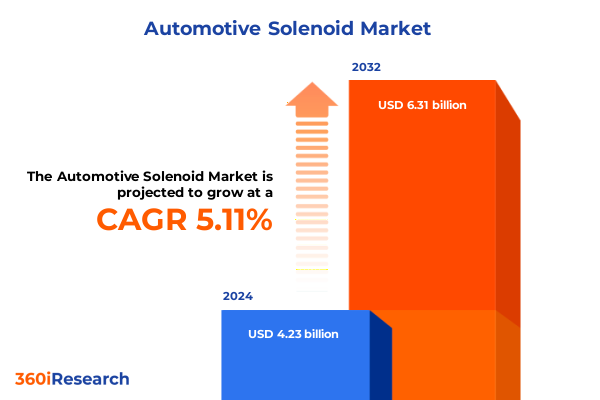

The Automotive Solenoid Market size was estimated at USD 4.42 billion in 2025 and expected to reach USD 4.62 billion in 2026, at a CAGR of 5.21% to reach USD 6.31 billion by 2032.

Understanding the Pivotal Role of Solenoids in Modern Vehicle Systems and the Forces Shaping Their Market Dynamics and Emerging Technological Trends

Solenoids serve as indispensable electromechanical actuators in modern vehicles, controlling fluid and gas flow in systems ranging from fuel injection to braking and transmission actuation. As vehicles evolve, the precision and reliability of these components underpin critical performance parameters, from emission control in internal combustion engines to thermal management in electric drivetrains. The rapid adoption of electric vehicles has created new demands for solenoid integration within battery cooling circuits, high-voltage interlock systems, and regenerative braking controls, underscoring their escalating strategic importance. Global sales of fully electric and plug-in hybrid vehicles rose by 25.6% year-on-year in 2024 to over 17 million units, representing more than 20% of new car sales and driving heightened demand for advanced solenoid solutions.

Concurrently, consumer expectations for enhanced safety and comfort have extended the role of solenoids into advanced driver assistance systems and cabin climate controls. Vehicle manufacturers are responding by expanding solenoid functionality to enable rapid valve actuation, adaptive flow control, and real-time self-diagnostics. This evolution in end-user requirements is coupled with intensified competition and shifting trade dynamics, as illustrated by Volkswagen’s 47% increase in battery electric vehicle deliveries in the first half of 2025 amid unresolved tariff uncertainties and Chinese automakers nearly doubling their share of the European market to 5.1% in H1 2025, reflecting the global market’s volatility and the impetus for continuous innovation among solenoid suppliers.

Examining the Technological and Market Inflections Driving the Evolution of Solenoid Applications Across Vehicle Electrification and Autonomy Transitions

The automotive landscape is undergoing a profound transformation as vehicles transition from purely mechanical systems to highly integrated electromechanical architectures. Traditional hydraulic and pneumatic actuators are increasingly being replaced by direct-acting, pilot-operated, and sophisticated proportional solenoids that provide variable control over fluid and gas flows. These advancements enable automakers to implement features such as variable valve timing, adaptive braking modulation, and electronic throttle control with unprecedented precision. With electric car sales exceeding 17 million in 2024 and accounting for over 20% of global car sales, solenoids have become essential for managing battery thermal systems, coolant flow, and high-voltage safety interlocks in electric and hybrid drivetrains.

Simultaneously, the rise of connected and autonomous vehicles is fueling demand for “smart” solenoid platforms equipped with onboard diagnostics, real-time monitoring, and remote actuation capabilities. As electric car sales are expected to surpass 20 million in 2025-over one-quarter of all new cars sold-OEMs and suppliers are investing heavily in solenoid innovations that support IoT integration and advanced driver assistance functions. These technological shifts are catalyzing the adoption of agile manufacturing techniques, including additive manufacturing for rapid prototyping and customization, to meet the escalating requirements for performance, reliability, and sustainability in solenoid production.

Assessing the Aggregate Effects of Recent U.S. Tariff Policies on Automotive Solenoid Supply Chains and Production Costs into 2025

The U.S. trade environment has become more complex with successive tariff measures impacting automotive parts and components. The United States Trade Representative’s final modifications to Section 301 tariffs increased duties on imported electric vehicles from 25% to 100% and raised tariffs on lithium-ion electric vehicle batteries to 25% effective September 27, 2024, with semiconductor-related components subject to 50% duties from January 1, 2025. These changes have directly raised input costs for solenoid manufacturers reliant on advanced power electronics and sensor modules for valve control.

