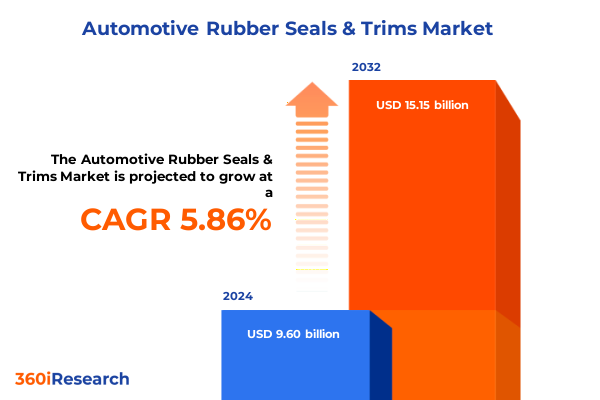

The Automotive Rubber Seals & Trims Market size was estimated at USD 10.08 billion in 2025 and expected to reach USD 10.69 billion in 2026, at a CAGR of 5.99% to reach USD 15.15 billion by 2032.

Setting the Stage for Next Generation Automotive Rubber Seals and Trims with an In-Depth Exploration of Core Market Drivers

The automotive industry is undergoing rapid transformation driven by technological innovation heightened environmental regulations and evolving consumer expectations In this dynamic landscape rubber seals and trims play a fundamental role in ensuring vehicle safety comfort and efficiency as manufacturers pivot toward electrification and lightweight design strategies From reducing cabin noise and improving cabin air quality to enhancing weather resistance and supporting aerodynamic performance these critical components are integral to a vehicle’s overall functionality As OEMs and suppliers collaborate to address stricter emissions norms and sustainability mandates the demand for advanced materials and precision engineered designs continues to accelerate Moreover strategic partnerships across the value chain are fostering innovation as material scientists designers and manufacturers coalesce their expertise to deliver next generation solutions Against this backdrop our executive summary provides a concise yet comprehensive overview of the automotive rubber seals and trims market encompassing the major transformative forces key segmentation insights regional dynamics and actionable recommendations for industry stakeholders

Identifying the Critical Industry Shifts Reshaping Automotive Seals and Trims with Electrification Sustainability and Digitalization

The automotive seals and trims arena is witnessing transformative shifts driven by three interrelated trends First the surge of electric vehicles is necessitating novel sealing solutions that support higher voltage components battery enclosures and thermal management systems Traditional seals designed for the internal combustion engine environment are giving way to lightweight low outgassing materials with superior dielectric properties Simultaneously sustainability imperatives are propelling the adoption of eco friendly compounds such as recycled thermoplastic elastomers and bio based rubbers which not only reduce carbon footprint but also satisfy stringent end of life vehicle regulations Additionally manufacturers are increasingly leveraging digitalization across their value chains with advanced simulation tools additive manufacturing and Industry 4.0 enabled production lines This integration of digital twins and real time data analytics is enhancing design validation and reducing time to market while mitigating quality risks Furthermore the convergence of connectivity features within vehicles underscores the need for seals that can isolate electronic modules from moisture dust and electromagnetic interference These transformative shifts collectively redefine product development priorities and competitive landscapes shaping the evolution of the automotive seals and trims market

Unveiling the Ripple Effects of New US Tariffs on Automotive Rubber Seals and Trims Supply Chains and Cost Structures in 2025

In early 2025 the United States government imposed a revised tariff regime targeting specific automotive component imports in a bid to bolster domestic manufacturing While the measures aim to encourage localized production they have triggered a cascade of supply chain realignments For producers reliant on imported rubber compounds and precision extrusion equipment the increased duties have elevated input costs by mid single digit percentages This has prompted many global suppliers to reassess their sourcing strategies and negotiate long term contracts with domestic material producers to preserve margin stability The ripple effects extend downstream as OEMs grapple with the need to absorb or pass through cost increases to their customers Some manufacturers have begun exploring dual sourcing models combining local and foreign suppliers to maintain flexibility and responsiveness Moreover, the tariff impact has underscored the importance of inventory optimization and just in time manufacturing practices, as excessive stockpiling can exacerbate working capital constraints under higher duty frameworks. At the same time policy uncertainties continue to influence capital expenditure decisions, driving a cautious approach to new plant expansions and technology investments. Ultimately this policy shift accentuates the strategic imperative for industry players to fortify supply chain resilience, diversify procurement channels and deepen collaboration with government bodies to navigate the evolving trade environment

Delving into Segmentation Dimensions Revealing Product Type Material Vehicle Application and Distribution Channel Dynamics

