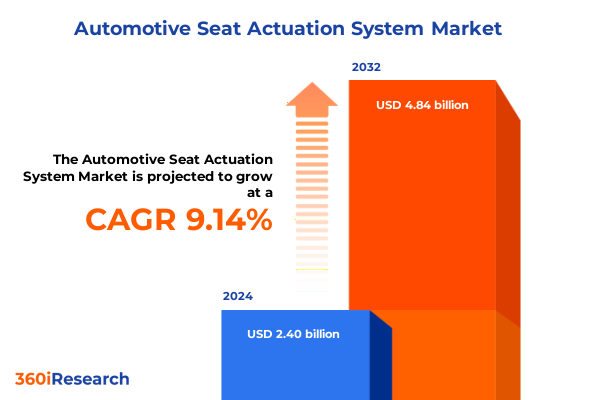

The Automotive Seat Actuation System Market size was estimated at USD 2.63 billion in 2025 and expected to reach USD 2.88 billion in 2026, at a CAGR of 9.43% to reach USD 4.94 billion by 2032.

Laying the Groundwork for Innovation Through an Overview of the Evolution and Critical Role of Automotive Seat Actuation Mechanisms

The evolution of automotive seating has transcended mere comfort to become an integral pillar of vehicle design, safety, and user experience. What began as simple manual adjustments has given way to sophisticated actuation systems that respond to the modern driver’s demand for customization, convenience, and connectivity. Over time, automotive seat actuation has evolved from basic lever-based positioning to fully integrated electric mechanisms capable of multidirectional adjustment, memory settings, and dynamic responses to driving conditions. This transformation reflects broader shifts in mobility trends, including the rise of electric and autonomous vehicles, heightened safety standards, and the pursuit of premium cabin experiences.

Advancements in sensor technologies, control electronics, and actuator designs have redefined the boundaries of what seat actuation systems can achieve. Modern architectures incorporate multiple actuators for height, tilt, lumbar support, and headrest adjustments, all orchestrated by sophisticated software algorithms. As vehicles become increasingly connected, seat systems now offer personalized profiles that can be linked to driver preferences through cloud-based platforms. In parallel, stringent crash-test protocols and occupant safety regulations have elevated the importance of robust and reliable actuation mechanisms that perform flawlessly under extreme conditions.

In this context, automotive manufacturers and seating suppliers view seat actuation not simply as a utility feature but as a critical differentiator. The capacity to deliver seamless integration between mechanical components, electronic control units, and user interfaces underscores the strategic relevance of this market segment. Understanding the underlying technologies, competitive landscape, and emerging trends is essential for stakeholders aiming to capitalize on the opportunities presented by next-generation seat actuation solutions.

Uncovering the Game-Changing Innovations and Emerging Trends That Are Reshaping Automotive Seat Actuation Systems Landscape

The landscape of automotive seat actuation systems has undergone a series of groundbreaking transformations that redefine not only vehicle ergonomics but also passenger experiences. The transition to electric actuation has been among the most significant, driven by the decline of manual lever systems and the ascendancy of powered motors capable of precise, automated adjustments. This shift has enabled features such as multi-point adjustment, memory seating functions, and programmable configurations that cater to diverse consumer preferences and vehicle segments.

Concurrently, the push toward vehicle electrification and autonomy has introduced new imperatives for seat actuation technology. Autonomous prototypes and concept vehicles necessitate seats that can rotate, recline, and reconfigure to accommodate non-driving scenarios, such as meetings or relaxation modes. These innovative requirements have spurred research into novel actuator designs, including compact brushless DC motor arrangements and stepper motor assemblies that provide both nimble responsiveness and high torque within constrained cabin spaces.

