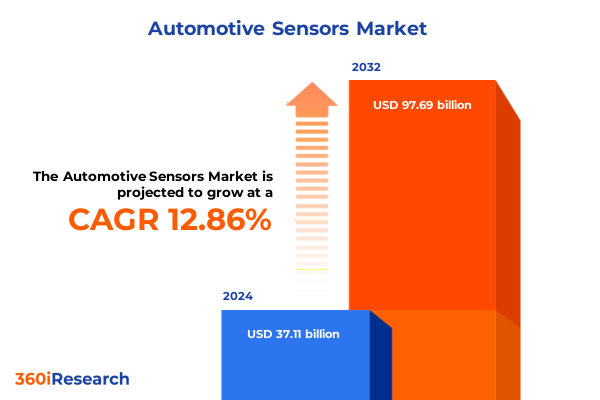

The Automotive Sensors Market size was estimated at USD 41.66 billion in 2025 and expected to reach USD 46.83 billion in 2026, at a CAGR of 12.94% to reach USD 97.69 billion by 2032.

Igniting Insight into the Automotive Sensor Ecosystem through Foundational Market Forces and Emerging Technological Drivers

The automotive sensors sector stands at the cusp of unprecedented transformation, characterized by a convergence of advanced materials, intelligent algorithms, and robust connectivity frameworks. As vehicle architectures evolve from mechanical assemblies to complex cyber-physical systems, sensors have emerged as the essential enablers of safety, efficiency, and user experience. This introduction provides a cohesive overview of the foundational drivers shaping sensor adoption, the key market dynamics at play, and the strategic focal points for industry stakeholders.

The convergence of electrification, autonomy, and shared mobility models is exerting immense pressure on traditional supply chains and design paradigms. Electrification mandates higher precision in thermal management, battery monitoring, and powertrain optimization, while autonomy relies on a fusion of radar, ultrasonic, and position sensing modalities to navigate complex traffic environments. Concurrently, the rise of subscription-based and ride-hailing services demands sensors capable of delivering consistent performance under intensive utilization rates. This introduction articulates how these intersecting trends establish the baseline for subsequent sections by highlighting critical strategic imperatives and emerging opportunity vectors.

Harnessing Next-Generation Sensor Architectures Powered by AI, Advanced Semiconductors, and Interoperable Connectivity Protocols

The automotive sensor landscape is undergoing transformative shifts driven by the integration of artificial intelligence, the miniaturization of semiconductor components, and the proliferation of vehicle-to-everything communication networks. Traditionally reliant on discrete sensing modules, modern sensor platforms are now incorporating machine learning algorithms at the edge, enabling contextual awareness and adaptive calibration without centralized processing overhead.

At the same time, the semiconductor supply chain is being reshaped by new fabrication techniques such as gallium nitride and silicon carbide devices, which offer superior thermal performance and higher voltage thresholds compared to legacy silicon-based systems. This technological pivot translates into more robust pressure, temperature, and gas sensors that can withstand the harsh operating conditions of electric powertrains and high-efficiency combustion engines. Moreover, the development of standardized V2X (vehicle-to-everything) protocols is fostering interoperability among radar, LiDAR, and ultrasonic arrays, thereby accelerating the adoption of advanced driver assistance features across disparate vehicle platforms.

These developments are not isolated; rather, they converge to form a new generation of sensor solutions that deliver higher data fidelity, lower latency, and greater resilience. As a result, automotive OEMs and tier-one suppliers are recalibrating product roadmaps to capitalize on intelligent sensing architectures that align with stringent global safety regulations and evolving consumer expectations.

Navigating Elevated Input Costs and Supply Chain Realignment under the 2025 United States Tariff Framework

In 2025, the cumulative impact of United States tariffs has introduced both challenges and strategic inflection points for the automotive sensor supply network. Tariffs on imported semiconductor wafers, molded cavity packages, and specialized alloy components have elevated input costs, prompting tier-one suppliers to reexamine sourcing strategies. The immediate ripple effects manifested as extended lead times, elevated working capital requirements, and renegotiations of long-term supply contracts.

