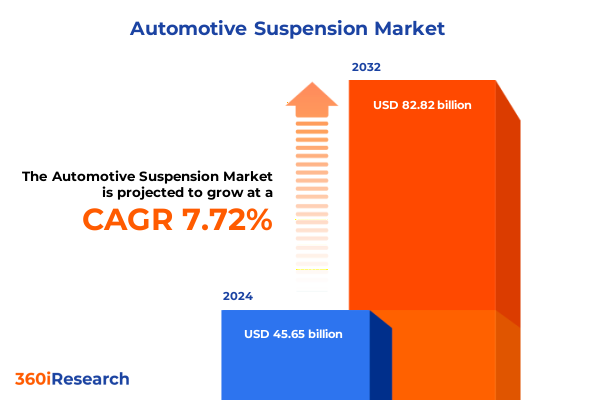

The Automotive Suspension Market size was estimated at USD 49.17 billion in 2025 and expected to reach USD 52.95 billion in 2026, at a CAGR of 7.73% to reach USD 82.82 billion by 2032.

Exploring the Convergence of Innovation, Regulation, and Consumer Expectations Shaping Tomorrow’s Suspension Systems

The foundation of modern automotive suspension systems has been reshaped by a convergence of technological breakthroughs, shifting regulatory environments, and evolving consumer expectations. Today’s suspension landscape is defined by an intricate interplay between precision-engineered mechanical components, sophisticated electronic control modules, and adaptive software algorithms. As vehicles become increasingly electrified and connected, suspension manufacturers face mounting pressure to deliver solutions that not only enhance ride comfort and handling but also integrate seamlessly with advanced driver assistance systems (ADAS) and electric powertrains.

Moreover, sustainability objectives are driving development toward lighter, more recyclable materials and energy-efficient manufacturing processes. Consequently, stakeholders across the supply chain-from material suppliers and tier-one component producers to OEMs and aftermarket distributors-must navigate this changing terrain with agility and foresight. Understanding the drivers behind these dynamics is essential for industry leaders aiming to capitalize on emergent opportunities and pre-empt potential disruptions. In particular, examining how regulatory incentives for vehicle electrification intersect with customer demands for superior comfort and safety will illuminate the complex forces shaping the next generation of suspension technologies.

In this context, an executive summary offers a strategic vantage point, distilling critical trends and actionable findings. It provides decision-makers with a succinct yet comprehensive overview of market transformations, trade policy implications, segmentation nuances, regional variations, and competitive developments that will guide effective planning in 2025 and beyond.

How Next-Generation Technologies, Regulatory Imperatives, and Evolving Buyer Demands Are Redefining Suspension Systems

The automotive suspension sector is experiencing transformative shifts driven by three primary vectors: technological innovation, policy directives, and evolving consumer preferences. First, the proliferation of semi-active and active suspension platforms is redefining dynamic vehicle control by leveraging real-time sensor feedback and electromechanical actuators. This shift is propelled by an ongoing quest for enhanced ride quality, improved safety margins, and integration with advanced driver assistance systems.

Second, global regulatory frameworks are increasingly incentivizing lightweight construction and emission reduction-pressing manufacturers to adopt high-strength yet lightweight alloys, composite materials, and modular suspension architectures. At the same time, regulations on electronic stability control and lane-keeping systems are heightening the importance of suspension subsystems in ensuring vehicle stability during emergency maneuvers.

Third, consumer expectations are propelling a move toward customizable ride profiles, over-the-air software updates, and predictive maintenance capabilities. These demands are fostering partnerships between legacy suspension suppliers and tech firms specializing in artificial intelligence and the Internet of Things. Consequently, companies that can seamlessly integrate mechanical expertise with digital connectivity stand to gain a decisive competitive edge. Collectively, these transformative forces underscore the critical importance of agility, collaboration, and cross-disciplinary innovation for sustainable growth.

