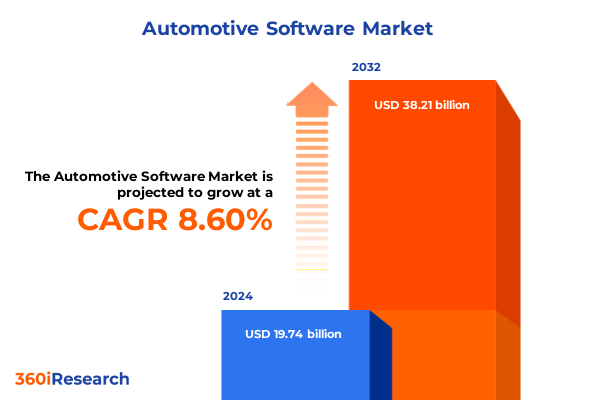

The Automotive Software Market size was estimated at USD 21.38 billion in 2025 and expected to reach USD 23.15 billion in 2026, at a CAGR of 8.64% to reach USD 38.21 billion by 2032.

Pioneering the Future of Automotive Software: Navigating Emerging Trends and Strategic Imperatives Transforming Mobility Solutions

The automotive industry is undergoing a profound transformation as vehicles shift from purely mechanical entities to complex, software-driven platforms. Innovation cycles have accelerated, and software has become the primary mechanism for delivering new capabilities, enhancing safety, and differentiating brands. In this landscape, automotive software encompasses a vast spectrum of functionalities-from foundational operating system components and middleware layers to advanced application software that powers infotainment, telematics, and autonomous driving features.

The convergence of electrification, connectivity, and autonomy has created an imperative for OEMs and suppliers to develop integrated software ecosystems that can adapt to evolving consumer expectations, regulatory requirements, and competitive pressures. As vehicles become increasingly software-defined, over-the-air updates and modular architectures are emerging as essential enablers of continuous improvement and rapid feature deployment. This trend elevates the importance of robust software development practices, cybersecurity frameworks, and scalable deployment models that ensure both innovation velocity and operational reliability.

Within this context, stakeholders must navigate a complex interplay of technological advances, strategic partnerships, and evolving business models. From licensing and subscription services to data monetization and cloud-native solutions, automotive software is redefining how value is created and captured across the mobility ecosystem. This introduction sets the stage for a deeper exploration of the transformative shifts, tariff impacts, segmentation nuances, regional dynamics, and strategic recommendations that underpin the future of automotive software market success.

Accelerated Disruption and Innovation in Automotive Software: How Connectivity, Autonomous Features, and AI Architectures Are Redefining Mobility Experiences

The automotive software landscape has experienced an unprecedented acceleration of innovation driven by three core forces: ubiquitous connectivity, advanced autonomy, and intelligent data analytics. Connectivity solutions now extend beyond basic telematics to encompass real-time vehicle-to-everything communication, enabling dynamic traffic management, predictive maintenance, and personalized in-vehicle experiences. This pervasive interconnectivity demands sophisticated middleware platforms capable of orchestrating high-volume data flows between vehicles, cloud services, and edge computing nodes.

Simultaneously, the integration of artificial intelligence and machine learning into autonomous driving systems has transformed the way vehicles sense, interpret, and respond to their surroundings. Sensor fusion techniques that combine radar, LiDAR, and camera data rely on highly optimized application software and operating systems to ensure deterministic performance and safety compliance. As automakers and technology partners pursue higher levels of autonomy, software architectures are evolving toward modular, microservices-based frameworks that facilitate scalability, functional safety, and rapid innovation.

Moreover, the shift from hardware-centric models to software-defined vehicle architectures has unlocked new revenue streams through subscription services, feature activation, and digital ecosystems. Over-the-air update capabilities enable continuous enhancement of vehicle functionalities, while robust cybersecurity measures protect against emerging threats. Together, these transformative shifts are redefining mobility experiences and establishing software as the key differentiator in the race for competitive advantage within the automotive sector.