To mitigate cost pressures, many manufacturers have accelerated the localization of assembly and testing facilities, leveraging favorable state-level incentives and retooling existing automotive clusters. This shift toward near-shore and on-shore production not only hedges against tariff volatility but also fosters closer collaboration between R&D centers and manufacturing lines. While the upfront capital expenditures increased, the long-term benefits include streamlined logistics, reduced currency risk, and enhanced responsiveness to fluctuating demand patterns.

Furthermore, the tariff environment has incentivized investments in alternative materials research, such as drift-resistant alloys for pressure sensors and advanced polymer coatings for ultrasonic modules. These material innovations hold the promise of both superior performance and reduced dependency on constrained import channels. As the tariff regime continues to evolve, stakeholders who proactively diversify their supplier base and internalize critical manufacturing processes are poised to gain a sustainable competitive advantage.

Uncovering Multi-Dimensional Automotive Sensor Segmentation Insights Informing Product Roadmaps and Market Positioning Strategies

Insight into automotive sensor segmentation reveals that Sensor Type influences product development cycles, with gas sensing materials necessitating rigorous calibration protocols and position sensors demanding sub-micron accuracy. Pressure sensors, which operate under extreme thermal gradients, drive advanced housing designs, while radar and speed sensors require specialized firmware tailored to high-frequency signal processing. Temperature sensors, essential for both powertrain management and climate control, rely on nanotechnology-enabled thin films to achieve rapid response times. Ultrasonic sensors, primarily deployed for parking and proximity detection, integrate digital signal processing to filter ambient noise and enhance object recognition.

Application segmentation underscores that chassis monitoring systems benefit from distributed sensor networks, whereas driver assistance and automation modules demand real-time data fusion. Exhaust systems now incorporate gas sensors for emissions control, and powertrain management leverages temperature and pressure sensing for enhanced efficiency and reliability. Safety and control systems integrate multiple sensor modalities to support airbag deployment algorithms, while telematics units centralize position and speed data for fleet analytics. Vehicle body electronics innovate through distributed temperature sensing to maintain occupant comfort and reduce energy consumption.

Vehicle type segmentation differentiates between the rugged demands of heavy commercial platforms, which require reinforced housings and extended calibration lifecycles, and passenger cars that prioritize miniaturization and weight optimization. Within commercial vehicles, the contrast between heavy and light platforms influences sensor topology, with heavy vehicles often adopting redundant arrays for mission-critical monitoring. End-use segmentation shows that aftermarket installations focus on retrofit compatibility and ease of integration, whereas original equipment manufacturers emphasize design-for-manufacturability and stringent qualification standards. Sales channel segmentation illustrates that offline dealerships offer bundled sensor packages with installation services, while online platforms cater to OEMs and fleet operators seeking rapid procurement and volume discounts.

This comprehensive research report categorizes the Automotive Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Application

- Vehicle Type

- End-Use

- Sales Channel

Revealing Regional Dynamics and Ecosystem Strengths Shaping Automotive Sensor Development across the Americas, EMEA, and Asia-Pacific

Key regional insights demonstrate that the Americas region is leveraging robust automotive ecosystems in the United States, Canada, and Mexico to drive sensor innovation through collaborative R&D partnerships and manufacturing clusters. In the United States, strong incentives for electrification and advanced safety programs have accelerated the adoption of radar and ultrasonic modules. Canada’s proximity to semiconductor fabrication hubs facilitates rapid prototyping, while Mexico’s evolving automotive manufacturing corridors provide cost advantages for large-volume sensor production.

In Europe, Middle East & Africa, stringent emissions regulations and advanced driver assistance system mandates have catalyzed demand for gas, pressure, and position sensors. Germany and France lead in integrating sensor arrays for autonomous vehicle testing, while deployed V2X infrastructure in the Nordics informs real-world validation. Meanwhile, investment in smart city initiatives across the Middle East is fuelling the deployment of telematics and environmental sensing solutions for public transport fleets. Africa remains an emerging landscape, with sensor adoption driven by aftermarket retrofits to enhance safety in commercial logistics.

