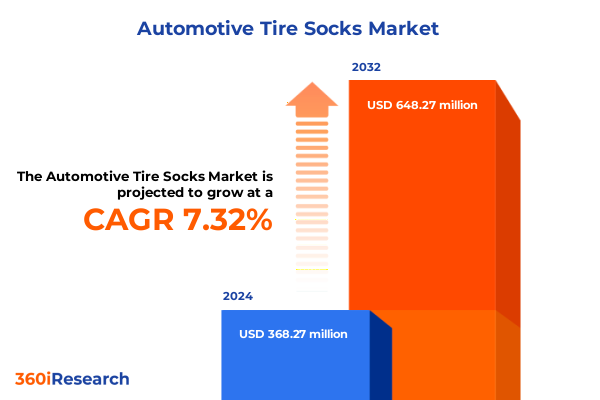

The Automotive Tire Socks Market size was estimated at USD 392.18 million in 2025 and expected to reach USD 421.37 million in 2026, at a CAGR of 7.44% to reach USD 648.27 million by 2032.

Setting the Stage for Winter Safety and Market Innovation Through Textile Tire Socks That Transform Vehicle Traction Solutions Amid Evolving Industry Demands

The winter traction device segment has evolved far beyond traditional metal chains as a critical component of automotive safety, driven by intensifying climate variability and consumer demand for convenience and sustainability. Recent assessments from NOAA reveal that 2024 was the warmest year on record for the contiguous United States, with extremes in temperature and precipitation contributing to greater variability in winter road conditions across regions. Meanwhile, Climate Central reports that winter warming has accelerated rapidly since 1970, shortening cold streaks and reducing freezing nights by an average of 13 days in many U.S. locations, paradoxically creating more unpredictable freeze–thaw cycles that challenge conventional traction solutions. As a result, textile-based tire socks have emerged as a versatile, lightweight alternative, offering rapid deployment in mixed terrain scenarios where both snow chains and winter tires may fall short under shifting environmental pressures.

This dynamic backdrop of climate extremes is compounded by a vehicle fleet undergoing continuous transformation. Electrification, weight reduction, and advanced driver assistance systems have reshaped traction requirements, while consumers increasingly demand eco-friendly materials that align with broader sustainability commitments. Consequently, manufacturers are innovating with wool, recycled polyester, and polypropylene blends to balance performance, durability, and environmental impact. At the same time, direct-to-consumer digital channels are expanding access to these solutions, enabling swift procurement and enhanced post-purchase engagement. Against this multi-faceted landscape, stakeholders must navigate complex regulatory frameworks, variable winter conditions, and evolving end-user expectations to capitalize on the growing relevance of automotive tire socks.

Navigating the Convergence of Advanced Smart Textiles, Sustainability Mandates and Digital Distribution Channels Revolutionizing the Tire Sock Industry

The landscape of automotive tire socks is being redefined by a confluence of technological, regulatory, and consumer-driven forces that are catalyzing rapid market transformation. In materials science, the rise of smart textiles and e-textiles offers unprecedented functionality, as fabrics integrate sensors and conductive elements to monitor traction performance in real time and adjust to changing road surfaces. Innovations in energy harvesting textiles further hint at the potential for self-powered traction devices that could communicate wear levels or alert drivers to replacement needs. Simultaneously, sustainability imperatives are steering research toward biodegradable fibers and closed-loop manufacturing processes, providing a pathway to reconcile high-performance demands with environmental stewardship.

Parallel to material advances, digital distribution is fostering direct engagement with consumers and fleets alike. E-commerce platforms now offer seamless sizing tools, subscription-based replacement services, and data-driven insights into usage patterns, enabling manufacturers and retailers to refine product development and tailor marketing strategies. At the same time, shifting regulatory frameworks in Europe, North America, and select Asia-Pacific countries are formalizing textile traction devices as approved alternatives to chains under specific conditions, reducing fragmentation and opening new territories for mainstream adoption. For instance, the European winter traction standard EN16662-1:2020 has catalyzed broad acceptance across EU member states, prompting manufacturers to secure certifications and leverage compliance as a competitive differentiator. These transformative shifts underscore the importance of agility and strategic foresight in navigating an increasingly interconnected and technology-driven industry.

