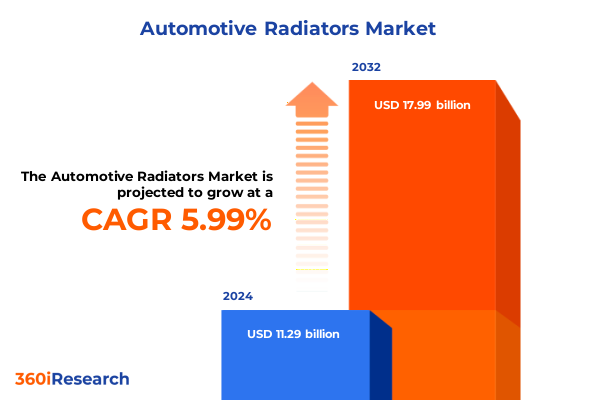

The Automotive Radiators Market size was estimated at USD 11.76 billion in 2025 and expected to reach USD 12.25 billion in 2026, at a CAGR of 6.25% to reach USD 17.99 billion by 2032.

Harnessing the Core Dynamics of Automotive Radiators to Illuminate Market Opportunities and Strategic Imperatives Across the Industry Landscape

In the dynamic realm of automotive thermal management, radiators serve as the critical interface between engine performance, vehicle safety, and environmental compliance. As global priorities shift toward higher efficiency and lower emissions, radiators must evolve beyond traditional metal cores to integrate advanced cooling architectures, smarter materials, and seamless compatibility with electric powertrains. Consequently, industry stakeholders from component suppliers to OEMs are pressed to reassess long-term strategies for design innovation, manufacturing agility, and supply chain resilience. Moreover, accelerated electrification and tightening regulatory standards are rewriting the playbook for heat rejection systems, compelling companies to forge partnerships, adopt agile production platforms, and invest in rapid prototyping. By understanding the interplay of regulatory drivers, technology breakthroughs, and shifting consumer preferences, decision makers can harness emerging opportunities to differentiate their product portfolios and deliver next-generation thermal solutions. This executive summary sets the stage for an in-depth exploration of transformative shifts, tariff impacts, segmentation nuances, regional variances, competitive landscapes, and actionable insights essential for securing a leadership position in the automotive radiator market.

Navigating the Confluence of Electrification Sustainability and Advanced Materials That Is Redefining the Automotive Radiator Ecosystem at Scale

The automotive cooling ecosystem is experiencing transformative shifts driven by the convergence of electrification, sustainability imperatives, and digital innovation. As electric vehicles gain traction, thermal management requirements extend beyond traditional engine coolant circuits to include battery temperature regulation and power electronics cooling. This paradigm shift has catalyzed the emergence of novel radiator configurations, such as integrated battery cooling plates and modular heat exchangers designed for multi-load management. Concurrently, advancements in computational fluid dynamics and digital twin simulations are enabling manufacturers to accelerate design cycles and optimize thermal performance with unprecedented precision. Meanwhile, environmental and regulatory pressures are intensifying the push toward lightweight materials and eco-friendly manufacturing processes, ushering in wider adoption of aluminum alloys, plastic composites, and bio-based materials. As a result, the radiator industry is rapidly transitioning from a component-centric model to a system-oriented, software-enabled value chain. Looking ahead, continued investment in collaborative R&D, strategic alliances, and cross-industry knowledge exchange will be pivotal for companies seeking to navigate this transformative landscape and capitalize on the accelerating shift toward zero-emission mobility.

Unpacking the Multifaceted Repercussions of 2025 United States Tariffs on Global Automotive Radiator Supply Chains Costs and Competitive Dynamics

Recent tariff policies enacted by the United States in early 2025 have introduced substantial changes to the cost structures and strategic sourcing decisions of automotive radiator manufacturers and assemblers. These measures, targeting imported radiators and heat exchangers from selected international suppliers, have disrupted long-standing supply agreements and compelled both OEMs and aftermarket distributors to reassess total landed costs. Domestic production capacity has come under renewed focus as businesses explore near-shoring opportunities to mitigate tariff burdens and ensure continuity of supply. At the same time, the increased duties have triggered a ripple effect across related upstream industries, influencing the procurement of raw materials such as aluminum, copper, and composite resins. Consequently, many original equipment suppliers have accelerated initiatives to localize value-added processes, from extrusion and brazing to plastic composite molding. Through strategic partnerships with local foundries and fabrication shops, companies are not only counterbalancing the immediate financial impacts but also building deeper alignment with domestic policy objectives. In the longer term, this tariff-induced restructuring is likely to reshape the competitive landscape, favoring those with nimble manufacturing footprints and robust regulatory risk management frameworks.

