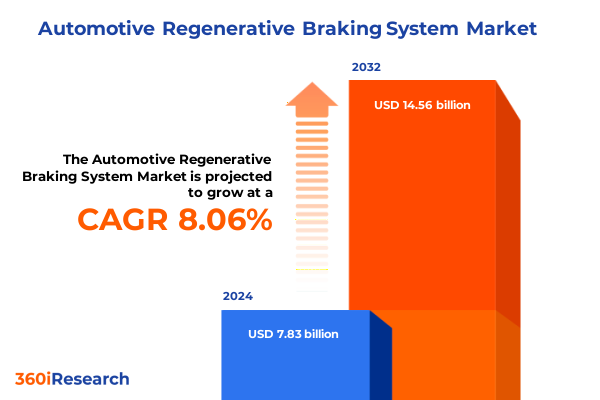

The Automotive Regenerative Braking System Market size was estimated at USD 8.45 billion in 2025 and expected to reach USD 9.13 billion in 2026, at a CAGR of 8.07% to reach USD 14.56 billion by 2032.

Driving the Future of Automotive Efficiency with Cutting-Edge Regenerative Braking Innovations Transforming Mobility for a Sustainable Tomorrow

Regenerative braking systems have emerged as a cornerstone technology in the pursuit of more efficient and sustainable mobility. By converting kinetic energy into electrical energy during deceleration, these systems recapture energy that would otherwise be dissipated as heat, storing it for subsequent use in electric and hybrid propulsion architectures. This process not only enhances overall vehicle efficiency but also reduces brake component wear, contributing to lower maintenance demands and total cost of ownership. Thoughtful engineering of regenerative systems is thus integral to modern vehicle design, aligning environmental goals with operational performance enhancements.

Leading automotive suppliers and OEMs have recognized the strategic importance of regenerative braking as a differentiating technology. Industry leaders such as Bosch, Continental, Denso, and ZF Friedrichshafen AG are at the forefront of innovation, integrating advanced control algorithms and energy storage solutions to maximize recovery potential. Simultaneously, progress in battery, supercapacitor, and hybrid storage architectures is enabling regenerative systems to store and dispatch energy more effectively, accelerating the transition to electrified powertrains and reinforcing the role of braking systems as key enablers of sustainable transportation.

Leveraging Digital Integration and Artificial Intelligence to Unlock Unprecedented Energy Recovery and Intelligent Braking System Synergies

The convergence of artificial intelligence and regenerative braking is reshaping the way vehicles manage energy recovery. AI-driven algorithms analyze driving patterns, terrain profiles, and traffic dynamics to determine optimal braking force distribution, seamlessly balancing regenerative capture and friction braking. Predictive analytics enable systems to anticipate deceleration events in real time, adapting energy recapture strategies to maximize efficiency without compromising safety or ride comfort. As a result, regenerative braking systems have evolved into intelligent platforms that contribute significantly to vehicle autonomy and driver assistance functionalities.

In parallel, the integration of regenerative braking with diverse energy storage and digital connectivity platforms is unlocking new avenues for system optimization. Automakers are marrying regenerative braking with lithium-ion, solid-state, and supercapacitor solutions to accommodate varied vehicle duty cycles, from stop-and-go urban driving to long-haul commercial routes. Moreover, connected vehicle frameworks and Vehicle-to-Everything (V2X) communication enable braking systems to exchange data with infrastructure and other vehicles, further refining energy recapture and contributing to smart city ecosystems. At the same time, tier-one suppliers are consolidating motor-generator and inverter components into compact, unified modules that reduce part count and system mass, thereby enhancing performance across multiple vehicle platforms.

