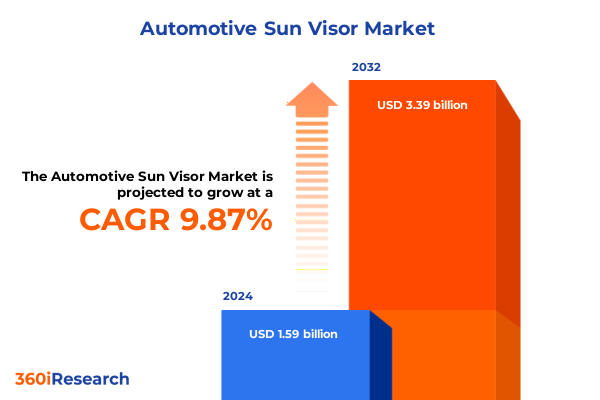

The Automotive Sun Visor Market size was estimated at USD 1.71 billion in 2025 and expected to reach USD 1.85 billion in 2026, at a CAGR of 10.22% to reach USD 3.39 billion by 2032.

Understanding the Critical Role of Sun Visors in Modern Automobiles and Their Evolving Importance for Driver Safety and Comfort

The sun visor, often perceived as a simple accessory, has emerged as a vital component in enhancing driver comfort, safety, and overall in-vehicle experience. As modern vehicles evolve in complexity and design sophistication, the sun visor transcends its traditional shade-blocking function to become an integrated part of the vehicle’s ergonomics and safety architecture. This section sets the stage by presenting the multifaceted role of sun visors within contemporary automotive cabins and highlights the growing expectations from both consumers and original equipment manufacturers alike.

Recent developments in automotive design have placed a premium on driver visibility and occupant protection, catalyzing innovation in sun visor materials, configurations, and multimedia integration. Regulatory bodies across various regions have introduced stricter guidelines for glare reduction and interior safety performance, prompting manufacturers to explore advanced polymers and smart technologies. Consequently, the sun visor has transformed from a passive component into a strategic enabler of enhanced driving comfort, aligning seamlessly with broader trends toward vehicle personalization and intelligent cabin systems. Transitioning from this foundational understanding, the subsequent sections delve deeper into the dynamic shifts reshaping the sun visor landscape.

Exploring How Technological Innovation, Lightweight Materials, and Regulatory Evolution Are Redefining Sun Visor Functionality and Design

The automotive sun visor arena is undergoing a fundamental transformation driven by several converging trends that redefine value beyond conventional shading. Foremost among these shifts is the growing demand for smart and adaptive cabin components. Integrating technologies such as ambient light sensors, digital displays, and even augmented reality overlays, innovative sun visor solutions now provide real-time information and enhanced glare management. This evolution reflects a broader industry push toward autonomous and connected vehicles where every interior element contributes to passenger well-being and situational awareness.

In parallel, the relentless pursuit of lightweighting has spurred material innovations in high-performance polymers. Manufacturers are increasingly adopting advanced grades of acrylonitrile butadiene styrene and polycarbonate ABS blends to achieve superior impact resistance without compromising weight targets. Moreover, polypropylene compounds have gained traction for their cost efficiency and recyclability, aligning with automaker commitments to circular economy principles. These material breakthroughs, coupled with modular design approaches, enable scalable production of both fixed and adjustable sun visors tailored to diverse vehicle segments.

Finally, regulatory evolution and consumer expectations for enhanced cabin aesthetics have propelled the emergence of premium sun visor types. Dual and extended visors now complement conventional designs, offering expanded coverage and ergonomic adjustability, while LCD or smart visors integrate storage pockets, illuminated vanity mirrors, and infotainment connectivity. Together, these transformative shifts underline the sun visor’s journey from a passive interior component to an interactive, multifunctional element in next-generation vehicles.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariffs on Material Costs, Supply Chains, and Production Strategies for Sun Visors

In 2025, the imposition of additional tariffs by the United States on key automotive components and raw materials has introduced a new dimension of complexity for sun visor manufacturers and automakers. These tariffs, enacted under broader trade policy measures, have targeted significant imports of high-grade polycarbonate and ABS resins primarily sourced from select international suppliers. The resulting cost pressures have prompted localized sourcing strategies, with many firms accelerating partnerships with domestic material producers to mitigate exposure to import duties.

Consequently, manufacturing facilities in North America have reoriented their procurement strategies, prioritizing supply chain resilience through diversified material portfolios and nearshoring initiatives. While this shift has partially offset the financial impact of tariffs, some downstream effects persist. For example, tooling costs for precision-molded components have risen marginally, leading to revised capital expenditure plans and phased product rollouts. Moreover, increased inventory buffers and contract renegotiations have become commonplace as organizations seek to stabilize lead times and maintain production continuity.

Looking ahead, the ability to manage tariff-induced cost variability will hinge on cross-functional collaboration between purchasing, engineering, and commercial teams. Embracing advanced cost modeling and demand forecasting will enable decision-makers to anticipate supply chain disruptions and optimize inventory levels. Ultimately, the cumulative impact of U.S. tariffs in 2025 underscores the importance of agile procurement strategies and robust supplier ecosystems to sustain competitiveness in the evolving sun visor market.

