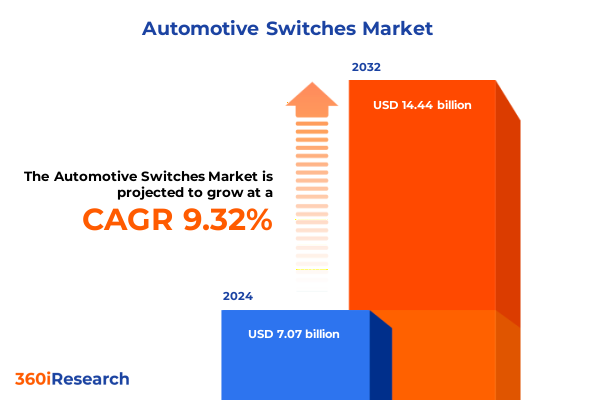

The Automotive Switches Market size was estimated at USD 7.73 billion in 2025 and expected to reach USD 8.45 billion in 2026, at a CAGR of 9.33% to reach USD 14.44 billion by 2032.

Exploring the Critical Role of Automotive Switch Technologies in Enhancing Vehicle Performance Connectivity Safety and User Experience

Exploring the automotive switch domain begins with recognizing how these seemingly simple components serve as vital interfaces between driver intent and vehicle functionality. From the moment a driver initiates a turn signal to the adjustment of interior lighting, switches translate human commands into precise electrical actions that underpin safety, comfort, and convenience. Over time, these components have evolved far beyond mere on-off mechanisms, integrating advanced materials, ergonomic form factors, and digital connectivity capabilities that meet the demands of contemporary vehicle architectures.

Moreover, as vehicle cabins become more digitally integrated, the user interface role of switches has grown in importance. Modern designs prioritize tactile feedback, modularity, and aesthetic harmony with broader cockpit layouts. At the same time, automotive electrification trends have heightened the performance requirements for contact reliability and current-carrying capacity. These converging pressures have intensified collaboration between OEMs and switch suppliers, giving rise to co-development initiatives that accelerate technology deployment while ensuring compliance with stringent automotive quality standards.

As we embark on a deeper examination of this sector, understanding these foundational dynamics is crucial. The subsequent sections will unveil pivotal shifts in technology, regulatory influences such as tariffs, strategic segmentation considerations, and regional as well as competitive landscapes that collectively shape the future trajectory of the automotive switch industry.

Charting the Dramatic Evolution of Automotive Switch Implementations Driven by Electrification Connectivity Autonomous Systems and Ergonomic Innovation

The past decade has witnessed a profound transformation in how switches are designed, manufactured, and integrated into vehicles, driven by the twin forces of electrification and digitalization. As more powertrain functions migrate to electric architectures, switches must now operate under higher voltage and current conditions, necessitating the adoption of advanced contact materials and innovative thermal management approaches. Concurrently, the rise of connected vehicles has spurred demand for switches with embedded sensors and communication modules, enabling features such as haptic feedback, programmable lighting, and data telemetry for predictive maintenance.

In parallel, the advent of advanced driver-assistance systems (ADAS) has led to the emergence of multifunctional controls that consolidate traditional switch roles into centralized modules capable of handling diverse signal types. Ergonomic and aesthetic considerations have also gained prominence, with biometric‐inspired textures, illuminated icons, and customizable actuation forces becoming key differentiators in premium vehicle segments.

Taken together, these trends reflect a broader industry shift toward smart human-machine interfaces that blend mechanical precision with software flexibility. The rapid adoption of modular architectures allows OEMs to tailor switch assemblies to distinct model lines without reengineering core hardware, while suppliers leverage scalable platforms to introduce incremental feature enhancements. This dynamic landscape underscores the critical importance of continuous innovation and cross-functional collaboration as the foundational blueprint for future success in automotive switch development.

Analyzing the Compounded Effects of United States 2025 Tariff Measures on Automotive Switch Supply Chains Manufacturing Costs and Strategic Sourcing Decisions

In 2025, the United States continued to adjust its trade policy framework, extending Section 301 tariffs on automotive components and related electronics to address perceived imbalances in global trade. For automotive switch manufacturers, which often rely on cross-border supply chains, these measures have delivered a cumulative impact that spans both cost structures and sourcing strategies.

