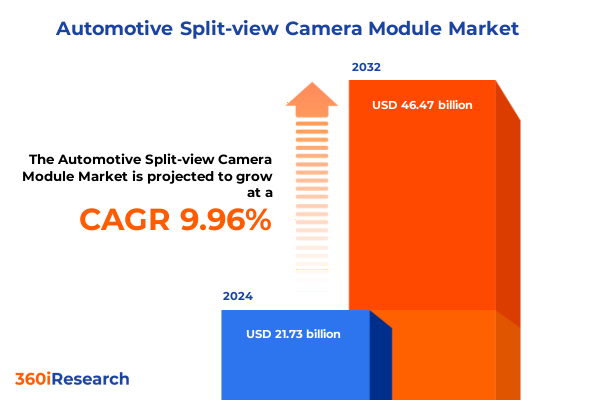

The Automotive Split-view Camera Module Market size was estimated at USD 23.56 billion in 2025 and expected to reach USD 25.55 billion in 2026, at a CAGR of 10.18% to reach USD 46.47 billion by 2032.

Overview of Technological Evolution and Market Dynamics Driving Adoption of Split-view Camera Modules in Next-generation Vehicle Architectures

Modern vehicles are undergoing a paradigm shift in how drivers perceive and interact with their surroundings, propelled by the integration of advanced driver-assistance systems that leverage split-view camera modules. These modules synthesize data from multiple wide-angle cameras to generate seamless panoramic and multi-view feeds, enabling features such as blind spot detection, parking assist, and surround view. By enhancing situational awareness and reducing driver workload, split-view camera architectures have become integral to the next generation of safety regulations and consumer expectations in both passenger and commercial sectors.

As electric vehicles and autonomous prototypes pave the way for increasingly sophisticated mobility solutions, the importance of reliable vision systems continues to intensify. Automakers and Tier-1 suppliers are racing to optimize image resolution, low-light performance, and real-time processing capabilities. At the same time, evolving supply chains and emerging regional regulations are reshaping how camera modules are sourced, manufactured, and deployed. Taken together, these forces set the stage for a dynamic marketplace where innovation, compliance, and strategic partnerships will determine who leads in safety, performance, and user experience.

Unprecedented Technological and Regulatory Shifts Catalyzing Landscape Transformation of Split-view Camera Applications Across Vehicle Segments

Recent years have seen a convergence of sensor miniaturization, computational advancements, and software-defined architectures that has profoundly shifted the competitive landscape for split-view camera modules. High-performance CMOS sensors now rival dedicated CCDs in dynamic range and low-light clarity, spurred by breakthroughs in pixel design and back-side illumination technologies. Concurrently, integrated vision processors powered by specialized neural accelerators enable on-board analytics for object detection, lane-keeping support, and real-time scene stitching. Such transformative shifts are making once-niche features like surround view and night vision more accessible to mainstream vehicle segments.

Regulatory frameworks are evolving in lockstep with technological innovation. Governments and safety bodies around the globe now mandate or incentivize advanced camera systems as part of broader ADAS requirements. For example, recent updates from European safety ratings have increased the weight of blind spot and rear-visibility functions in scoring methodologies, prompting OEMs to embed multi-camera suites at an accelerated pace. In parallel, collaborative partnerships between automotive OEMs and semiconductor developers have become commonplace, reflecting growing recognition that cross-industry alliances are essential to keep pace with the accelerating rate of change in both hardware and software domains.

Assessing the Ripple Effects of United States 2025 Tariff Adjustments on Automotive Split-view Camera Module Supply Chains and Cost Structures

In 2025, new United States tariff adjustments targeting automotive components have significantly reshaped cost structures for split-view camera modules. These levies, which increased duties on imported imaging sensors and related subassemblies, have compounded input costs by as much as 15 to 20 percent in certain supply scenarios. The cumulative impact has been felt across the value chain-from sensor manufacturers reliant on precision glass and semiconductor wafers to Tier-1 integrators balancing price pressures against performance benchmarks. In turn, OEM procurement teams are reevaluating sourcing strategies to buffer against further volatility and maintain competitive vehicle pricing.