Assessing the Expanding Influence of 2025 U.S. Trade Policies on Automotive Software Development, Supply Chain Dynamics, and Industry Resilience Strategies

The cumulative effect of United States trade policies in 2025 has introduced significant cost pressures and operational complexities for the automotive software value chain. A recent analysis highlighted that ongoing tariff-related uncertainty contributed to combined sector losses estimated between $6.6 billion and $7.8 billion within a single week. Industry leaders such as General Motors have projected tariff impacts totaling up to $5 billion for 2025, acknowledging that nearly half of their domestic vehicle sales rely on imports subject to these levies.

These increased costs are not only affecting hardware components but also inflating expenses associated with software integration and development. The imposition of higher duties on critical semiconductor imports has led to procurement challenges and price volatility, compelling OEMs to reassess global sourcing strategies. As a result, automakers and technology partners are redirecting investments toward domestic R&D centers and exploring dual-sourcing arrangements to mitigate exposure. At the same time, elevated compliance requirements are extending validation cycles for new software modules, further delaying time-to-market and straining development budgets.

Beyond supply chain disruptions, the tariff environment has influenced R&D allocation, with firms prioritizing essential feature rollouts and deferring less critical innovations. A recent report by an industry research division noted that while initial cost burdens appear incremental at the unit level, their aggregate impact can substantially erode margins and delay the deployment of advanced driver assistance systems and software-defined functionality. Organizations that proactively respond by renegotiating supplier contracts, optimizing logistics protocols, and investing in localized software platforms will be better positioned to navigate these trade-related headwinds.

Unveiling Deep Segmentation Perspectives in Automotive Software: Software Types, Propulsion Systems, Vehicle Classes, Deployment Modes, and Application Domains Shaping Software Solutions

The software landscape for vehicles can be dissected through a lens of five distinct segmentation dimensions. When evaluating software type, application software modules are differentiated by their user-facing functionality, middleware provides the critical translation layer between applications and hardware, and operating system software serves as the foundational layer that governs resource management and real-time performance.

In terms of propulsion type, electric vehicles demand sophisticated energy management and battery optimization algorithms, while internal combustion engine applications rely on legacy engine control units and powertrain software. For vehicle type segmentation, commercial vehicles often prioritize fleet management, predictive maintenance, and telematics, whereas passenger vehicle software focuses on infotainment, user interface design, and personalized connectivity features.

Deployment mode segmentation delineates the choice between cloud-based solutions that offer scalable analytics and remote update capabilities versus on-premises architectures that provide greater control over data locality and latency-sensitive operations. Finally, application segmentation covers a spectrum of use cases: advanced driver assistance systems and safety-critical software, engine management and powertrain control, infotainment and user experience platforms, on-board diagnostic and maintenance utilities, telematics and navigation services, and vehicle-to-everything communication frameworks. These segmentation insights form the cornerstone for understanding nuanced market dynamics and guiding targeted strategy development.

This comprehensive research report categorizes the Automotive Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Software Type

- Software Layer

- Propulsion Type

- Vehicle Type

- Deployment Mode

- End-User

Exploring Regional Dynamics Shaping Automotive Software Adoption in the Americas, EMEA, and Asia Pacific for Informed Strategic Planning

Regional market dynamics in automotive software exhibit pronounced distinctions driven by regulatory environments, infrastructural maturity, and consumer preferences. In the Americas, advanced telematics adoption and rapidly expanding electric vehicle charging networks have catalyzed demand for cloud-integrated software services. North American regulatory frameworks emphasize data privacy and cybersecurity standards, influencing software design and certification requirements across both OEMs and suppliers.

Over in Europe, Middle East & Africa, stringent safety regulations and evolving emissions standards have accelerated investment in ADAS and engine management solutions. This region’s complex patchwork of data sovereignty laws encourages hybrid deployment models, wherein critical safety and compliance functions remain on-premises, while user-centric applications leverage cloud capabilities. The convergence of EU-wide digital policy initiatives and the rise of connected infrastructure projects in the Middle East are shaping a diverse software ecosystem with pronounced opportunities for interoperability and cross-border collaboration.

