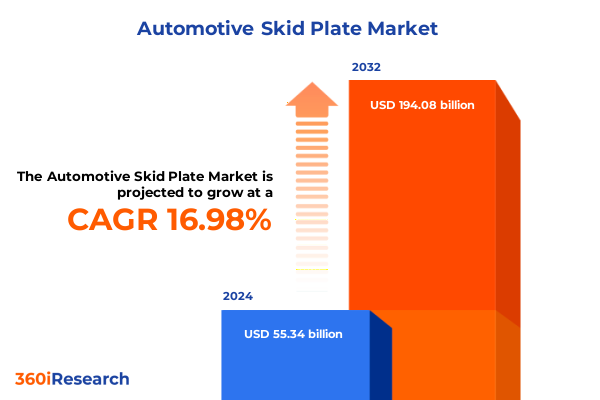

The Automotive Skid Plate Market size was estimated at USD 64.46 billion in 2025 and expected to reach USD 75.09 billion in 2026, at a CAGR of 17.05% to reach USD 194.08 billion by 2032.

Revolutionizing Underbody Defense: A Comprehensive Overview of Emerging Trends and Strategic Importance in the Automotive Skid Plate Industry

The automotive skid plate market has emerged as a critical area of focus for manufacturers and operators aiming to enhance vehicle reliability and performance in increasingly demanding environments. Underbody protection systems are no longer optional accessories; they have become essential components that safeguard powertrain, fuel tanks, and transmission units from impact, corrosion, and debris. As off-road recreational activities and commercial applications expand, end users are seeking durability enhancements that extend service intervals, reduce maintenance costs, and enable uncompromised operational readiness.

Against this backdrop, industry participants are deploying advanced engineering techniques and novel material combinations to meet stringent safety regulations and consumer expectations. The convergence of global efforts to reduce vehicle weight, increase fuel economy, and improve off-highway capabilities has propelled skid plates beyond steel stamping into the realm of high-performance composites and multi-material hybrids. At the same time, original equipment manufacturers are exploring integration strategies that streamline assembly processes while optimizing structural rigidity.

As the market navigates rapid electrification trends and evolving trade policies, stakeholders require a cohesive overview of emerging dynamics. This introduction establishes the context for a comprehensive investigation into transformative shifts in material science, tariff influences on supply chains, segmentation-driven demand patterns, and region-specific growth drivers that collectively define the future trajectory of underbody protection solutions.

Navigating the Future of Underbody Protection Amidst Electrification, Material Breakthroughs and Evolving Regulatory Dynamics

Over the last decade, the automotive skid plate landscape has undergone profound transformations driven by electrification, lightweighting imperatives, and the pursuit of enhanced vehicle versatility. Electrified powertrains, with their distinct packaging architectures and thermal management requirements, have introduced new challenges for underbody protection design. Engineers must now balance electromagnetic shielding needs with heat dissipation networks, prompting the rise of hybrid material assemblies that combine conductive metallic layers with thermally stable composites.

Concurrently, weight reduction targets adopted by regulators and OEMs have sparked a shift away from traditional stamped steel skid plates toward aluminum and advanced composite alternatives. High-strength aluminum alloys deliver corrosion resistance and formability advantages, while carbon fiber and fiberglass composites provide superior energy absorption at a fraction of the mass. The integration of these materials demands novel attachment mechanisms, adhesive systems, and modular configurations, underscoring a wave of product innovation across the sector.

Furthermore, regulatory frameworks emphasizing vehicle safety and emissions compliance are reshaping consumption patterns. Off-road and commercial operators are increasingly mandating skid plate certification to meet industry-specific standards, while aftermarket providers are embracing digital platforms to offer tailored retrofit solutions. These converging forces have elevated underbody protection from a peripheral accessory to a strategic differentiator in both OEM lineups and aftermarket portfolios, setting the stage for sustained innovation and growth.

Assessing the Heightened Impact of 2025 United States Steel and Aluminum Tariffs on Automotive Underbody Shield Supply Chains

The ongoing United States tariffs on steel and aluminum, originally enacted under Section 232, continue to resonate through the automotive skid plate supply chain in 2025. Elevated duties on imported raw materials have amplified sourcing costs for both OEM and aftermarket manufacturers, compelling many to re-evaluate global procurement strategies. Domestic producers have ramped capacity and prioritized contracts with tier 1 suppliers to mitigate exposure, yet capacity constraints and lead time volatility persist.

Amid these headwinds, a growing number of manufacturers are diversifying their material portfolios. The cost pressures associated with imported metallic plates have accelerated the adoption of aluminum extrusions and composite laminates, which are subject to lower or no tariffs and offer performance benefits. At the same time, manufacturers are negotiating direct agreements with mills and composite fabricators, locking in multi-year pricing and delivery commitments to insulate against future tariff escalations.

Despite these adaptive strategies, residual impacts such as slightly elevated production costs and elongated supply cycles remain. Some aftermarket specialists have responded by localizing secondary fabrication and assembly operations, effectively shortening logistics corridors. Looking forward, the ability to navigate the complexities of tariff policy, while leveraging material innovation to offset cost burdens, will be a defining capability for competitive leadership in the underbody protection market.

