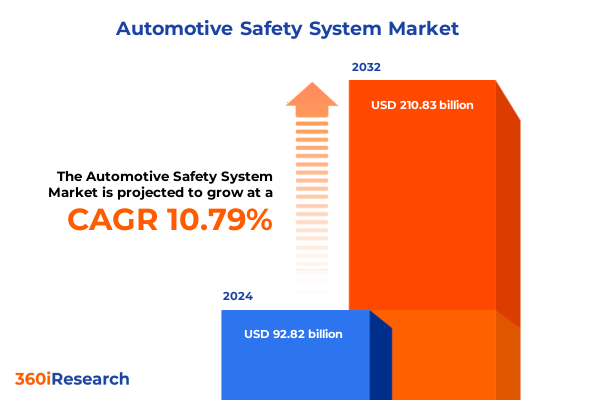

The Automotive Safety System Market size was estimated at USD 102.77 billion in 2025 and expected to reach USD 112.24 billion in 2026, at a CAGR of 10.81% to reach USD 210.83 billion by 2032.

Setting the Foundation for Next-Generation Vehicle Safety by Examining the Evolution, Importance, and Emerging Opportunities Within Automotive Safety Systems

As vehicles become ever more integrated with advanced electronics, the imperative to safeguard occupants and pedestrians has never been greater. Over recent years, the automotive safety systems sector has transitioned from basic seatbelt and airbag technologies to an intricate array of interdependent active and passive components. This transformation reflects the confluence of regulatory demands, consumer expectations for zero-fatality mobility, and the advent of sophisticated sensor and software platforms.

Understanding this dynamic ecosystem requires an appreciation for the layered architecture of modern safety solutions. At the core, passive safety measures such as airbags, seatbelts, and child restraints remain indispensable for crash protection. Surrounding this foundation is a burgeoning suite of active safety and driver-assistance systems that leverage cameras, radar, LiDAR, and ultrasonic sensors to preempt collisions and assist operators. These parallel developments underscore a shift toward holistic safety architectures that anticipate hazards, intervene when necessary, and preserve structural integrity upon impact.

Looking ahead, the interplay between evolving vehicle architectures-particularly electric and autonomous platforms-and safety system integration will define competitive differentiation. Manufacturers and suppliers who can seamlessly harmonize multi-sensor arrays with resilient actuator and restraint mechanisms will be best positioned to meet future regulatory frameworks and consumer trust thresholds. This report delves into the key drivers, technology inflections, and market dynamics shaping the automotive safety landscape as we move toward an era of predictive and fully automated mobility.

Uncovering the Paradigm-Altering Forces Reshaping Automotive Safety Through Converging Technology Breakthroughs, Regulatory Evolution, and Market Dynamics

The automotive safety domain is experiencing a confluence of transformative shifts driven by rapid technological breakthroughs, evolving regulatory frameworks, and profoundly changed consumer expectations. Sensor fusion, enabled by advances in radar and LiDAR resolution as well as high-definition camera processing, is now facilitating real-time hazard detection and autonomous maneuvering capabilities that were once relegated to speculative concept vehicles. Concurrently, electric vehicle platforms are catalyzing new safety paradigms by reshaping vehicle architecture, altering crash dynamics, and amplifying the importance of battery thermal management alongside occupant protection.

Regulators across North America, Europe, and Asia-Pacific are responding to stakeholder calls for enhanced occupant and pedestrian safety with increasingly stringent standards. Mandates for automatic emergency braking, lane keeping assistance, and blind spot monitoring have transitioned from optional features to baseline requirements in key markets. Beyond minimum compliance, several national testing bodies are elevating their assessment criteria to encompass scenario-based safety validation, demanding holistic reasoning from sensor, software, and control systems. This regulatory evolution is harmonizing safety expectations globally, even as regional priorities diverge in areas such as pedestrian detection and cyclist protection.

On the consumer side, heightened public awareness stemming from high-profile collision analyses and insurance-based incentive programs is driving stronger demand for advanced safety packages. Competitive positioning now necessitates not only the presence of driver-assistance features but demonstrable performance metrics under real-world conditions. As a result, alliances between OEMs, Tier-1 suppliers, and technology firms are proliferating, focusing on cross-domain data analytics, cybersecurity, and scalable software architectures that can swiftly adapt to emerging threats and regulatory shifts.

