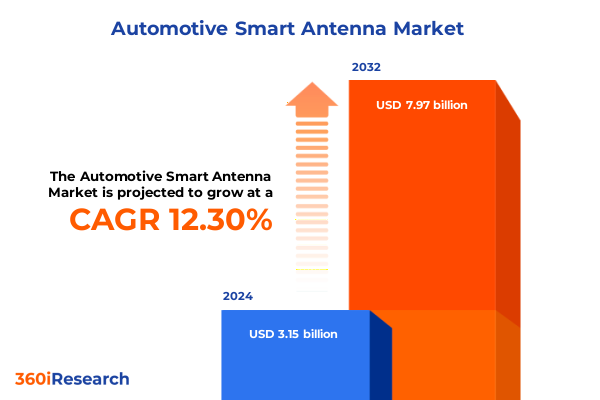

The Automotive Smart Antenna Market size was estimated at USD 3.51 billion in 2025 and expected to reach USD 3.92 billion in 2026, at a CAGR of 12.40% to reach USD 7.97 billion by 2032.

Exploring the Crucial Role of Automotive Smart Antennas in Shaping Next-Generation Connected Mobility and Vehicle Communication Ecosystems

Automotive smart antennas have emerged as indispensable enablers of modern vehicle connectivity, consolidating multiple communication functions into streamlined, high-performance modules. These systems integrate cellular, satellite navigation, Wi-Fi, and digital radio connectivity within a single compact package, reducing wiring complexity and improving signal integrity. By combining advanced electronics with precision-engineered antenna elements, smart antennas overcome the design constraints of traditional solutions, delivering robust performance under diverse driving conditions and across vehicle segments.

Beyond mere signal reception, smart antennas also facilitate critical safety and infotainment applications, supporting advanced driver-assistance systems and seamless in-vehicle entertainment experiences. These antennas play a vital role in enabling radar, V2X, and telematics functions, feeding real-time data to onboard processors and external infrastructure. As a result, they form the backbone of connected mobility initiatives, driving innovation in urban transportation, autonomous driving research, and next-generation telematics services.

Examining the Transformative Forces Redefining the Automotive Smart Antenna Landscape Amid Industry-Wide Technological and Market Convergence

The automotive smart antenna industry is undergoing a profound metamorphosis as vehicles embrace electrification, autonomy, and ubiquitous connectivity. No longer standalone accessories, smart antennas now intertwine with electronic control units, sensor arrays, and software-defined architectures. This convergence has spurred an industry-wide push toward multifunctional designs, advanced beamforming techniques, and embedded software-defined radio capabilities. The fusion of antenna systems with radar and LiDAR sensors has further accelerated innovation, enabling seamless integration of safety and communication functionalities within a single housing.

Simultaneously, market dynamics have shifted toward strategic collaborations between antenna suppliers, semiconductor firms, and telecommunication providers. Tier-one automotive OEMs are forging partnerships to co-develop in-vehicle 5G and V2X connectivity platforms, while research consortia explore the application of AI for adaptive signal processing and enhanced cybersecurity. These alliances reflect a broader trend toward ecosystem-driven development, where shared standards and cross-industry cooperation define the roadmap for next-generation smart antenna solutions.

Assessing the Comprehensive Effects of the 2025 United States Section 232 Tariffs on Automotive Smart Antenna Supply Chains and Cost Structures

In early 2025, the United States invoked Section 232 of the Trade Expansion Act to impose a blanket 25 percent tariff on imported passenger vehicles and light trucks, followed by a subsequent imposition of the same rate on key automotive parts such as electronic control units, transceivers, and wiring components. These measures, aimed at safeguarding domestic automotive production, have introduced significant cost pressures across global supply chains. Antenna modules, which rely on high-precision connectors, advanced electronics, and specialized materials, have been particularly affected by the elevated import duties on components and finished assemblies.

According to industry analyses, the phased implementation beginning in April 2025 for vehicles and May 2025 for components has prompted automakers and tier-one suppliers to re-evaluate sourcing strategies and accelerate local production initiatives. While some manufacturers explore offset agreements and USMCA certification processes to mitigate tariff exposure, others have begun shifting critical assembly operations closer to end markets. As a result, smart antenna suppliers face increased complexity in cost modeling, contract negotiations, and logistics, necessitating agile responses to evolving trade policies and potential regulatory revisions.

Uncovering In-Depth Segmentation Perspectives Across Antenna Types, Components, Frequencies, Applications, Vehicle Classes, and Sales Channels

Analyzing the market through the lens of antenna type reveals that embedded rooftop solutions, fixed rod designs, and shark-fin modules each serve distinct vehicle architectures and price tiers. Embedded variants excel in premium applications where aerodynamic efficiency and hidden installation are paramount, while rod antennas continue to deliver cost-effective solutions for commercial fleets. Shark-fin configurations, offering multi-band integration and aesthetic versatility, have become ubiquitous in passenger vehicles seeking to balance form and function.