The Asia-Pacific region continues to dominate manufacturing capacity, with China’s wafer fabrication expansion and Japan’s precision component expertise underpinning global sensor supply. South Korea’s semiconductor prowess enables advanced MEMS sensor designs, while India’s burgeoning automotive market is fostering local assembly hubs. Southeast Asia is emerging as a strategic low-cost manufacturing alternative, driving high-volume deployment of speed and temperature sensors for two- and four-wheeled platforms. This regional mosaic underscores the imperative for tailored go-to-market approaches based on regulatory frameworks, local ecosystem maturity, and industrial policies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Automotive Sensor Providers and Disruptive Innovators Shaping the Competitive and Collaborative Ecosystem

The competitive landscape of automotive sensor providers is defined by a dynamic interplay of legacy conglomerates, specialized MEMS innovators, and emerging technology startups. Established players maintain dominance through vertically integrated portfolios that span sensor design, fabrication, and tier-one assembly. Their extensive global footprint and long-standing OEM relationships grant them preferential access to collaborative development programs and joint quality audits.

Conversely, nimble entrants are carving out niche positions by pioneering novel sensing materials, such as graphene-enhanced pressure films and photonic‐based gas detection arrays. These companies often engage in strategic partnerships with semiconductor foundries to accelerate time-to-market, leveraging cloud-enabled analytics platforms to offer predictive maintenance services. Their focused approach allows rapid iteration of prototypes and customized firmware, thereby addressing specific OEM applications like micro-mobility devices or heavy-duty off-road equipment.

In parallel, technology consortiums and standardization bodies are shaping market entry requirements by defining interoperability protocols, calibration benchmarks, and cybersecurity guidelines. Collaborative ventures between tier-one suppliers and research institutions are fueling joint development agreements for next-generation sensor fusion platforms. As a result, the industry’s innovation ecosystem is evolving into a synergistic network where incumbents and startups co-create advanced sensor architectures to meet evolving functional safety and performance specifications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allegro MicroSystems, LLC

- Analog Devices, Inc.

- Aptiv PLC

- BorgWarner Inc.

- Continental AG

- CTS Corporation

- DENSO Corporation

- HELLA GmbH & Co. KGaA

- Hitachi Astemo Ltd.

- Honeywell International Inc.

- Hyundai Mobis Co. Ltd.

- Infineon Technologies AG

- Magna International Inc.

- Murata Manufacturing Co. Ltd.

- NXP Semiconductors N.V.

- onsemi

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- STMicroelectronics N.V.

- TDK Corporation

- TE Connectivity Ltd.

- Texas Instruments Incorporated

- Valeo SA

- ZF Friedrichshafen AG

Implementing Proactive Innovation, Supply Chain Resilience, and Regionally Customized Go-To-Market Frameworks to Elevate Market Leadership

Industry leaders should adopt a proactive innovation agenda that prioritizes partnerships with semiconductor foundries and research institutes to co-develop high-performance sensor materials and advanced packaging techniques. Embracing digital twins for virtual calibration and leveraging cloud-based analytics will enable real-time performance monitoring, predictive maintenance solutions, and continuous firmware upgrades. By establishing cross-functional centers of excellence, organizations can streamline the integration of radar, ultrasonic, and position sensing modalities into cohesive driver assistance systems that adapt to evolving regulatory mandates.

Simultaneously, supply chain resilience must be reinforced through dual-sourcing strategies, near-shoring of critical components, and the deployment of blockchain-enabled traceability platforms. These measures will reduce exposure to tariff fluctuations, minimize inventory holding costs, and enhance transparency in component provenance. Additionally, embedding sustainability metrics within sensor design processes-such as using recyclable materials and optimizing energy consumption-will align product roadmaps with global decarbonization goals.

