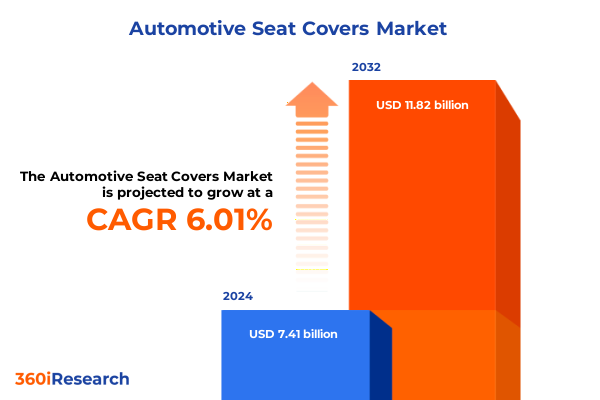

The Automotive Seat Covers Market size was estimated at USD 7.83 billion in 2025 and expected to reach USD 8.29 billion in 2026, at a CAGR of 6.05% to reach USD 11.82 billion by 2032.

Exploring the Evolution and Significance of Automotive Seat Covers in Today’s Vehicle Interiors and Consumer Preferences

The automotive seat cover market has undergone a remarkable evolution, transforming from a purely protective accessory to a critical element of interior design and passenger comfort. As vehicle interiors become more refined, seat covers have transcended their original functional role and emerged as a key differentiator within highly competitive markets. Consumer demand has shifted toward premium materials, enhanced ergonomics, and technologically advanced features that elevate driving experiences and reflect personal taste.

In recent years, trends such as customization and sustainability have converged with the broader automotive industry’s commitment to superior quality and environmental responsibility. Seat covers now incorporate eco-friendly fabrics, recyclable synthetics, and innovative manufacturing methods that reduce waste. Simultaneously, aesthetic customization options-from bespoke stitching patterns to a palette of colors-allow automakers and aftermarket suppliers to cater to niche segments and lifestyle aspirations with precision.

As automotive manufacturers continue to integrate advanced features into seating systems, including heating, cooling, and massage functionalities, the seat cover segment is poised at the nexus of comfort and technology. This shift underscores the growing importance of cross-disciplinary collaboration between material scientists, interior designers, and engineering teams. Consequently, stakeholders across the value chain are dedicating greater resources to research and development, ensuring that the next generation of seat covers consistently exceeds consumer expectations.

Uncovering the Major Transformative Shifts Driving Innovation and Disruption in the Automotive Seat Cover Market Landscape

The landscape of automotive seat covers is rapidly transforming under the influence of several converging forces that redefine materials, manufacturing processes, and consumer priorities. Advancements in smart textiles have ushered in seat covers capable of monitoring physiological signals, integrating seamlessly with in-vehicle health monitoring systems. This convergence of automotive seating and wearable technology promises to elevate safety, comfort, and personalized user experiences through adaptive temperature control and real-time posture correction.

Parallel to the technological revolution, sustainability initiatives have spurred the adoption of bio-based fibers and recycled polymers in place of traditional leather and synthetic materials. As regulatory pressures and corporate social responsibility commitments intensify, manufacturers are investing in closed-loop production models that minimize carbon footprints and align with global decarbonization targets. These transformative shifts are reshaping supplier networks and compelling legacy players to innovate or risk obsolescence.

Moreover, the rise of direct-to-consumer sales channels and digital customization platforms has disrupted traditional distribution paradigms. Consumers now expect seamless online configurators, rapid lead times, and transparent sourcing information when selecting seat covers. This evolution has empowered smaller disruptors to capture niche markets while encouraging established brands to enhance their digital strategies, thereby driving a wave of competitive differentiation across the entire value chain.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on Raw Materials and Supply Chains for Seat Cover Production

The implementation of heightened United States tariffs on key raw materials and components in 2025 has exerted significant pressures across the automotive seat cover supply chain. Imported leather hides, high-performance fabrics, and specialized foams have experienced increased landed costs, prompting manufacturers to reevaluate sourcing strategies. To mitigate margin erosion, many suppliers have accelerated efforts to diversify their upstream partnerships and identify tariff-exempt or lower-duty alternatives from emerging markets.

