodology Incorporating Primary, Secondary, and Analytical Frameworks to Ensure Market Intelligence Integrity

This research applies a rigorous methodology combining primary and secondary data collection, quantitative analysis, and qualitative validation. Secondary research sources encompass regulatory filings, patents, technical journals, industry white papers, and publicly available financial disclosures, enabling an initial data triangulation. Primary inputs are gathered through structured interviews with powertrain engineers, procurement executives, and end-user focus groups, ensuring firsthand perspectives on technology adoption, operational challenges, and market sentiment.

Quantitative assessments leverage bottom-up modeling of cost structures, supply chain flows, and production capacities, integrated with scenario analysis to evaluate the implications of policy shifts and technology roadmaps. Qualitative insights are derived from cross-functional workshops and expert panels that contextualize quantitative outputs, test hypotheses, and refine strategic assumptions. A multi-stage validation process consolidates findings through peer review and executive briefings, ensuring accuracy, relevance, and actionable utility. Together, these methodological elements underwrite a comprehensive intelligence framework that supports evidence-based decision making across the automotive powertrain ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Powertrain market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Powertrain Market, by Powertrain Type

- Automotive Powertrain Market, by Vehicle Type

- Automotive Powertrain Market, by Component

- Automotive Powertrain Market, by Application

- Automotive Powertrain Market, by Region

- Automotive Powertrain Market, by Group

- Automotive Powertrain Market, by Country

- United States Automotive Powertrain Market

- China Automotive Powertrain Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings to Emphasize Strategic Imperatives, Market Evolution, and Future Outlook for Automotive Powertrain Innovation

The convergence of electrification, hybridization, and hydrogen solutions underscores a pivotal inflection point for automotive powertrains. Key findings reveal that while battery electric vehicles dominate innovation narratives, hybrid architectures continue to fulfill critical transitional roles, especially in regions where charging infrastructure remains nascent. Tariff-induced supply chain realignments highlight the importance of agile manufacturing and strategic localization, whereas component specialization drives differentiation across power density, cost, and performance metrics.

Strategic imperatives include deepening cross-industry collaborations to secure raw materials, scaling advanced battery production lines to achieve cost parity with combustion counterparts, and investing in digital engineering capabilities to accelerate development cycles. Regional market dynamics necessitate tailored deployment roadmaps, balancing global platforms with localized variants. Ultimately, the future of powertrain innovation will hinge on the ability of stakeholders to integrate technological breakthroughs with robust policy engagement and resilient supply chain design. As the mobility landscape continues to evolve, organizations that proactively adapt will secure leadership positions in the emergent low-carbon era of transportation.

Engaging with Associate Director Ketan Rohom to Secure Comprehensive Automotive Powertrain Market Research Insights Today

Securing a comprehensive market research report on automotive powertrain enables organizations to translate deep analytics into decisive strategies. To acquire an indispensable resource that delves into the complexities of electrification, hybridization, hydrogen integration, and internal combustion innovations, reach out to Associate Director Ketan Rohom in Sales and Marketing. His expertise will guide the customization of a package that aligns with your strategic objectives and ensures access to the latest insights, data, and forward-looking analyses. Initiate direct engagement to elevate your decision-making capabilities and strengthen your competitive positioning across global powertrain markets.

- How big is the Automotive Powertrain Market?

- What is the Automotive Powertrain Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?