Deciphering the Nuances of Vehicle Type End Use Material Distribution Channel and Core Type to Unveil Strategic Segmentation Insights

Segment analysis reveals that the radiator market’s growth narrative is intricately tied to the distribution of vehicle types, end uses, material choices, sales channels, and core architectures. Within vehicle classifications, commercial applications span heavy and light truck platforms with distinct cooling requirements, while passenger segments encompass compact hatchbacks, multi-purpose vehicles, sedans, and sport utility vehicles, each demanding tailored thermal profiles. Complementing this, the emergence of electric propulsion has introduced battery cooling radiators and power electronics heat exchangers, whereas internal combustion powertrains continue to leverage traditional diesel engine and gasoline engine radiator formats. Material considerations further influence performance and cost trade-offs, as aluminum systems dominate due to their favorable weight-to-heat transfer ratio, while copper-brass assemblies and advanced plastic composites offer niche advantages in corrosion resistance and modular integration. Distribution channels bifurcate between original equipment manufacturer supply networks and aftermarket replenishment channels, affecting lead times and service models. Core construction techniques such as bar-and-plate assemblies-brazed or welded-provide high-capacity cooling for heavy-duty vehicles, whereas tube-and-fin configurations in single-pass or multi-pass variations deliver compact solutions for smaller vehicles. This layered segmentation lens equips stakeholders with a granular view of market dynamics, enabling finely tuned product positioning and channel prioritization strategies.

This comprehensive research report categorizes the Automotive Radiators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Material

- Core Type

- End Use

- Distribution Channel

Illuminating the Divergent Growth Drivers and Strategic Imperatives Across the Americas Europe Middle East Africa and Asia Pacific Regions

A regional lens underscores divergent growth catalysts and strategic priorities across the Americas, Europe, Middle East and Africa, and Asia-Pacific markets. In North and South America, established automotive hubs are witnessing renewed interest in domestic radiator production to address tariff volatility and optimize supply chains, while aftermarket distributors focus on retrofit solutions for fleet electrification. Transitioning to Europe, Middle East and Africa, stringent CO2 emissions targets and evolving urban mobility policies are accelerating the uptake of advanced thermal systems in both passenger and commercial vehicles, driven by partnerships between OEMs and thermal management specialists. Meanwhile, Asia-Pacific remains the largest producer and consumer of automotive radiators, propelled by surging EV adoption rates in China and rapid vehicle fleet expansion in India, Southeast Asia, and Japan. Local manufacturers in the region are investing heavily in capacity expansions and R&D centers to capture emerging opportunities, often in collaboration with global technology providers. These regional dynamics collectively shape the competitive terrain, demanding agile market entry approaches and differentiated value propositions to address varied regulatory landscapes, infrastructural maturity levels, and consumer preferences across geographies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Radiators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automotive Radiator Innovators to Highlight Strategic Initiatives and Competitive Differentiators Shaping the Industry Landscape

A review of leading market participants highlights diverse approaches to product innovation, supply chain optimization, and strategic partnerships. Global tier-one suppliers have intensified efforts in digital modeling and additive manufacturing to accelerate prototype-to-production timelines for next-generation radiators. Simultaneously, specialized component manufacturers have broadened their material science portfolios, offering hybrid assemblies that enhance thermal conductivity while reducing weight. Notably, several incumbents are deepening collaborations with automotive OEMs to co-develop integrated thermal modules tailored for electric vehicle platforms, encompassing battery, power electronics, and cabin heating subsystems. At the same time, emerging entrants are targeting niche aftermarket segments with plug-and-play solutions optimized for fleet retrofit programs and commercial vehicle upfits. Across the value chain, companies are also forging alliances with raw material suppliers and fabrication partners to secure just-in-time inventory strategies that minimize working capital strain. These collective efforts underscore a competitive ecosystem where R&D prowess, flexible manufacturing footprints, and ecosystem partnerships serve as critical differentiators for sustained market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Radiators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Banco Products (India) Ltd.

- Behr Hella Service GmbH

- CSF Radiators Inc.

- Denso Corporation

- DURA Automotive Systems, LLC

- G&M Radiator Manufacturing Ltd.

- Griffin Thermal Products Inc.

- Guangdong Faret Auto Radiator Co., Ltd.

- Hanon Systems Co., Ltd.

- Keihin Corporation

- Koyorad Co., Ltd.

- Lurun Group Co., Ltd.

- MAHLE GmbH

- Marelli Holdings Co., Ltd.

- Mishimoto Automotive, Inc.

- Modine Manufacturing Company

- Nissens A/S

- Sanden Holdings Corporation

- Shandong Pilot Radiator Co., Ltd.

