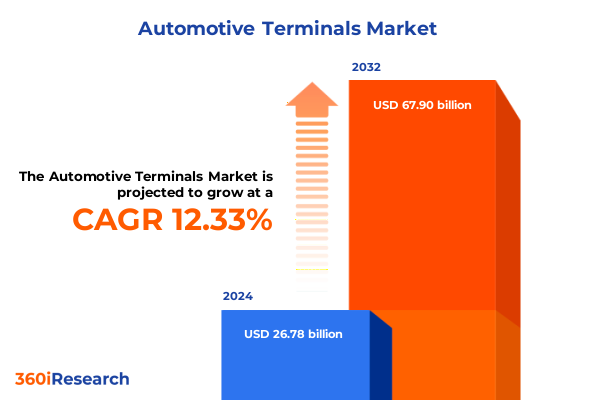

The Automotive Terminals Market size was estimated at USD 30.03 billion in 2025 and expected to reach USD 33.69 billion in 2026, at a CAGR of 12.35% to reach USD 67.90 billion by 2032.

Exploring the Critical Role of Automotive Terminals Amidst Technological Advances and Shifting Market Demands in the Global Mobility Ecosystem

The automotive terminal market sits at the intersection of electrical connectivity and mobility innovation, serving as the vital link between power, data, and control within modern vehicles. As consumer expectations for reliability, safety, and digital functionality accelerate, terminals have evolved beyond simple metal connectors to sophisticated components that enable advanced powertrain configurations, autonomous driving systems, and robust infotainment architectures. In this environment, terminals must accommodate higher voltage demands, stricter safety standards, and ever-more compact packaging, all while delivering the quality and consistency required by original equipment manufacturers.

This executable summary highlights how market forces such as electrification, digitalization, and regulatory oversight are converging to transform product requirements, supply chain dynamics, and competitive strategies. It sheds light on the catalysts shaping demand, the technologies redefining performance benchmarks, and the stakeholder ecosystems driving innovation. By understanding these foundational shifts, industry participants can better align their R&D focus, production footprints, and go-to-market approaches to capture emerging opportunities and manage potential disruptions.

Unveiling the Technological and Regulatory Transitions Redefining Automotive Terminal Design Production Integration Across Evolving Vehicle Architectures

The automotive terminal landscape is undergoing profound transformation driven by converging technological revolutions and regulatory imperatives. The rise of electric vehicles imposes unique demands on terminal designs, requiring high-voltage insulation, thermal stability, and enhanced current-carrying capacity. Simultaneously, the proliferation of driver assistance systems and autonomous driving platforms has intensified the complexity of data transmission pathways, necessitating terminals capable of shielding sensitive signals from electromagnetic interference and ensuring ultra-reliable connectivity across diverse operating conditions.

Regulatory pressures around emissions, safety, and sustainability have further accelerated innovation cycles. Standards bodies and governmental agencies are mandating rigorous testing protocols and environmental compliance measures, compelling suppliers to adopt advanced materials and manufacturing processes. In parallel, the shift toward lightweighting and compact vehicle architectures is driving miniaturization efforts, pushing the boundaries of terminal form factors without compromising electrical performance.

Beyond product engineering, supply chain resilience has emerged as a strategic imperative. Geopolitical tensions, raw material volatility, and the complexities of just-in-time logistics have prompted companies to rethink sourcing strategies, expand nearshoring initiatives, and invest in digital supply chain visibility tools. This reconfiguration of global value chains underscores the need for agility and collaboration among terminal suppliers, tier-one integrators, and OEMs to navigate disruptions effectively while maintaining high service levels.

Assessing the Broad Economic and Operational Consequences of United States Tariff Measures on Automotive Component Markets and Supply Chains in 2025

The cumulative impact of United States tariff measures in 2025 has reshaped cost structures, supply chain flows, and strategic investment decisions across the automotive terminal market. The imposition of a 25% import duty on finished vehicles and certain component categories under national security provisions has prompted a transactional shift as importers, rather than foreign suppliers, have absorbed much of the additional burden. This redistribution of cost has eroded margins for component manufacturers and vehicle assemblers, especially those reliant on non-domestic content, and has introduced uncertainty into procurement planning for connectors, spade and ring terminals, and other critical interface elements.

In response, many global terminal suppliers have accelerated discussions around localizing production footprints within North America, seeking to leverage free trade agreements and qualify under domestic content thresholds. These relocation efforts often involve establishing new manufacturing lines or expanding existing facilities, as well as forging partnerships with regional contract manufacturers. At the same time, companies are implementing buffer inventory strategies to mitigate short-term volatility, which has led to temporary congestion at ports and inland distribution centers, affecting RoRo operations and yard management practices.

Furthermore, the tariff environment has broken long-standing assumptions about near-zero duties in the automotive sector, prompting a reassessment of product portfolios. Suppliers are prioritizing higher-value, low-volume terminals that complement premium and electric vehicle platforms, while scaling back standard connector offerings in more price-sensitive tiers. This selective focus aims to protect profitability in a context where broad cost increases cannot be fully passed through to end customers. As a result, terminal design roadmaps now incorporate modularity and regional customization features to remain competitive under divergent tariff and regulatory regimes.