Decoding Market Dynamics Through Detailed Vehicle Type, Advanced Material, Distribution Channel and Application Segmentation Insights for Strategic Clarity

A thorough analysis of vehicle type segmentation reveals that heavy commercial vehicles demand robust skid plates engineered to withstand frequent exposure to rugged terrains and heavy loads. Light commercial vehicles, balancing payload capacity with fuel efficiency, are driving development of modular plate systems that can be customized for diverse vocational applications. Passenger vehicle applications encompass both conventional internal combustion platforms and electric drivetrains, each presenting unique packaging constraints; electric models in particular require skid plates that integrate cooling channel compatibility and underbody sensor protection.

Material segmentation underscores a clear migration from traditional steel toward aluminum, composite, and plastic substrates. Aluminum plates offer a compelling compromise between structural strength and weight reduction, while composite solutions-ranging from carbon fiber laminates to fiberglass matrices-deliver enhanced energy absorption and corrosion immunity that meet the demands of high-end and off-road specialty markets. Plastic polymers, reinforced with proprietary fillers, are increasingly deployed in light-duty contexts where cost sensitivity and assembly speed take precedence.

In evaluating sales channels, aftermarket distributors and OEM partnerships each play pivotal roles. Offline distributors continue to serve established repair networks through regional warehouses and technical training, whereas online platforms are leveraging digital configurators and rapid delivery models to capture growth among tech-savvy consumers. Lastly, application-based segmentation spanning engine protection, fuel tank shielding, and transmission safeguarding highlights the importance of tailored engineering approaches, as each functional domain entails distinct loading profiles, serviceability requirements, and thermal management considerations.

This comprehensive research report categorizes the Automotive Skid Plate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Material

- Sales Channel

- Application

Unveiling Regional Growth Drivers in the Americas, Europe Middle East & Africa and Asia-Pacific Underbody Protection Markets

In the Americas, a mature automotive ecosystem underpinned by extensive highway networks and a strong off-road culture sustains robust demand for skid plates across both OEM and retrofit channels. Regulatory focus on vehicle safety ratings and off-road vehicle standards in the United States has elevated product specifications, prompting continuous innovation in materials and fastening technologies. Canada’s commercial fleet sector further contributes to regional growth, particularly among operators seeking maintenance cost reductions through enhanced underbody protection.

Turning to Europe, Middle East & Africa, diverse market maturity levels shape regional dynamics. Western European markets operate under stringent homologation requirements and have shown early adoption of composite solutions, while emerging markets in the Middle East leverage skid plates as critical safeguards against harsh environmental conditions and unpaved terrain. In Africa, aftermarket retrofit demand is driven by fleet owners in mining, agriculture, and construction, underscoring the need for durable, easily replaceable plate systems.

Asia-Pacific exhibits the fastest growth trajectory, fueled by expanding automotive manufacturing hubs, rising disposable incomes, and government incentives promoting electric vehicle adoption. Countries such as China and India have witnessed a surge in off-road SUV sales, spurring both OEMs and local aftermarket specialists to introduce competitively priced aluminum and polymer-based skid plate offerings. Southeast Asian regions, characterized by varied road quality and monsoon conditions, display growing acceptance of underbody shields as a preventive maintenance measure.

This comprehensive research report examines key regions that drive the evolution of the Automotive Skid Plate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry-Leading Innovators Shaping the Future of Automotive Underbody Defense Through Strategic Partnerships and Technological Advancements

Leading original equipment suppliers and specialized aftermarket innovators are shaping the competitive landscape of the automotive skid plate market. Tier 1 manufacturers are forging strategic collaborations with automakers to integrate underbody protection as a standard feature on off-road and utility-focused vehicle lines, thereby enhancing durability credentials and reducing warranty exposure. Concurrently, boutique engineering firms are capitalizing on niche segments by developing carbon fiber and hybrid composite plates tailored for performance SUV and premium pickup applications.

In the aftermarket sphere, established distribution networks and emerging e-commerce platforms are differentiating through value-added services such as custom fittings, 3D-printed templates, and installation kits optimized for DIY enthusiasts. This has intensified competition as companies vie to offer the fastest lead times and most comprehensive technical support across North America and Western Europe. Strategic acquisitions and licensing agreements are further consolidating market share, with larger players seeking to augment their product portfolios through targeted purchases of innovative startups.

Looking ahead, technology convergence-encompassing digital design, lightweight material science, and enhanced corrosion-proof coatings-will underscore the next wave of competitive advantage. Companies that successfully blend supply chain resilience, material diversification, and OEM integration will emerge as the most influential voices in defining the direction of underbody defense solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Skid Plate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- All-Pro Offroad

- ARB Corporation Ltd.

- Artec Industries, LLC

- BudBuilt

- Dorman Products, Inc.

- EVO Manufacturing

- Fabtech Motorsports, LLC

- Foshan Tanghan Precision Metal Products Co.,Ltd.

- Guangzhou Dongsui Auto Accessories & Spare Parts Co., Ltd.

