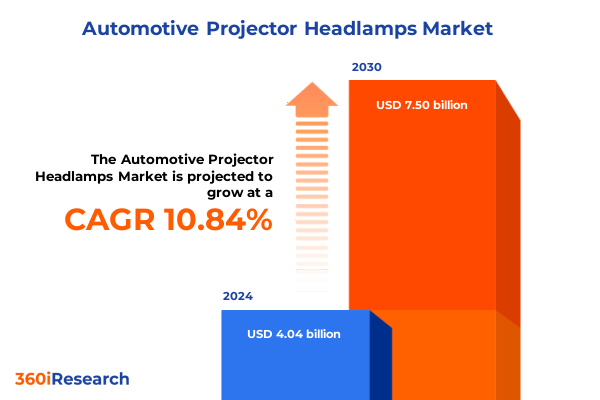

The Automotive Projector Headlamps Market size was estimated at USD 4.04 billion in 2024 and expected to reach USD 4.47 billion in 2025, at a CAGR of 10.84% to reach USD 7.50 billion by 2030.

Elevating the Driving Experience Through Precision Lighting: An Introduction to the Evolution and Importance of Automotive Projector Headlamps

The automotive projector headlamp has emerged as a cornerstone of modern vehicular lighting, redefining how illumination, safety, and aesthetic appeal converge on every roadway. At its core, this technology employs a precisely engineered optical system that focuses light through a lens, resulting in a sharply defined beam pattern that enhances driver visibility without causing glare to oncoming traffic. Originally conceived to provide superior nighttime illumination compared to traditional reflector-based lamps, projector systems have become a symbol of automotive innovation, seamlessly integrating with evolving vehicle architectures and electronic controls.

In recent years, projector headlamps have transcended their technical origins to become a key differentiator among OEMs and aftermarket suppliers alike. Increasingly stringent global regulations on beam performance and pedestrian safety have propelled manufacturers to adopt projector solutions that can meet complex photometric requirements. Simultaneously, consumer preferences have shifted toward vehicles that not only perform safely but also deliver distinctive styling cues. As a result, projector headlamps have become both a functional necessity and a hallmark of premium design. With advancements in light source technologies and digital controls, the capabilities of projector systems continue to expand, ushering in a new era where headlamps are integral to the holistic driving experience.

Transformative Technological, Consumer, and Regulatory Shifts Redefining the Automotive Projector Headlamp Landscape in the Modern Era

The landscape of automotive projector headlamps is undergoing transformative change as technological breakthroughs, shifting consumer expectations, and evolving regulatory frameworks intersect to reshape the industry’s trajectory. From a technological standpoint, the migration away from traditional halogen toward high-intensity discharge and, more prominently, light emitting diode sources has unlocked unprecedented levels of luminous efficacy, energy efficiency, and design flexibility. Such progress has laid the groundwork for more adaptive and intelligent lighting systems, including dynamic beam shaping and integration with advanced driver assistance functionalities.

Beyond the hardware, consumer demands are pivoting toward vehicles that blend safety, sustainability, and sophistication. Drivers now expect headlamp systems that automatically adapt to varied traffic and weather conditions while minimizing energy consumption to support growing electrification trends. At the same time, global and regional safety regulations are becoming progressively stringent, mandating specific beam cut-off requirements and standards for glare mitigation. These regulatory shifts compel manufacturers to innovate rapidly, ensuring projector modules meet detailed photometric criteria and seamlessly integrate with vehicle electronics. Consequently, the industry is experiencing a convergence of technical refinement and regulatory impetus that is collectively redefining the capabilities and expectations for projector headlamps.

Assessing the Multidimensional Effects of Cumulative United States Tariffs on the Automotive Projector Headlamp Supply Chain in 2025

As of 2025, cumulative United States tariff measures have imposed significant layers of complexity on the supply chain for automotive projector headlamps. Initial duties levied under Section 301 targeted a broad range of imported automotive components, including headlamp modules and subassemblies, creating immediate cost pressures for manufacturers reliant on offshore production. Subsequent rounds of tariffs and antidumping duties have compounded these challenges, driving many suppliers to reassess sourcing strategies and evaluate nearshoring opportunities. As a result, component costs have escalated, prompting strategic reevaluations of production footprints across North America.