Consequently, leading suppliers have accelerated near-shoring efforts and diversified their manufacturing footprints to mitigate tariff exposure. Production lines have been adapted to incorporate locally procured optics and interconnects, while collaborative ventures with domestic foundries now form a core mitigation tactic. At the same time, some manufacturers are exploring flexible module designs that can interchange sensor packages of varying origins without compromising integration timelines. As the tariff outlook remains uncertain, supply chain agility and modular architectures are emerging as critical capabilities for organizations aiming to maintain margins and safeguard product roadmaps.

Strategic Insights Derived from Multifaceted Segmentation Analysis Revealing Nuanced Opportunities in the Camera Module Market

A closer look at the market reveals distinct opportunity pools defined by application, sales channel, vehicle type, imaging technology, installation mode, and price tier. Split-view camera modules for surround view and parking assist applications are driving broad adoption among both OEMs and retrofit specialists, whereas night vision and blind spot detection remain targeted toward luxury and commercial fleets that prioritize specialized safety-critical features. Alongside modular ADAS offerings, aftermarket channels are leveraging retrofit kits to tap into the growing base of legacy vehicles, while OEMs continue to embed these systems as standard equipment on higher trim levels.

Vehicle segmentation further highlights the diversification of demand. Passenger cars and light commercial vehicles account for the lion’s share of volume due to broader unit sales, although heavy commercial segments are capturing interest for fleet optimization and operator safety programs. From a technology standpoint, CMOS sensors have become the preferred imaging solution thanks to their scalability and integration ease, gradually eclipsing legacy CCD modules in mainstream applications. Installation approaches range from fully integrated systems designed in concert with OEM vehicle architectures to standalone cameras tailored for specialty use cases and retrofit opportunities. Price brackets span economy offerings aimed at mass-market models, standard modules balancing cost and capability for mid-tier vehicles, and premium packages delivering unmatched resolution and feature sets for luxury segments.

This comprehensive research report categorizes the Automotive Split-view Camera Module market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Imaging Technology

- Installation Type

- Price Point

- Application

- Sales Channel

Exploring Regional Market Dynamics to Uncover Distinct Growth Drivers and Emerging Challenges Across the Americas, EMEA, and Asia-Pacific Territories

Regional landscapes present contrasting trajectories shaped by regulation, infrastructure, and consumer demand. In the Americas, rigorous safety mandates from U.S. agencies and growing consumer awareness of ADAS features have driven rapid diffusion of multi-camera arrays, especially in premium and mid-range passenger vehicles. Moreover, strong retrofit demand in Latin American markets is creating an aftermarket expansion path for independent installers and specialty tier-1 suppliers, facilitating the entry of agile local players.

Meanwhile, Europe, the Middle East & Africa region is marked by stringent Euro NCAP requirements and a proliferation of vehicle safety directives, which have spurred OEMs to integrate split-view camera modules as standard across more trim levels. At the same time, luxury markets in the Middle East continue to invest heavily in advanced imaging solutions, while growth pockets in North African nations are attracting attention for targeted aftermarket strategies. Across this region, the interplay of regulatory compliance and premium consumer expectations is fueling a dual-track approach combining broad accessibility and high-end differentiation.

In the Asia-Pacific zone, China stands at the forefront of both production and consumption, with domestic vehicle manufacturers embedding split-view cameras into high-volume models to meet government safety incentives and local consumer preferences for advanced safety packages. Japan and South Korea are leveraging their semiconductor expertise to co-develop next-generation vision processors with automotive partners, while emerging markets such as India and Southeast Asia are rapidly expanding both OEM and aftermarket adoption as vehicle parc renewal accelerates. Collectively, these regional dynamics underline a mosaic of regulatory drivers, production synergies, and market maturity levels that shape the global opportunity landscape.