A nuanced understanding of market segmentation reveals the diverse requirements shaping the automotive rubber seals and trims sector. When analyzing product types it becomes evident that door seals prioritize resilience against environmental exposure while glass run channels demand precise dimensional tolerances to ensure smooth window operation. Hood seals and trunk seals serve critical roles in protecting powertrain components from moisture ingress yet differ in profile complexity and mounting methods. Weather strips designed for roof seams and sunroof interfaces must balance UV resistance with sealing performance, whereas window seals require materials capable of enduring repetitive motion without compromising integrity. Turning to material segmentation, EPDM continues to dominate due to its exceptional weather and ozone resistance, while neoprene offers superior oil and chemical impermeability for underhood applications. Nitrile demonstrates strong abrasion resistance, making it suitable for contact surfaces subject to mechanical wear. PVC retains a cost advantage in aftermarket operations, and silicone emerges as the material of choice for high temperature environments. Thermoplastic elastomers gain ground for their recyclability and design flexibility. Vehicle type segmentation further underscores heterogeneity across end users. Heavy commercial vehicles such as buses and trucks demand seals engineered to withstand extreme temperature fluctuations and extended service cycles. Light commercial vehicles including mini trucks pickups and vans prioritize ease of installation and cost efficiency. In passenger cars coupes hatchbacks sedans and SUVs carmakers emphasize acoustic comfort, aerodynamic sealing and lightweight profiles. Application segmentation highlights the divergent requirements across exterior and interior usage. Exterior applications covering doors hoods sunroofs trunks and windows demand seals capable of resisting weather elements, while interior applications around consoles dashboards door panels and seats focus on noise dampening, aesthetic integration and occupant comfort. Finally distribution channel segmentation distinguishes between aftermarket and OEM sales. Aftermarket channels leverage offline retail stores service centers and online platforms to supply a wide range of replacement and upgrade products, whereas OEM channels focus on tailored design collaboration, quality certification and long term supplier partnerships

This comprehensive research report categorizes the Automotive Rubber Seals & Trims market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Vehicle Type

- Application

- Distribution Channel

Mapping Regional Variations and Growth Trajectories across Americas Europe Middle East Africa and Asia Pacific Markets

Regional analysis illuminates significant growth differentials driven by localized regulatory frameworks and consumer preferences in the Americas, Europe Middle East & Africa and Asia Pacific. In the Americas, stringent federal and state emissions regulations coupled with a rapid shift toward electric vehicles are driving demand for advanced sealing solutions with enhanced dielectric and thermal management properties. The aftermarket landscape is also robust, buoyed by a mature vehicle parc and rising maintenance cycles. In contrast, Europe Middle East & Africa is witnessing a surge in sustainability mandates, particularly in the European Union where new end of life vehicle directives incentivize recyclable materials and circular economy practices. Growth is further propelled by robust automotive production hubs in Germany France and the UK, alongside expanding urban mobility projects throughout Gulf Cooperation Council nations seeking to minimize noise and emissions. Meanwhile Asia Pacific stands out as the most dynamic region, led by China India and Southeast Asia. Rapid urbanization, combined with aggressive electrification targets in China, has fostered significant investments in manufacturing capacity for high performance rubber compounds. India’s expanding passenger car market and rising demand for mid tier SUVs underscore a growing aftermarket for replacement seals, while Southeast Asian nations capitalize on low cost manufacturing bases for export to global automotive OEMs. Collectively these regional trends illustrate how local policy environments and market maturity shape the evolution of the automotive seals and trims industry across the globe

This comprehensive research report examines key regions that drive the evolution of the Automotive Rubber Seals & Trims market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Market Players Their Strategic Moves and Competitive Footprints in the Automotive Seals and Trims Ecosystem

The competitive landscape is defined by global material and component suppliers competing on advanced material science, innovation speed, and integrated service offerings. Leading elastomer manufacturers continue to invest in proprietary compound formulations that enhance durability and sustainability, partnering closely with extrusion and molding specialists to shorten development cycles. Tier one suppliers are broadening their footprints through targeted acquisitions, extending beyond traditional rubber seals to encompass multifunctional trim solutions incorporating active sealing technologies and sensor integration. At the same time, agile niche players are carving out market share by focusing on specialized applications such as high voltage battery pack sealing or luxury vehicle acoustic dampers, leveraging deep domain expertise to outpace larger competitors in speed and customization. Collaboration between OEMs and suppliers is intensifying as automakers seek to co develop next generation solutions directly on digital design platforms, leading to increased vertical integration and shared risk frameworks. Furthermore, strategic joint ventures in emerging regions reflect a growing emphasis on localized production to meet evolving trade policies and reduce supply chain complexities. This increasingly competitive ecosystem underscores the imperative for continuous innovation and strategic alliances to maintain leadership in the automotive seals and trims market

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Rubber Seals & Trims market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cooper-Standard Holdings Inc.

- Dana Incorporated

- Eaton Corporation plc

- ElringKlinger AG

- Freudenberg Sealing Technologies GmbH & Co. KG

- Henniges Automotive Holdings, Inc.

- Hutchinson SA

- Minth Group Ltd.

- Nishikawa Rubber Co., Ltd.

- Parker-Hannifin Corporation

- Rogers Corporation

- SaarGummi Technologies GmbH & Co. KG

- SKF AB

- Sumitomo Riko Company Limited

- Talbros Automotive Components Ltd.

- Toyo Tire Corporation

- Toyoda Gosei Co., Ltd.