In response to these tariff-driven realities, industry participants have pursued a variety of supply chain resilience strategies. Some key suppliers have accelerated investments in local manufacturing capacities, establishing new production lines in Mexico and select U.S. states to mitigate tariffs and shorten lead times. Others have formed collaborative joint ventures with domestic partners to share technology while circumventing import duties. Meanwhile, contract manufacturers and OEMs have leveraged tariff exclusion requests and engaged in rigorous tariff engineering to reclassify headlamp assemblies and limit applicable duty rates. These adaptive measures underscore the profound influence of U.S. trade policy on cost structures, procurement timelines, and long-term strategic planning within the automotive projector headlamp sector.

Uncovering Core Market Dynamics Through Technology, Beam Type, Installation, Distribution Channel, and Vehicle Type Segmentation Perspectives

Examining market dynamics through the lens of technology reveals distinct trajectories for halogen, high-intensity discharge, and light emitting diode solutions. Halogen remains prevalent in entry-level applications due to its low cost and simple design, yet its limited efficiency and shorter lifespan increasingly contrast with the superior performance characteristics of advanced light sources. High-intensity discharge modules, once heralded for their brightness advantages, are encountering displacement as more efficient LED configurations gain momentum. Meanwhile, LED-based projector headlamps continue to set new benchmarks for compactness, energy conservation, and adaptive capabilities, ultimately redefining the industry’s performance standards.

Focusing on beam type underscores the divergent requirements between single beam and dual beam architectures. Single beam configurations offer streamlined functionality and reduced complexity, catering to cost-sensitive segments where fundamental illumination suffices. In contrast, dual beam designs deliver separate high and low beam operations within a unified housing, providing drivers with more precise control over beam patterns. These dual beam arrangements are increasingly favored in premium vehicles, where heightened visibility, adaptive beam steering, and integration with advanced electronic controls form part of an elevated driving experience.

Viewing installation modes highlights the evolving balance between factory integration in new vehicles and retrofit applications. New vehicle installations allow OEMs to embed projector headlamps seamlessly within the vehicle’s original design, ensuring optimal performance and warranty alignment. Conversely, the retrofit channel addresses the aftermarket demand for upgraded lighting solutions in older vehicles, enabling consumers to retrofit their existing cars with projector modules that offer enhanced safety and style at a lower entry point.

Analyzing distribution channels illustrates the interplay between original equipment manufacturers and the aftermarket network. OEM-driven sales are characterized by long-term contracts, quality certifications, and stringent standards, whereas the aftermarket channel thrives on rapid innovation cycles, customization options, and broad availability. Suppliers often manage dual pathways, tailoring product portfolios to meet the specific regulatory, technical, and commercial demands of both segments.

Considering vehicle type opens a dual perspective across commercial vehicles and passenger cars. Within the commercial vehicle domain, heavy and light segments prioritize durability, long-range illumination, and maintenance simplicity, reflecting the rigorous operational demands of trucking and logistics. Passenger cars span hatchback, sedan, and SUV models, each presenting unique styling and performance requirements; compact vehicles favor streamlined designs and cost-effectiveness, sedans balance elegance and efficiency, while SUVs demand powerful projection to support higher ride heights and larger frontal profiles.

This comprehensive research report categorizes the Automotive Projector Headlamps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Beam Type

- Installation

- Distribution Channel

- Vehicle Type

Examining Distinct Market Drivers and Opportunities Across the Americas, Europe Middle East & Africa, and Asia-Pacific Regional Ecosystems

In the Americas, automotive lighting suppliers navigate a mature environment characterized by stringent safety standards and robust aftermarket channels. The United States, in particular, maintains intricate headlamp regulations under federal guidelines that dictate beam cut-offs and glare limits, prompting OEMs and suppliers to innovate continuously to achieve compliance. Canada’s market follows closely, aligning standards with its southern neighbor while emphasizing sustainability goals. Latin American countries display varied adoption rates, with new vehicle installations driving growth in urban markets as infrastructure upgrades and rising disposable incomes encourage consumers to prioritize upgraded lighting solutions.

The Europe, Middle East & Africa region encompasses a diverse tapestry of regulatory regimes and consumer attitudes. In the European Union, the move toward unified lighting standards and the adoption of the UNECE regulatory framework have fostered cross-border technology harmonization, accelerating LED projector uptake. Meanwhile, Middle Eastern markets show strong demand for high-performance lighting to address challenging driving conditions, such as desert environments and extended night-time travel. African nations, though at an earlier adoption stage, present compelling opportunities as infrastructure investments and second-hand vehicle imports generate demand for both OEM and retrofit projector solutions.

