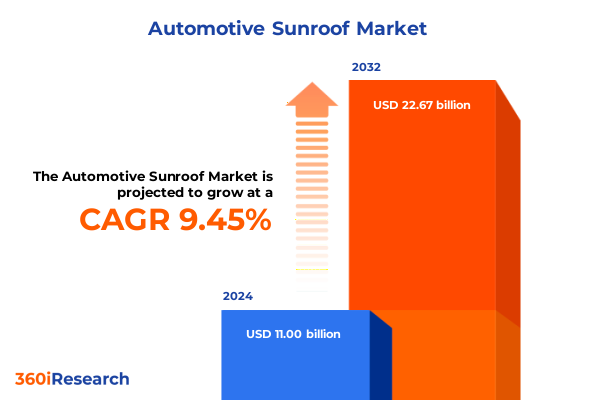

The Automotive Sunroof Market size was estimated at USD 11.86 billion in 2025 and expected to reach USD 12.79 billion in 2026, at a CAGR of 9.68% to reach USD 22.67 billion by 2032.

Understanding the Evolution and Significance of Vehicle Sunroofs in Modern Automotive Design and Consumer Experience Across Various Market Dynamics

The automotive sunroof has transitioned from a simple opening in the roof to an integral design element that elevates passenger experience and vehicle appeal. In its earliest form, the manual pop-up sunroof provided a basic way for drivers and passengers to feel the breeze and sunlight. Over decades, advances in manufacturing and consumer demand for premium features have driven the evolution toward sophisticated panoramic systems, integrated solar shading, and seamless roof panels. This transformation underscores the sunroof’s role as a differentiator in vehicle aesthetics and occupant comfort.

As modern consumers increasingly seek vehicles that blend functionality with innovation, the sunroof has gained prominence as an amenity that enhances cabin ambiance and perceived luxury. Auto manufacturers have responded by embedding sunroof design into vehicle architecture from the concept phase, rather than treating it as an afterthought. Consequently, the sunroof is no longer simply an optional add-on; it has become a core feature affecting engineering, materials selection, and overall vehicle engineering.

Looking ahead, the role of sunroofs in electric vehicles and autonomous driving platforms is poised to expand further. Innovations such as solar-collecting roof panels and lightweight composite materials are redefining what a sunroof can offer. By understanding this progression from functional opening to high-tech component, industry stakeholders can better appreciate its impact on both consumer perceptions and broader vehicle development strategies.

Examining How Technological Innovations and Shifting Consumer Preferences Are Driving Transformative Changes in the Sunroof Industry Landscape

The sunroof industry is experiencing a wave of technological innovation that is reshaping product portfolios and reimagining consumer expectations. Advancements in actuation mechanisms now allow seamless, whisper-quiet operation through precision-driven electric motors, while progress in transparent solar films enables roof panels to generate auxiliary power and improve energy efficiency. Meanwhile, the integration of smart controls and personalization software has elevated the sunroof from a static feature to an interactive interface, allowing drivers to tailor cabin lighting and ventilation with smartphone connectivity.

Concurrently, shifting consumer priorities are influencing design choices. Demand for panoramic views and open-air experiences has fueled growth in large dual-panel sunroofs, prompting manufacturers to explore new glazing composites that balance weight, durability, and UV protection. At the same time, sustainability imperatives are guiding the development of recyclable polymers, lightweight aluminum alloys, and eco-friendly manufacturing processes. As environmental regulations tighten and electric mobility gains momentum, these sustainable innovations are becoming key differentiators in supplier evaluations.

Moreover, the consolidation of digital retail channels and rising aftermarket personalization trends are redefining how OEMs and tier-one suppliers approach product distribution. Virtual configuration tools and online ordering platforms are streamlining customer journeys, while nimble aftermarket specialists cater to niche consumer segments seeking bespoke sunroof enhancements. Together, these transformative shifts are forging a more dynamic and competitive landscape, compelling all participants to innovate rapidly and align offerings with evolving mobility paradigms.

Assessing the Collective Effects of United States Tariff Policies Implemented in 2025 on Cost Structures Supply Chains and Market Dynamics in the Sunroof Sector

In 2025, changes in United States tariff policy introduced new cost considerations for sunroof frame components and raw materials. Steel and aluminum tariffs, applied to imports from key manufacturing hubs, prompted suppliers to reevaluate sourcing strategies and supply chain footprints. As a result, many tier-one providers accelerated nearshoring initiatives and broadened local partnerships to mitigate increased duty burdens and maintain pricing stability for OEM customers.

These tariff measures have also influenced material engineering priorities. Suppliers are investing in advanced composite alloys and high-strength plastics that can meet or exceed structural requirements while circumventing high-tariff metal imports. The shift toward lightweight, engineered polymers delivers resilience against cost volatility, though it necessitates rigorous testing and validation to satisfy safety and durability standards. Consequently, engineering cycles have grown more complex as developers balance regulatory compliance, performance criteria, and cost controls.