This tariff-driven readjustment has also catalyzed a resurgence of domestic production capabilities, with new investments flowing into local tanning and textile facilities. While onshoring raw material processing enhances supply chain resilience, it also requires substantial capital expenditure and time to achieve the quality standards long established in traditional production hubs. Nevertheless, the strategic imperative to reduce exposure to trade uncertainties has become a defining feature of corporate risk management in this sector.

In parallel, seat cover manufacturers have leveraged vertically integrated models to reclaim greater control over material inputs and production workflows. By internalizing critical stages such as foam lamination and surface finishing, companies can optimize cost structures and improve responsiveness to design iterations. This holistic approach fosters closer collaboration between R&D, procurement, and manufacturing teams, ultimately preserving product quality and accelerating time-to-market in a tariff-challenged environment.

Delivering In-Depth Segmentation Insights Across Material Type Fit Type Distribution Channels Vehicle Types and Technology Applications

A nuanced understanding of market segmentation reveals the multifaceted nature of the automotive seat cover industry. When examining material type, the spectrum spans traditional fabric offerings through premium leather, neoprene variants designed for rugged durability, and synthetic leather engineered to mimic natural hides while supporting sustainability goals. Each material class presents distinct advantages, whether cost efficiency, aesthetic appeal, or performance under extreme conditions, driving targeted product development.

Fit type segmentation delineates the market into OEM-fit solutions that conform precisely to specific vehicle models and universal-fit options that promise cross-compatibility and streamlined aftermarket inventory management. OEM-fit products cater to consumers seeking factory-grade integration, whereas universal-fit designs appeal to cost-conscious buyers and small fleet operators requiring flexibility. Distribution strategies vary accordingly, with OEM channels focusing on direct partnerships with automakers and aftermarket players leveraging retail networks, online platforms, and specialty upholstery shops.

Vehicle type segmentation further refines strategic priorities as seat cover requirements diverge between heavy commercial vehicles-encompassing buses and trucks-light commercial vehicles such as pickups and vans, and passenger vehicles including hatchbacks, sedans, and SUVs. Each vehicle segment imposes unique durability, aesthetic, and functionality imperatives. Technological segmentation overlays this structure, categorizing products into heated, massage-enhanced, ventilated, and standard variants, reflecting the rising consumer appetite for comfort and wellness features in both premium and mass-market tiers.

This comprehensive research report categorizes the Automotive Seat Covers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Vehicle Type

- Technology

- Fabric

- Distribution Channel

- End User

Highlighting Key Regional Dynamics Shaping Demand Trends and Growth Opportunities in the Americas EMEA and Asia-Pacific Automotive Seat Cover Markets

The Americas region demonstrates a robust appetite for customized and premium seat cover solutions, driven by high vehicle ownership rates and a cultural emphasis on personalization. North American consumers, in particular, have embraced advanced textile treatments and comfort-enhancing features as standard considerations, encouraging suppliers to expand local design centers and co-development programs with leading automakers. Latin American markets are progressively aligning with these trends, although price sensitivity remains more pronounced and sustains demand for universal-fit and synthetic alternatives.

In Europe, the Middle East, and Africa, regulatory frameworks and safety standards heavily influence product portfolios. European legislators’ stringent emissions and waste reduction targets have accelerated the adoption of recycled and bio-derived materials in seat covers. Meanwhile, consumers across the Gulf Cooperation Council emphasize luxury and bespoke craftsmanship, supporting a niche ecosystem of artisanal upholstery providers. In Sub-Saharan Africa, emerging vehicle fleets rely on hardy and cost-effective seat covers capable of withstanding harsh environmental conditions, spurring demand for neoprene and heavy-duty fabric solutions.