Asia-Pacific stands at the forefront of projector headlamp innovation and production, with leading suppliers headquartered in Japan, South Korea, and China. Stringent safety regulations in key markets such as Japan and Australia drive adoption of the latest LED and dynamic beam technologies, while China’s vast automotive ecosystem fuels high-volume manufacturing and rapid product evolution. Southeast Asian countries, experiencing rising vehicle ownership, are witnessing an influx of projector headlamps through new vehicle integrations and aftermarket upgrades, supported by expanding distribution networks and localized assembly initiatives.

This comprehensive research report examines key regions that drive the evolution of the Automotive Projector Headlamps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Shaping the Competitive Landscape of Automotive Projector Headlamp Manufacturing and Technology

Leading innovators in the projector headlamp segment are capitalizing on the intersection of advanced optics, electronics, and materials science to maintain a competitive edge. Key industry players have embarked on strategic collaborations with semiconductor manufacturers to co-develop custom LED arrays that optimize light output while reducing thermal stress. Others have invested heavily in research partnerships with academic institutions to pioneer novel phosphor coatings and micro-optic lens configurations that push the envelope of beam precision and uniformity.

At the same time, several prominent suppliers are extending their capabilities through acquisitions of specialized component manufacturers, strengthening vertical integration. These moves often facilitate more efficient supply chains and tighter quality control, enabling faster time-to-market for new headlamp modules. Partnerships with software providers have also emerged, allowing headlamp systems to communicate with vehicle control units for real-time beam adjustments based on speed, steering angle, and ambient conditions.

Furthermore, global players are diversifying their footprints by establishing regional development centers, thereby tailoring product designs to meet local regulatory requirements and consumer preferences. Such localized engineering approaches expedite certification processes while fostering closer collaboration with regional OEMs. Overall, the concerted efforts of these leading companies are driving technological advancement, operational excellence, and strategic agility across the automotive projector headlamp landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Projector Headlamps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams OSRAM AG

- Clarience Technologies

- Continental AG

- Fiem Industries Limited

- FORVIA Group

- Guangzhou AES Electronic Technology Co., Ltd.

- HYUNDAI MOBIS CO., LTD

- KOITO MANUFACTURING CO., LTD.

- Koninklijke Philips N.V.

- Lumax Industries Limited

- Lumileds Holding B.V.

- Magna International Inc.

- Marelli Holdings Co., Ltd.

- Neolite ZKW Pvt. Ltd.

- Robert Bosch GmbH

- Roots Industries India Private Limited

- SL Corporation

- Stanley Electric Co., Ltd.

- Texas Instruments Incorporated

- Two Brothers Inc.

- Uno Minda Limited

- Valeo S.A.

- Varroc Group by Plastic Omnium

- ZKW Group GmbH by LG Corporation

Strategic Actionable Recommendations for Industry Leaders to Drive Innovation, Ensure Resilience, and Enhance Competitiveness in Projector Headlamp Market

Industry leaders must prioritize forward-thinking technology roadmaps that align with the accelerating shift toward electrified and autonomous vehicles. By dedicating resources to advanced LED and dynamic beam research, executives can ensure their organizations remain at the vanguard of lighting innovation. Simultaneously, establishing flexible manufacturing platforms capable of accommodating multiple light source technologies will foster rapid adaptation to evolving regulatory mandates.

To mitigate the ongoing impact of trade tariffs and supply chain disruptions, companies should diversify their supplier networks and pursue nearshore production partnerships. Developing collaborative joint ventures with regional contract manufacturers can secure alternative sourcing channels while preserving cost competitiveness. Concurrently, applying tariff engineering techniques to reclassify assemblies can yield financial relief and maintain margin integrity.

Engaging in strategic alliances with OEMs and tier-one electronic suppliers is essential to unlock integrated headlamp functionalities such as adaptive driving beams and sensor-fusion capabilities. By co-creating lighting modules that interface seamlessly with advanced driver assistance systems, organizations can capture a premium value proposition and meet stringent safety requirements. Moreover, embracing sustainability imperatives through reduced material waste and energy-efficient production processes will appeal to stakeholders across the automotive ecosystem.