Assessing the Strategic Repercussions of Expanded U.S. Tariff Policies on Suspension Component Sourcing and Supply Chain Resilience

The cumulative impact of U.S. tariff policy in 2025 has reverberated across the automotive suspension supply chain, prompting strategic recalibrations among both domestic and international stakeholders. Building on earlier Section 301 measures, recent adjustments have expanded the scope to encompass a broader array of spring components and electronic damper modules imported from select trading partners. As a result, manufacturers have accelerated efforts to diversify sourcing locations, shifting a portion of production to Mexico, Central America, and Southeast Asia to mitigate increased duties.

In parallel, original equipment manufacturers have undertaken comprehensive supplier audits, favoring domestic and near-shore partners capable of ensuring continuity of supply and compliance with stringent content requirements. These developments have also spurred greater investment in automation technologies within U.S.-based facilities, where manufacturers seek to offset tariff-driven cost pressures through productivity gains.

Looking ahead, the ripple effects of tariff realignments are expected to influence strategic partnerships, joint ventures, and potential mergers, as companies aim to consolidate expertise and secure preferential trade credentials. Additionally, aftermarket channels are reevaluating inventory strategies, given that duty increases on imported leaf springs and torsion beam subassemblies have altered relative cost structures. Ultimately, the 2025 tariff landscape has catalyzed supply chain resilience initiatives and underscored the strategic importance of agility in response to evolving trade policies.

Deciphering Suspension Market Dynamics Through Multifaceted Segmentation of Products, Technologies, and Distribution Channels

Insight into market segmentation reveals how diverse product and distribution vectors shape competitive strategies across suspension offerings. When examining suspension type classifications-air spring, coil spring, leaf spring, and torsion beam-differing performance attributes and manufacturing complexities become apparent. Air spring solutions, segmented further into rolling lobe and sleeve bellows variants, appeal to luxury and commercial segments where adjustable ride height and load leveling are critical. In contrast, coil springs deliver a balance of cost-effectiveness and ride comfort that underpins a broad spectrum of passenger vehicle designs, while mono-leaf and multi-leaf configurations address heavy-duty applications with robust load-bearing requirements.

Component-based differentiation underscores the role of anti-roll bars, bearings, and bushings in fine-tuning chassis dynamics. Dampers-further grouped into adjustable, electronic, and standard variants-serve as crucial modulators of suspension behavior, with electronic damper systems increasingly adopted to support semi-active and active architectures. Technology classifications, spanning active, passive, and semi-active systems, further delineate supplier specializations and R&D focuses, reflecting varying levels of integration with vehicle electronics and control software.

Vehicle type segmentation distinguishes the unique demands of heavy commercial vehicles, light commercial vehicles, and passenger cars, each demanding tailored suspension performance and compliance standards. Finally, distribution channels, including aftermarket and original equipment manufacturer pathways, guide go-to-market strategies and influence aftermarket service ecosystems. A holistic understanding of these segmentation dimensions is vital for companies seeking to align their product portfolios with distinct application requirements and end-customer preferences.

This comprehensive research report categorizes the Automotive Suspension market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Suspension Type

- Component

- Technology

- Vehicle Type

- End User

- Sales Channel

Uncovering Regional Contrasts in Suspension Demand Trends Driven by Regulatory Mandates and Infrastructure Development

Regional insights highlight stark contrasts in market maturity, regulatory frameworks, and infrastructure development across the Americas, Europe-Middle East & Africa, and Asia-Pacific. In the Americas, OEMs are rapidly adopting semi-active suspension solutions to meet stringent North American safety regulations and consumer demand for ride comfort in SUVs and pickup trucks. The reshoring trend has also gained traction, as manufacturers invest in localized production capabilities to mitigate tariff impacts and ensure supply chain continuity.

Within Europe, the Middle East, and Africa, a diverse regulatory landscape has led to a range of adoption curves: Western Europe’s push toward electrification and advanced safety systems has catalyzed demand for active suspension platforms, whereas emerging markets in the Middle East continue to rely predominantly on cost-efficient passive systems. Africa’s nascent automotive industry, meanwhile, presents long-term growth potential, though current infrastructure constraints and import duties influence slower market penetration.