Additionally, the Department of Commerce’s implementation of Section 232 tariffs has imposed a uniform 25% duty on imported auto parts, with a newly established quarterly petition process for domestic producers to request tariff inclusions beginning July 1, 2025. While a presidential executive order in April 2025 curtailed tariff stacking between steel, aluminum, and auto parts levies-offering temporary relief on layered duties-the baseline 25% tariff on imported automotive components remains, compelling manufacturers to reassess supply chain strategies and consider onshoring certain production activities to mitigate cost volatility.

Uncovering Critical Insights from Type, Distribution Channel, End User, and Application Segmentations for Strategic Market Positioning

The market for automotive solenoids can be dissected through multiple dimensions that reveal unique demand drivers and growth opportunities. Based on type, the landscape spans direct-acting, pilot-operated, and proportional solenoids, with direct-acting variants further differentiated into dual-coil and single-coil designs, each offering distinct trade-offs in actuation force and response time. This segmentation underscores the need for manufacturers to align product portfolios with specific system requirements, as dual-coil solenoids often serve high-force applications while single-coil devices suit space-constrained environments.

Distribution channels also play a pivotal role in market dynamics, with OEM partnerships driving integrated design and aftermarket channels supporting retrofit and repair demand. Meanwhile, end users span commercial vehicles-encompassing buses and trucks-off-road vehicles in agricultural and construction contexts, and passenger vehicles such as hatchbacks, sedans, and SUVs. Each category imposes divergent performance and durability criteria, from heavy-duty cycle requirements in commercial fleets to precision and comfort considerations in passenger cars. Finally, solenoids find application across braking systems (ABS and EBS), engines (fuel injection, starter, variable valve timing), fuel and emission controls, HVAC systems, and transmissions, illustrating the ubiquity of these components across vehicle subsystems and the importance of tailored solutions to meet sector-specific technical benchmarks.

This comprehensive research report categorizes the Automotive Solenoid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Distribution Channel

- End User

- Application

Analyzing Regional Market Dynamics and Growth Drivers Across the Americas, EMEA, and Asia-Pacific for Automotive Solenoid Adoption

Regional variations in automotive solenoid demand reflect divergent regulatory frameworks, economic conditions, and infrastructure investments. In the Americas, policy incentives such as the U.S. federal electric vehicle tax credit and Canada’s Clean Fuel Standard have stimulated demand for advanced solenoid-based systems, with electric car sales in the United States climbing to 1.6 million vehicles in 2024 and representing over 10% of new car registrations. This supportive environment is fostering R&D investment and opening opportunities for solenoid innovations tailored to electrified powertrains.

Across Europe, tightening CO₂ emission standards and evolving consumer preferences have driven battery electric vehicles to account for 17.4% of registrations in the first half of 2025 despite a 4.4% overall market contraction in June 2025. Automotive solenoid suppliers are thus refining solutions for emission control and transmission management in response to stringent EU regulatory mandates.

The Asia-Pacific region remains the largest contributor to global solenoid demand, led by China where electric vehicle sales exceeded 11 million in 2024-almost two-thirds of global electric car sales-and where supportive trade-in incentives and a maturing charging infrastructure continue to elevate solenoid usage in both conventional and electrified vehicles. Expanding automotive production in India, Southeast Asia, and Oceania further diversifies regional applications and encourages localization efforts by major suppliers.

This comprehensive research report examines key regions that drive the evolution of the Automotive Solenoid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Technological Developments by Leading Automotive Solenoid Suppliers Shaping the Industry's Competitive Landscape

Bosch continues to push the envelope with its power solutions portfolio, unveiling hydrogen injectors, compact fuel cell power modules, and next-generation thermal management systems at the ACT Expo 2025. These innovations highlight the company’s commitment to diversified powertrain strategies and underscore the evolving role of solenoids in both electric and hydrogen-powered applications.

Denso Corporation has set ambitious targets for its electrification business, aiming to generate approximately 1.2 trillion yen (equivalent to USD 7.97 billion) in revenue by the 2025 business year. The company plans to achieve this through expanded sales of inverters, thermal management units, and solenoid-based control systems, supported by significant investments in semiconductors and software engineering talent to meet escalating EV demand.