Turning to component analysis, the interplay between connectors, digital bus interfaces, electronic control units, transceivers, and wiring harnesses underscores the system’s complexity. Robust connector technologies ensure signal fidelity across harsh environments, whereas advanced digital bus protocols enable high-speed data transfer between the antenna unit and the vehicle’s central computing platform. Electronic control units must handle dynamic frequency management, beamforming adjustments, and real-time diagnostics, while transceivers and harness assemblies tie these elements together into cohesive modules.

Frequency considerations further differentiate solution strategies, with high-frequency bands providing dedicated channels for emerging 5G and V2X applications, ultra-high frequencies facilitating satellite navigation and telematics, and very-high frequencies securing legacy cellular and AM/FM radio services. Designers must balance antenna footprint, gain requirements, and interference mitigation across these bands, often employing multi-layer substrates and adaptive matching networks.

From an application standpoint, automotive smart antennas underpin advanced driver-assistance systems, infotainment services, navigation and telematics, remote diagnostics platforms, and vehicle-to-everything communication networks. Each use case demands tailored performance criteria, whether ultra-low latency for autonomous maneuvers, high throughput for streaming media, or robust security for over-the-air firmware updates. This application diversity drives segment-specific design pathways and testing protocols.

Vehicle type also shapes antenna requirements, as commercial vehicles prioritize durability and extended-range communications for fleet management, electric vehicles integrate antennas within emerging battery housing designs to optimize aerodynamics, and passenger vehicles emphasize seamless user experiences and multi-protocol support. Meanwhile, the dual pathways of aftermarket upgrades and original equipment manufacturing channels influence distribution strategies, quality standards, and lifecycle support offerings, reflecting the unique commercialization models within the automotive ecosystem.

This comprehensive research report categorizes the Automotive Smart Antenna market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Antenna Type

- Component Type

- Frequency

- Application

- Vehicle Type

- Sales Channel

Revealing Regional Dynamics and Connectivity Infrastructure Variations Across Americas, Europe Middle East & Africa, and Asia-Pacific Zones

North America’s automotive landscape, driven by advanced transportation initiatives and robust telecommunication infrastructure, has seen smart antenna adoption accelerate, particularly in connected insights and autonomous research programs. OEMs and suppliers are investing in localized production to navigate recent trade measures, while network operators expand 5G coverage to support real-time V2X deployments and remote diagnostics platforms. As a result, the region’s supply chain continues to evolve, balancing cost efficiencies with performance requirements.

In Europe, the Middle East, and Africa, stringent regulatory frameworks around vehicle safety and emissions have fueled demand for antennas that support advanced driver-assistance systems and over-the-air software updates. Manufacturers in these markets prioritize interoperability and compliance with regional telematics standards, while European automakers explore offset agreements to offset tariff impacts. Strategic partnerships between antenna developers and automotive OEMs have become commonplace, enabling co-innovation across multiple vehicle programs.

Across Asia-Pacific, government-led smart city initiatives and rapid 5G rollouts have created fertile ground for smart antenna integration. Automotive OEMs headquartered in Japan and South Korea collaborate closely with domestic antenna suppliers to co-develop high-frequency, multi-protocol modules, while Chinese manufacturers leverage strong local production ecosystems to drive scale. Emerging Southeast Asian markets likewise pursue regional harmonization of telematics regulations, fostering cross-border collaboration and expanding commercialization pathways.

This comprehensive research report examines key regions that drive the evolution of the Automotive Smart Antenna market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players Driving Automotive Smart Antenna Innovation Through Strategic Investments, Collaborations, and Technological Leadership

Leading industry players are differentiating through targeted R&D investments, strategic alliances, and expanded manufacturing footprints. Continental AG’s focus on multi-band, high-gain modules positions it at the forefront of 5G-enabled vehicle programs, while Denso leverages its expertise in V2X and sensor integration to address autonomous driving applications. TE Connectivity’s strength in ruggedized connectors and digital bus interfaces underpins its market leadership in global OEM programs.

Kathrein Automotive’s reputation for RF system performance and reliability has made it a go-to partner for premium and luxury models, while Harman International integrates smart antennas seamlessly into infotainment platforms, emphasizing aesthetic design and user experience. European supplier Ficosa Group targets diverse applications from ADAS to telematics, underscoring a balanced portfolio approach. German electronics specialist Hella GmbH & Co. KGaA focuses on next-generation beamforming and cybersecurity features, securing its role in safety-critical systems. Meanwhile, Robert Bosch GmbH continues to refine compact, multi-band antennas that support electric and autonomous vehicle architectures, and Laird Connectivity advances miniaturization for cost-sensitive segments. Japanese firm YOKOWO drives innovation in adaptive matching networks and substrate materials, reinforcing its presence in passenger and commercial vehicle platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Smart Antenna market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airgain, Inc.

