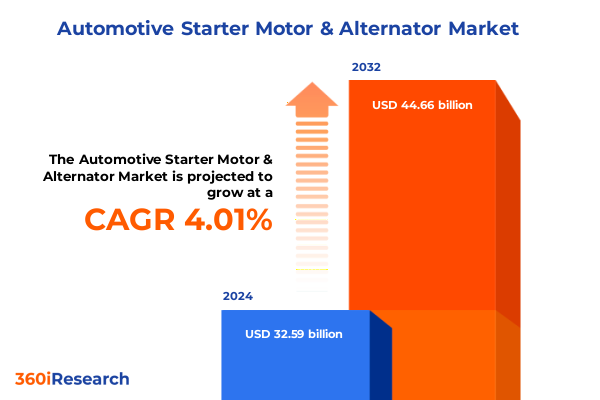

The Automotive Starter Motor & Alternator Market size was estimated at USD 33.81 billion in 2025 and expected to reach USD 35.09 billion in 2026, at a CAGR of 4.05% to reach USD 44.66 billion by 2032.

Exploring the Critical Roles and Ongoing Evolution of Automotive Starter Motors and Alternators within Advanced Powertrain Architectures

The automotive powertrain relies fundamentally on the synergy between starter motors and alternators to enable ignition sequences and sustain electrical systems throughout vehicle operation In modern powertrain architectures these components have evolved significantly from basic mechanical devices into complex electromechanical systems that support advanced functionalities such as stop-start operations regenerative braking integration and enhanced battery management As a result industry stakeholders must understand both the foundational principles and the implications of recent technological advancements to maintain relevancy and drive innovation

As vehicle manufacturers continue to pursue stringent fuel-economy and emission targets the roles of starter motors and alternators have expanded beyond their original purposes While the traditional starter is responsible for initiating engine rotations the next-generation units support hybrid and mild-hybrid systems by facilitating seamless transitions between electric and combustion modes Similarly alternators no longer serve solely to charge the battery; they now contribute to energy recuperation and power ancillary systems with higher efficiency and reduced parasitic losses

Consequently leaders in the automotive supply chain face rising pressure to develop components that combine lower weight with higher power density and intelligent control capabilities This introduction establishes the context for exploring the transformative forces shaping the market and highlights the importance of strategic alignment between technological progress manufacturing scalability and regulatory compliance

Navigating the Electrification Revolution and Technological Breakthroughs Redefining Starter Motor and Alternator Performance

The automotive component landscape is undergoing a profound transformation driven by the rise of electrification advanced materials and digital integration In starter motor and alternator design this shift manifests through the adoption of brushless architectures improved thermal management techniques and the integration of power electronics to optimize performance and reliability Traditional commutator-based motors are giving way to electronic control modules that deliver precise torque management and facilitate predictive maintenance capabilities

In parallel the emergence of integrated starter-generator systems is redefining the boundary between engines and electric drivelines These systems perform dual functions by replacing conventional alternators and starter motors with a single unit capable of delivering propulsion assistance and energy recuperation This consolidated approach reduces weight and complexity while enabling rapid response in stop-start scenarios and supporting advanced hybrid vehicle functionalities

Moreover materials innovation has unlocked the potential for more compact rotor designs and enhanced magnetic efficiency enabling higher power densities without a proportional increase in size or weight As data analytics becomes embedded within component control units manufacturers can now harness real-time operational insights to extend service intervals and minimize downtime via condition-based maintenance protocols

Taken together these dynamics are reshaping design paradigms and challenging suppliers to embrace cross-disciplinary collaboration between mechanical engineering power electronics and software development

Assessing the Far-reaching Implications of 2025 United States Tariffs on the Automotive Starter Motor and Alternator Supply Chain

The enactment of new tariff measures in the United States during 2025 has triggered a series of supply chain adjustments for starter motor and alternator manufacturers Heavy duties on select raw materials and finished component imports have increased procurement costs and prompted a recalibration of sourcing strategies As a result companies are accelerating efforts to localize production closer to key automotive assembly hubs in order to mitigate tariff exposure and maintain price competitiveness

Furthermore these trade actions have exposed vulnerabilities in the established supply networks leading to expanded partnerships with domestic suppliers and regional foundries Special emphasis has been placed on securing high-precision steel and copper alloys used in stators rotors and commutators to avoid potential bottlenecks While some manufacturers have absorbed incremental cost pressures in the short term many are proactively negotiating long-term agreements to stabilize input costs and ensure continuity of supply

Simultaneously the heightened import barriers have underscored the importance of production flexibility and the ability to pivot between global facilities in different jurisdictions Regulatory changes have also prompted greater scrutiny on origin documentation and compliance processes pushing organizations to invest in enhanced traceability systems and trade-compliance teams

Ultimately these policy shifts are driving structural realignment in the component ecosystem and redefining competitive advantages based on geographic footprint domestic capabilities and supply chain resilience

Unveiling Key Segmentation Dynamics across Product Types End Users Connection Strategies Power Ratings and Vehicle Applications