In the Asia-Pacific, the proliferation of domestic OEMs and tier one suppliers is driving rapid growth in integrated software platforms. Strong government support for EV adoption in China, Japan, and South Korea has fostered robust R&D ecosystems for battery management, over-the-air updates, and vehicle-to-everything communication standards. This region’s emphasis on digital consumer services has also spearheaded innovations in infotainment and telematics, creating compelling case studies for global software integration strategies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Landscape and Innovation Drivers Among Leading Automotive Software Companies to Uncover Strategic Differentiators and Growth Levers

Leading automotive software companies are defining the competitive landscape through differentiated technology portfolios and strategic partnerships. OEMs with integrated software development centers have gained an edge by aligning hardware and software roadmaps, enabling seamless over-the-air updates and advanced feature rollouts. Meanwhile, pure-play software vendors are specializing in operating systems, AI-enabled perception stacks, and secure connectivity modules that can be licensed across multiple vehicle platforms.

Collaborative alliances between chip manufacturers, software integrators, and tier one suppliers have emerged as a critical model for managing complexity and ensuring end-to-end system integrity. These partnerships enable shared investments in R&D, accelerate certification processes, and foster the development of open standards that promote interoperability. Companies investing in open-architecture frameworks are better positioned to leverage a broader ecosystem of independent software developers and technology innovators.

Innovation leadership also derives from platform scalability and cybersecurity robustness. Organizations that implement modular, service-oriented architectures can deploy new features iteratively, maintain rigorous security update cycles, and optimize hardware utilization. As cybersecurity threats evolve, firms that demonstrate proactive vulnerability management and compliance with emerging regulatory mandates will solidify their reputational advantage and mitigate operational risks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- BlackBerry Limited

- BorgWarner

- Continental AG

- Denso Corporation

- ELEKS Holding OÜ.

- Green Hills Software LLC, by

- Infineon Technologies AG

- Intellias LLC

- KPIT Technologies Ltd

- LeddarTech Holdings Inc.

- N-iX Ltd

- Nvidia Corporation

- NXP Semiconductors N.V.

- Panasonic Automotive Systems Co., Ltd.

- Renesas Electronics Corporation

- Robert Bosch GmbH

- SAP SE

- SCSK Corporation by Sumitomo Corporation

- Siemens AG

- Sigma Software

- Synopsys, Inc.

- Tata Technologies Ltd.

- Texas Instruments Incorporated

- Tietoevry Corporation

- Valeo SE

- Waymo LLC by Alphabet Inc.

- ZF Friedrichshafen AG

Formulating Actionable Recommendations for Automotive Software Executives to Enhance Innovation Velocity, Fortify Supply Chains, and Elevate User Experience

To navigate the challenges and opportunities within the automotive software domain, industry leaders should prioritize the adoption of modular development frameworks that facilitate rapid feature deployment and minimize integration bottlenecks. Fostering strong relationships with semiconductor suppliers and investing in dual-sourcing strategies will mitigate exposure to trade-induced disruptions and enhance supply chain resilience.

Executives are advised to integrate advanced analytics into their development pipelines, leveraging real-world vehicle data to inform predictive maintenance algorithms and user behavior modeling. Embedding cybersecurity by design-including secure boot processes, encrypted communication channels, and continuous vulnerability assessments-will be essential for maintaining consumer trust and regulatory compliance.

Furthermore, articulating a clear monetization strategy for software-enabled services can unlock recurring revenue streams. This should be complemented by agile go-to-market approaches that combine pilot deployments with scalable, cloud-based distribution. By aligning internal capabilities with external partnership ecosystems-ranging from cloud providers to independent software vendors-organizations can accelerate innovation cycles and secure a sustainable competitive advantage.

