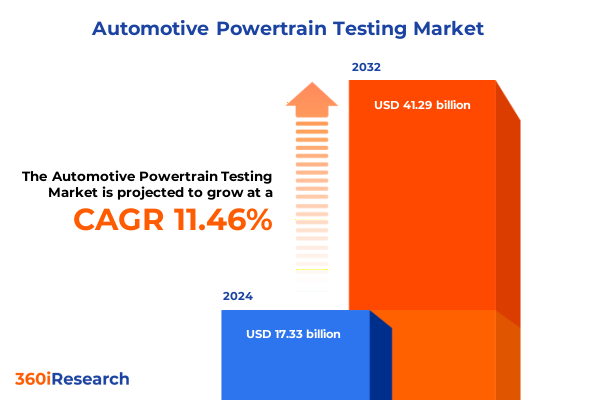

The Automotive Powertrain Testing Market size was estimated at USD 19.32 billion in 2025 and expected to reach USD 21.32 billion in 2026, at a CAGR of 11.45% to reach USD 41.29 billion by 2032.

Exploring the Vital Intersection of Technological Innovation and Regulatory Demands in Modern Automotive Powertrain Testing Practices

As the automotive industry accelerates toward electrification and stringent emissions regulations, the importance of rigorous powertrain testing has never been greater. Stakeholders across the value chain-from vehicle makers to component suppliers and independent laboratories-face mounting pressure to validate performance, reliability, and compliance with evolving standards. In this context, testing protocols act not only as a quality gate but also as a catalyst for innovation, enabling manufacturers to refine battery systems, hybrid control strategies, and advanced combustion technologies.

Against this backdrop, regulatory bodies worldwide continue to raise the bar on emissions and safety requirements. This intensifies demand for sophisticated testing solutions such as environmental chambers that simulate extreme climates, dynamometers capable of high-fidelity load profiles, and data acquisition systems that capture granular performance metrics. Consequently, testing organizations are compelled to expand capabilities beyond traditional powertrain evaluation, incorporating durability and lifecycle assessments to ensure long-term viability and regulatory adherence.

Moreover, the advent of digital transformation brings new opportunities to enhance testing efficiency and insight quality. Virtual testing environments, enabled by high-performance computing and digital twin technology, allow for early-stage validation of powertrain designs before physical prototypes are available. By integrating simulation data with laboratory results, firms can accelerate development cycles and optimize testing investments. This introduction lays the foundation for an in-depth exploration of the forces reshaping automotive powertrain testing and the strategic responses that define market leadership.

Identifying the Transformative Shifts That Are Redefining Automotive Powertrain Testing Through Electrification, Digitalization, and Sustainable Mobility Innovation

The automotive powertrain testing landscape is undergoing a transformative shift driven by three interrelated trends: electrification, digitalization, and sustainability. Electrification mandates have prompted a surge in battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) test requirements, compelling laboratories to adapt their infrastructure for high-voltage safety protocols, thermal management assessments, and electromagnetic compatibility evaluations. Concurrently, the rise of fuel cell electric vehicles (FCEV) has introduced specialized hydrogen handling procedures, necessitating new safety standards and sensor calibration methods.

Digitalization advances offer unprecedented granularity and efficiency in testing operations. Automated test cells equipped with real-time analytics enable continuous monitoring of performance parameters, while cloud-based data platforms facilitate remote collaboration and benchmarking across global facilities. By harnessing machine learning algorithms, testing teams can identify failure modes earlier, predict maintenance needs, and optimize test durations without compromising result validity. This shift from manual, time-intensive processes to data-driven execution is redefining cost structures, throughput expectations, and quality assurance benchmarks.

Furthermore, sustainability imperatives are reinforcing the integration of emission testing into every powertrain evaluation. Beyond traditional CO2 measurements, laboratories now conduct NOx and particulate matter analyses as standard practice, leveraging advanced emission analyzers calibrated for the tightest regulatory tolerances. As life-cycle assessments gain prominence, durability testing protocols are also evolving to capture real-world usage patterns and long-term wear characteristics. Collectively, these transformative forces compel industry participants to reconfigure their testing frameworks, invest in multi-modal equipment, and cultivate cross-functional expertise.

Assessing the Cumulative Effects of 2025 United States Tariffs on Automotive Powertrain Testing Supply Chains, Costs, and Strategic Sourcing Decisions

In 2025, the United States introduced a series of tariff measures aimed at protecting domestic manufacturing of critical powertrain components, including battery cells, electric motors, and specialized testing equipment. These levies apply to imports of high-capacity lithium-ion cells, hydrogen fuel cell stacks, and advanced dynamometer systems sourced primarily from Asian and European suppliers. The cumulative effect has been a marked increase in landed costs for testing facilities that rely on foreign-made instruments and consumables, prompting many operators to rethink their sourcing strategies.

