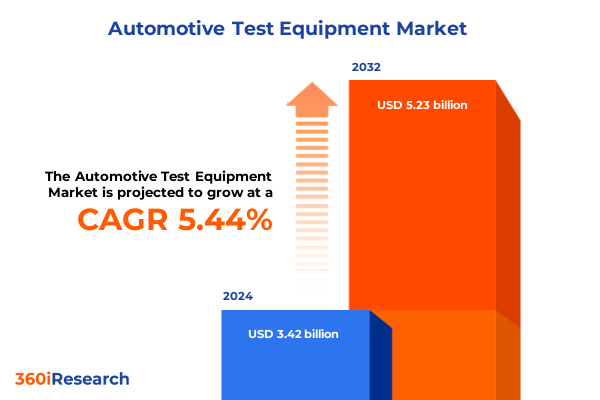

The Automotive Test Equipment Market size was estimated at USD 3.59 billion in 2025 and expected to reach USD 3.77 billion in 2026, at a CAGR of 5.52% to reach USD 5.23 billion by 2032.

Unveiling the Critical Role of Advanced Automotive Test Equipment in Shaping Industry Resilience and Innovation Amid Evolving Market Dynamics

The automotive industry is undergoing a transformative phase, and the role of specialized test equipment has never been more crucial. Modern powertrain diversification, from internal combustion to battery electric and fuel cell systems, demands highly sophisticated testing protocols to ensure both performance and compliance. Meanwhile, regulatory authorities worldwide are imposing increasingly stringent emissions and safety standards, requiring dynamic testing capabilities for emission analyzers, NVH measurement tools, and engine evaluation systems. As a result, manufacturers and research institutions alike are recalibrating their strategies to invest in cutting-edge test benches, digital twin simulations, and automated inspection lines.

Against this backdrop, stakeholders must navigate a confluence of technological advances and shifting policy landscapes. The proliferation of advanced driver assistance systems and connectivity solutions further underscores the need for precision and repeatability in test scenarios. Concurrently, the pandemic-induced supply chain disruptions and the ongoing push toward sustainable manufacturing practices have accelerated adoption of remote monitoring and cloud-enabled diagnostics. This Executive Summary sets the stage for a deep exploration of market dynamics, regulatory influences, and strategic imperatives shaping the future of automotive test equipment.

Exploring Emerging Technological Advancements and Regulatory Forces Driving Transformative Shifts in the Automotive Test Equipment Landscape

Rapid innovation in sensor technologies, artificial intelligence, and automation is redefining the contours of the automotive test equipment landscape. Digital twin platforms now allow real-time simulation of engine performance and emissions under virtual load cycles, dramatically reducing time-to-results and physical prototyping costs. Moreover, machine learning algorithms are being embedded within test rigs to predict component failures, optimize calibration routines, and adapt test parameters on the fly. In parallel, the emergence of fully automated test cells, capable of executing complex NVH assessments and emission analyses with minimal human intervention, is augmenting throughput and precision.

Regulatory shifts are equally transformative. Phase-in of Euro 7 and equivalent U.S. emissions regulations is driving demand for ultra-sensitive NOx and particulate analyzers, while evolving safety standards necessitate integrated functional safety testing for electronic control units. At the same time, global harmonization efforts are creating interoperability requirements that influence testing protocols and equipment interoperability. Collectively, these technological and regulatory forces are converging to accelerate the migration from legacy manual and semi-automated methods to next-generation testing ecosystems, unlocking new opportunities for equipment vendors and end users alike.

Examining How the Cumulative Impact of United States Tariffs in 2025 Reshapes Supply Chains and Pricing Strategies for Automotive Test Equipment

The cumulative impact of U.S. tariff measures in 2025 has reshaped supply chain economics and strategic sourcing for automotive test equipment. Tariffs initially enacted under Section 301 on Chinese imports have persisted, imposing up to 25% duties on critical analyzers and electronic component test modules. In addition, steel and aluminum tariffs under Section 232 continue to influence the cost base of structural test benches and chassis dynamometers, elevating capital expenditures for both domestic manufacturers and importers.

As a result, many global equipment providers are reassessing production footprints, with nearshoring initiatives gaining momentum to mitigate tariff exposure. Suppliers are also negotiating alternative component sourcing from tariff-exempt regions or leveraging free trade agreements in North America and Asia. Furthermore, the tariff environment has spurred manufacturers to explore modular designs that allow critical subassemblies to be produced in lowtariff jurisdictions, then integrated domestically. These strategic adaptations are critical for preserving margin targets, optimizing inventory management, and ensuring timely delivery of advanced test solutions to OEMs, independent labs, and research institutes across the region.