This comprehensive research report examines key regions that drive the evolution of the Automotive Split-view Camera Module market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders and Pioneering Innovators Driving Advancements in Split-view Camera Module Technologies Worldwide

Leading stakeholders have established positions in the automotive split-view camera module space through differentiated technology roadmaps and strategic alliances. Continental has woven advanced surround view and night vision systems into comprehensive ADAS platforms, collaborating with AI software firms to enhance object recognition and sensor fusion capabilities. Valeo has similarly expanded its footprint by delivering compact, high-resolution modules optimized for both OEM integration and aftermarket retrofits, underpinned by robust image-processing software stacks.

Bosch remains a key innovator, advancing compact multi-camera arrays with unified processor designs that support both vision-based safety features and emerging autonomous functions. Denso, leveraging its deep ties with Japanese automakers, has introduced solid-state camera solutions offering improved durability and miniaturization for harsh commercial vehicle environments. Magna and Aptiv have both pursued joint ventures with semiconductor manufacturers to secure critical components and co-develope proprietary vision processors tailored to automotive applications. Panasonic and Hyundai Mobis are further diversifying the competitive arena by integrating lidar and radar subsystems with camera modules, aiming to deliver holistic perception suites for next-generation vehicles.

New entrants and specialized players such as Ambarella, Horizon Robotics, and Black Sesame Technologies are challenging incumbents with AI-centric camera chips and software-defined architectures. Their focus on scalable processing, over-the-air updates, and customizable analytics positions them as strategic partners for OEMs seeking to differentiate on user experience and real-time safety validations. Collectively, these leadership and challenger brands are accelerating innovation cycles while reinforcing the imperative for seamless hardware-software integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Split-view Camera Module market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Continental AG

- Denso Corporation

- Gentex Corporation

- Hella KGaA Hueck & Co.

- Hyundai Mobis Co., Ltd.

- Magna International Inc.

- Robert Bosch GmbH

- Valeo SA

- Visteon Corporation

- ZF Friedrichshafen AG

Actionable Strategic Roadmap for Industry Leaders to Capitalize on Emerging Trends and Navigate Supply Chain Complexities in Camera Module Markets

To thrive in the competitive split-view camera module market, industry leaders should prioritize deep investments in next-generation CMOS sensor platforms and high dynamic range technologies that deliver superior image quality under diverse environmental conditions. By forging strategic partnerships with semiconductor innovators and AI software developers, OEMs and Tier-1 suppliers can accelerate time-to-market for modules with embedded analytics, enabling differentiated safety and convenience features that resonate with both regulators and consumers.

Simultaneously, organizations must diversify manufacturing footprints to mitigate geopolitical risks and tariff exposures by establishing regional assembly cells and qualifying multiple supply sources for critical subcomponents. Modular hardware designs that allow for sensor interchangeability and software abstraction layers will reduce integration complexity while supporting rapid customization for different market requirements. In parallel, a dual-track channel strategy that addresses both factory-fitted systems and retrofit demands can capture latent demand among existing vehicle populations, especially in regions where new vehicle penetration remains moderate.

Moreover, adopting tiered pricing models and flexible installation options can expand the addressable market by accommodating entry-level segments with economy offerings and premium buyers with advanced feature sets. Finally, embedding over-the-air update capabilities and connected-service frameworks will enhance long-term customer engagement, creating opportunities for recurring revenue streams tied to software subscriptions and data-driven safety services. Collectively, these strategic imperatives will equip industry stakeholders to navigate complex supply chains, regulatory shifts, and evolving consumer expectations with greater agility and confidence.