- HeftyFabworks

- Henan LiChen Aluminum Co., Ltd.

- Ironman 4WD Pty Ltd

- Rhino-Rack Pty Ltd

- RIVAL4x4, LLC

- Road Armor, LLC

- Rough Country, Inc.

- TJM Australia Pty Ltd

- UnderCover, LLC

Strategic Imperatives and Actionable Roadmap for Industry Leaders to Capitalize on Emerging Opportunities in the Skid Plate Segment

Industry leaders seeking to capture untapped demand and fortify market position should prioritize investments in advanced composite research, focusing on hybrid laminates that deliver superior energy absorption with minimal weight gain. By establishing joint development agreements with material science institutes and leveraging additive manufacturing for rapid prototyping, organizations can accelerate time-to-market for next-generation skid plates designed for electric and autonomous vehicle platforms.

Furthermore, cultivating direct-to-consumer online channels will enable companies to harness data analytics and digital configurators, thereby tailoring underbody protection packages to individual vehicle specifications and usage profiles. Enhancing digital customer engagement through virtual reality installation previews and predictive maintenance notifications can differentiate offerings in a crowded aftermarket environment. At the same time, reinforcing relationships with tier 1 automotive OEMs through co-engineering programs will align product roadmaps with future vehicle architectures.

Finally, supply chain optimization must address the persistent challenges of tariff-induced cost volatility. Diversifying raw material sourcing, securing multi-year supply agreements for key composites and aluminum alloys, and exploring nearshoring opportunities will reduce lead time risk and cost fluctuations. Taken together, these strategic imperatives form an actionable roadmap for driving sustainable growth and maintaining competitive advantage in the dynamic automotive skid plate market.

Illuminating the Rigorous Research Framework and Analytical Techniques Underpinning the Automotive Skid Plate Market Study

This study employs a blend of primary and secondary research methodologies to ensure comprehensive coverage of the automotive skid plate market. Primary research involved structured interviews with senior executives from original equipment manufacturers, tier 1 suppliers, aftermarket distributors, and material fabricators. Insights from these conversations informed qualitative assessments of product innovation trends, procurement strategies, and distribution channel evolution.

Secondary research drew upon a broad spectrum of credible sources, including trade association publications, technical white papers, patent filings, and regulatory filings related to underbody protection standards. Proprietary databases were leveraged to map competitive landscapes, track M&A activity, and analyze material cost trajectories over time. Detailed case studies highlighted regional initiatives and OEM programs that have successfully integrated skid plates into standard vehicle offerings.

Analytical techniques included cross-segmentation analysis across vehicle type, material composition, sales channel, and application domains, enabling nuanced exploration of demand patterns. A triangulation approach was applied to reconcile qualitative insights with quantitative supply chain data, ensuring the final recommendations rest on a robust evidentiary foundation. This rigorous research framework provides stakeholders with actionable intelligence to guide strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Skid Plate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Skid Plate Market, by Vehicle Type

- Automotive Skid Plate Market, by Material

- Automotive Skid Plate Market, by Sales Channel

- Automotive Skid Plate Market, by Application

- Automotive Skid Plate Market, by Region

- Automotive Skid Plate Market, by Group

- Automotive Skid Plate Market, by Country

- United States Automotive Skid Plate Market

- China Automotive Skid Plate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Chart a Forward-Looking Vision for Sustainable Growth and Innovation in Underbody Protection

The convergence of electrification, stringent safety regulations, and evolving trade policies has redefined the competitive parameters of the automotive skid plate market. Material innovation continues to drive differentiation, with hybrid composite solutions carving out a distinct niche alongside lighter aluminum alternatives. Segmentation analysis underscores the importance of aligning product design with vehicle type requirements, from heavy-duty commercial fleets to precision-engineered electric passenger models.

Regional insights reveal a mature Americas market buoyed by off-road culture and regulatory incentives, a diverse EMEA landscape shaped by homologation mandates and aftermarket retrofit demand, and a high-growth Asia-Pacific arena driven by manufacturing expansion and electric vehicle adoption. Leading companies are responding through strategic partnerships, technology acquisitions, and channel diversification, positioning underbody protection as a key asset in total cost of ownership optimization.

Looking forward, the ability to navigate tariff-induced cost pressures while scaling material research and enhancing digital customer engagement will determine market leadership. Stakeholders equipped with a clear understanding of segmentation nuances, regional drivers, and emerging innovation pathways will be best placed to capture growth. These synthesized insights chart a forward-looking vision for sustained advancement in underbody defense solutions.

Secure Your Competitive Advantage Today by Engaging with Ketan Rohom to Access the Comprehensive Automotive Skid Plate Market Research Report

To gain an in-depth understanding of the competitive landscape, material trends, and regulatory implications shaping the automotive skid plate market, we invite you to secure your copy of the complete research report. Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, ensures you receive tailored insights, priority access to proprietary analysis, and expert guidance on leveraging this intelligence for strategic decision-making. Reach out today to transform your market approach and stay ahead of evolving industry dynamics.

- How big is the Automotive Skid Plate Market?

- What is the Automotive Skid Plate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?