Decoding Critical Segment Dynamics Across Equipment Type Vehicle Type Powertrain Method and End User to Uncover Actionable Market Insights

Analyzing market demand through the lens of equipment type reveals a pronounced surge in emission test analyzers, notably NOx and particulate measurement systems, driven by tighter regulatory thresholds. Simultaneously, engine test benches tailored to alternative fuel engines are gaining traction as manufacturers validate performance across diesel, gasoline, and emerging biofuel blends. Equally, the NVH segment is witnessing elevated interest in combined sound and vibration analyzer suites, reflecting an industry-wide focus on noise reduction and cabin comfort.

Segmenting by vehicle type underscores the dominant volume contributed by passenger cars, though growth in the light commercial and heavy commercial vehicle segments is emerging as fleets electrify. Within the powertrain segmentation, battery electric vehicle testing platforms are experiencing exponential demand as OEMs refine battery management protocols, while hybrid electric and fuel cell vehicle test setups are maturing in parallel. Test method preferences are shifting decisively toward fully automated systems that deliver higher throughput and data consistency, with semi-automated solutions serving niche applications and manual tests reserved for specialized validation tasks. Finally, end-user analysis highlights the strategic importance of OEM in-house labs for new product launches, while independent test labs and aftermarket service providers seek turnkey solutions, and academic and research institutes focus on customizable modular platforms to support innovation.

This comprehensive research report categorizes the Automotive Test Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Vehicle Type

- Powertrain Type

- Test Method

- End User

Mapping Distinct Regional Market Characteristics Across Americas Europe Middle East Africa and Asia Pacific for Automotive Test Equipment Growth

In the Americas, robust automotive manufacturing hubs in the United States and Mexico are catalyzing investment in emission analyzers and engine test systems, propelled by federal and state emissions mandates and nearshoring trends. The region’s focus on electrification is also accelerating procurement of battery simulation and electric propulsion test rigs, aligning with government incentives and infrastructure roll-outs.

Europe, the Middle East, and Africa demonstrate a nuanced landscape where stringent Euro 7 standards and global NCAP safety requirements drive demand for integrated test solutions combining emissions, safety validation, and NVH assessment. Key automotive clusters in Germany, France, and the UK are pioneering automated testing cells, while emerging markets in the Middle East explore localized testing capabilities to support expanding commercial vehicle fleets.

Asia-Pacific remains a powerhouse of production volume, with China, Japan, and South Korea leading in OEM capacity and R&D investments. Evolving national emission regulations and a rapid shift toward EV adoption underpin growth in emission and electric powertrain testing equipment. Additionally, capacity expansions in India and Southeast Asia are increasing demand for flexible, modular test setups that can adapt to diverse vehicle platforms and regulatory requirements.

This comprehensive research report examines key regions that drive the evolution of the Automotive Test Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies Innovation Investments and Innovation Roadmaps of Leading Players Driving Progress in the Automotive Test Equipment Sector

The competitive arena is defined by global incumbents and agile regional specialists vying for market share through differentiated technology offerings and service excellence. Leading players are forging collaborative partnerships with automotive OEMs to co-develop tailored test platforms that integrate proprietary software for advanced data analytics. Meanwhile, investments in digital twin ecosystems are emerging as a key differentiator, enabling remote diagnostics and virtual validation workflows that elevate customer value propositions.

Strategic acquisitions are also reshaping the vendor landscape, as established companies target niche innovators in areas such as wireless NVH monitoring and high-precision emission sensing. Moreover, several firms are expanding aftermarket support networks and digital service portals to deliver real-time calibration updates and predictive maintenance capabilities. This evolving competitive dynamic underscores the importance of end-to-end solution packages, combining hardware, software, and lifecycle services to drive stickiness and recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Test Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantest Corporation

- Anritsu Corporation

- AVL List GmbH

- Chroma ATE Inc.

- Fluke Corporation

- HORIBA, Ltd.

- Keysight Technologies, Inc.

- MTS Systems Corporation

- National Instruments Corporation

- Robert Bosch GmbH

- Rohde & Schwarz GmbH & Co KG

- Tektronix, Inc.

- Teradyne, Inc.