Finally, exploring retrofit opportunities for legacy vehicles offers an avenue to expand addressable demand. Developing modular retrofit kits that simplify installation and ensure compliance with regulatory guidelines can extend business reach into the aftermarket, generating incremental growth while reinforcing brand presence.

Detailing a Rigorous Research Methodology Incorporating Primary Engagements, Secondary Analysis, and Comprehensive Validation Processes

This research integrates a rigorous multi-stage methodology to ensure comprehensive and reliable insights. In the initial phase, extensive secondary research involved a careful review of publicly available technical papers, regulatory standards, and industry white papers to establish foundational knowledge on projector headlamp technologies, materials, and global regulations. Concurrently, company filings, patent databases, and trade association publications were analyzed to identify key innovations and strategic movements within the industry.

Building on this groundwork, the primary research phase encompassed in-depth interviews with senior executives, product development specialists, and supply chain managers across OEMs and key component suppliers. These discussions provided nuanced perspectives on technological challenges, cost structures, and market dynamics. In addition, workshops with domain experts validated emerging trends and ensured alignment with real-world operational considerations.

The collected qualitative and quantitative data were then synthesized through a bottom-up approach, cross-verifying insights to enhance accuracy and reduce bias. Multiple rounds of data triangulation were conducted, comparing inputs from diverse stakeholder groups and contrasting them against market intelligence reports. Finally, a panel of independent automotive and lighting experts reviewed the findings to ensure methodological rigor and strategic relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Projector Headlamps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Projector Headlamps Market, by Technology

- Automotive Projector Headlamps Market, by Beam Type

- Automotive Projector Headlamps Market, by Installation

- Automotive Projector Headlamps Market, by Distribution Channel

- Automotive Projector Headlamps Market, by Vehicle Type

- Automotive Projector Headlamps Market, by Region

- Automotive Projector Headlamps Market, by Group

- Automotive Projector Headlamps Market, by Country

- United States Automotive Projector Headlamps Market

- China Automotive Projector Headlamps Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Perspectives Highlighting the Evolutionary Trajectory and Strategic Imperatives for Automotive Projector Headlamp Stakeholders

Automotive projector headlamps have undergone a remarkable evolution, transitioning from niche luxury features to standard safety-critical components in modern vehicles. Technological advancements in light sources, optical design, and electronic controls continue to push the boundaries of performance, efficiency, and adaptive functionality. Coupled with tightening safety regulations and shifting consumer expectations, these developments have established projector systems as an integral element of vehicle illumination strategies.

Segmentation analysis has revealed diverse adoption pathways, with distinct preferences emerging across technology types, beam architectures, installation scenarios, distribution channels, and vehicle categories. Regional studies underscore the varying drivers and regulatory landscapes in the Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting unique opportunities and challenges. Meanwhile, leading companies are responding through strategic partnerships, acquisitions, and localized engineering initiatives, all aimed at delivering cutting-edge lighting solutions.

Looking ahead, industry participants that embrace collaborative innovation, supply chain diversification, and targeted aftermarket growth will be best positioned to capitalize on emerging trends. As the automotive sector advances toward greater electrification and autonomy, projector headlamps are poised to play an increasingly sophisticated role, integrating with sensor suites and vehicle networks to enhance safety, efficiency, and comfort. In this context, strategic alignment with evolving regulatory frameworks and consumer priorities will define market leadership.

Initiate Your Journey to Market Leadership Today by Acquiring In-Depth Insights from Associate Director of Sales and Marketing for Automotive Lighting

To embark on a journey toward enhanced lighting excellence and secure a competitive advantage in the automotive projector headlamp sphere, reach out today to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s deep understanding of regional variances, technological trajectories, and tariff impacts, coupled with a bespoke dialogue tailored to your organization’s strategic priorities, will provide immediate clarity and direction. By engaging with Ketan, prospective clients gain access to comprehensive intelligence, expert guidance on implementation pathways, and a clear roadmap for leveraging headlamp innovations to meet evolving regulatory, consumer, and supply chain demands. Elevate your strategic planning and capture emerging opportunities by initiating a conversation that will translate rich insights into decisive action; connect with Ketan Rohom now to secure the full report and redefine your market positioning.

- How big is the Automotive Projector Headlamps Market?

- What is the Automotive Projector Headlamps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?