Beyond functional enhancements, sustainability considerations have catalyzed the adoption of eco-friendly materials and energy-efficient systems. Innovations in lightweight actuator housings, recyclable composites, and low-power consumption control units reflect a growing commitment to reducing vehicle carbon footprints. As a result, the market is witnessing integrative platforms that harmonize traditional mechanical reliability with advanced electronics and sustainable design principles, charting a new course for automotive seat actuation systems.

Analyzing the Lasting Consequences of 2025 U.S. Tariff Measures on Automotive Seat Actuation Supply Chains and Cost Structures

In 2025, the United States implemented a series of tariff measures that reverberated through the global seat actuation supply chain, particularly targeting imported actuator components from key manufacturing hubs. These levies, aimed at bolstering domestic production and addressing trade imbalances, introduced incremental cost pressures for vehicle assemblers and tier one suppliers heavily reliant on offshore sourcing. As a result, procurement teams faced the imperative to reassess supplier networks and cost structures to maintain competitive pricing in end markets.

The cumulative effect of these tariffs prompted a strategic shift toward nearshoring and localizing critical actuator production. Suppliers accelerated investments in North American manufacturing facilities, leveraging incentives and streamlined logistics to mitigate duty burdens. This pivot not only enhanced supply chain resilience, but also reduced lead times and enabled closer collaboration between OEM engineering teams and component manufacturers. Concurrently, engineering teams prioritized design modifications that minimized reliance on tariff-impacted materials, exploring alternative alloys and streamlined actuator architectures.

While initial outlays for facility expansion and retooling presented financial challenges, the longer-term benefits included greater agility in responding to OEM customization demands and enhanced control over quality assurance processes. Collectively, these supply chain realignments illustrate how tariff policy can serve as a catalyst for industrial modernization, driving suppliers to adopt leaner operations and reposition their production footprint for sustained competitiveness.

Segmentation Insights Illuminating Market Dynamics Across Actuation Modes Vehicle Classes Seat Positions Technologies and Sales Channels

Segmentation analysis of the seat actuation market uncovers distinctive dynamics across different actuation types, vehicle categories, seating positions, actuator technologies, and distribution channels. When considering actuation modes, electric systems lead innovation through brushless DC, DC, and stepper motor variants that deliver precision and energy efficiency, while manual and pneumatic solutions continue to address cost-sensitive and specialized applications. This diversity underscores the need for tailored engineering approaches that balance performance, durability, and affordability.

Exploring vehicle categories reveals that passenger cars-from hatchbacks to sedans and SUVs-demand versatile actuation solutions that accommodate varied cabin architectures and consumer expectations for comfort. Meanwhile, commercial vehicles often prioritize robustness and simplicity, driving continued demand for manual and heavy-duty electric configurations. These distinctions inform product roadmaps, guiding suppliers to calibrate actuator power ratings and durability thresholds to each segment’s operational profile.

Seat position segmentation highlights the prominence of front-seat actuation for driver ergonomics, while rear-seat mechanisms, encompassing both second and third-row placements, are gaining traction in multi-passenger vehicles where flexible seating arrangements and cargo adaptability are paramount. Actuator technology selection further refines product strategies, as electro-hydraulic actuators offer high force outputs in compact form factors, linear actuators deliver smooth stroke movements, and rotary actuators excel in angular adjustments.

Finally, distribution channels shape market outreach, with original equipment manufacturers driving most initial integration, while aftermarket channels cater to retrofit and repair demand. These sales channels challenge suppliers to develop modular designs and simplified installation kits that streamline aftermarket adoption without compromising performance standards.

This comprehensive research report categorizes the Automotive Seat Actuation System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Actuation Type

- Vehicle Type

- Seat Position

- Actuator Technology

- Sales Channel

Comparative Analysis of Regional Dynamics Revealing How the Americas EMEA and Asia-Pacific Are Shaping the Future of Seat Actuation Technology

Regional dynamics in the seat actuation market illustrate how economic, regulatory, and consumer factors converge across the Americas, Europe Middle East Africa, and Asia-Pacific. In the Americas, robust demand for personalization and comfort features, particularly in the United States and Canada, has spurred rapid adoption of advanced electric actuation systems. OEMs in this region emphasize safety compliance and customer-centric features such as memory seating and real-time adjustment capabilities, elevating performance requirements for suppliers.