A nuanced understanding of market segmentation reveals critical insights into the behavior and requirements of different customer groups Product classifications start by distinguishing alternators and starter motors where alternator variants include brushless alternators claw pole alternators and cylindrical rotor alternators Each of these offers unique benefits in terms of efficiency durability and electromagnetic compatibility while starter motor families encompass direct drive starter units electric starter motors and gear reduction starters which address different torque profiles and packaging constraints

End-user divisions further elucidate demand patterns as aftermarket customers typically prioritize cost-effective replacements and availability whereas original equipment manufacturers focus on long-term reliability integration capabilities and adherence to stringent quality standards Connectivity preferences also play a role because belt drive arrangements offer simplicity and ease of maintenance while direct drive connections enhance mechanical efficiency and reduce parasitic losses

Power ratings provide an additional dimension with systems rated below 1.5 kW catering to smaller vehicles and two-wheelers midrange outputs between 1.5 and 3.5 kW suited for passenger cars and larger light vehicles and high-power units exceeding 3.5 kW often specified in commercial and off-highway applications Each power band presents different thermal management and control challenges which shape component design and cost structures

Vehicle classification underscores these trends as well because commercial vehicle operators demand rugged components with extended service life whereas passenger car users seek refined integration with start-stop comfort features and two-wheeler manufacturers focus on weight reduction and compact packaging Off-highway sectors impose additional requirements for resistance to extreme conditions and vibration tolerance

This comprehensive research report categorizes the Automotive Starter Motor & Alternator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connection Type

- Power

- Vehicle Type

- End User

Comparative Regional Landscape Analysis Highlighting Unique Drivers in the Americas EMEA and Asia Pacific Automotive Component Markets

Regional market characteristics reflect the diverse priorities of automotive ecosystems in the Americas EMEA and Asia Pacific The Americas exhibit strong momentum in electrification driven by policy incentives infrastructure expansion and consumer adoption of hybrid and battery electric vehicles This trend has spurred local production of next-generation starter generators and alternators tailored to fast-charging networks and sustainable power management solutions

In Europe the regulatory environment remains a potent catalyst for innovation as manufacturers respond to increasingly stringent CO2 targets and emissions regulations Claw pole alternators with improved quiescent current performance are gaining traction in mild-hybrid and micro-hybrid architectures Meanwhile the Middle East and Africa are witnessing gradual modernization of commercial fleets which is elevating demand for robust starter systems that can withstand high ambient temperatures and dust exposure

Asia Pacific continues to dominate global vehicle production with a dual focus on cost-effective mass-market components and rapid integration of digital control systems in premium segments Local suppliers are leveraging economies of scale to produce cylindrical rotor alternators at competitive price points while simultaneously investing in R&D centers to collaborate with vehicle OEMs on sensor-fused alternator controls and predictive diagnostics

This comprehensive research report examines key regions that drive the evolution of the Automotive Starter Motor & Alternator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leading Manufacturers and Emerging Players Shaping Innovation in Starter Motor and Alternator Technologies

Several leading manufacturers have distinguished themselves through targeted investments in advanced manufacturing capabilities and strategic collaborations with vehicle OEMs Bosch continues to refine its brushless alternator portfolio by integrating silicon carbide inverters to enhance thermal efficiency and reduce electrical losses Denso prioritizes miniaturization technologies that enable electric starter motors to deliver high torque in constrained engine bays

Valeo has developed modular starter-generator platforms that facilitate rapid customization for different hybrid architectures while ensuring commonality of core components across regions Mitsubishi Electric emphasizes digital twin simulations to accelerate development cycles and validate complex electromagnetic designs before physical prototyping begins Delco Remy maintains a focus on service support networks in key markets to uphold aftermarket performance and brand loyalty

Emerging suppliers are also making inroads by leveraging niche expertise such as magnetic materials optimization and additive manufacturing for lightweight rotor assemblies Their agility in adopting new materials and digital manufacturing techniques positions them to challenge incumbents in specialized applications where rapid iteration and low volumes provide a competitive edge

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Starter Motor & Alternator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AS-PL Sp. z o.o.

- ASIMCO Technologies Ltd.

- BBB Industries, LLC

- BorgWarner Inc.

- Broad-Ocean Technologies Limited

- Controlled Power Technologies Ltd.

- Cummins Inc.

- Denso Corporation

- HELLA GmbH & Co. KGaA

- Hitachi Automotive Systems, Ltd.

- Lucas TVS Limited

- Minda Autoelektrik Limited

- Mitsubishi Electric Corporation

- Nidec Corporation

- Prestolite Electric, Inc.

- Robert Bosch GmbH

- S&I Systems Co., Ltd.

- SEG Automotive Germany GmbH

- Shanghai Broad-Ocean Motor Co., Ltd.

- Sona BLW Precision Forgings Ltd.

- Valeo SA

- Yangzhou Shuanglin Automotive Electric Co., Ltd.