Initially, the imposition of supplemental duties prompted many suppliers to absorb costs or negotiate price concessions with OEM customers, straining margins across the value chain. As tariffs persisted, firms reevaluated their procurement footprints, accelerating nearshore production in Mexico and diversifying component sourcing to tariff-exempt markets. These strategic shifts have not only alleviated some cost pressures but also introduced new complexities in logistics coordination, quality assurance, and regulatory compliance.

Furthermore, the ripple effects of tariff measures have spurred innovation in raw material selection and product design. Suppliers are increasingly exploring alternative alloys and contact finishes that maintain performance under variable cost conditions, while modular assembly approaches enable rapid adaptation to evolving duty classifications. Additionally, collaborations between OEMs and switch suppliers have deepened, focusing on joint forecasting and inventory management practices aimed at mitigating the risk of future policy changes.

Looking forward, the legacy of these tariff decisions will likely endure as a catalyst for greater supply chain resilience. Companies that have successfully navigated the 2025 landscape are now better positioned to optimize their global footprints, secure strategic partnerships, and invest in the flexible manufacturing capabilities that will define the next era of automotive switch production.

Uncovering Strategic Insights from Segmentation of Automotive Switches Across Product Types Configurations Vehicle Applications and Distribution Channels

Segmenting the automotive switch market by product type reveals a hierarchy of design priorities, where pushbutton controls often dominate power window and interior lighting applications due to their compact footprint and consistent tactile feedback, while rocker switches are preferred for headlamp and fog lamp operations given their intuitive on-off orientation. Rotary controls, with their smooth incremental rotation, find widespread use in mirror adjustment and climate control functions, whereas slide switches, prized for their linear actuation, enable precise seat movement adjustments and wiper control settings. Toggle mechanisms, with their lever-based action, remain integral to emergency and auxiliary signaling, offering high reliability under repeated use.

Contact configuration further refines these offerings, with double pole double throw architectures supporting complex circuit pathways in advanced lighting modules, and double pole single throw designs serving dual-circuit infotainment systems. Multi pole configurations underpin multifunctional steering-column stalks, while single pole double throw contacts are frequently deployed in turnover functions such as power window reversal. The ubiquity of single pole single throw contacts across basic switch arrays underscores their cost-effectiveness for low-current interior lighting zones.

Vehicle type segmentation bifurcates demand into commercial vehicles-where robustness and ease of maintenance are paramount-and passenger cars, which emphasize ergonomic styling and integration with digital dashboards. Application segmentation extends this nuance, encompassing lighting subsegments including fog lamps, headlights, and interior ambient zones; power window assemblies differentiated between front and rear panels; seat adjustment modules offering electric or manual options; and wiper controls calibrated for front- and rear-window operation.

Finally, end-user channels reveal divergent purchasing behaviors: original equipment manufacturers prioritize lifecycle support and volume pricing, while aftermarket purchasers value ease of replacement and broad distribution access. Likewise, the distribution channel split between offline dealer networks and burgeoning online platforms demands tailored go-to-market approaches that balance digital convenience with technical support and warranty assurance.

This comprehensive research report categorizes the Automotive Switches market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Contact Configuration

- Vehicle Type

- Application

- End User

- Distribution Channel

Evaluating Regional Dynamics Shaping the Global Automotive Switch Market in the Americas EMEA and Asia Pacific Manufacturing and Consumer Trends

The Americas region remains a dynamic arena for automotive switch innovation, anchored by the United States’ leadership in advanced vehicle electrification and Canada’s growing emphasis on zero-emission fleets. North American OEMs have invested heavily in modular interior architectures that facilitate rapid integration of smart switch modules, while supply chain restructuring-driven by nearshoring and automated assembly investments-has enhanced responsiveness to shifting market demands. South American markets, led by Brazil and Argentina, continue to prioritize durable switch designs capable of withstanding harsh environmental conditions, spurring suppliers to develop corrosion-resistant finishes and higher ingress protection ratings.