Across Europe Middle East Africa, stringent safety and emissions regulations in European markets necessitate lightweight designs and low-power actuators that align with environmental targets. Manufacturers in this region invest heavily in R&D to refine electro-hydraulic and rotary technologies that reduce energy consumption without compromising adjustment speed or reliability. In the Middle East and Africa, growing vehicle fleets and infrastructure investment fuel demand for durable systems, while regional customization trends spark interest in novel seat configurations for premium segments.

Asia-Pacific remains a critical manufacturing hub and a rapidly expanding end market. Leading automotive producers in China, Japan, and South Korea are integrating smart seating solutions into next-generation models, leveraging high-volume production capabilities to achieve economies of scale. Meanwhile, Southeast Asian markets exhibit strong aftermarket growth, driven by cost-conscious consumers seeking reliable and affordable actuation upgrades. The confluence of local manufacturing prowess and rising consumer expectations positions Asia-Pacific as a focal point for innovation and production optimization.

This comprehensive research report examines key regions that drive the evolution of the Automotive Seat Actuation System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategies Strengths and Collaborative Endeavors of Leading Companies Driving Innovation in Automotive Seat Actuation Systems

Leading participants in the seat actuation arena are leveraging differentiated strategies to secure market leadership and drive future growth. Prominent suppliers such as Adient and Lear concentrate on expanding their electric actuator portfolios through modular platforms that serve diverse vehicle segments, emphasizing seamless integration with vehicle electronics architectures and advanced driver-assistance systems. These companies also pursue targeted acquisitions to augment their technology pipelines and accelerate time to market.

Meanwhile, Faurecia and Brose focus on collaborative partnerships with OEMs to co-develop next-generation seating architectures, melding actuator innovations with lightweight materials and digital user interfaces. Their efforts center on delivering turnkey solutions that streamline installation and reduce system complexity. Companies like NSK and ZF emphasize global footprint expansion, establishing regional manufacturing facilities to align with localized demand patterns while maintaining stringent quality control processes.

Smaller specialized players bring agility to niche applications, supplying high-torque stepper motor actuators and custom electro-hydraulic units for emerging vehicle categories such as electric commercial fleets and autonomous shuttles. Across the board, investment in software platforms that enable diagnostics, over-the-air updates, and predictive maintenance elevates the value proposition for automakers seeking to differentiate their seating offerings while reducing lifecycle costs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Seat Actuation System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient plc

- Aisin Corporation

- Brose Fahrzeugteile GmbH & Co. KG

- Continental AG

- Faurecia S.E.

- Grammer AG

- Johnson Electric Holdings Limited

- Kongsberg Automotive Holding ASA

- Lear Corporation

- Leggett & Platt Inc.

- Magna International Inc.

- Nidec Corporation

- Robert Bosch GmbH

- Toyota Boshoku Corporation

- TS Tech Co., Ltd.

Proposing Strategic Actions and Operational Best Practices to Capitalize on Emerging Opportunities in Automotive Seat Actuation Systems

Industry leaders can capitalize on evolving market dynamics by embracing a multipronged strategic approach. First, investing in advanced R&D to refine actuator efficiency and integrate smart sensors will unlock new personalization capabilities, catering to consumer demand for seamless and adaptive seating experiences. Coupling these technological advances with collaborative development models alongside OEM partners will ensure alignment with vehicle architecture roadmaps and reduce integration timelines.

Second, diversifying the supplier base through nearshoring and multi-regional manufacturing hubs can mitigate tariff-related risks and enhance supply chain resilience. Establishing flexible production lines capable of accommodating both high-volume and low-volume runs will enable rapid response to shifting regional demand patterns, while also supporting just-in-time delivery models.