Unveiling Comprehensive Segmentation Dynamics Across Materials, Technologies, Types, Applications and Distribution Channels Influencing Market Strategies

When examining the market through the lens of material selection, manufacturers have increasingly weighed the benefits of acrylonitrile butadiene styrene for its balanced impact resistance and surface finish against the durability of polycarbonate ABS blends, which offer enhanced thermal stability. Polypropylene has emerged as a cost-effective alternative, particularly suited to high-volume applications where recyclability and lightweighting are paramount. Each material choice influences downstream tooling requirements, surface molding techniques, and recycling processes, underscoring the importance of strategic polymer selection.

Turning to technology variations, adjustable sun visors continue to drive consumer preference by allowing personalized glare control and improved visibility angles, especially crucial for drivers of taller vehicles and trucks. Conversely, fixed sun visors maintain a strong presence in entry-level and cost-sensitive models, where simplicity and reliability remain key considerations. Automakers are evaluating these trade-offs to align product portfolios with target demographics and vehicle price points.

In terms of type segmentation, conventional sun visors retain widespread adoption due to their proven design and ease of integration. However, dual and extended visors are gaining traction in premium vehicle segments, offering enhanced coverage and ergonomic flexibility. Meanwhile, LCD sun visors or smart sun visors cater to luxury and tech-savvy consumers by integrating illuminated mirrors, touch-sensitive controls, and connectivity with in-cabin infotainment systems.

Analyzing application-based segmentation reveals divergent requirements between commercial and passenger vehicles. In heavy and light commercial vehicles, durability and ease of maintenance take precedence, with sun visors often subjected to frequent adjustments and harsh operating environments. Passenger vehicles, particularly in coupe, hatchback, sedan, SUV, and van configurations, demand a harmonious balance of aesthetics, functionality, and safety compliance. Lastly, the choice between OEM and aftermarket distribution channels reflects differing priorities: OEM partnerships emphasize design alignment and warranty integration, whereas aftermarket channels focus on accessibility, ease of installation, and cost competitiveness.

This comprehensive research report categorizes the Automotive Sun Visor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Technology

- Type

- Application

- Distribution Channel

Highlighting Contrasting Regional Trends, Regulatory Drivers, and Consumer Preferences Shaping the Global Distribution of Sun Visor Solutions

Regional insights reveal contrasting market dynamics driven by consumer preferences, regulatory frameworks, and economic conditions. In the Americas, a strong preference for customizable sun visors in SUVs and pickup trucks has bolstered demand for adjustable and extended designs. North American manufacturers are leveraging localized material production and trade agreements to optimize supply chains, while South American markets show growing interest in cost-effective polypropylene variants, driven by expanding automotive assembly plants in the region.

As for Europe, Middle East & Africa, stringent safety and environmental regulations are the primary drivers of innovation. European automakers mandate advanced glare management standards and recyclability requirements, encouraging the adoption of high-performance polymers and smart visor technologies. In the Middle East, premium vehicle segments fuel demand for dual and smart visors, whereas African markets prioritize durability and simplicity in commercial vehicle applications. Cross-border collaboration among regional suppliers has become essential to ensure compliance and cost effectiveness across disparate regulatory landscapes.

In the Asia-Pacific region, rapid automotive production growth and escalating consumer expectations for in-cabin comfort have propelled the sun visor market forward. China’s large-scale manufacturing ecosystem fosters economies of scale for all sun visor types, including emerging LCD and smart variants. Meanwhile, Japan and South Korea continue to lead in technology integration and quality assurance for advanced sun visors. Southeast Asian markets, with burgeoning passenger vehicle sales, represent a fertile ground for both OEM and aftermarket channels, particularly for fixed and adjustable sun visor options.

This comprehensive research report examines key regions that drive the evolution of the Automotive Sun Visor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Suppliers Are Advancing Product Innovation, Partnerships, and Manufacturing Capabilities to Gain Market Leadership

Leading industry players are navigating competitive pressures through product innovation, strategic partnerships, and targeted investments. Gentex Corporation has expanded its smart sun visor portfolio by integrating OLED display technology and sensor-based glare detection, enhancing both functionality and user experience. Meanwhile, Magna International has leveraged its global manufacturing footprint to develop lightweight polymer blends tailored to major automaker specifications, positioning itself as a one-stop supplier for both conventional and dual visor assemblies.

Murakami Corporation has focused on modular design architectures, enabling rapid customization and reduced tooling lead times for both adjustable and fixed sun visors. The company’s strategic alliances with regional material producers in North America and Asia have fortified its supply chain resilience. At the same time, Motherson Sumi Systems has prioritized cost optimization and scalability by establishing dedicated production lines for polypropylene-based visors in emerging markets, responding to growing aftermarket demand.

Additionally, Visteon has ventured into augmented reality-enabled visor prototypes, aiming to create dynamic information overlays for next-generation vehicles. This forward-looking approach aligns with broader autonomous driving trends and positions Visteon as a pioneer in multifunctional cabin components. Collectively, these companies exemplify diverse strategies-from advanced material applications to smart technology integration-driving the competitive landscape and setting benchmarks for innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Sun Visor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC AUTOMOTIVE EUROPE SA

- American Stitchco, Inc.