- Amphenol Corporation

- Antenova Limited by discoverIE Group plc

- Aptiv PLC

- Autotalks Ltd. by Qualcomm Incorporated

- Calearo Antenne SPA

- Continental AG

- Ficosa Internacional SA

- Harman International Industries, Inc. by Samsung Electronics Co., Ltd.

- Infineon Technologies AG

- Kyocera AVX Components Corporation

- LYNwave Technology Ltd.

- Molex LLC

- Murata Manufacturing Co., Ltd.

- NXP Semiconductors

- Siemens AG

- STMicroelectronics N.V.

- Taoglas Limited

- TDK Corporation

- TE Connectivity, Ltd.

- Telefonaktiebolaget LM Ericsson

- World Products Inc.

- Yageo Corporation

- Yokowo Co., Ltd.

- Zhejiang JC Antenna Co., Ltd

Implementing Actionable Strategies to Enhance Competitiveness, Mitigate Trade Disruptions, and Accelerate Innovation in Smart Antenna Development

Industry leaders should prioritize strategic investments in software-defined antenna architectures that support dynamic frequency management and over-the-air reconfiguration, ensuring readiness for evolving connectivity protocols. Forming alliances with telecommunication operators and semiconductor vendors can accelerate integration timelines and leverage shared R&D resources. Moreover, diversification of supply chains through regional manufacturing hubs will help mitigate exposure to trade actions, while at the same time reducing lead times and logistics costs associated with global sourcing strategies.

Further, incorporating rigorous cybersecurity frameworks within antenna control units will be essential as vehicles become more interconnected. Adopting industry standards for secure bootstrapping, encryption, and intrusion detection will protect critical communication pathways against emerging threats. Finally, embedding sustainability principles-from eco-friendly materials selection to end-of-life recyclability-will address evolving regulatory and consumer expectations, strengthening brand reputation and supporting long-term innovation roadmaps.

Detailing a Comprehensive Research Framework Incorporating Primary Interviews, Secondary Sources, and Rigorous Data Triangulation for Market Integrity

This research leverages an integrated approach combining primary interviews with senior executives at automotive suppliers, OEM connectivity leads, and technology partners, supplemented by secondary data from regulatory databases, patent filings, and corporate disclosures. Following data collection, triangulation techniques validate insights, reconciling qualitative perspectives with documented trends.

Market segmentation analysis is underpinned by a comprehensive review of antenna architectures, component technologies, frequency allocations, and application case studies. Regional assessments draw upon trade statistics, telecommunications deployment maps, and policy frameworks. Key company profiles are developed through direct engagement, financial disclosures, and patent activity monitoring, ensuring balanced coverage of innovation drivers and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Smart Antenna market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Smart Antenna Market, by Antenna Type

- Automotive Smart Antenna Market, by Component Type

- Automotive Smart Antenna Market, by Frequency

- Automotive Smart Antenna Market, by Application

- Automotive Smart Antenna Market, by Vehicle Type

- Automotive Smart Antenna Market, by Sales Channel

- Automotive Smart Antenna Market, by Region

- Automotive Smart Antenna Market, by Group

- Automotive Smart Antenna Market, by Country

- United States Automotive Smart Antenna Market

- China Automotive Smart Antenna Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Consolidating Insights on Technological Trends, Market Drivers, and Strategic Imperatives to Outline the Path Forward for Smart Antenna Evolution

Throughout this analysis, the convergence of connectivity, autonomy, and electrification emerges as the defining force shaping automotive smart antenna evolution. Technological advancements in beamforming, material science, and software-defined functionality are expanding antenna capabilities, enabling seamless integration across vehicle systems. Concurrently, regulatory and trade environments are driving reshoring initiatives and localized production, reshaping global supply chains.

Looking ahead, the ability to adapt rapidly to new spectrum allocations, cybersecurity imperative, and sustainability mandates will determine leadership in this dynamic landscape. By aligning R&D, manufacturing, and strategic partnerships with these imperatives, industry stakeholders can unlock new value streams and guide the next wave of innovation in connected and autonomous mobility.

Contact Ketan Rohom to Secure Your In-Depth Automotive Smart Antenna Market Research Report and Unlock Competitive Insights Today

To explore in greater depth the advancements and applications of automotive smart antennas, we encourage you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise can provide direct access to the comprehensive research report, delivering key findings, proprietary data, and strategic analysis that will empower your organization to capitalize on evolving connectivity trends and gain a competitive edge.

- How big is the Automotive Smart Antenna Market?

- What is the Automotive Smart Antenna Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?