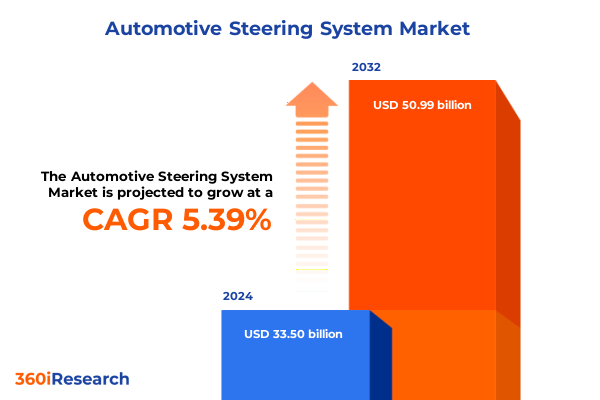

The Automotive Steering System Market size was estimated at USD 34.73 billion in 2025 and expected to reach USD 36.00 billion in 2026, at a CAGR of 5.64% to reach USD 50.99 billion by 2032.

Examining Electrification, Autonomous Driving, and Consumer Demand Trends That Are Redefining Performance and Precision in Modern Automotive Steering Systems

The automotive steering system today stands at a pivotal juncture, evolving from basic mechanical linkages into highly sophisticated, software-driven architectures that integrate sensors, actuators, and electronic control units. As automakers contend with increasingly stringent regulatory mandates for fuel efficiency and emissions reduction, electrification and digital integration have emerged as primary drivers of technological change. Consequently, original equipment manufacturers and suppliers are reimagining traditional hydraulic and manual steering solutions in favor of electric power steering and advanced electronic systems that can interface seamlessly with electric powertrains and advanced driver-assistance systems (ADAS).

Moreover, the shift toward electrified vehicles places the steering system at the heart of both performance optimization and energy management strategies. Enhanced steering precision and adjustable feedback are no longer luxuries; they are essential criteria shaping consumer perceptions of ride comfort and driving dynamics. In tandem, the rapid maturation of vehicle autonomy is spurring the development of steer-by-wire technologies that eliminate mechanical linkages, reduce weight, and enable software-defined steering characteristics. As the automotive industry accelerates toward a future defined by carbon neutrality and autonomous operation, stakeholders across the ecosystem must align product roadmaps, supply chains, and R&D investments to capitalize on this era of transformation.

Discovering Transformative Shifts in Control Technologies, Software Integration, and Sustainable Materials That Are Propelling the Next Era of Steering Systems

In the past decade, the steering system landscape has undergone multifaceted transformations driven by electrification, software-defined functionality, and the integration of autonomous capabilities. Traditional hydraulic power steering is being rapidly supplanted by electric and electro-hydraulic variants that minimize parasitic power losses and support variable steering assistance. This evolution not only enhances fuel efficiency but also enables dynamic tuning of steering feel to suit diverse driving modes and use cases. At the same time, the introduction of ADAS features-such as lane-keeping assistance and automated parking-necessitates the convergence of high-fidelity sensors, precise actuators, and real-time control algorithms within the steering subsystem.

Furthermore, materials innovation and weight-reduction initiatives have introduced novel composites and lightweight alloys into steering columns and gears, balancing strength with durability. Software architectures are increasingly modular, allowing over-the-air updates and adaptive calibration that extend component lifespans and introduce new functionalities post-deployment. Cybersecurity considerations have also risen to prominence, prompting collaborations with semiconductor and security specialists to protect steer-by-wire communications. These converging trends are redefining supplier–OEM relationships, fostering partnerships that span traditional automotive expertise and emerging tech domains, and setting the stage for the next generation of steering solutions.

Analyzing How United States Tariff Policies in 2025 Are Reshaping Supply Chains, Cost Structures, and Competitive Dynamics in the Steering System Market

United States trade policy in 2025 continues to exert a profound influence on the global steering system supply chain, as tariff adjustments and trade measures reshape sourcing strategies and cost structures. The extension of Section 301 duties on select imported components, coupled with steel and aluminum levies under Section 232, has elevated input costs for both hydraulic and electronic steering modules. In response, manufacturers are reevaluating supplier agreements, accelerating qualification of alternative vendors, and pursuing nearshoring opportunities to mitigate duty exposure and enhance supply chain resilience.