Furthermore, the accumulated impact of these tariffs has spurred negotiations between automakers and suppliers to share cost increases or realign contractual terms. Some OEMs have opted for modular sunroof platforms that enable flexible component substitutions, thereby preserving feature consistency across differing regional regulations. Overall, the aggregate effect of the 2025 tariff policies has been to reinforce the importance of agile supply chain design, robust material R&D, and collaborative risk-sharing frameworks.

Revealing In-Depth Insights Derived from Multi-Dimensional Segmentation Covering Type Actuation Vehicle Categories and Distribution Channels in the Sunroof Market

Deep segmentation analysis reveals that sunroof adoption varies markedly across product and customer dimensions. Based on type, the market spans traditional in-built openings, advanced panoramic panels, minimalist pop-up solutions, and sporty spoiler designs. Within the panoramic category itself, dual-panel configurations are distinguished by their expansive views, while single-panel versions balance cost efficiency with generous cabin illumination.

When considering actuation mechanisms, electric systems featuring DC motors deliver rapid response and smooth operation, while stepper motor variants offer incremental positioning precision. In contrast, manual sunroof options persist in entry-level segments, with crank handle designs providing user-driven control and pull cord solutions catering to lightweight assemblies. Each actuation choice aligns with specific vehicle architectures and target consumer expectations.

Examining vehicle type underscores further variation, as commercial vehicles, passenger cars, sport utility vehicles, and vans all incorporate sunroof technologies in unique ways. Vans divide again into cargo configurations, where durability and minimal maintenance are paramount, and minivan models, which leverage panoramic designs to enhance family-oriented comfort. Finally, sales channel segmentation shows a dominant share for OEM installed solutions, complemented by a growing aftermarket segment where retrofit specialists offer customization kits and specialized service packages.

This comprehensive research report categorizes the Automotive Sunroof market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Actuation

- Vehicle Type

- Sales Channel

Uncovering Regional Variations and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific in the Global Sunroof Industry Ecosystem

Regional market dynamics shape sunroof adoption through a blend of consumer preferences, regulatory frameworks, and infrastructure factors. In the Americas, strong consumer appetite for SUVs and premium passenger cars has driven demand for expansive panoramic roof systems integrated at the factory. Aftermarket customization hubs in North America further amplify this trend by offering rapid installation of dual-panel kits and solar-tinted solutions.

In Europe Middle East and Africa, stringent safety regulations and environmental directives influence both design and material selection. OEMs in this region favor robust in-built and spoiler sunroofs that comply with rigorous crash testing standards while offering UV-protective glazing. Simultaneously, the aftermarket landscape thrives in mature automotive markets, where discerning customers seek unique finishes and electronically controlled retractable designs to distinguish their vehicles.

Across Asia Pacific, surging passenger car volumes in emerging economies fuel entry-level sunroof penetration, particularly manual pop-up and single-panel panoramic types. Conversely, established markets like Japan and Australia exhibit strong uptake of electric sunroofs paired with sophisticated control systems. These diverse regional patterns underscore the need for suppliers to tailor offerings by combining global innovation with local market customization.

This comprehensive research report examines key regions that drive the evolution of the Automotive Sunroof market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Strategies Innovations and Collaborations Shaping the Competitive Landscape of Sunroof Manufacturing and Supply

Key industry participants have pursued differentiated strategies to secure competitive advantage in the sunroof domain. Established tier-one suppliers focus on modular platforms that accommodate multiple vehicle platforms and actuation types, enabling OEMs to streamline integration and reduce assembly complexity. Partnerships between component specialists and glazing technology providers have accelerated the development of lightweight, high-durability roof panels that meet evolving regulatory and sustainability targets.

Additionally, mergers and acquisitions have reshaped the competitive landscape, as companies seek to augment their product portfolios and geographic reach. Strategic collaborations with electric motor manufacturers and smart control software developers have empowered suppliers to deliver turnkey sunroof modules complete with user interfaces and remote diagnostic capabilities. Such end-to-end solutions enhance value propositions and foster deeper customer relationships.

Innovation cycles are further compressed by cross-industry cooperation in materials science and manufacturing automation. Companies are pooling resources to pioneer recyclable composites, integrated solar films, and digitally optimized production lines. In doing so, these leaders set new performance benchmarks while positioning themselves as preferred partners for next-generation mobility programs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Sunroof market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- BOS GmbH & Co. KG

- DeFuLai Automotive Sunroof Systems Co., Ltd.

- Donghee Holdings Co., Ltd.

- Fuyao Glass Industry Group Co., Ltd.

- Gabriel India Limited

- Inalfa Roof Systems B.V.

- Inteva Products, LLC

- Jincheng (Chongqing) Sunroof Systems Co., Ltd.

- Johnan Manufacturing Inc.

- Magna International Inc.

- Mitsuba Corporation

- Mobitech Co., Ltd.

- Motiontec Co., Ltd.

- Ningbo Sun-Manner Auto Parts Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- Saint-Gobain S.A.

- Saint-Gobain Sekurit

- Shenzhen CIMC Tianda Automotive Glass Co., Ltd.