Third, adopting lean principles and digital manufacturing techniques, such as additive manufacturing for prototyping and small-batch actuator production, will accelerate innovation cycles and lower production costs. Companies should also explore strategic partnerships with software developers to integrate predictive maintenance and diagnostics into seat actuation systems, delivering enhanced lifecycle value to end customers.

Finally, aligning product roadmaps with sustainability objectives-through the use of recyclable materials, energy-efficient components, and end-of-life recovery initiatives-will resonate with regulators and eco-conscious consumers, strengthening brand reputation in an increasingly competitive marketplace.

Detailing Rigorous Research Methods and Validation Techniques Employed to Ensure Robust Insights in the Automotive Seat Actuation Study

This study harnessed a blend of comprehensive secondary research and targeted primary engagements to deliver robust insights into the automotive seat actuation sector. Secondary research encompassed the review of industry white papers, regulatory publications, OEM technical specifications, and patent filings to map evolving technology trajectories and regulatory landscapes. Concurrently, financial statements and supply chain reports from leading component suppliers provided visibility into investment patterns and production footprints.

Primary research involved structured interviews with key stakeholders, including OEM seating engineers, tier one systems integrators, and aftermarket distributors. These dialogues yielded qualitative perspectives on development priorities, cost drivers, and future innovation plans. Data triangulation techniques were applied to reconcile quantitative inputs from financial analyses with qualitative insights, ensuring balanced and validated conclusions.

Throughout the process, methodological rigor was maintained via iterative consultation with domain experts and cross-validation against publicly disclosed case studies. This approach ensured that findings not only reflect current market realities, but also anticipate emerging trends and stress-test strategic assumptions under varying regulatory and economic scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Seat Actuation System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Seat Actuation System Market, by Actuation Type

- Automotive Seat Actuation System Market, by Vehicle Type

- Automotive Seat Actuation System Market, by Seat Position

- Automotive Seat Actuation System Market, by Actuator Technology

- Automotive Seat Actuation System Market, by Sales Channel

- Automotive Seat Actuation System Market, by Region

- Automotive Seat Actuation System Market, by Group

- Automotive Seat Actuation System Market, by Country

- United States Automotive Seat Actuation System Market

- China Automotive Seat Actuation System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing Conclusions on Key Findings and Highlighting the Imperative for Innovation and Collaboration in Seat Actuation System Development

In synthesizing the study’s findings, it becomes evident that the automotive seat actuation market stands at the nexus of mechanical innovation, electronic integration, and user-centric design. The convergence of electrification, autonomous mobility imperatives, and sustainability targets has elevated seat actuation from a purely functional component to a strategic differentiator. As tariffs and trade policy continue to shape global sourcing decisions, manufacturers and suppliers that adapt through nearshoring and design optimization will emerge with competitive advantages.

Key segmentation and regional insights highlight the importance of tailoring solutions to distinct use cases-from high-end memory seating in passenger vehicles to rugged manual systems in commercial fleets. Leading companies distinguish themselves through collaborative R&D, agile manufacturing footprints, and investments in digital platforms that enhance product lifecycles. These collective dynamics underscore a pivotal moment for stakeholders to embrace cross-functional collaboration and invest in next-generation actuator technologies.

By aligning strategic action plans with validated market insights and rigorous research methodologies, industry participants can navigate uncertainties, capitalize on emerging opportunities, and shape the future of automotive seat actuation systems.

Drive Strategic Growth in Automotive Seat Actuation by Securing Comprehensive Insights in This Exclusive Market Analysis Report

Unlock unparalleled access to in-depth analysis and strategic perspectives by liaising with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive market research report designed to inform key decisions and drive competitive advantage in the evolving automotive seat actuation domain

- How big is the Automotive Seat Actuation System Market?

- What is the Automotive Seat Actuation System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?