- Trelleborg AB

- Zhongding Group Co., Ltd.

Formulating Strategic Imperatives for Industry Stakeholders to Navigate Market Volatility and Seize Emerging Opportunities

Industry leaders must embrace several critical imperatives to thrive amid market volatility and capitalize on emerging trends. First adopting a modular product platform approach will enable swift customization across different vehicle architectures and accelerate time to market. By standardizing core seal geometries and materials while offering configurable attachments and finishes manufacturers can address diverse OEM specifications efficiently. Second establishing robust strategic partnerships with material innovators and digital solution providers is essential to co create next generation sealing systems equipped with embedded sensors for condition monitoring. This cross functional collaboration will unlock predictive maintenance capabilities and enhance overall vehicle reliability. Third investing in local production footprints in key geographies will mitigate trade risks and foster closer alignment with regional regulations and end user preferences. Whether through greenfield expansions or joint ventures, proximity to OEM assembly plants is critical to reducing lead times and logistics costs. Fourth implementing advanced manufacturing technologies such as additive manufacturing and automated in line quality inspection can optimize design complexity and ensure consistent tolerances. Finally, leaders should prioritize sustainability by integrating recycled content and circular economy principles across product lifecycles, converting end of life seals into raw materials for new product lines This holistic set of strategic actions will fortify competitive advantage and position companies for long term market leadership

Outlining the Comprehensive Research Framework Employed to Generate Robust Insights into the Automotive Seals and Trims Market

The insights presented in this executive summary stem from a rigorous research methodology tailored to the complexity of the automotive rubber seals and trims market. Primary research included in depth interviews with senior executives across OEMs and tier one suppliers, capturing firsthand perspectives on design priorities manufacturing challenges and procurement trends. Complementing this, primary discussions with material scientists and R&D engineers provided detailed technical evaluations of emerging elastomer compounds and processing techniques. Secondary research encompassed a comprehensive review of industry publications regulatory filings and patent databases to map recent technological advancements and sustainability regulations. Trade association reports and government tariff schedules were analyzed to quantify the impact of policy changes on supply chain structures. Proprietary databases were leveraged to track company financials strategic partnerships and M&A activity, ensuring a nuanced view of competitive dynamics. Advanced data triangulation techniques were employed to validate market segmentation and regional growth patterns, while scenario analysis frameworks helped anticipate future disruptions. This integrated approach combining qualitative depth and quantitative rigor underpins the credibility and robustness of our findings

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Rubber Seals & Trims market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Rubber Seals & Trims Market, by Product Type

- Automotive Rubber Seals & Trims Market, by Material

- Automotive Rubber Seals & Trims Market, by Vehicle Type

- Automotive Rubber Seals & Trims Market, by Application

- Automotive Rubber Seals & Trims Market, by Distribution Channel

- Automotive Rubber Seals & Trims Market, by Region

- Automotive Rubber Seals & Trims Market, by Group

- Automotive Rubber Seals & Trims Market, by Country

- United States Automotive Rubber Seals & Trims Market

- China Automotive Rubber Seals & Trims Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Distilling Core Takeaways and Strategic Conclusions to Empower Decision Makers in the Automotive Rubber Seals and Trims Market

In summary the automotive rubber seals and trims market stands at a pivotal juncture shaped by electrification sustainability mandates and evolving trade policies. Key trends such as the rise of electric vehicles are redefining material requirements and design priorities, while new tariff regimes underscore the critical importance of resilient supply chains and strategic local sourcing. Segmentation analysis reveals diverse performance criteria across product types materials and applications that demand tailored solutions, and regional insights highlight varying growth drivers-from the mature aftermarket environment in the Americas to the sustainability focus in Europe Middle East Africa and the rapid industrialization of Asia Pacific. Competitive dynamics are intensifying as global leaders and specialized niche players vie to deliver next generation sealing systems, leveraging digitalization and collaborative innovation models. As the industry advances stakeholders must adopt modular design approaches embrace advanced manufacturing and foster close partnerships to navigate the complexities ahead. Ultimately the integration of sustainability principles and digital capabilities will define the next wave of breakthroughs in the automotive seals and trims space, offering manufacturers a pathway to enhanced vehicle performance reliability and compliance

Engage with Ketan Rohom to Unlock Invaluable Automotive Rubber Seals and Trims Market Insights and Propel Strategic Decision Making

Are you ready to leverage comprehensive market intelligence and transform your strategic roadmap for automotive rubber seals and trims We invite you to connect directly with Ketan Rohom Associate Director Sales & Marketing to gain immediate access to our in-depth research report Discover how you can harness our latest data driven insights and expert analysis to sharpen your competitive edge Our tailored solutions will empower you to pinpoint growth prospects mitigate emerging risks and optimize your supply chain Collaborate with Ketan to customize your research package ensuring you have the precise market intelligence necessary for confident decision making Reach out today to secure your copy of the market research report and embark on a journey to innovation and market leadership

- How big is the Automotive Rubber Seals & Trims Market?

- What is the Automotive Rubber Seals & Trims Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?