Delivering In-Depth Insights into Product Vehicle Application and Distribution Segmentation Trends Shaping the Demand Patterns in Automotive Terminal Markets

Insight into the market’s segmentation reveals critical nuances that inform targeted strategies for product development and commercialization. The product type dimension encompasses a diverse set of connector styles, ranging from bullet terminals and butt connectors to spade and ring terminals, each designed to meet particular electrical and mechanical requirements. Understanding the performance trade-offs and volume dynamics across these terminal variants enables suppliers to optimize production line setups and inventory management.

When viewed through the lens of vehicle type, the market divides between commercial and passenger vehicles. Commercial platforms, including heavy and light commercial models, demand terminals tailored for durability under extreme duty cycles and robust environmental exposure. Passenger vehicles, especially in the hatchback, sedan, and SUV categories, drive higher-volume production runs and emphasize compact, weight-saving designs that support efficiency and interior integration.

Application-based segmentation further refines the landscape by aligning terminal solutions with specific vehicle systems. From battery and charging architectures to wiring harnesses, safety systems to infotainment networks, each application segment places unique stressors on terminal materials and configurations. Suppliers that can demonstrate validated performance in high-current, high-signal integrity, or harsh-environment scenarios are best positioned to win new platform awards.

Finally, distribution channels differentiate between original equipment manufacturing and aftermarket pathways. While OEM channels prioritize long-cycle contracts, stringent qualification processes, and integrated supply partnerships, the aftermarket offers opportunities for retrofits, replacement components, and specialized upgrade kits. Navigating these channels demands distinct marketing, logistics, and certification approaches, underscoring the importance of channel-specific go-to-market models.

This comprehensive research report categorizes the Automotive Terminals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Application

- Distribution Channel

Illuminating Regional Dynamics and Emerging Opportunities Across the Americas Europe Middle East Africa and Asia-Pacific Automotive Terminal Ecosystems

Regional dynamics play a pivotal role in shaping competitive strategies and investment priorities for automotive terminal suppliers. The Americas continue to serve as a strategic hub for high-value production, driven by strong OEM demand in North America and a well-established aftermarket infrastructure. Localization initiatives are underway to comply with regional content requirements and to support nearshoring trends, particularly as automakers pivot toward electric vehicle production in the United States and Mexico.

In Europe, the Middle East, and Africa, regulatory rigor around emissions and safety standards has spurred innovation in next-generation connector technologies. Suppliers in EMEA benefit from close collaboration with leading automotive clusters in Germany, France, and Italy, where research consortia and standards bodies advance harmonized testing protocols. However, exposure to fluctuating trade policies and complex VAT regimes requires agile commercial structures and dynamic pricing mechanisms.

Asia-Pacific remains at the forefront of volume-driven manufacturing and rapid scalability, with China, South Korea, Japan, and India anchoring extensive production ecosystems. The region offers cost competitiveness and manufacturing agility, particularly for mass-market terminals. At the same time, rising labor costs and regional trade agreements are prompting diversification into Southeast Asia and beyond, as companies seek to balance cost efficiency with supply chain resilience. This evolving regional mosaic creates both opportunities and complexities for global players aiming to synchronize production capacity with global demand patterns.

This comprehensive research report examines key regions that drive the evolution of the Automotive Terminals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders and Strategic Collaborations Driving Innovation Competitive Advantage and Growth Trajectories within the Automotive Terminal Industry

Leading participants in the automotive terminal market demonstrate a spectrum of strategic approaches, from organic innovation to collaborative venture models. Major global suppliers differentiate through proprietary material science, process automation, and integrated design services that address the twin imperatives of performance and cost. They invest heavily in advanced stamping and plating technologies that enhance corrosion resistance, ensure consistent contact resistance, and support high-speed production runs.

In parallel, several companies have pursued targeted joint ventures with tier-one harness manufacturers and automotive OEMs to co-develop application-specific terminals for electric and autonomous platforms. These partnerships often include shared R&D centers and pilot production facilities that accelerate time to market. Additionally, M&A activity has been notable, with acquisitions focusing on specialty connector portfolios, complementary tooling capabilities, or regional production footprints that enhance proximity to key customers.

Innovation labs and digital factories have emerged as strategic assets, enabling suppliers to simulate terminal performance under accelerated life-cycle testing and to implement Industry 4.0 practices across the production line. Data-driven quality control, predictive maintenance, and digitized supply chain tracking reduce error rates and promote traceability. As customers demand ever-faster validation cycles, companies with robust digital twins and virtual commissioning capabilities secure a competitive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Terminals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amphenol Corporation

- Aptiv PLC

- AVX Corporation

- Foxconn Technology Group

- Fujikura Ltd.

- HARTING Technology Group AG

- Harwin Plc

- Hirose Electric Co., Ltd.

- ITT Inc.

- Japan Aviation Electronics Industry, Ltd.

- JST Co., Ltd.

- Korea Electric Terminal Co., Ltd.

- Kyocera Corporation

- Lear Corporation

- Leoni AG

- Molex LLC

- Nexans S.A.