Meanwhile, cumulative tariff impacts have driven a wave of consolidation among tier-1 suppliers and a renewed emphasis on vertical integration. By internalizing key production steps-such as electric motor winding and sensor calibration-companies seek to regain margin stability and preserve product quality. At the same time, collaborative alliances with regional manufacturing partners offer cost-effective assembly platforms that reduce freight expenses and duty burdens. While these strategic shifts introduce complexity to procurement and logistics planning, they also unlock new pathways for localized innovation and faster time to market.

Gaining Critical Insights into Market Dynamics Across Steering System Types, Component Specializations, Vehicle Applications, and End-User Channels

By examining the market through the lens of steering system type, electric power steering emerges as the dominant architecture driving growth, buoyed by its compatibility with electrified powertrains and ability to deliver variable assist characteristics. Electro-hydraulic solutions maintain relevance in specific commercial vehicle segments where redundancy and servo-hydraulics play a critical safety role, whereas fully hydraulic and manual steering persist in entry-level and specialty applications where cost and mechanical simplicity remain paramount.

Parallel insights arise when considering components, as electric motors have become focal points of R&D investment due to their central role in torque delivery and energy efficiency, while steering sensors and columns now incorporate advanced materials and electronic interfaces. Steering gears continue to evolve with optimized tooth profiles for smoother operation, and the steering wheel itself is increasingly integrated with haptic feedback actuators to convey road and ADAS cues.

When viewed by vehicle type, passenger cars lead in adopting cutting-edge steer-by-wire and variable-assist systems, light commercial vehicles follow with demand for reliability under load, and heavy commercial vehicles prioritize robustness and serviceability. Finally, end-user segmentation highlights that original equipment manufacturers drive foundational demand through volume production programs, while the aftermarket seizes opportunities to retrofit advanced steering kits, offering improved driver experience and extended vehicle lifecycles.

This comprehensive research report categorizes the Automotive Steering System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Steering System Type

- Component

- Vehicle Type

- End User

Unveiling Distinct Regional Dynamics and Growth Patterns Across Americas, Europe Middle East & Africa, and Asia-Pacific Steering System Markets

Regional dynamics reveal distinct trajectories for steering system adoption and innovation across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, stringent federal and state emissions regulations combined with strong demand for electric and hybrid vehicles have accelerated the transition toward electric power steering solutions. Localized research hubs and supplier networks in North America also facilitate rapid prototyping and collaborative development, supporting OEMs in reducing time to market.

In Europe Middle East & Africa, rigorous safety and efficiency standards have positioned the region at the forefront of steer-by-wire trials and ADAS integration. OEMs headquartered in Europe lead investments in sustainable materials and modular architectures, while Middle East assemblers leverage free trade zones to support component exports.

Asia-Pacific remains the largest and most dynamic market by volume, driven by substantial production bases in China, Japan, South Korea, and India. Here, cost-competitive manufacturing is complemented by government incentives for electric vehicle uptake, fostering a highly competitive environment where innovation cycles are compressed and design-for-manufacturability principles guide component evolution. Across each region, localized consumer preferences and regulatory frameworks continue to shape steering system development roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Automotive Steering System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves, Innovative Product Launches, and Collaborative Ventures Among Leading Steering System Manufacturers and Suppliers

The competitive landscape of steering system providers is defined by a balance of global reach and specialized expertise. Leading players have intensified investments in electric motor technologies and sensor fusion capabilities, propelling differentiated product offerings that meet both efficiency targets and ADAS requirements. Strategic partnerships, such as alliances with semiconductor companies and software integrators, have enabled tier-1 suppliers to deliver end-to-end steering solutions rather than standalone components.

Meanwhile, mergers and acquisitions have reshaped market dynamics, as established manufacturers acquire innovative startups to bolster steer-by-wire and cybersecurity portfolios. Collaboration with vehicle manufacturers on dedicated electric platforms has become standard practice, ensuring seamless integration and reducing system complexity. In parallel, regional suppliers in emerging markets leverage low-cost production facilities and government incentives to capture share in volume-driven segments, compelling global players to adapt pricing models and value propositions in those markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Steering System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Alps Electric Co., Ltd

- Automotive IQ by IQPC GmbH

- Ayd Infra Private Limited

- Bendix Commercial Vehicle Systems LLC

- Complete Steering Australia

- Continental AG

- Delphi Technologies by BorgWarner Inc

- Denso Corporation

- FTL Steering Systems GmbH

- GKN PLC.

- Global Steering Systems LLC

- Hiatchi Ltd.