The broader shift toward electric and autonomous vehicles-with global EV sales up 25.6% in 2024 and robust gains in key markets-underscores the imperative for solenoid suppliers to integrate sensing, diagnostic, and connectivity features into their products. This collaborative trend between tier-one suppliers and OEMs is reshaping product roadmaps and competitive positioning across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Solenoid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd

- Aptiv PLC

- Continental AG

- Denso Corporation

- Emerson Electric Co.

- Hitachi Automotive Systems, Ltd

- Johnson Electric Holdings Limited

- Nidec Corporation

- Robert Bosch GmbH

- Sumitomo Electric Industries, Ltd

- Valeo SA

Delivering Tactical Recommendations for Automotive Solenoid Industry Leaders to Navigate Market Disruptions and Capitalize on Emerging Opportunities

Develop a resilient sourcing strategy that balances cost, quality, and geopolitical risk. By diversifying supply bases beyond traditional hubs and qualifying alternate suppliers-including domestic capabilities for critical components-organizations can mitigate the combined impact of Section 301 and Section 232 tariffs on semiconductor-enhanced solenoids.

Invest in the development of intelligent solenoid platforms featuring embedded sensors, self-diagnostic capabilities, and IoT connectivity to address the accelerating shift toward ADAS and electrification. Such enhancements will not only meet OEM demands for precision actuation but also open new service offerings around predictive maintenance and data-driven performance optimizations.

Engage proactively with U.S. policy processes to optimize cost structures. By submitting timely inclusion requests under the Department of Commerce’s quarterly auto parts tariff petition windows and participating in industry trade associations, leaders can influence tariff determinations and secure exemptions that improve competitiveness and support long-term supply chain stability.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity and Comprehensive Market Understanding for Solenoid Analysis

This research synthesis combines exhaustive secondary analysis of industry publications, government records, and reputable news sources with primary insights garnered through expert interviews spanning solenoid OEMs, automotive engineers, and supply chain strategists. Secondary sources include official U.S. trade documents, peer-reviewed technical articles, and authoritative energy outlooks.

Primary research comprised in-depth discussions with design and sourcing engineers to capture firsthand perspectives on emerging technical requirements, material constraints, and regulatory impacts. Data triangulation was conducted to validate conflicting viewpoints and ensure robust, unbiased analysis.

Quantitative assessments were supplemented by qualitative scenario modeling to explore the impacts of potential regulatory changes, technological breakthroughs, and supply chain disruptions. The resulting framework provides a comprehensive, actionable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Solenoid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Solenoid Market, by Type

- Automotive Solenoid Market, by Distribution Channel

- Automotive Solenoid Market, by End User

- Automotive Solenoid Market, by Application

- Automotive Solenoid Market, by Region

- Automotive Solenoid Market, by Group

- Automotive Solenoid Market, by Country

- United States Automotive Solenoid Market

- China Automotive Solenoid Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Crucial Insights from Transformative Trends and Market Forces to Guide Strategic Decisions in the Automotive Solenoid Sector

The automotive solenoid market stands at a strategic inflection point characterized by accelerating electrification, mounting regulatory pressures, and complex trade landscapes. The transition from mechanical to electro-mechanical actuation paradigms underscores solenoids’ central role in enabling fuel efficiency, emission control, and advanced safety functions. Concurrently, U.S. tariff policies and regional regulatory frameworks compel manufacturers to recalibrate supply chains and innovate proactively.

In this dynamic environment, segmentation insights reveal the necessity of tailored solutions across diverse vehicle types and applications, while regional analyses highlight the critical influence of policy incentives and market maturation. Leading suppliers are responding with cutting-edge technologies-from hydrogen injectors to smart solenoid platforms-demonstrating the competitive imperative of continuous R&D and agile operational models.

Armed with these insights, industry stakeholders are positioned to make informed decisions on portfolio strategies, investment priorities, and policy engagements. By aligning technical capabilities with evolving market requirements and regulatory expectations, solenoid manufacturers and automotive OEMs can drive sustainable growth and secure leadership in the next generation of mobility.

Engage with Ketan Rohom for Personalized Insights and Secure Your Comprehensive Automotive Solenoid Market Research Report Today

We invite you to engage with Ketan Rohom to gain personalized guidance on leveraging these insights for your strategic planning and operational needs. Reach out to Ketan to explore tailored solutions and secure access to the full comprehensive automotive solenoid market research report that will empower your organization to stay ahead of evolving market dynamics and technological disruptions.

- How big is the Automotive Solenoid Market?

- What is the Automotive Solenoid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?