As a result, some independent laboratories and OEMs have responded by establishing local assembly or calibration centers to mitigate tariff-induced expenses. Certain firms have pursued joint ventures with domestic equipment manufacturers to secure preferential pricing and reduce supply chain complexity. Others have broadened their procurement networks, seeking alternative suppliers in tariff-exempt jurisdictions or regions with free trade agreements that minimize duties. In parallel, testing organizations are renegotiating service contracts to pass through incremental costs to end users, while maintaining competitive service levels through operational efficiencies.

Looking ahead, the tariff landscape is expected to remain dynamic, influenced by geopolitical negotiations and the broader push for supply chain resilience. Strategic stakeholders are closely monitoring policy developments as they weigh the trade-offs between immediate cost burdens and long-term investment in local production capabilities. By proactively assessing the tariff implications on equipment procurement, maintenance schedules, and pricing models, industry participants can better position themselves for sustainable growth amidst shifting trade policies.

Uncovering the Nuanced Segmentation Dynamics That Drive Automotive Powertrain Testing Demand Across Diverse Powertrains, Vehicles, Equipment, Test Types, and End Users

The intricacies of automotive powertrain testing demand a nuanced understanding of how diverse market segments intersect and influence equipment and service needs. When examining the market through the lens of powertrain type, battery electric vehicles necessitate comprehensive battery testing protocols that incorporate charging cycle evaluation alongside thermal management assessments, while fuel cell electric vehicles require specialized hydrogen safety and leakage detection procedures. Hybrid electric vehicles blend internal combustion engine and electric motor assessments, and internally combustion platforms span CNG, diesel, and gasoline configurations, each presenting unique emission profiles and durability requirements. Parallel and series plug-in hybrids further complicate test matrix design by combining high-voltage components with traditional engine testing sequences.

Shifting focus to vehicle types, commercial platforms-encompassing both heavy- and light-duty vehicles-demand high-capacity dynamometer setups capable of simulating extended haul cycles, as well as robust test cells that reproduce rugged service conditions. Passenger vehicles, in contrast, emphasize comfort-related performance testing, NVH analysis, and rapid charge-discharge cycling for emerging mobility applications. The differentiation between light and heavy commercial applications also influences environmental chamber specifications, as heavy-duty units often require endurance testing under elevated torque loads and perturbed thermal regimes.

From an equipment perspective, data acquisition systems form the backbone of all testing activities, capturing high-resolution signals from engine dynamometers to chassis roller rigs. Within dynamometer offerings, chassis dynamometers simulate road load more accurately for complete drivetrain validation, whereas engine dynamometers isolate power units for targeted emission and performance characterization. Meanwhile, emission analyzers, environmental chambers, and integrated test cells extend the testing envelope by facilitating multi-factor evaluations, such as cold start performance under subzero temperatures or particulate emissions at varying altitude equivalents.

Test type segmentation further refines the market view by distinguishing battery testing’s charging cycle and thermal protocols from durability assessments that replicate thousands of hours of operation. Emission test suites cover CO₂, NOₓ, and particulate measurements to satisfy both regulated and voluntary environmental standards. Engine testing segments encompass cold start evaluations and endurance trials, each designed to reveal failure mechanisms and wear patterns over time. Performance tests integrate torque curve mapping, transient response, and overall efficiency measurements to validate design objectives.

Finally, end-user segmentation highlights the differing priorities of independent laboratories versus original equipment manufacturers. Independent labs often focus on offering turnkey testing services, catering to multiple OEMs and tier suppliers with flexible scheduling and customizable reporting formats. OEM-owned testing divisions, however, prioritize in-depth integration with product development workflows, leveraging proprietary test protocols that align with corporate standards. Within OEMs, distinctions emerge between commercial and passenger vehicle divisions, each subject to specific regulatory mandates and market-driven performance targets.

This comprehensive research report categorizes the Automotive Powertrain Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Powertrain Type

- Vehicle Type

- Equipment Type

- Test Type

- End User

Evaluating Regional Variations in Automotive Powertrain Testing Growth and Innovation Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional landscapes for automotive powertrain testing reveal distinct drivers and challenges across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, the United States remains the epicenter of advanced testing due to its mature regulatory framework, robust R&D infrastructure, and growing base of independent laboratories. Canada complements this ecosystem with specialized test facilities geared toward cold climate validation for electrified powertrains, while Latin American markets, particularly Brazil, show increasing demand for testing services that support compressed natural gas and ethanol-fueled internal combustion engines.