- Hyundai Mobis Co. Ltd

- JIYI Robot (Shanghai) Co., Ltd.

- Jtekt Machine Systems Corp.

- Mitsubishi Electric Corporation

- Pailton Engineering Ltd.

- Prestolite Electric Incorporated

- PSS Steering & Hydraulics

- Rane Limited

- Robert Bosch GmbH

- Schaeffler Group

- Sona Koyo Steering System Ltd

- ZF Steering Gear Ltd.

Crafting Actionable Strategies for Industry Leaders to Navigate Disruption, Capitalize on Technological Advances, and Optimize Steering System Investments

Industry leaders seeking to thrive must prioritize investments in steer-by-wire technology, ensuring that mechanical-free control architectures are backed by robust fail‐safe designs and comprehensive cybersecurity protocols. In addition, forging partnerships with software developers and semiconductor firms will accelerate the development of advanced control algorithms, sensor fusion modules, and over-the-air update capabilities. Simultaneously, diversifying supply chains through nearshore manufacturing and strategic alliances can mitigate tariff impacts and strengthen resilience against geopolitical fluctuations.

Moreover, companies should embed sustainability into product roadmaps by exploring lightweight composites and recyclable materials, reducing environmental footprints while adhering to emerging regulatory mandates. Building cross-functional teams that blend traditional mechanical expertise with software engineering and data analytics talent will enable organizations to adapt swiftly to evolving consumer and regulatory demands. Finally, continuous engagement with standard-setting bodies and participation in pilot programs for autonomous and ADAS-enhanced driving will ensure that steering system solutions remain aligned with the mobility trends redefining the industry.

Detailing Rigorous Research Methodologies, Data Collection Techniques, and Analytical Frameworks Ensuring Robust Insights into Steering System Market Dynamics

The research methodology underpinning this analysis combines extensive primary and secondary research to ensure clarity, rigor, and actionable insights. Primary data collection involved in-depth interviews with senior procurement and R&D executives from original equipment manufacturers, tier-1 suppliers, and system integrators, capturing first-hand perspectives on demand drivers, technology roadmaps, and regulatory challenges. Concurrently, field surveys with maintenance and aftermarket specialists provided granular understanding of refurbishment trends and retrofitting opportunities.

Secondary research encompassed a comprehensive review of industry white papers, patent filings, regulatory frameworks, and conference proceedings, supplemented by analysis of trade association publications and technical standards. Data triangulation protocols were employed to reconcile divergent sources and validate findings, while analytical frameworks such as SWOT analysis and Porter's Five Forces elucidated competitive pressures and market attractiveness. Scenario planning exercises further tested the robustness of strategic recommendations under varying tariff, regulatory, and technology adoption trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Steering System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Steering System Market, by Steering System Type

- Automotive Steering System Market, by Component

- Automotive Steering System Market, by Vehicle Type

- Automotive Steering System Market, by End User

- Automotive Steering System Market, by Region

- Automotive Steering System Market, by Group

- Automotive Steering System Market, by Country

- United States Automotive Steering System Market

- China Automotive Steering System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Key Takeaways and Strategic Imperatives That Will Define Success in the Rapidly Evolving Automotive Steering System Ecosystem

This executive summary highlights the imperative for automotive stakeholders to embrace a holistic transformation of steering system strategies. The confluence of electrification, autonomous driving functionalities, and evolving consumer expectations is redefining performance benchmarks and supply chain structures alike. At the same time, evolving tariff landscapes demand proactive supply chain diversification and cost management tactics to maintain competitive advantage.

Segmentation insights illustrate that electric power steering and advanced components such as sensors and actuators will dominate future innovation, while regional nuances underscore the need for tailored market approaches. Key players must pursue strategic partnerships, sustainable design practices, and modular software architectures to navigate market complexities and capture growth opportunities.

Ultimately, organizations that integrate technical excellence with agile business models, while engaging proactively with regulatory bodies and technology standards consortiums, will set themselves apart in a rapidly evolving ecosystem. By internalizing these imperatives, steering system manufacturers and their partners can position themselves at the vanguard of next-generation vehicle control solutions.

Take Action Now to Secure Exclusive Access to the Comprehensive Automotive Steering System Market Report and Drive Strategic Growth for Your Organization

To unlock the full depth of insights, detailed competitor profiles, and actionable market intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive Automotive Steering System market research report and accelerate your strategic planning and investment decisions

- How big is the Automotive Steering System Market?

- What is the Automotive Steering System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?