Assessing the Strategic Implications of New U.S. Import Tariffs on Automotive Components and Their Cascading Effects Across Supply Chains

In March 2025, the U.S. government invoked Section 232 of the Trade Expansion Act to impose a 25 percent tariff on imported passenger vehicles, light trucks, and key automotive components. This measure, aimed at bolstering national security by safeguarding domestic production capabilities, extends to engine, transmission, powertrain, and electrical parts that are critical to regenerative braking systems. Under the new regulations, importers certifying compliance with United States-Mexico-Canada Agreement (USMCA) content requirements may mitigate the tariff’s impact on qualifying components, but non-U.S. content remains subject to the full levy.

Automakers have begun to absorb a substantial share of these increased costs to avoid abrupt price hikes for consumers and safeguard market position. Leading global OEMs have reported significant profit margin contractions, with some estimating impacts in the low billions of dollars this year alone. Many manufacturers are deferring adjustments to retail pricing, opting instead to implement incremental cost management and supply chain realignment strategies. Despite these efforts, prolonged tariff exposure could trigger upward pressure on vehicle and component pricing, while eroding the competitiveness of imported regenerative braking modules and related technologies.

Beyond the headline impacts on OEM balance sheets, smaller auto parts suppliers face acute challenges. With limited capacity to absorb or offset the levies through relocation or alternative sourcing, many specialized component producers risk margin erosion, inventory shortages, and financial distress. These dynamics threaten to disrupt the established tier-one and aftermarket ecosystems that support regenerative braking innovation and deployment, potentially delaying new system introductions and aftermarket service availability.

Illuminating Market Dynamics Through Vehicle Type Propulsion System and Channel Segmentation to Enhance Strategic Decision Making

A nuanced understanding of market segmentation reveals divergent requirements and growth pathways within the regenerative braking domain. Commercial vehicles bifurcate into heavy-duty and light-duty segments, each presenting distinct energy recovery demands. Heavy commercial platforms capitalize on high-mass deceleration events to maximize the benefits of electric kinetic energy recovery systems, while light commercial vehicles operating in urban logistics often integrate hydraulic systems for rapid energy capture during frequent stops. Passenger car applications span hatchbacks, MPVs, sedans, and SUVs, with sport utility vehicles leveraging greater braking force modulation to optimize both comfort and energy recirculation in dynamic driving conditions. The customization of system control strategies to align with these use cases ensures that manufacturers can deliver braking solutions tailored for each vehicle archetype.

Similarly, propulsion segmentation underscores the universal relevance of regenerative braking across BEVs, HEVs, and PHEVs. Battery electric vehicles inherently rely on energy recapture as a primary tool to extend driving range, while hybrid platforms have long utilized regenerative modules to reduce ICE load and improve fuel economy. Plug-in hybrids balance these approaches, optimizing energy distribution between onboard battery reserves and internal combustion support. System-type differentiation further clarifies market offerings: kinetic energy recovery systems manifest in electrical and mechanical configurations, each suited to particular performance and cost profiles, and are complemented by regenerative anti-lock braking integration that ensures seamless transition between recovery and friction braking. Finally, sales channels-including original equipment manufacturer installations and aftermarket retrofit solutions-cater to both new vehicle production and retrofit opportunities, underlining the breadth of uptake strategies for regenerative braking technologies.

This comprehensive research report categorizes the Automotive Regenerative Braking System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Propulsion Type

- System Type

- Sales Channel

Understanding Regional Variations in Regenerative Braking Adoption Technologies and Policies Across Key Global Markets for Targeted Growth Strategies

The Americas region displays a dual dynamic of rapid electrification combined with evolving trade policies. On one hand, the widespread adoption of electric and hybrid vehicles in the United States and Canada is accelerating demand for advanced regenerative braking solutions, driven by federal incentives, state-level zero-emissions mandates, and corporate sustainability commitments. On the other hand, recent Section 232 tariffs have introduced complexity into cross-border component flows, prompting suppliers and OEMs to reassess global sourcing strategies and in-region manufacturing investments to mitigate import levies.