Asia-Pacific markets embody a spectrum of maturity levels, from established automotive powerhouses in Japan and South Korea to rapidly expanding volumes in India and Southeast Asia. In advanced markets, automakers integrate seat cover innovations as part of broader connected vehicle ecosystems, embedding heating, ventilation, and monitoring sensors. Conversely, Southeast Asian and Indian manufacturers prioritize affordability and scalable manufacturing. This diversity incentivizes global suppliers to adopt flexible footprint models, situating production near key automotive clusters while tailoring offerings to regional price and quality benchmarks.

This comprehensive research report examines key regions that drive the evolution of the Automotive Seat Covers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Competitive Landscape and Strategic Profiles of Leading Automotive Seat Cover Manufacturers and Innovators Driving Market Leadership

Leading players in the automotive seat cover space have adopted distinct strategies to cement their positions and outpace emerging competitors. Some firms focus on vertical integration, extending control over raw material procurement, processing, and assembly to secure cost advantages and safeguard quality consistency. Others have forged strategic alliances with technology startups, co-innovating smart textiles that embed sensors for temperature regulation, biometric monitoring, and seating diagnostics.

Product portfolio diversification has become a cornerstone for sustained competitiveness. Companies are broadening their offerings beyond conventional fabrics and leather by developing multifunctional seat covers that cater to wellness trends-incorporating massage functions and advanced ventilation systems. By showcasing these capabilities at major automotive exhibitions and design forums, they reinforce brand equity and stimulate interest among Tier 1 OEM partners.

Geographic expansion and targeted acquisitions further underscore the competitive landscape. Several manufacturers have pursued bolt-on acquisitions of niche upholstery specialists in key growth regions to secure immediate market access and local expertise. Others collaborate with major automakers on dedicated programs for electric vehicles, aligning seat cover innovations with broader sustainability and lightweighting initiatives. This dual focus on product and partnership excellence ensures they maintain leadership amid evolving consumer expectations and regulatory frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Seat Covers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Adient plc

- Asahi Kasei Corporation

- Bader GmbH & Co. KG

- BASF SE

- Bharat Seats Limited

- Continental AG

- Daimler Truck AG

- DK-SCHWEIZER LEATHER SDN BHD

- FORVIA SA

- Franz Kiel GmbH

- Freedman Seating Company

- Haartz Corporation

- Kuraray Co., Ltd.

- Lear Corporation

- Magna International Inc.

- NHK Spring Co., Ltd.

- Recticel S.A.

- Seiren Co., Ltd.

- TACHI-S ENGINEERING U.S.A. INC.

- The Dow Chemical Company

- Toyota Boshoku Corporation

- TS TECH Co., Ltd.

- VOGELSITZE GmbH

- Yanfeng Automotive Interiors Co., Ltd.

Formulating Actionable Recommendations for Industry Leaders to Navigate Transformative Trends and Strengthen Competitiveness in Seat Cover Sector

Industry leaders should prioritize a dual emphasis on innovation and operational agility to thrive amid shifting market dynamics. By investing in modular manufacturing platforms, companies can rapidly reconfigure production lines to accommodate new materials or technologies, reducing time-to-market for innovative seat cover designs. Integrating digital twins within these processes provides real-time insights into quality metrics and throughput, helping to preemptively address production bottlenecks.

Simultaneously, strengthening supplier relationships through long-term agreements and joint development initiatives can mitigate the volatility introduced by tariff fluctuations and material shortages. Collaborative frameworks enable mutual forecasting and co-investment in capacity expansions or process optimizations, fostering a more resilient and transparent supply chain. Leaders can also explore nearshoring critical operations to stabilize costs and cut transit times, while retaining the flexibility to pivot as geopolitical conditions evolve.