Evaluating the Far-Reaching Consequences of 2025 U.S. Tariff Adjustments on Supply Chains and Cost Structures in the Tire Sock Market

In early 2025, the United States invoked Section 232 of the Trade Expansion Act to impose a 25% tariff on imported automobiles and certain automobile parts, effective April 3, 2025, with specific provisions for non-U.S. content under USMCA remaining tariff-free until further notice. This measure directly influences the cost structure of composite textile traction aids, as many components- including high-performance polyester and polypropylene yarns-are sourced globally. Concurrently, Section 301 tariff exclusions on pandemic-related Chinese imports are winding down, stepping up duties on key raw materials and manufacturing equipment through May 31, 2025. Recognizing the risk of overlapping duties, a subsequent executive order was issued on April 29, 2025, to prevent cumulative tariff stacking on single articles and establish a hierarchy for tariff application, thereby partially mitigating cost escalation for complex multi-component products such as tire socks.

These adjustments have prompted manufacturers to diversify sourcing strategies, explore near-shoring options in Mexico and Eastern Europe, and pursue tariff classification reviews to optimize duty exposure. Moreover, supply chain agility has become a strategic imperative, as lead times lengthen and input costs climb. Procurement teams are now engaging in scenario planning to assess duty-driven cost increases against potential shifts in demand, while regulatory affairs specialists negotiate exclusions and certifications to preserve market access. As the year progresses, the cumulative impact of these tariff measures will continue to shape pricing, sourcing, and competitive positioning across the tire sock value chain.

Unpacking Critical Market Segmentation Across Product Variety Vehicle Applications Materials Channels Usage Cases and End-User Dynamics Driving Strategic Growth

A nuanced understanding of market segmentation is vital to unlocking targeted growth strategies for automotive tire socks. Based on product type, demand is distributed across eco-friendly tire socks crafted from recycled fibers, heavy-duty variants engineered for commercial and off-road applications, and standard tire socks optimized for passenger vehicles in moderate winter conditions. From a vehicle classification standpoint, commercial vehicles such as delivery trucks and municipal fleets rely on reinforced designs, while passenger cars and increasingly popular SUVs & crossovers demand easy-to-install solutions that complement advanced safety systems. Material composition insights reveal a spectrum ranging from innovative blend fabrics that balance performance and sustainability to specialized polyester and polypropylene threads valued for durability, and premium wool offerings prized for their natural grip and biodegradability.

Channel dynamics further differentiate market approaches, with offline distribution through aftermarket retailers, specialty automotive outlets, and fleet service providers coexisting alongside burgeoning online storefronts offering direct-to-consumer delivery and subscription replacement plans. Application requirements span pure snow traction use cases, mixed-terrain scenarios where gravel or slush may be encountered, and dedicated ice-traction products featuring specialized slip-resistant weaves. Finally, the end-user perspective bifurcates between aftermarket purchasers seeking rapid solutions for seasonal challenges and OEM partnerships that embed tire socks into vehicle winter accessory packages. By aligning product development, marketing, and channel strategies with these interlocking segmentation dimensions, stakeholders can craft tailored value propositions that resonate with distinct customer cohorts.

This comprehensive research report categorizes the Automotive Tire Socks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Material Type

- Distribution Channel

- Application

- End User

Analyzing Regional Market Dynamics from Americas Through Europe Middle East Africa to Asia Pacific Illuminating Divergent Growth Drivers

Regional market dynamics for automotive tire socks reflect the interplay between climatic conditions, regulatory frameworks, and consumer behavior. In the Americas, harsh winter climates in the northern United States and Canada drive consistent demand for both aftermarket and fleet-oriented solutions, while milder southern regions increasingly adopt mixed-terrain products for occasional snow and ice events. Latin American markets, though limited by seasonal snowfall, show emerging interest in premium textile traction aids among adventure tourism operators and high-end automotive enthusiasts. Across Europe, Middle East and Africa, European nations benefit from unified winter traction standards such as EN16662-1, bolstering textile traction acceptance, whereas mountainous regions in the Middle East apply similar regulatory principles to support safety on elevated roadways. African markets, particularly in North Africa, are exploring textile traction devices for mixed desert-sand icy passes, indicating nascent adoption in niche applications.