In the Asia-Pacific region, surging vehicle production hubs in China, India, and Southeast Asia have fostered robust investment in both standard and electronically controlled dampers. Local OEMs are forging technology partnerships to develop tailored solutions for high-volume passenger cars and commercial fleets. Additionally, regional free-trade agreements are spurring cross-border component flows, enabling manufacturers to optimize plant utilization and reduce production lead times. These regional nuances underscore the strategic value of tailoring product development, manufacturing footprints, and market entry approaches to local conditions and regulatory imperatives.

This comprehensive research report examines key regions that drive the evolution of the Automotive Suspension market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies and Innovation Pathways Shaping the Global Suspension Supplier Landscape

Key company insights reveal a competitive field marked by varying strategic imperatives and innovation trajectories. Leading suspension system suppliers have differentiated their positions through targeted acquisitions, strategic alliances, and in-house R&D investments. Companies emphasizing electronic damping technologies are carving out leadership in semi-active and active system segments by leveraging proprietary control algorithms and sensor integration expertise. In contrast, players with deep manufacturing heritage in steel springs and passive components are focusing on operational excellence and cost leadership, optimizing plant automation and material sourcing strategies to maintain profitability under tariff pressures.

Meanwhile, emerging challengers are disrupting traditional hierarchies by offering modular suspension kits that facilitate rapid customization and simplified assembly. Several firms have also expanded their aftermarket service networks, coupling predictive maintenance software with extended warranty offerings to capture additional revenue streams. Collaboration between suspension specialists and automotive OEMs has intensified, with joint development agreements targeting next-generation electric vehicle platforms and autonomous driving suites. These alliances underscore the importance of combining mechanical expertise with software-driven control systems.

In addition, investments in sustainability-ranging from bio-based elastomers for bushings to recyclable composite spring materials-have become a hallmark of forward-looking suppliers. By pursuing environmentally friendly manufacturing and end-of-life recovery programs, leading companies are enhancing brand positioning and preempting future regulatory requirements, thus setting new benchmarks for corporate responsibility within the suspension industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Suspension market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Benteler International AG

- Bilstein Group GmbH

- BWI Group

- Continental AG

- Hendrickson USA, L.L.C.

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- KYB Corporation

- Magna International Inc.

- Mando Corporation

- Marelli Holdings Co., Ltd.

- Meritor, Inc.

- NHK Spring Co., Ltd.

- Schaeffler AG

- Showa Corporation

- Sogefi S.p.A.

- Tenneco Inc.

- Thyssenkrupp AG

- ZF Friedrichshafen AG

Charting a Strategic Roadmap That Integrates Technology Partnerships, Agile Manufacturing, and Sustainability to Drive Growth

Industry leaders must pursue a multi-pronged approach to thrive amid ongoing market transformations. First, forging strategic partnerships with technology firms specializing in artificial intelligence and sensor fusion can accelerate development of predictive suspension control systems. By integrating data analytics and machine learning, companies can offer dynamic ride tuning that adapts to road conditions and driver preferences in real time. Second, investing in flexible manufacturing platforms enables rapid reconfiguration of production lines to accommodate both legacy passive components and emerging electronic modules, thereby mitigating risks associated with shifting tariff landscapes.

Furthermore, embracing nearshore and dual-sourcing strategies will enhance supply chain resilience. Collaborating with regional partners across North and Central America can reduce lead times and exposure to duty fluctuations. At the same time, embedding sustainability throughout the product lifecycle-from material selection to end-of-life recycling-will align offerings with evolving regulatory mandates and consumer expectations for green mobility.

Finally, developing comprehensive aftermarket solutions that combine hardware with software-driven maintenance services can unlock new revenue streams and reinforce customer loyalty. By offering subscription-based diagnostics and performance upgrades, suspension suppliers can differentiate their brands and capture value beyond the initial sale. Collectively, these recommendations will equip industry leaders to navigate volatility, capitalize on technological convergence, and sustain growth as the suspension market continues to evolve.