Turning to Europe, Middle East, and Africa, regulatory stringency around vehicle safety and environmental standards has propelled the adoption of illuminated and haptic switch technologies that meet UNECE requirements, particularly for lane departure and adaptive lighting controls. Western European manufacturers have cultivated local switch production hubs, leveraging skilled labor and robust materials ecosystems to deliver high-precision rotary and rocker assemblies for premium vehicle segments. In the Middle East and Africa, infrastructure considerations drive demand for heavy-duty switch configurations in commercial vehicles and off-road applications, with suppliers tailoring contact configurations to accommodate variable voltage systems.

In Asia-Pacific, China’s expansive automotive industry has evolved into a global switch manufacturing powerhouse, combining scale with rapid design-to-production cycles. Chinese and Japanese suppliers alike are at the forefront of integrating Internet of Things capabilities into switch modules, enabling over-the-air updates and remote diagnostics. India’s burgeoning passenger car market has also emerged as a testing ground for cost-optimized slide and toggle controls, while Southeast Asian production clusters benefit from competitive labor rates and favorable export frameworks.

Across these three macro-regions, the interplay of regulatory environments, manufacturing ecosystems, and consumer preferences defines distinct growth pathways, even as global supply chains and technology transfers weave them into an interconnected market tapestry.

This comprehensive research report examines key regions that drive the evolution of the Automotive Switches market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies Innovations Partnerships and Growth Initiatives of Leading Automotive Switch Manufacturers and Suppliers

Leading the competitive landscape, TE Connectivity continues to strengthen its position through serial acquisitions of specialty switch providers and by deepening its partnerships with major automotive OEMs, leveraging its expertise in sensor integration and high-reliability contacts. Alps Alpine has distinguished itself with innovative capacitive-touch switch modules that blend traditional actuation with digital user interfaces, targeting next-generation cockpit electrification programs. BorgWarner, traditionally recognized for powertrain components, has expanded into thermal and electromechanical switch assemblies tailored for high-voltage applications, marking its strategic foray into interior electrification.

Crafting differentiated offerings, CTS Corporation has focused on enhancing environmental resilience, introducing switch families with ultra-low power profiles and IP69K ratings for use in commercial truck cabins and construction vehicles. Gentherm has leveraged its climate control heritage to deliver modular switch clusters that seamlessly integrate both HVAC and seat adjustment functions, reinforcing its competitive edge in premium passenger vehicles. Other noteworthy players, including EAO and Nidec, have adopted platform-based development models that enable them to address diverse cabin architectures with minimal redesign cycles.

Across the board, collaboration and co-development agreements between suppliers and OEM innovation centers have become par for the course, spurring rapid prototyping and shorter validation cycles. Strategic investments in advanced manufacturing technologies-such as laser-welding contact assemblies, automated optical inspection, and digital twin validation-further differentiate these key players, solidifying their market leadership and setting new benchmarks for switch performance and integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Switches market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- ALPS ALPINE Co., Ltd.

- Aptiv PLC

- Eaton Corporation plc

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Sensata Technologies Holding plc

- TE Connectivity Ltd.

- Viney Corporation Pvt. Ltd.

- Yazaki Corporation

Formulating Strategic Initiatives to Mitigate Technological Disruptions Supply Chain Risks and Regulatory Challenges in Automotive Switch Industry

Industry leaders seeking to thrive amid rapid technological change and supply chain uncertainty should prioritize flexible manufacturing networks that can pivot in response to evolving tariff landscapes and regional demand shifts. Establishing dual-sourcing agreements in nearshore and low-tariff jurisdictions can safeguard continuity while fostering competitive cost structures. In parallel, investing in modular platform architectures for switch assemblies not only accelerates time-to-market for new models but also enhances customization options for OEM customers.

Equally critical is the adoption of advanced materials research to develop durable contact finishes and corrosion-resistant alloys optimized for higher voltage thresholds. Collaborating with universities and specialized labs can yield proprietary formulations that balance conductivity, longevity, and cost efficiency. From a product perspective, integrating digital intelligence-such as capacitive sensing, optical actuation feedback, and wireless diagnostic capabilities-will be a key differentiator, enabling enhanced user experiences and predictive maintenance programs.