Analyzing the Aggregate Consequences of Recent U.S. Tariff Measures on Automotive Component Costs, Supply Chain Resilience, and Manufacturing Strategies Through 2025

Recent U.S. trade policies have exerted a substantial combined influence on the cost structure, procurement strategies, and supply chain resilience of automotive safety component manufacturers. The reinstatement of a 50 percent ad valorem tariff on steel and aluminum in June 2025 has directly increased raw material costs for restraint and structural subsystems, including airbag inflators, seatbelt anchors, and sensor mounting brackets. This measure has compelled suppliers to explore alternative sourcing strategies, such as nearshoring metal fabrication to Canada and Mexico or investing in domestic foundries to mitigate price volatility and lead-time risks.

Simultaneously, Section 301 tariffs targeting Chinese-origin goods have intensified cost pressures on electrified drivetrain and sensor technologies integral to active safety systems. An increase in duties on imported electric vehicles to 100 percent, alongside a doubling of tariffs on lithium-ion EV batteries, semiconductor wafers, and related critical minerals, has reverberated across the supply chain. ADAS sensors-particularly radar modules and camera systems reliant on advanced semiconductor lithography-are subject to a 50 percent levy as of January 1, 2025. The compounded effect of these levies without a proportional relief mechanism would have risked inflating end-customer prices; however, the April 2025 executive order provisionally exempts automakers that assemble vehicles domestically from stacked tariffs, offering limited reimbursement for qualifying imported parts during a two-year relief window.

The aggregate consequence of these policy actions has been a recalibration of supplier footprints and strategic investments. Component manufacturers are accelerating joint ventures to establish onshore production of high-precision plastics and sensor ceramics, while OEMs are reinforcing collaborative R&D initiatives with domestic technology providers to secure preferential tariff treatment. Although short-term financial burdens have risen, the unfolding landscape is incentivizing resilient manufacturing networks that align with national security objectives and long-term cost stability.

Deriving Strategic Intelligence from Component, Technology, Vehicle Type, and Application Segmentation to Decode Nuanced Opportunities in Automotive Safety

Strategic segmentation analysis reveals nuanced insights that enable stakeholders to target investment and innovation more effectively within the automotive safety arena. By dissecting the market based on component categories, it becomes clear that active safety components such as radar, LiDAR, camera sensors, and various electronic stability control systems are commanding heightened R&D allocations, driven by the imperative for real-time collision avoidance and automated intervention. In parallel, passive safety offerings encompassing airbag systems ranging from curtain to side variants, sophisticated child restraint mechanisms, and advanced pretensioner-enabled seatbelt architectures continue to evolve through material science breakthroughs and integrated sensor triggers.

Examining the market through a technology lens underscores camera sensors’ dominance in delivering cost-effective solution packages for lane departure, blind spot detection, and parking assist applications, while LiDAR technologies-spanning flash to mechanical to solid-state formats-are carving out indispensable roles in long-range object detection for higher levels of autonomy. Complementary radar modalities, differentiated by long-range and short-range capabilities, furnish robust performance under adverse weather conditions and form critical elements of adaptive cruise control and forward-collision warning systems. Ultrasonic sensors, segmented into high and low frequency variants, persist as reliable workhorses for close-range maneuvers and park assist functionalities.

Vehicle type segmentation further accentuates divergent growth trajectories, with electrified fleets placing greater emphasis on sophisticated battery management safety protocols and integrated thermal sensors, while passenger cars-ranging from hatchbacks to SUVs-prioritize mainstream adoption of standard ADAS suites. Commercial vehicles, from heavy haulers to light delivery trucks, demand tailored collision avoidance and stability control packages that can withstand rigorous duty cycles. Across application categories, from collision avoidance to night vision to autonomous parking, the interplay of sensor fusion, machine learning algorithms, and real-time actuation highlights manifold opportunities for modular platforms that can be customized to region-specific safety regulations and end-user preferences.

This comprehensive research report categorizes the Automotive Safety System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Category

- Technology

- Vehicle Type

- Application

Exploring Regional Disparities and Growth Drivers across the Americas, Europe Middle East Africa, and Asia-Pacific in the Automotive Safety Ecosystem

Regional dynamics in automotive safety system adoption and innovation exhibit marked contrasts that hinge upon local regulatory rigor, industrial capabilities, and consumer priorities. In the Americas, the United States leads with comprehensive safety regulations that mandate features such as automatic emergency braking and lane keeping assistance, creating a robust market for both OEM-embedded and aftermarket solutions. Mexico and Canada have strengthened their own standards in step with U.S. requirements, facilitating cross-border manufacturing alignments and just-in-time supply operations that enhance cost efficiencies and reduce logistical complexity.