Leveraging a Rigorous Framework of Primary Interviews, Secondary Intelligence, and Advanced Analytics to Deliver Reliable Insights

The research methodology underpinning this analysis combines primary and secondary data sources to ensure rigorous, objective insights. Primary research included in-depth interviews with senior executives from leading suspension component suppliers, tier-one automotive OEM procurement specialists, and aftermarket channel managers. These conversations provided nuanced perspectives on technology adoption timelines, supplier selection criteria, and the operational implications of U.S. tariff adjustments in 2025.

Complementing these insights, secondary research drew upon a comprehensive review of industry publications, trade association reports, regulatory filings, and technical white papers. Advanced analytics were applied to qualitative and quantitative datasets to uncover patterns in technology diffusion, supply chain realignments, and regional adoption rates. Cross-validation techniques, including triangulation of expert opinions and documentary evidence, were employed to verify the consistency and reliability of findings.

Throughout the research process, emphasis was placed on transparency and reproducibility. All data sources were documented, and key assumptions were tested against alternative scenarios. This robust methodology ensures that the resulting strategic conclusions and actionable recommendations are grounded in empirical evidence and reflective of the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Suspension market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Suspension Market, by Suspension Type

- Automotive Suspension Market, by Component

- Automotive Suspension Market, by Technology

- Automotive Suspension Market, by Vehicle Type

- Automotive Suspension Market, by End User

- Automotive Suspension Market, by Sales Channel

- Automotive Suspension Market, by Region

- Automotive Suspension Market, by Group

- Automotive Suspension Market, by Country

- United States Automotive Suspension Market

- China Automotive Suspension Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Technological, Trade, and Competitive Dynamics to Illuminate the Path Forward for Suspension Market Leadership

In sum, the automotive suspension industry stands at the threshold of profound transformation, driven by the interplay of advanced control technologies, evolving regulatory imperatives, and shifting trade policies. The rise of active and semi-active suspension platforms heralds a new era of vehicle dynamics, where real-time adaptability and connectivity converge to deliver unparalleled ride experiences. At the same time, tariff adjustments in 2025 have underscored the importance of supply chain agility and nearshore diversification, compelling manufacturers to rethink sourcing and production strategies.

Segmentation insights highlight the need for tailored solutions across suspension types, component categories, technology levels, vehicle classes, and distribution channels. Regional contrasts further demonstrate that a one-size-fits-all approach is no longer viable; success requires customized strategies responsive to local regulations, infrastructure maturity, and consumer preferences. Meanwhile, competitive analysis reveals that firms combining mechanical expertise with software-driven innovation and sustainability commitments are best positioned to lead the market forward.

Moving from analysis to action, industry players are advised to embrace cross-disciplinary partnerships, invest in flexible manufacturing, and expand aftermarket service offerings. By doing so, they will not only navigate current challenges but also lay the groundwork for long-term leadership in a rapidly evolving landscape. Ultimately, those who integrate strategic foresight with operational excellence will thrive as the suspension market advances into its next chapter.

Secure Exclusive Access to Comprehensive Automotive Suspension Insights and Tailored Strategic Support from an Industry Expert

Engaging in a personalized exploration of the automotive suspension landscape requires access to in-depth insights, and I am eager to assist you directly in obtaining the comprehensive research report that will inform strategic decision-making. Whether you are seeking clarity on the nuanced effects of evolving U.S. trade policies on component sourcing, or looking to understand how advances in semi-active suspension systems can enhance vehicle performance, I am available to guide you through the report’s rich data and analysis. As Associate Director of Sales & Marketing, I will ensure that you receive tailored support and exclusive access to detailed charts, supplier evaluations, and the latest regulatory assessments.

By partnering with me, you will gain a trusted advisor who understands your unique business challenges and objectives. I can walk you through case studies of leading OEMs integrating next-generation dampers, discuss regional supply chain realignments across the Americas, EMEA, and Asia-Pacific, and highlight actionable recommendations for near-term implementation. Don’t miss the opportunity to leverage cutting-edge intelligence that can shape your market entry, product development, and investment strategies in 2025 and beyond.

Contact me today to schedule a personalized briefing and secure your copy of the full market research report. Let’s collaborate to turn industry insights into competitive advantage.

- How big is the Automotive Suspension Market?

- What is the Automotive Suspension Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?