On the operational front, leveraging digital twin models and predictive analytics can refine production planning and quality control, reducing scrap rates and accelerating root-cause analysis. Companies should also establish formal channels for real-time collaboration with OEM procurement teams, ensuring that design specifications remain synchronized with evolving regulatory requirements and consumer expectations. Finally, building a resilient workforce through continuous training in mechatronics, data analytics, and advanced manufacturing techniques will be essential to sustaining innovation momentum and delivering strategic value to customers.

Detailing a Rigorous Mixed Methodology Blending Primary Industry Interviews Secondary Data Analysis and Robust Triangulation for Reliable Market Research

This study employed a mixed-methods research framework to ensure robust and reliable insights. The primary research phase included in-depth interviews with senior R&D and procurement executives at leading OEMs, switch module designers, and tier-one suppliers, providing firsthand perspectives on evolving product requirements, regulatory pressures, and strategic partnerships. Complementing these discussions, technical workshops and site visits at manufacturing facilities offered practical understanding of production workflows, quality assurance protocols, and innovation pipelines.

Secondary research drew on a broad spectrum of industry documentation, including trade association reports, regulatory filings, patent databases, and academic publications, facilitating cross-validation of key trends and technological breakthroughs. Proprietary data sources were reviewed to map supply chain footprints, while specialized journals and conference proceedings shed light on emerging materials science developments and manufacturing automation advances.

Data triangulation techniques enhanced analytical rigor, aligning interview insights with documented performance metrics and case studies. Hypothesis testing was conducted via scenario modeling to gauge the potential impact of tariff changes and regional manufacturing shifts. Finally, iterative review cycles with peer experts and internal senior analysts were conducted to refine conclusions, ensure methodological transparency, and uphold the highest standards of data integrity and objectivity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Switches market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Switches Market, by Product Type

- Automotive Switches Market, by Contact Configuration

- Automotive Switches Market, by Vehicle Type

- Automotive Switches Market, by Application

- Automotive Switches Market, by End User

- Automotive Switches Market, by Distribution Channel

- Automotive Switches Market, by Region

- Automotive Switches Market, by Group

- Automotive Switches Market, by Country

- United States Automotive Switches Market

- China Automotive Switches Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Takeaways and Imperatives to Guide Stakeholders Through Emerging Trends Challenges and Opportunities in the Automotive Switch Ecosystem

In synthesizing these insights, it is evident that the automotive switch industry stands at the intersection of rapid technological evolution, shifting trade policies, and diverse regional dynamics. Manufacturers that excel will be those capable of marrying advanced materials and digital functionality with flexible production and supply chain strategies. As regulatory environments continue to evolve, collaborative engagements with OEMs and proactive scenario planning will differentiate leaders from laggards.

The segmentation analysis underscores the importance of a nuanced approach to product development-balancing the demands of passenger and commercial vehicle segments, tailoring switch configurations to specific applications, and aligning end-user channel strategies with distribution networks. Regional considerations further highlight the need for a geographically diversified footprint that leverages both cost advantages and regulatory alignment.

Ultimately, the path forward hinges on a commitment to continuous innovation, operational resilience, and strategic partnerships. By harnessing cutting-edge manufacturing technologies, forging cross-functional collaborations, and maintaining an adaptive mindset toward policy shifts and market trends, companies can secure a sustainable competitive edge in the dynamic automotive switch landscape.

Engaging with Ketan Rohom to Secure Your Customized Automotive Switch Market Analysis and Unlock Actionable Insights for Strategic Decision Making

To obtain the comprehensive insights and detailed analysis that will empower your organization to stay ahead in the rapidly evolving automotive switch sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to secure a tailored consultation that aligns with your strategic priorities, whether it’s optimizing supply chain resilience, evaluating emerging product innovations, or navigating complex tariff implications. By partnering with Ketan Rohom, you will unlock actionable intelligence designed to inform critical business decisions, drive competitive advantage, and foster long-term growth. Connect today to discuss how this bespoke research can be adapted to your unique needs and to learn about flexible purchasing options for the full market study

- How big is the Automotive Switches Market?

- What is the Automotive Switches Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?