Conversely, Europe, the Middle East, and Africa present a mosaic of adoption rates driven by a combination of Euro NCAP protocols, variable local regulations, and economic diversity. Western European markets emphasize pedestrian protection and intersection safety, stimulating demand for advanced stereo-camera systems and radar arrays capable of complex urban scenario analysis. In the Middle East, where high-speed travel predominates, long-range radar-enhanced adaptive cruise control represents a critical safety focus. Simultaneously, sub-Saharan African markets face different challenges, such as the integration of ruggedized restraint systems for variable road conditions and low-cost collision warning technologies to address infrastructure constraints.

In Asia-Pacific, China has rapidly solidified its position as both a leading consumer and manufacturer of automotive safety subsystems, supported by national mandates for electronic stability control and ADAS packages at various safety levels. India’s emerging regulatory environment is progressively aligning with UNECE guidelines, forging a pathway for wider ADAS inclusion in passenger cars. Meanwhile, Japan, South Korea, and Australia spotlight advanced sensor development, particularly around LiDAR miniaturization and AI-driven night vision, positioning them at the forefront of next-generation safety system research and application.

This comprehensive research report examines key regions that drive the evolution of the Automotive Safety System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Innovators Shaping the Future of Automotive Safety Systems through Advanced Sensor Software and Integration Expertise

An examination of leading industry players provides valuable context for understanding where competitive advantages are being forged and where collaborative gaps persist. Tier-1 suppliers specializing in sensor hardware, such as Bosch and Continental, continue to drive economies of scale in radar module production and camera assembly, leveraging global manufacturing footprints to meet surging ADAS content demand. Continental’s recent launch of an integrated radar-camera fusion platform exemplifies this approach, combining perception layers for enhanced object classification and reliability under complex scenarios.

Simultaneously, Denso and ZF are intensifying their investments in software development, notably in AI-based data interpretation frameworks that can seamlessly integrate inputs from disparate sensor modalities. The supply chain is further enriched by technology-focused entrants like Mobileye and Velodyne, which are propelling high-resolution LiDAR and vision-based safety solutions into mainstream OEM adoption through modular kits and strategic OEM partnerships. Autoliv, with its historical focus on passive safety, is now expanding into active safety through collaborative ventures that fuse restraint systems with predictive sensor triggers, bridging traditional boundaries between impact protection and collision avoidance.

Semiconductor and AI-enablement leaders such as Texas Instruments and Qualcomm are emerging as pivotal enablers of next-generation safety functions, providing system-on-chip platforms that support advanced driver-assistance algorithms and real-time sensor data processing. This convergence of hardware robustness, embedded software sophistication, and holistic system integration is progressively defining the competitive contours of the automotive safety market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Safety System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AISIN CORPORATION

- Aptiv PLC

- Autoliv Inc.

- Bendix Commercial Vehicle Systems LLC

- Continental AG

- Daicel Corporation

- Denso Corporation

- Hella GmbH & Co. KGaA

- Hitachi Astemo

- Hyundai Mobis

- Infineon Technologies AG

- Joyson Safety Systems

- Knorr-Bremse AG

- Lear Corporation

- Magna International Inc.

- Nippon Kayaku Seizo Co., Ltd.

- Renesas Electronics Corp.

- Robert Bosch GmbH

- Texas Instruments Inc.

- Toyoda Gosei Co. Ltd.

- Valeo SA

- Veoneer AB

- ZF Friedrichshafen AG

Actionable Strategies for Industry Leaders to Navigate Technological Disruption, Regulatory Complexity, and Supply Chain Volatility in Vehicle Safety

To maintain competitive resilience and capitalize on emerging technological inflections, industry leaders should prioritize a strategic roadmap that aligns R&D, manufacturing, and regulatory engagement. First, investing in multi-sensor fusion research and modular software architectures will ensure the rapid deployment of new safety functions across vehicle platforms, enabling incremental feature upgrades without full hardware overhauls. This approach not only reduces time-to-market but also future-proofs product portfolios against evolving safety standards.