Europe, Middle East & Africa presents a complex mosaic of regulatory regimes and market maturity levels. Western Europe is characterized by aggressive decarbonization targets and a dense network of multi-modal test centers equipped for real-world driving emulation and urban emission assessments. Meanwhile, Eastern European countries are investing in upgrading legacy testing infrastructure to accommodate hybrid and battery electric vehicles. In the Middle East, strategic investments in hydrogen and fuel cell technologies are beginning to drive niche testing requirements, whereas African markets lag in standardized testing capabilities but offer emerging opportunities for light commercial vehicle assessments under challenging operating conditions.

Asia-Pacific dominates global powertrain testing volumes, propelled by China’s expansive automotive manufacturing sector and Japan’s leading role in hybrid technology development. Rapid expansion of battery cell production facilities in South Korea and China fuels high-volume battery testing operations, while India’s growing passenger vehicle market drives demand for versatile dynamometer solutions capable of evaluating both electric and traditional engines. Across the region, government incentives aimed at localizing supply chains and enhancing quality control are also motivating increased capital expenditure on in-country testing assets.

This comprehensive research report examines key regions that drive the evolution of the Automotive Powertrain Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players and Their Strategic Initiatives That Are Shaping the Competitive Landscape in Automotive Powertrain Testing Technology and Services

A handful of established firms and agile newcomers are shaping the competitive dynamics of the automotive powertrain testing ecosystem. Among test solution providers, industry stalwarts leverage decades of domain expertise to deliver turnkey systems that integrate data acquisition, automation, and emissions analysis. These companies differentiate through strategic partnerships with OEMs and research institutions, enabling co-development of customized test protocols that address emerging powertrain architectures and regulatory requirements.

Concurrently, specialist vendors focusing on digital transformation have introduced cloud-native analytics platforms that unify disparate data streams from multiple test sites. By offering Software-as-a-Service models, these companies lower barriers to entry for independent laboratories looking to scale operations without significant upfront infrastructure investment. Their solutions often include predictive maintenance modules for dynamometers and environmental chambers, helping clients reduce unplanned downtime and extend equipment life.

Startup technology firms are also entering the fray with mobile testing units and portable emission analyzers designed for on-road validation and in-field diagnostics. These offerings cater to fleet operators and service providers seeking rapid, location-agnostic assessments of performance and compliance. By leveraging compact hardware and wireless connectivity, these newcomers provide flexible testing options that complement traditional laboratory services.

Finally, OEMs with in-house testing capabilities are increasingly forging strategic alliances or acquiring niche laboratories to bolster vertical integration. This trend reflects a desire to streamline test cycles, protect intellectual property, and maintain tighter control over quality assurance processes. As a result, the competitive landscape continues to evolve, with collaboration and consolidation shaping the strategies of companies across the testing value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Powertrain Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- AVL List GmbH

- Dewesoft d.o.o.

- FEV Group GmbH

- Honeywell International Inc.

- Horiba, Ltd.

- IAV GmbH

- Intertek Group plc

- Kistler Group

- Meidensha Corporation

- MTS Systems Corporation

- Mustang Dynamometer

- National Instruments Corporation

- Ricardo plc

- Robert Bosch GmbH

- Rototest GmbH

- SGS S.A.

- Siemens AG

- SuperFlow Corporation

- Taylor Dynamometer, Inc.

- ThyssenKrupp AG

- TÜV SÜD AG

Presenting Strategic, Actionable Recommendations for Industry Leaders to Enhance Testing Capabilities, Adopt Advanced Technologies, and Mitigate Emerging Regulatory and Market Risks

To remain at the forefront of automotive powertrain testing, industry leaders must pursue a multifaceted strategy that balances technological investment with operational agility. First, prioritizing the development of digital twins and virtual testing environments can significantly reduce physical prototyping costs and accelerate validation timelines. By integrating simulation data with laboratory results, organizations can identify performance bottlenecks earlier and optimize test iterations.

Next, strengthening supply chain resilience is critical in the face of tariff fluctuations and component scarcity. Testing entities should cultivate relationships with multiple equipment suppliers, including domestic manufacturers, to ensure redundancy and competitive pricing. Establishing strategic stockpiles of consumables such as calibration gases and expendable sensors further mitigates the risk of service disruptions.

Workforce development is another pillar of a robust testing strategy. Leaders should invest in specialized training programs that equip engineers and technicians with skills in high-voltage safety, advanced data analytics, and cross-disciplinary problem solving. Collaboration with academic institutions and certification bodies can help create a talent pipeline aligned with evolving testing requirements.