Across Europe, the Middle East, and Africa, public transportation and urban mobility initiatives are catalyzing growth in regenerative braking deployments. London’s double-deck bus fleet has incorporated motor racing-style flywheel energy recovery systems to achieve significant fuel efficiency gains, while commercial fleet operators in Germany and the Gulf region explore hydraulic and electric KERS solutions for refuse trucks and delivery vans. Demonstration projects, such as rigid trucks retrofitted with ultracapacitor-based systems, highlight the region’s openness to innovative retrofit programs that reduce emissions and operational costs.

In the Asia-Pacific landscape, government-led electrification drives and heavy-rail modernization are propelling regenerative braking into the mainstream. Indian Railways’ adoption of energy recapture technology across multiple locomotive classes has delivered up to thirty percent reductions in traction power demand, underscoring the transformative potential of kinetic energy recovery at scale. Meanwhile, suppliers in Japan and Southeast Asia are scaling compact regenerative control units for two-wheelers, reflecting the region’s strength in lightweight electric mobility and its influence on component innovation for broader automotive applications.

This comprehensive research report examines key regions that drive the evolution of the Automotive Regenerative Braking System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring the Innovative Developments and Competitive Strategies of Leading Tier One Suppliers Revolutionizing Regenerative Braking Systems Worldwide

Tier-one supplier Bosch has advanced its iBooster Gen 3 platform, embedding AI-enhanced decision-making to dynamically adjust regenerative braking intensity in milliseconds based on driver behavior and traffic context. This system has been integrated into over twenty electric vehicle models globally since Q3 2023, establishing Bosch as a leader in intelligent braking controls that harmonize energy recovery with conventional safety functions.

Continental’s MK-C2 module represents a significant leap in system integration, merging anti-lock braking, stability control, and regenerative functions into a thirty percent smaller package compared to previous generations. Launched in Q2 2023 and adopted in multiple premium electric vehicle lineups, this consolidated architecture reduces wiring complexity and weight, while delivering seamless transitions between friction and regenerative braking.

ZF Friedrichshafen AG’s decoupled regenerative braking unit for electric SUVs has demonstrated up to twenty-two percent gains in energy recirculation under variable load and grip conditions. By dynamically modulating the engagement between electric and hydraulic systems, ZF’s solution optimizes efficiency in off-road and urban scenarios alike, reinforcing the company’s reputation for versatile drivetrain innovations.

Denso’s compact braking control unit for two-wheelers, weighing just 1.2 kg, leverages magnet-less position sensors to bolster reliability in humid and demanding environments. Deployed in over one million scooters across Japan and Vietnam, this unit underscores Denso’s capability to miniaturize energy recapture technologies for emerging mobility segments.

Adgero’s UltraBoost ST system applies motor-racing KERS developed in partnership with ultracapacitor specialist Skeleton Technologies to medium-duty rigid trucks, showcasing fuel savings of up to twenty-five percent and rapid retrofit feasibility. This collaboration highlights the growing influence of startup-incumbent partnerships in extending regenerative braking beyond passenger cars into heavy commercial applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Regenerative Braking System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- BorgWarner Inc.

- Brembo S.p.A.

- Continental AG

- DENSO Corporation

- Hitachi Automotive Systems, Ltd.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Schaeffler AG

- Valeo SA

- ZF Friedrichshafen AG

Implementing Actionable Strategies to Accelerate Innovation Enhance Resilience and Drive Sustainable Growth in Automotive Regenerative Braking Systems

Industry leaders should prioritize the integration of AI-driven control algorithms and predictive analytics within regenerative braking architectures to capture the full spectrum of deceleration events. By harnessing machine learning models that adapt to driver behavior, route profiles, and real-time environmental data, companies can elevate energy recovery rates while maintaining the seamless braking feel expected by consumers. Investments in software platforms that facilitate over-the-air updates will ensure continuous refinement of these intelligent systems.

To mitigate the risks posed by evolving trade policies and tariffs, organizations must diversify their supply chains across multiple regions and foster greater in-region production capacities. Establishing or expanding manufacturing footprints in North America, Europe, and Asia-Pacific will reduce exposure to import levies and enhance responsiveness to market fluctuations. Concurrently, deeper collaborations with tier-two and tier-three suppliers can fortify component resilience and secure critical regenerator elements against geopolitical disruptions.