Second, diversifying the supplier base and establishing onshore or nearshore production for critical materials and components will mitigate exposure to tariff fluctuations and geopolitical disruptions. Collaborative initiatives that bring together OEMs, Tier-1 suppliers, and semiconductor providers can secure preferential treatment under local content regulations and accelerate the development of industry-wide safety standards.

Third, proactive regulatory engagement at both national and international forums is essential for shaping upcoming safety mandates and ensuring compliance pathways are clear and cost-effective. Companies should actively participate in standard-setting bodies and pilot programs that validate performance under complex real-world scenarios.

Lastly, embedding robust cybersecurity protocols and over-the-air update capabilities within safety systems will address rising concerns over data integrity and system resilience. As vehicles become more connected and autonomous, the ability to quickly patch vulnerabilities and update safety algorithms remotely will be indispensable for maintaining consumer trust and regulatory compliance.

Detailing the Rigorous Mixed-Method Research Framework Utilized to Derive Insights and Validate Trends in the Automotive Safety Systems Market

This research was conducted through a structured mixed-methodology designed to ensure the robustness and credibility of insights. Secondary research encompassed a comprehensive review of publicly available regulatory documents, technical standards, peer-reviewed journals, and proprietary whitepapers focusing on sensor technologies, materials science, and vehicle dynamics. To validate secondary data, a series of in-depth interviews were carried out with senior executives from OEMs, Tier-1 suppliers, and industry associations, providing firsthand perspectives on technology roadmaps and market uncertainties.

Complementing qualitative inputs, primary quantitative research involved a global survey of engineering and procurement leaders across key automotive markets. Survey findings were cross-referenced with case study analyses of recent product launches and recall data to identify real-world performance trends. Triangulation of secondary and primary data streams was further enhanced through expert workshops that simulated policy scenarios, enabling stress-testing of tariff impacts and regulatory shifts.

Finally, all insights underwent rigorous data validation protocols, including alignment with import-export databases, tariff schedules, and trade association forecasts to ensure consistency and accuracy. This methodological framework provides a transparent foundation for interpreting trends, assessing strategic opportunities, and formulating actionable recommendations that address the complex dynamics of automotive safety systems.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Safety System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Safety System Market, by Component Category

- Automotive Safety System Market, by Technology

- Automotive Safety System Market, by Vehicle Type

- Automotive Safety System Market, by Application

- Automotive Safety System Market, by Region

- Automotive Safety System Market, by Group

- Automotive Safety System Market, by Country

- United States Automotive Safety System Market

- China Automotive Safety System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3657 ]

Concluding Insights on the Imperative of Integrated Safety Architectures, Collaborative Innovation, and Resilient Supply Chains in Modern Mobility

In summary, the automotive safety systems sector stands at the nexus of technological innovation, regulatory evolution, and global supply chain realignment. The integration of advanced sensor arrays, AI-driven software, and resilient actuation mechanisms is redefining how vehicles anticipate and respond to hazards, moving the industry closer to the vision of zero-fatality mobility. At the same time, shifting tariff landscapes and regional policy divergences are reshaping procurement strategies, compelling stakeholders to adopt agile manufacturing networks and strategic partnerships.

As competition intensifies, success will hinge on the ability to orchestrate holistic safety solutions that seamlessly blend passive and active elements within modular architectures. Companies that invest in sensor fusion, diversify production footprints, and engage proactively with evolving safety mandates will unlock sustained growth and differentiation. Ultimately, the journey toward fully automated, incident-free transportation demands unwavering collaboration across OEMs, suppliers, regulators, and technology innovators, united by a shared commitment to protect human lives on the road.

Engage with Ketan Rohom to Unlock In-Depth Insights and Secure Your Comprehensive Automotive Safety Systems Market Report

If you’re ready to deepen your understanding of the rapidly evolving automotive safety systems landscape and gain a competitive advantage in steering your strategic roadmap, connect with Ketan Rohom, Associate Director of Sales & Marketing. Through a tailored briefing, Ketan can guide you through the comprehensive findings, detailed segmentation analyses, and actionable recommendations featured in this report. Secure your copy today to access unparalleled market intelligence that will drive informed decision-making across product development, supply chain management, and strategic partnerships. Engage with Ketan Rohom to elevate your organization’s safety innovations and capitalize on emerging opportunities.

- How big is the Automotive Safety System Market?

- What is the Automotive Safety System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?