Detailing Robust Research Methodology Integrating Secondary Data Reviews, Expert Consultations, Rigorous Validation, and Continuous Quality Assurance Measures

This research employed a structured approach combining in-depth secondary data review with primary insights gathered through consultations with industry experts, senior executives at OEMs, tier one suppliers, and leading software integrators. The secondary phase encompassed comprehensive literature analysis of regulatory filings, patent databases, and public financial disclosures, ensuring a robust understanding of current market dynamics.

Primary research interviews were conducted using a standardized questionnaire to capture qualitative perspectives on technology adoption, strategic priorities, and perceived barriers to growth. Data triangulation techniques were applied to validate findings across multiple sources and reconcile any discrepancies. Rigorous quality assurance protocols-including peer reviews and statistical confidence checks-were implemented to guarantee the accuracy and reliability of insights.

This multi-layered methodology underpins the credibility of the report’s conclusions and recommendations, offering stakeholders a transparent view of the processes that shaped the analysis. The integration of continuous feedback loops further ensures that the research remains responsive to emerging trends and evolving market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Software Market, by Software Type

- Automotive Software Market, by Software Layer

- Automotive Software Market, by Propulsion Type

- Automotive Software Market, by Vehicle Type

- Automotive Software Market, by Deployment Mode

- Automotive Software Market, by End-User

- Automotive Software Market, by Region

- Automotive Software Market, by Group

- Automotive Software Market, by Country

- United States Automotive Software Market

- China Automotive Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesizing Crucial Findings to Empower Strategic Decision Making and Foster Agile Collaborations in the Evolving Landscape of Automotive Software Solutions

The convergence of software-defined vehicle architectures, advanced connectivity, and AI-driven functionalities is reshaping the competitive fabric of the automotive sector. Key insights reveal that modular software platforms, over-the-air update capabilities, and cybersecurity preparedness have become non-negotiable prerequisites for market leadership. The imposition of 2025 U.S. tariffs has highlighted the strategic necessity of supply chain diversification and localized development efforts to safeguard margins and minimize time-to-market delays.

Segment-specific analysis underscores the importance of tailoring software solutions to distinct categories-application software, middleware, and operating systems-while aligning product roadmaps with propulsion types, vehicle segments, deployment modes, and application domains. Regional dynamics further illustrate that regulatory frameworks and infrastructure maturity will influence adoption trajectories, necessitating customized go-to-market strategies and partnership models.

Ultimately, organizations that harmonize agile development practices with strategic partnerships, data-driven decision making, and a proactive stance on regulatory and trade-related risks will be best positioned to capitalize on the burgeoning opportunities within the automotive software landscape. This synthesis of critical findings provides a clear roadmap for stakeholders seeking to drive transformative growth and outpace competitors in a rapidly evolving market.

Connect with Associate Director Ketan Rohom to Secure Exclusive Access to Comprehensive Market Intelligence and Drive Your Automotive Software Strategy Today

The depth of insight provided in this market research report underscores the critical role of timely, strategic intelligence in navigating the rapidly evolving automotive software ecosystem. By engaging directly with Associate Director Ketan Rohom, organizations can obtain tailored guidance that aligns with their unique business objectives, leveraging the latest data and expert interpretations to drive decision making.

Through a consultative approach, prospective clients will gain clarity on emerging opportunities, potential risks, and the strategic imperatives necessary to remain competitive. This direct dialogue enables a nuanced understanding of the report’s findings and facilitates the development of actionable roadmaps that address both immediate challenges and long-term growth aspirations.

Contacting Ketan Rohom today ensures priority access to this comprehensive analysis, real-time updates, and customized support packages. Organizations will be poised to capitalize on early mover advantages in areas such as software-defined vehicle architectures, next-generation connectivity, and advanced driver assistance. Seize this opportunity to transform insights into impactful strategies and secure a leading edge in the automotive software market.

- How big is the Automotive Software Market?

- What is the Automotive Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?