Formulating Strategic Action Plans for Industry Leaders to Capitalize on Emerging Trends and Mitigate Risks in Automotive Test Equipment Markets

Industry leaders should prioritize diversification of manufacturing footprints to alleviate tariff pressures and enhance supply chain agility. By forging partnerships with contract manufacturers in low-tariff jurisdictions and leveraging nearshoring initiatives, companies can stabilize lead times and protect margin profiles. At the same time, accelerating the transition to fully automated test cells will drive operational efficiencies and meet the escalating throughput requirements of electric and hybrid vehicle validation programs.

In parallel, investing in modular, software-driven architectures will position organizations to address cross-segment demand swiftly, from emission compliance to NVH refinement. Collaborative alliances with academic and research institutes can foster innovation in test methodologies for next-generation powertrains, while strategic engagements with independent test labs will expand market access. Finally, a proactive regulatory intelligence function will enable manufacturers to anticipate policy shifts, refine product roadmaps, and offer compliance-centric solutions ahead of market curves.

Detailing a Rigorous Research Methodology Combining Primary Interviews Secondary Data Analysis and Analytical Frameworks to Ensure Robust Findings

This research employs a multi-phase approach combining qualitative and quantitative methodologies to deliver a comprehensive market perspective. Primary data collection involved in-depth interviews with senior executives from OEMs, independent test laboratories, equipment vendors, and regulatory bodies across key regions. These insights were complemented by structured surveys capturing end-user requirements, procurement cycles, and technology adoption patterns.

Secondary research drew upon a wide array of industry publications, technical whitepapers, patent databases, and trade association reports to validate equipment typologies and segment definitions. Data triangulation was achieved by correlating primary findings with publicly available financial disclosures and supply chain analyses. Additionally, expert panel workshops were conducted to refine scenario modeling and stress-test market assumptions under varying regulatory and tariff conditions. This rigorous framework ensures that the findings reflect a balanced and actionable view of the global automotive test equipment ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Test Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Test Equipment Market, by Equipment Type

- Automotive Test Equipment Market, by Vehicle Type

- Automotive Test Equipment Market, by Powertrain Type

- Automotive Test Equipment Market, by Test Method

- Automotive Test Equipment Market, by End User

- Automotive Test Equipment Market, by Region

- Automotive Test Equipment Market, by Group

- Automotive Test Equipment Market, by Country

- United States Automotive Test Equipment Market

- China Automotive Test Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Core Industry Insights on Market Trajectories and Strategic Imperatives to Navigate the Future of Automotive Test Equipment Successfully

In summary, the automotive test equipment industry stands at the nexus of profound technological innovation and tightening regulatory requirements. The convergence of electrification, digital twins, and automated testing is redefining how components and systems are validated, while evolving tariffs and trade policies are reshaping supply chain strategies. Regional dynamics underscore the need for localized solutions, from emission analyzers in stringent markets to flexible test rigs in high-growth production hubs.

Competitive differentiation will hinge on integrated service offerings, digital platform capabilities, and agile manufacturing footprints. Organizations that proactively align investments with emerging powertrain architectures and regulatory trajectories will secure a leadership position. This Executive Summary illuminates the strategic imperatives and market contours necessary for stakeholders to navigate a rapidly evolving landscape and harness the full potential of their test equipment portfolios.

Connect with Ketan Rohom to Secure Your Comprehensive Automotive Test Equipment Market Research Report and Drive Informed Strategic Decisions

Unlock unparalleled market intelligence and strategic guidance by connecting with Ketan Rohom, Associate Director of Sales & Marketing, to acquire a comprehensive automotive test equipment research report.

Your organization’s ability to anticipate market shifts and engineer impactful strategies hinges on timely and accurate insights. By engaging with Ketan Rohom, you gain immediate access to the latest analysis of technology trends, regulatory evolutions, competitive dynamics, and regional variances shaping the global automotive test equipment industry. This report distills complex data into actionable recommendations designed to enhance your decision-making, streamline product development priorities, and fortify supply chain resilience.

Whether you aim to accelerate adoption of automated testing platforms, navigate the ramifications of evolving U.S. tariffs, or tailor your solutions to emerging powertrain architectures, this report delivers the intelligence you need. Reach out today to secure your copy and empower your team to translate insights into high-impact strategies, drive revenue growth, and maintain a competitive edge in tomorrow’s rapidly transforming market.

- How big is the Automotive Test Equipment Market?

- What is the Automotive Test Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?