- Shandong Tongchuang Auto Radiator Co., Ltd.

- Spectra Premium Industries Inc.

- T.RAD Co., Ltd.

- Valeo S.A.

- YINLUN Co., Ltd.

- Youngshin Radiator Co., Ltd.

Empowering Industry Leaders with Actionable Strategies to Optimize Supply Chains Drive Innovation and Secure Competitive Advantage in Automotive Radiators

To thrive in this rapidly evolving environment, industry leaders must embrace a suite of strategic actions. Foremost, diversifying supplier networks and near-shoring critical production processes can cushion against tariff shocks and logistical disruptions, while optimizing total cost of ownership. Next, investing in next-generation material platforms, such as high-performance aluminum alloys, hybrid composite cores, and low-GWP refrigerants, will be essential to meet stringent efficiency targets. Concurrently, integrating advanced simulation tools and digital twins into product development workflows will accelerate time-to-market and enable predictive maintenance capabilities post-deployment. Moreover, establishing cross-sector collaborations with battery, power electronics, and polymer specialists can unlock holistic thermal solutions uniquely suited for electric and hybrid architectures. In parallel, fostering an agile organizational culture that prioritizes rapid iteration, continuous learning, and regulatory foresight will be crucial for staying ahead of policy shifts and emerging industry standards. By executing these initiatives in concert, companies can sharpen their competitive edge, deliver superior customer value, and lay the foundation for sustainable growth in the automotive radiator sphere.

Elucidating the Rigorous Multi-Stage Research Methodology Underpinning the Automotive Radiator Market Analysis for Robust Validation

The methodological framework underpinning this analysis blends rigorous secondary research, primary stakeholder engagement, and multi-layered data validation. Initially, publicly available sources, trade journals, technical patents, and regulatory filings were systematically reviewed to establish a foundational knowledge base. Building on this, structured interviews were conducted with senior executives, design engineers, procurement managers, and aftersales specialists across OEMs, tier-one suppliers, and material providers to capture firsthand insights into emerging challenges and priorities. Quantitative data points were then triangulated with proprietary industry databases and cross-checked against published financial reports to ensure consistency and accuracy. Throughout the process, a dedicated quality assurance protocol, including peer reviews by thermal management experts, was applied to verify key findings and thematic interpretations. This blended research approach ensures that the conclusions and strategic recommendations presented herein are grounded in both empirical evidence and real-world industry experience, offering a robust foundation for confident decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Radiators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Radiators Market, by Vehicle Type

- Automotive Radiators Market, by Material

- Automotive Radiators Market, by Core Type

- Automotive Radiators Market, by End Use

- Automotive Radiators Market, by Distribution Channel

- Automotive Radiators Market, by Region

- Automotive Radiators Market, by Group

- Automotive Radiators Market, by Country

- United States Automotive Radiators Market

- China Automotive Radiators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Converging Insights to Articulate the Strategic Imperatives and Future Pathways for Stakeholders in the Automotive Radiator Domain

Synthesis of the analysis reveals that the automotive radiator sector stands at a pivotal crossroads, shaped by electrification trends, tariff landscapes, material innovations, and regional market dynamics. As the industry transitions from legacy coolant systems to integrated thermal management platforms, companies that effectively align technical capabilities with strategic supply chain configurations will distinguish themselves. The cumulative effects of tariff adjustments in 2025 underscore the necessity of agile manufacturing and proactive policy engagement, while the segmentation framework highlights the nuanced requirements across vehicle types, end uses, materials, channels, and core designs. Furthermore, regional insights emphasize that success hinges upon tailored approaches to local regulatory environments and evolving consumer demands. Ultimately, those who prioritize collaborative R&D, digital transformation, and resilient sourcing strategies will be well positioned to capture growth opportunities and navigate uncertainty. This concluding perspective reaffirms the critical importance of informed strategic planning and the adoption of best practices as the radiator market evolves to meet next-generation mobility challenges.

Engage with Our Associate Director Ketan Rohom to Unlock In-Depth Market Intelligence and Drive Strategic Decision Making in Automotive Radiators

To gain the comprehensive insights and strategic intelligence necessary to navigate the evolving automotive radiator landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the extensive market research report tailored for executives, engineers, and investors seeking to refine product roadmaps, optimize procurement strategies, and strengthen competitive positioning. By partnering with Ketan, you will access in-depth analysis of technological innovations, tariff implications, segmentation breakdowns, regional dynamics, and actionable recommendations that can accelerate your growth trajectory. Don’t miss the opportunity to leverage this authoritative resource for data-driven decision making-contact Ketan today and unlock the full potential of your automotive thermal management strategies.

- How big is the Automotive Radiators Market?

- What is the Automotive Radiators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?