To capture evolving consumer preferences, embracing direct-to-consumer channels and immersive digital configurators will be essential. By harnessing data analytics and AI-driven recommendation engines, companies can tailor product suggestions to individual buyers, boosting average order values and fostering brand loyalty. Finally, a concerted focus on sustainability credentials-from renewable material certifications to circular economy programs-will differentiate forward-thinking suppliers in a market where environmental stewardship is increasingly non-negotiable.

Outlining Rigorous Research Methodology and Data Collection Approaches Employed to Ensure Comprehensive Analysis of Automotive Seat Cover Market

The research methodology underpinning this analysis combined rigorous primary and secondary data collection to ensure a comprehensive and unbiased perspective. Primary insights were gathered through in-depth interviews with supply chain executives, design engineers, and aftermarket specialists across North America, Europe, and Asia-Pacific, providing firsthand perspectives on evolving priorities and operational challenges.

Secondary research involved a systematic review of industry publications, regulatory archives, patent filings, and technical white papers. This phase mapped historical shifts in raw material processing, tariff histories, and emerging smart textile technologies. To validate findings, a panel of domain experts reviewed preliminary conclusions, offering critical feedback on segmentation relevance and regional differentiators.

Quantitative data was triangulated against trade statistics and publicly available corporate reports to establish trend consistency, though no proprietary market sizing or forecasting models were applied. The segmentation framework was then stress-tested across key geographies and application scenarios, ensuring that material type, fit type, distribution channel, vehicle category, and technology focus accurately capture the market’s multidimensional dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Seat Covers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Seat Covers Market, by Material Type

- Automotive Seat Covers Market, by Vehicle Type

- Automotive Seat Covers Market, by Technology

- Automotive Seat Covers Market, by Fabric

- Automotive Seat Covers Market, by Distribution Channel

- Automotive Seat Covers Market, by End User

- Automotive Seat Covers Market, by Region

- Automotive Seat Covers Market, by Group

- Automotive Seat Covers Market, by Country

- United States Automotive Seat Covers Market

- China Automotive Seat Covers Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Forward-Looking Perspectives to Illuminate Strategic Imperatives in the Evolving Automotive Seat Cover Domain

This analysis synthesizes a dynamic overview of the automotive seat cover landscape, emphasizing how technological advancements, regulatory influences, and evolving consumer expectations intersect to shape market trajectories. By examining critical segments-ranging from material innovations to advanced comfort technologies-it becomes evident that agility and strategic foresight are paramount for stakeholders aiming to capitalize on emerging opportunities.

The forward-looking perspective underscores the strategic imperative to balance cost efficiencies with premium value propositions, particularly in the wake of tariff-driven supply chain realignments. Firms that proactively diversify their material sources, foster digital engagement channels, and refine product portfolios will be best positioned to navigate competitive pressures and regulatory shifts. Moreover, a continued focus on sustainability and wellness integrations will resonate with end users and reinforce brand differentiation.

Ultimately, the evolving seat cover domain offers a fertile ground for innovation and growth. As vehicles become increasingly connected and autonomous, seating systems will transcend traditional roles, presenting new frontiers for integrated technologies, ergonomic excellence, and personalized comfort. Stakeholders who synthesize these insights into cohesive strategic initiatives will secure a competitive edge and drive long-term value creation.

Encouraging Industry Stakeholders to Engage with Expert Analysis and Secure Comprehensive Automotive Seat Cover Insights through Personalized Consultation

Interested industry professionals and decision-makers seeking comprehensive insights into the automotive seat cover market are encouraged to engage directly with Ketan Rohom, Associate Director, Sales & Marketing, for a personalized consultation. His deep knowledge of market dynamics and tailored research solutions will ensure you extract maximum value from the report. Through a one-on-one discussion, Ketan can address your specific requirements, uncover niche opportunities, and provide strategic guidance aligned with your organizational goals. Don’t miss the chance to leverage expert perspectives and secure critical competitive intelligence that drives informed decision-making and stimulates long-term growth across the automotive seat cover landscape.

- How big is the Automotive Seat Covers Market?

- What is the Automotive Seat Covers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?