Finally, embracing aftermarket retrofit initiatives offers a strategic avenue to monetize existing vehicle fleets and accelerate technology diffusion. Developing modular regeneration kits optimized for commercial fleets and urban buses can unlock immediate energy savings for operators while nurturing new revenue streams. Partnering with service networks and leveraging digital diagnostic tools will ensure high installation rates and robust post-sales support, cementing regenerative braking as both an OEM and aftermarket growth pillar.

Detailing a Robust Research Framework Integrating Comprehensive Data Sources Expert Insights and Rigorous Analytical Methods for Credible Findings

This research draws upon a multi-tiered methodology designed to capture both broad industry trends and specific technology innovations. Secondary research encompassed an extensive review of government publications, including trade fact sheets and regulatory announcements pertaining to tariffs and electric vehicle incentives. White papers and technical papers published by leading automotive suppliers provided detailed engineering perspectives, while patent databases were analyzed to track emerging intellectual property developments.

Primary research involved structured interviews with senior executives and technical experts from OEMs, tier-one suppliers, and aftermarket specialists. These discussions yielded insights into product roadmaps, commercial strategies, and regulatory responses. In parallel, a series of workshops with fleet operators and public transportation authorities validated real-world performance feedback and retrofit cases. Finally, rigorous data triangulation was performed to reconcile findings across sources, ensuring robustness and credibility of the conclusions presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Regenerative Braking System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Regenerative Braking System Market, by Vehicle Type

- Automotive Regenerative Braking System Market, by Propulsion Type

- Automotive Regenerative Braking System Market, by System Type

- Automotive Regenerative Braking System Market, by Sales Channel

- Automotive Regenerative Braking System Market, by Region

- Automotive Regenerative Braking System Market, by Group

- Automotive Regenerative Braking System Market, by Country

- United States Automotive Regenerative Braking System Market

- China Automotive Regenerative Braking System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Insights to Chart a Strategic Path Forward for Sustainable Growth and Technological Leadership in Regenerative Braking Systems

The evolution of regenerative braking technology exemplifies the intersection of mechanical engineering, electronics integration, and digital intelligence in advancing vehicle efficiency. By harnessing deceleration energy through increasingly sophisticated hardware and software solutions, the automotive industry is redefining its environmental footprint and operational economics. Transformative shifts-from AI-driven controls to modular energy storage-have broadened the applicability of regenerative systems across vehicle classes and global regions. As trade dynamics and regulatory landscapes evolve, agility in supply chain management and proactive retrofit strategies will determine market leadership.

Looking ahead, stakeholders who align innovation agendas with actionable policy advocacy and strategic partnerships will be best positioned to capitalize on the momentum of electrification. The continued maturity of regenerative braking systems will reinforce their role as foundational enablers of sustainable mobility, fostering synergies across vehicle architectures and infrastructure ecosystems. Ultimately, the companies that navigate this complex terrain with foresight and flexibility will drive the next generation of automotive performance and environmental stewardship.

Secure Your In-Depth Market Research Report Today by Partnering with Ketan Rohom to Empower Strategic Decisions in Automotive Regenerative Braking Systems

To take full advantage of the insights and strategic analyses detailed in this report, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, who stands ready to facilitate your acquisition. By partnering with Ketan, you will gain access to a comprehensive suite of customized market intelligence tailored to your organization’s specific needs in the automotive regenerative braking domain. Elevate your decision-making with exclusive data, expert commentary, and forward-looking recommendations that drive competitive advantage. Reach out to Ketan Rohom today to secure your report and empower your team to navigate the evolving landscape of regenerative braking technologies with confidence and clarity.

- How big is the Automotive Regenerative Braking System Market?

- What is the Automotive Regenerative Braking System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?