Finally, tailored go-to-market models that reflect the nuances of regional ecosystems will be essential. Whether through localized manufacturing partnerships in Mexico, collaborative testing facilities in Germany, or digital procurement platforms in Asia, businesses must calibrate their strategies to regional regulatory landscapes and customer preferences. A holistic approach that integrates technological innovation, supply chain agility, and market-specific tactics will position sensor providers to unlock new revenue streams and reinforce competitive differentiation.

Outlining Multi-Method Research Protocols Integrating Primary Expert Interviews, Secondary Data Triangulation, and Rigorous Validation Standards

This research employs a multi-method approach combining primary interviews with tier-one procurement executives, sensor R&D leaders, and regulatory agency representatives, alongside secondary data from industry whitepapers, patent filings, and open-source technical journals. Qualitative insights derived from expert consultations are supplemented by quantitative analysis of import/export records, trade-policy documentation, and regional incentive programs. Data points have been triangulated across multiple sources to ensure consistency and reliability.

The segmentation framework incorporates sensor type, application domain, vehicle classification, end-use channels, and distribution pathways, ensuring a granular understanding of market dynamics without reliance on aggregated sizing or forecasting. Regional analysis synthesizes policy reviews, trade agreements, and manufacturing capacity assessments to elucidate comparative strengths across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Competitive mapping leverages patent analytics, partnership announcements, and public financial disclosures to chart the innovation landscape and identify potential disruptors. Supply chain impact assessment includes scenario planning around tariff changes, localized production models, and material substitution initiatives. Throughout the methodology, rigorous validation protocols-such as peer-reviewed sampling, cross-regional expert panels, and iterative quality checks-ensure that insights are both robust and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Sensors Market, by Sensor Type

- Automotive Sensors Market, by Application

- Automotive Sensors Market, by Vehicle Type

- Automotive Sensors Market, by End-Use

- Automotive Sensors Market, by Sales Channel

- Automotive Sensors Market, by Region

- Automotive Sensors Market, by Group

- Automotive Sensors Market, by Country

- United States Automotive Sensors Market

- China Automotive Sensors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Strategic Imperatives and Segmentation-Based Approaches to Navigate the Evolving Automotive Sensor Environment

The automotive sensor domain is rapidly evolving, driven by the convergence of advanced sensing materials, edge intelligence, and resilient supply chains. Stakeholders who align their R&D investments with emerging semiconductor technologies and AI-enabled signal processing will be best positioned to meet escalating safety and efficiency requirements. Supply chain strategies that emphasize localization, dual sourcing, and traceability will mitigate geopolitical and tariff‐related risks.

Meanwhile, segmentation insights underscore the necessity of tailoring product architectures to distinct vehicle platforms, application requirements, and channel structures. Regional dynamics further necessitate customized approaches, as regulatory regimes and ecosystem maturities vary across the Americas, EMEA, and Asia-Pacific. Competitive differentiation will increasingly hinge on collaborative innovation models, where incumbents and startups coalesce around standardized protocols and shared R&D consortia.

Ultimately, success in the automotive sensor market will depend on the ability to synthesize technological breakthroughs, supply chain resilience, and market-specific go-to-market strategies. The recommendations and data within this report provide a strategic blueprint for executives seeking to navigate complex regulatory environments, capitalize on emerging opportunities, and deliver sensor solutions that drive the next era of mobility innovation.

Discover Personalized Market Roadmaps and Strategic Guidance by Connecting with Ketan Rohom to Unlock the Full Potential of Automotive Sensor Intelligence

To explore how your organization can harness the intelligence within this report to drive product roadmaps, refine go-to-market strategies, and stay ahead of evolving regulations, contact Associate Director of Sales & Marketing, Ketan Rohom. He will guide you through tailored insights, address your unique business challenges, and facilitate access to comprehensive data, benchmarking tools, and expert analysis. Unlock the full potential of the automotive sensor market today and partner with an authority in advanced sensor research to power the next wave of innovation.

- How big is the Automotive Sensors Market?

- What is the Automotive Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?