Comprehensive Research Methodology Employing Rigorous Primary and Secondary Techniques to Ensure Integrity of Market Insights and Analyses

This analysis is underpinned by a rigorous research methodology that combines extensive primary engagements with comprehensive secondary intelligence to achieve a holistic market perspective. Primary research comprised in-depth interviews with senior executives at global OEMs, Tier-1 suppliers, and aftermarket distributors, alongside structured surveys of fleet operators and end-users to validate feature-level preferences and performance benchmarks.

Secondary research entailed systematic reviews of regulatory filings, patent databases, technical white papers, and industry conference proceedings to track emerging sensor technologies, safety regulations, and regional policy shifts. Media reports and industry journals supplemented these sources, providing real-time context on strategic partnerships, tariff developments, and commercial announcements. Data from government agencies and automotive associations was meticulously cross-referenced to confirm the timing and scope of regulatory mandates.

All collected data underwent rigorous triangulation, quality assurance checks, and expert panel validation to ensure the integrity and reliability of the findings. An advisory board of academic scholars, former OEM engineers, and sensor designers provided critical insights and peer reviews at each stage of the research process. This layered approach underlines the credibility of the conclusions and recommendations presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Split-view Camera Module market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Split-view Camera Module Market, by Vehicle Type

- Automotive Split-view Camera Module Market, by Imaging Technology

- Automotive Split-view Camera Module Market, by Installation Type

- Automotive Split-view Camera Module Market, by Price Point

- Automotive Split-view Camera Module Market, by Application

- Automotive Split-view Camera Module Market, by Sales Channel

- Automotive Split-view Camera Module Market, by Region

- Automotive Split-view Camera Module Market, by Group

- Automotive Split-view Camera Module Market, by Country

- United States Automotive Split-view Camera Module Market

- China Automotive Split-view Camera Module Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesis of Key Findings Highlighting Critical Market Drivers, Emerging Challenges, and Strategic Imperatives for the Automotive Industry

In summary, the automotive split-view camera module market is being reshaped by a confluence of technological breakthroughs, regulatory imperatives, and evolving supply chain dynamics. High-performance CMOS sensors and embedded AI processors are democratizing advanced ADAS functions, while global safety mandates and consumer demand for enhanced situational awareness continue to drive integration across a range of vehicle segments.

United States tariff reforms have introduced cost challenges that are prompting manufacturers to rethink sourcing and production strategies, ultimately emphasizing agility through near-shoring and modular design. Segmentation analyses reveal that opportunities span from entry-level economy modules for mass-market vehicles to premium offerings delivering exceptional performance in luxury and heavy-duty applications. Regional distinctions underscore the need for tailored strategies, with the Americas focusing on retrofit expansion, EMEA balancing compliance and premium differentiation, and Asia-Pacific leveraging domestic production capabilities and regulatory incentives.

For companies seeking to lead, a multifaceted approach that blends hardware innovation, software-centric upgrades, flexible business models, and proactive supply chain risk management will be vital. These strategic imperatives, grounded in robust research and stakeholder collaboration, offer a clear playbook for capturing value and sustaining competitive advantage as the market embarks on its next growth phase.

Empower Your Strategic Decisions with Direct Access to In-depth Insights and Expert Consultation from Our Senior Analyst Ketan Rohom

If you are ready to elevate your strategic planning with a deep dive into the intricacies of the automotive split-view camera module market, our comprehensive report offers a wealth of actionable insights and granular data that no executive should overlook.

Connect with Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the full market research study. This subscription grants you access to detailed segmentation analyses, regulatory tracking tools, supply chain mapping exercises, and expert commentary designed to sharpen your position in an increasingly competitive landscape. Engage in a personalized briefing to explore how these insights apply directly to your business objectives and product roadmaps.

Don’t let critical opportunities pass by. Reach out today to ensure your organization has the foresight and confidence needed to navigate the evolving automotive camera ecosystem and capitalize on emerging trends.

- How big is the Automotive Split-view Camera Module Market?

- What is the Automotive Split-view Camera Module Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?