Strategic Imperatives and Actionable Steps for Manufacturers to Capitalize on Shifting Market Demands and Regulatory Landscapes

Manufacturers should prioritize integration of power electronics and embedded software within starter generators to capture emerging opportunities in the hybrid vehicle segment By developing proprietary control algorithms that optimize energy recuperation and reduce mechanical wear stakeholders can differentiate their offerings and command premium positioning in the OEM market It is equally important to collaborate with battery suppliers and electric motor specialists to ensure seamless interoperability

Supply chain diversification emerges as a crucial strategy to mitigate tariff‐induced cost fluctuations and geopolitical risks Cultivating partnerships with regional material suppliers and exploring advanced alloy formulations will safeguard production continuity and strengthen negotiating leverage With this approach companies can maintain margin stability while accommodating shifts in regulatory landscapes

Investment in digital platforms for predictive maintenance will also yield significant returns by reducing warranty costs and supporting subscription‐based service models As vehicles become increasingly connected component suppliers can offer performance analytics and condition monitoring as value-added solutions that deepen customer relationships and open recurring revenue streams

Finally organizations should commit to workforce development initiatives focused on electric drive systems and advanced manufacturing methods Equipping employees with skills in power electronics assembly and digital diagnostics will enhance operational agility and support accelerated adoption of next-generation component designs

Comprehensive Research Approach Employing Primary Interviews Secondary Data Analysis and Expert Validation to Ensure Insightful Market Intelligence

This research integrates primary qualitative insights drawn from in-depth interviews with senior executives engineers and procurement specialists across tier-1 suppliers and vehicle OEMs The interviews provided nuanced perspectives on design priorities cost pressures and long-term technology roadmaps In parallel secondary data was collated from white papers technical journals and trade association reports to validate emerging trends and benchmark regional performances

To ensure data integrity the methodology applied a triangulation framework cross-referencing interview statements with supplier press releases patent filings and publicly available certification records A dedicated expert panel reviewed interim findings to refine key themes and align projection assumptions with observed market behaviors Furthermore supply chain analyses leveraged import-export databases and customs records to map trade flows and quantify the impacts of regulatory changes on material sourcing

Analytical models were constructed to segment demand drivers across product types connection methods power categories and vehicle classes thereby providing a structured lens for evaluating growth vectors and capacity utilization By combining qualitative insights with quantitative assessments this approach delivers holistic visibility into competitive dynamics and potential disruption scenarios

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Starter Motor & Alternator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Starter Motor & Alternator Market, by Product Type

- Automotive Starter Motor & Alternator Market, by Connection Type

- Automotive Starter Motor & Alternator Market, by Power

- Automotive Starter Motor & Alternator Market, by Vehicle Type

- Automotive Starter Motor & Alternator Market, by End User

- Automotive Starter Motor & Alternator Market, by Region

- Automotive Starter Motor & Alternator Market, by Group

- Automotive Starter Motor & Alternator Market, by Country

- United States Automotive Starter Motor & Alternator Market

- China Automotive Starter Motor & Alternator Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Drawing Together Strategic Insights and Industry Trends to Outline the Future Trajectory of Starter Motor and Alternator Technologies

The starter motor and alternator landscape stands at the intersection of electrification mandates and evolving customer expectations As vehicle architectures transition to hybrid and electric formats core legacy components are being reimagined as intelligent modules capable of energy recuperation advanced diagnostics and seamless integration with digital ecosystems Continuous innovation will define the competitive hierarchy as materials science breakthroughs and software-driven control strategies unlock higher efficiencies and reduced lifecycle costs

Meanwhile the shifting regulatory environment and tariff considerations underscore the need for adaptable supply chain strategies that balance nearshore sourcing with strategic alliances across global regions The future market leaders will be those that successfully orchestrate cross-functional teams bridging mechanical design electronics and data analytics while maintaining operational resilience

In essence the convergence of technological advancement and policy drivers is creating fertile ground for differentiated solutions that deliver both performance and sustainability Organizations that embrace this multifaceted transformation can expect to elevate their market positioning and deliver enhanced value to OEMs fleet operators and end users alike

Engage with Ketan Rohom to Gain Exclusive Access to In-depth Starter Motor and Alternator Market Intelligence Tailored for Strategic Decision Making

To explore the full depth of industry dynamics and unlock strategic foresight in the starter motor and alternator market you are invited to connect directly with Ketan Rohom Associate Director of Sales & Marketing at our firm Your engagement will provide you with tailored insights and a comprehensive market research report designed to inform your product development roadmap and go-to-market strategies

By partnering with Ketan you will gain privileged access to proprietary data comparative vendor assessments and actionable growth frameworks that address emerging opportunities and competitive challenges This collaboration offers an unparalleled avenue to secure a competitive edge and drive sustainable value in your operations

Secure a customized consultation today and empower your leadership teams with the precise intelligence required to navigate complex trade environments advancing regulatory terrain and rapid technology adoption Contact Ketan Rohom to acquire the definitive market intelligence report that will accelerate your decision-making process and catalyze organizational growth

- How big is the Automotive Starter Motor & Alternator Market?

- What is the Automotive Starter Motor & Alternator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?