In parallel, pursuing lean operational practices and modular facility design enables flexible scaling of test capacity based on market demand. Modular test cells and reconfigurable equipment platforms reduce capital intensity while offering the versatility to support a broad array of powertrain types, vehicle classes, and test protocols. Finally, proactive engagement with regulatory authorities and standards organizations ensures that testing processes remain aligned with emerging environmental and safety mandates, positioning organizations to anticipate and adapt to new compliance thresholds.

Detailing the Comprehensive Research Methodology Underpinning the Analysis of Automotive Powertrain Testing, Integrating Primary Insights, Secondary Data, and Rigorous Validation Techniques

The research methodology underpinning this analysis combines primary and secondary data collection with rigorous validation to ensure comprehensive coverage of the automotive powertrain testing sector. Primary research involved structured interviews with senior executives from global OEMs, independent testing laboratories, and equipment vendors. These discussions provided qualitative insights into strategic priorities, technology adoption timelines, and regional expansion plans.

Secondary research drew on a wide array of authoritative sources, including technical whitepapers, regulatory publications, and industry association reports. Emission standards documentation, patent filings, and supply chain announcements were systematically reviewed to map emerging equipment innovations and policy impacts. In addition, financial filings and press releases from leading test solution providers were analyzed to identify strategic partnerships, capital investments, and geographic footprint developments.

To ensure data integrity, a triangulation process was employed, cross-referencing primary findings with secondary evidence and market signals such as patent grant rates and equipment deployment statistics. Quantitative data were subject to consistency checks and trend analysis, while qualitative inputs were coded thematically to highlight common challenges and success factors. Finally, draft findings were reviewed by an expert panel of industry practitioners and academic researchers, enabling iterative refinement and bolstering the robustness of the final conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Powertrain Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Powertrain Testing Market, by Powertrain Type

- Automotive Powertrain Testing Market, by Vehicle Type

- Automotive Powertrain Testing Market, by Equipment Type

- Automotive Powertrain Testing Market, by Test Type

- Automotive Powertrain Testing Market, by End User

- Automotive Powertrain Testing Market, by Region

- Automotive Powertrain Testing Market, by Group

- Automotive Powertrain Testing Market, by Country

- United States Automotive Powertrain Testing Market

- China Automotive Powertrain Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Insights That Synthesize Key Findings, Highlight Strategic Imperatives, and Illuminate the Future Trajectory of Automotive Powertrain Testing Trends and Innovation

The convergence of electrification, stringent emissions standards, and digital transformation has propelled automotive powertrain testing into a new era of complexity and opportunity. Key insights reveal that equipment diversity, from high-voltage battery test systems to advanced emission analyzers, is essential to address the full spectrum of powertrain architectures. Regional dynamics underscore the need for tailored strategies, with North America emphasizing compliance and domestic sourcing, EMEA focusing on decarbonization mandates, and Asia-Pacific leading volume testing for mass-market electrification.

Strategic imperatives emerge clearly: investing in digital twins, fortifying supply chains, and nurturing specialized talent will define market leaders. As tariffs and trade policies continue to reshape equipment procurement, agility in sourcing and partnerships will be paramount. By aligning testing capabilities with evolving powertrain technologies and regulatory landscapes, stakeholders can drive product innovation while ensuring reliability and compliance.

Looking ahead, the integration of artificial intelligence and remote testing capabilities promises to further enhance operational efficiency and expand service offerings. Organizations that adopt modular infrastructure and proactive engagement with policy developments will be best positioned to capitalize on emerging opportunities. In sum, the path forward demands a holistic approach that harmonizes technological advancement, market segmentation insights, and strategic foresight.

Engaging Decision Makers With a Clear Call to Action to Connect With Ketan Rohom for Exclusive Access to In-Depth Automotive Powertrain Testing Market Insights and Reports

To gain a thorough understanding of the evolving trends, competitive dynamics, and emerging opportunities within automotive powertrain testing, securing the full market research report will equip your organization with the insights needed to make informed strategic decisions. Whether you aim to refine testing protocols, expand your service offerings, or optimize investment strategies, our comprehensive analysis addresses the critical questions that drive success in this complex and rapidly changing landscape.

For personalized guidance on how to leverage these insights effectively, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will provide detailed information on the full report’s scope, sample deliverables, and customizable research packages tailored to your organization’s unique objectives. Contacting Ketan ensures you gain priority access to expert support and the in-depth data that will propel your initiatives forward.

Don’t miss the opportunity to secure a competitive edge by incorporating the latest automotive powertrain testing intelligence into your planning and execution. Connect with Ketan Rohom today to discuss your specific requirements and learn how our detailed market research report can empower your next strategic move.

- How big is the Automotive Powertrain Testing Market?

- What is the Automotive Powertrain Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?