- Panasonic Corporation

- Rosenberger Hochfrequenztechnik GmbH & Co. KG

- Samtec Inc.

- Sumitomo Electric Industries, Ltd.

- TE Connectivity Ltd.

- Yazaki Corporation

Outlining Strategic Actions and Best Practices for Automotive Terminal Leaders to Navigate Market Complexities and Capitalize on Emerging Growth Pathways

For industry leaders intent on navigating complexity and capitalizing on growth, a multi-pronged strategy is essential. First, investing in research toward advanced alloys, composite insulators, and high-efficiency plating processes can yield performance advantages in high-current and high-temperature applications. Coupling these material innovations with modular design architectures enables scalable customization for different vehicle platforms.

Second, diversifying manufacturing footprints through strategic partnerships and regional joint ventures mitigates tariff exposure and supply chain bottlenecks. Aligning with local contract manufacturers and establishing small-batch rapid prototyping facilities can accelerate new program launches and foster resilience against geopolitical disruptions.

Third, embedding digitalization across the value chain-from intelligent tooling and predictive analytics to end-to-end traceability-supports lean manufacturing and reduces time to market. Implementing collaborative platforms with OEM and tier-one customers will streamline qualification processes and improve visibility into future platform roadmaps.

Finally, cultivating dedicated business units focused on aftermarket development, serviceability, and retrofit solutions opens additional revenue channels. Tailored marketing approaches that highlight ease of installation, reliability in harsh environments, and safety certifications can differentiate aftermarket portfolios. This balanced approach ensures that organizations remain agile, innovative, and well-positioned to meet evolving customer requirements.

Describing the Rigorous Research Framework Data Collection Analysis and Validation Process Underpinning the Automotive Terminal Market Insights

The research underpinning these insights leveraged a comprehensive methodology combining both secondary and primary data sources. Initially, an extensive review of industry publications, regulatory filings, and patent databases established a foundational understanding of technological trends, standards developments, and competitive landscapes. This was complemented by analysis of trade data, import-export filings, and corporate financial disclosures to track shifts in manufacturing footprints and supply chain orientations.

Primary research included in-depth interviews with subject matter experts spanning terminal design engineers, procurement managers at OEMs, aftermarket channel distributors, and materials scientists. These dialogues provided contextual perspectives on emerging performance requirements, lead-time dynamics, and cost imperatives. Survey instruments targeted decision-makers across engineering, purchasing, and strategic planning functions to quantify priorities related to electrification, digitalization, and regional sourcing.

Quantitative data points were triangulated with qualitative judgments through iterative validation workshops, ensuring consistency and accuracy across the segmentation and regional analyses. The methodology emphasizes transparency, with clear documentation of inclusion criteria for product categories, vehicle platforms, application segments, and distribution channels. This rigorous approach underlies the credibility and actionability of the presented insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Terminals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Terminals Market, by Product Type

- Automotive Terminals Market, by Vehicle Type

- Automotive Terminals Market, by Application

- Automotive Terminals Market, by Distribution Channel

- Automotive Terminals Market, by Region

- Automotive Terminals Market, by Group

- Automotive Terminals Market, by Country

- United States Automotive Terminals Market

- China Automotive Terminals Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Critical Discoveries and Strategic Imperatives to Guide Decision-Making and Foster Sustainable Growth in the Automotive Terminal Sector

In synthesizing the key findings, it becomes evident that the automotive terminal market is at a pivotal inflection point where performance demands, regulatory pressures, and competitive forces intersect. Electrification and connectivity have elevated terminal requirements to a strategic priority, prompting suppliers to innovate in materials, designs, and digital capabilities. At the same time, evolving tariff regimes and geopolitical considerations underscore the importance of supply chain flexibility and localized production strategies.

Segment-specific insights reveal that targeted product portfolios aligned with high-value applications-such as high-voltage battery connections and advanced infotainment harnesses-offer the most attractive growth pathways. Regional dynamics further highlight differentiated strategies, with localization in the Americas, regulatory-driven innovation in EMEA, and volume-led expansion in Asia-Pacific shaping investment and operational decisions.

Ultimately, companies that integrate advanced R&D, agile manufacturing, and digital supply chain orchestration will capture the greatest share of emerging opportunities. By adopting a forward-looking posture grounded in these insights, stakeholders can drive sustainable growth, foster resilient partnerships, and navigate the evolving mobility ecosystem with confidence.

Connect with Ketan Rohom to Unlock Comprehensive Automotive Terminal Market Intelligence and Empower Your Strategic Planning with a Detailed Research Report

To gain exclusive access to the complete market intelligence and strategic insights outlined in this summary, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the full breadth of analysis, from in-depth segmentation breakdowns to detailed regional trajectories, and will provide tailored solutions to address your specific strategic objectives. By engaging with Ketan, you will benefit from a personalized consultation that illuminates growth opportunities, competitor dynamics, and actionable recommendations for advancing your market positioning. Secure your competitive advantage today by harnessing the rigorously researched data and foresight contained within the full automotive terminal market research report, ensuring your organization is equipped to thrive in an evolving landscape.

- How big is the Automotive Terminals Market?

- What is the Automotive Terminals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?