- Signature Automotive Products LLC

- Wanchao Automotive Components Co., Ltd.

- Webasto SE

- Wuxi Mingfang Automotive Parts Co., Ltd.

- Xinyi Glass Holdings Limited

- Yachiyo Wuhan Manufacturing Co., Ltd.

Strategic and Practical Recommendations to Capitalize on Emerging Opportunities and Mitigate Risks in the Evolving Sunroof Market Environment

To capitalize on rising interest in premium sunroof offerings, industry leaders should prioritize investments in high-performance panoramic systems that leverage dual-panel glazing and next-gen solar integration. By aligning R&D efforts with sustainability mandates, suppliers can differentiate products through eco-friendly materials and energy-harvesting capabilities. Simultaneously, strengthening local manufacturing footprints will help insulate cost structures from regional tariffs and logistical disruptions.

Moreover, expanding electric actuation portfolios-particularly with DC motor and stepper motor variants-will address an array of vehicle types from SUVs to minivans. Developing modular mirror-image platforms simplifies the transition between single-panel and dual-panel configurations, thereby reducing engineering lead times. In parallel, nurturing strategic alliances with glazing and software vendors ensures access to cutting-edge controls and IoT-enabled diagnostics.

Finally, cultivating a balanced go-to-market approach that combines OEM partnerships with selective aftermarket channels will broaden customer reach. Tailored training programs for installation specialists and digital configurator tools for end users can accelerate volume adoption. By executing these targeted strategies, companies can unlock new growth avenues and sustain leadership in the dynamic sunroof ecosystem.

Detailing the Comprehensive Research Methodology Including Data Collection Analysis Validation and Segmentation Frameworks Underpinning the Study

This study employs a structured research methodology combining qualitative and quantitative insights to ensure robust analysis. Primary research involved in-depth interviews with OEM product planners, tier-one supplier executives, and aftermarket specialists to capture on-the-ground perspectives and validate emerging trends. Complementary secondary research drew on industry publications, patent filings, and regulatory databases to inform contextual understanding and identify technological advancements.

Data triangulation was performed through cross-validation workshops with materials engineers, product designers, and supply chain experts, ensuring alignment between conceptual findings and operational realities. Segmentation frameworks were developed across product type actuation mechanism vehicle category and sales channel dimensions to uncover nuanced performance drivers. Each segment’s assessment was reinforced by comparative case studies and best-practice reviews, fostering a comprehensive viewpoint.

Finally, the research team synthesized these insights through a multi-tiered analytical process that incorporated SWOT analysis and trend-mapping exercises. The result is a cohesive narrative supported by expert judgment and validated data, providing decision-makers with actionable intelligence on strategic directions and innovation imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Sunroof market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Sunroof Market, by Type

- Automotive Sunroof Market, by Actuation

- Automotive Sunroof Market, by Vehicle Type

- Automotive Sunroof Market, by Sales Channel

- Automotive Sunroof Market, by Region

- Automotive Sunroof Market, by Group

- Automotive Sunroof Market, by Country

- United States Automotive Sunroof Market

- China Automotive Sunroof Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing Key Insights Drawn from the Study to Illuminate Future Pathways and Drive Informed Decision-Making in the Sunroof Sector

The findings from this analysis illuminate how technological breakthroughs actuation innovations and shifting consumer preferences converge to redefine the sunroof landscape. Importantly, panoramic configurations and electric actuation dominate premium segments, while manual options persist in value-oriented vehicle classes. Regional nuances-from tariff-responsive sourcing practices in the Americas to safety-driven designs in Europe Middle East and Africa, and volume-driven growth in Asia Pacific-underscore the complexity of global market dynamics.

These insights emphasize the critical importance of agile supply chains and modular product architectures in responding to regulatory changes and cost pressures. Leading suppliers that harness partnerships in materials science control software and glazing technologies are poised to capture significant opportunities as automakers intensify their focus on sustainability and differentiated customer experiences.

By synthesizing segmentation-level observations and regional patterns, this study offers a holistic perspective on where investments in R&D manufacturing and go-to-market strategies can deliver the greatest returns. Readers are encouraged to leverage these conclusions as a roadmap for prioritizing initiatives and guiding resource allocation in the continually evolving sunroof sector.

Take the Next Step to Secure a Comprehensive Sunroof Market Intelligence Report by Connecting with Associate Director of Sales and Marketing Ketan Rohom

To explore a full spectrum of insights and gain a competitive advantage in the evolving sunroof market environment, reach out to Associate Director of Sales and Marketing Ketan Rohom. He will guide you through the comprehensive report’s value proposition and how its findings can directly support your strategic objectives. Engaging with Ketan will ensure you receive personalized support to navigate procurement, unlock exclusive expert analyses, and tailor the research package to your organizational needs. Connect with Ketan Rohom today for a seamless purchasing experience that positions your team at the forefront of industry intelligence and innovation.

- How big is the Automotive Sunroof Market?

- What is the Automotive Sunroof Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?