- Atlas Holdings LLC

- CARiD

- Continental AG

- Dongfeng Motor Parts and Components Group Co., Ltd.

- Dorman Products, Inc.

- Gentex Corporation

- GRIOS s.r.o.

- Grupo Antolin

- Hammacher Schlemmer & Company, Inc.

- Hayashi Telempu Co., Ltd.

- Kasai Kogyo Co., Ltd.

- KB Foam Inc.

- Knauf Industries

- Leman Industries

- Martur Fompak International

- Nifco Inc.

- Nye Lubricants, Inc.

- Patent Yogi LLC

- Reed Relays and Electronics India Limited

- Ripper Merchandise, LLC

- Shigeru Co., Ltd.

- Toyota Boshoku Corporation

Strategic Actions for Establishing Supply Chain Resilience, Embracing Modular Designs and Forging Technology Partnerships to Drive Competitive Advantage

Industry leaders must prioritize agility in sourcing to mitigate the impact of fluctuating material costs and evolving trade policies. Establishing long-term agreements with a diversified pool of polymer suppliers and exploring alternative high-performance composites will buffer against tariff-induced volatility. Furthermore, cross-functional collaboration between engineering and procurement teams is essential to evaluate material substitutions and optimize design for both cost and performance.

Concurrently, organizations should invest in modular sun visor architectures that support rapid customization and scalability across vehicle platforms. By adopting digital twin simulation and rapid prototyping, manufacturers can accelerate product validation cycles and respond swiftly to customer demands. Emphasizing digital integration with features such as ambient light sensing and driver assistance interfaces will differentiate offerings in crowded segments and align with future autonomous vehicle ecosystems.

Lastly, forging strategic alliances with technology firms and research institutions can unlock access to emerging smart visor technologies, from OLED displays to AR overlays. Cultivating these partnerships will enable industry participants to co-develop advanced solutions while sharing development risks. By focusing on supply chain resilience, modular innovation, and collaborative technology integration, industry leaders can navigate market uncertainties and secure sustainable growth.

Detailing a Robust Research Framework Combining Primary Stakeholder Engagement, Secondary Data Validation, and Proprietary Quantitative Analysis

This report draws upon a rigorous, multi-tiered methodology to ensure the integrity and depth of analysis. The primary phase involved extensive interviews with key stakeholders across the automotive value chain, including procurement directors, design engineers, and aftermarket distributors. These interviews provided firsthand insights into emerging needs, material preferences, and technology adoption roadmaps.

Complementing primary research, secondary sources such as industry journals, regulatory publications, and company reports were systematically reviewed to validate market developments and benchmark product specifications. Data triangulation techniques were applied to reconcile discrepancies and strengthen the accuracy of segment-specific findings. Additionally, a proprietary database of global automotive component shipments facilitated quantitative analysis of production trends and distribution channel dynamics.

Quality assurance protocols were embedded throughout the research process, including peer reviews by subject matter experts and iterative validation workshops with industry practitioners. This comprehensive approach ensures that the report’s conclusions are grounded in empirical evidence and reflect real-world market conditions, empowering decision-makers with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Sun Visor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Sun Visor Market, by Material

- Automotive Sun Visor Market, by Technology

- Automotive Sun Visor Market, by Type

- Automotive Sun Visor Market, by Application

- Automotive Sun Visor Market, by Distribution Channel

- Automotive Sun Visor Market, by Region

- Automotive Sun Visor Market, by Group

- Automotive Sun Visor Market, by Country

- United States Automotive Sun Visor Market

- China Automotive Sun Visor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Market Dynamics, Technology Drivers, and Strategic Imperatives to Navigate the Future of Automotive Sun Visors

In sum, the automotive sun visor market is at a pivotal juncture, shaped by technological innovation, evolving material preferences, and dynamic trade environments. The confluence of smart integration and lightweight polymers is redefining product value, while regional regulatory landscapes and tariff policies continue to influence supply chain strategies. Leading companies are differentiating through modular architectures and strategic alliances, signaling the competitive imperatives for both OEM and aftermarket participants.

By understanding these multifaceted dynamics and leveraging the actionable recommendations outlined herein, stakeholders can develop resilient procurement frameworks, accelerate product development cycles, and harness emerging smart visor technologies. This comprehensive executive summary serves as a strategic roadmap for navigating the complexities of the market and unlocking growth opportunities in an increasingly sophisticated automotive ecosystem.

Take decisive action today by consulting with Ketan Rohom to access unparalleled research insights and drive growth in the automotive sun visor market

To explore the comprehensive insights and strategic guidance presented in this report and position your organization for success in the rapidly evolving automotive sun visor market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. With deep industry expertise and a proven track record, Ketan can guide you through our detailed findings and customize solutions that align with your unique needs. Don’t miss the opportunity to leverage our rigorous analysis and actionable recommendations; contact Ketan Rohom today to secure your copy of the full market research report and gain a competitive advantage.

- How big is the Automotive Sun Visor Market?

- What is the Automotive Sun Visor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?