The Asia-Pacific region exhibits diverse growth trajectories, with countries like Japan and South Korea driven by well-established winter tourism industries and stringent safety regulations, and China scaling domestic manufacturing capacity for both OEM and aftermarket channels. India’s northern states, experiencing extreme winter conditions in high-altitude corridors, are demonstrating increased traction device adoption, while Australia and New Zealand report seasonal spikes correlating with alpine sports and emergency preparedness initiatives. By decoding these regional nuances, manufacturers and distributors can calibrate product portfolios, adjust certification priorities, and optimize go-to-market strategies to capture the full spectrum of growth opportunities worldwide.

This comprehensive research report examines key regions that drive the evolution of the Automotive Tire Socks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Alliances Shaping Certification Compliance Product Differentiation and Channel Diversification in Tire Socks

The competitive landscape of the tire sock industry is characterized by a mix of specialized innovators and legacy automotive suppliers pursuing diversified portfolios. AutoSock ASA, the originator of textile snow traction devices, commands market leadership through extensive OEM approvals and global distribution partnerships, leveraging certifications under EN16662-1 and V 5121 to underpin its premium positioning. K&K Auto Accessories has emerged as a formidable challenger, combining competitive pricing on major e-commerce platforms with EU and U.S. state regulatory approvals-such as Colorado Department of Transportation Alternate Traction Device certification-to capture value-oriented segments and increase market penetration across North America and Europe.

Tier 1 automotive supplier Michelin has also entered the traction textile space with its S.O.S. GRIP offering, capitalizing on brand equity and blending composite cable reinforcement with textile weaves for enhanced grip, while integrating reflectors for improved visibility in darkness. In parallel, security chain specialists like SCC Peerless and regional brands such as Carall are exploring hybrid metal-textile solutions to address extreme off-road and industrial use cases, often partnering with logistics and public safety fleets for custom-engineered programs. These strategic profiles underscore a market in which technological differentiation, regulatory compliance, channel diversification, and brand authority converge to shape competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Tire Socks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AtliChain

- AutoSock Direct Ltd

- AutoSock Operations AS

- AutoSock USA

- DAC Srl

- Fit and Go

- Glacier Chain Supply Inc

- GoSoft

- ISSE Safety SL

- Konig SpA

- Michelin

- PicoYa

- Silknet

- Snow Chain Store

- Snow Chains And Socks Ltd

- Snow Chains com

- Snow Sox

- SnowGecko

- Sparco SpA

- Trendy

Strategic Imperatives for Industry Leaders to Advance Material Innovation Optimize Supply Chains and Accelerate Market Expansion

Industry leaders aiming to solidify their positions must prioritize several strategic imperatives. First, accelerating material innovation through partnerships with textile research institutes can yield next-generation fibers that enhance grip, durability and environmental credentials, while integrating sensor capabilities for predictive maintenance. Second, supply chain resilience must be bolstered by geographic diversification of raw material sourcing and proactive tariff management to mitigate the financial impact of Section 232 and Section 301 duties. Third, strengthening OEM relationships through co-development agreements and bundled winter accessory packages will create seamless consumer experiences and elevate traction textiles from optional accessories to standard equipment.

Furthermore, digital transformation initiatives in direct-to-consumer channels and data analytics platforms can unlock real-time insights into usage patterns, enabling personalized marketing and Just-In-Time inventory replenishment. Meanwhile, comprehensive certification roadmaps addressing regional regulatory frameworks will streamline market entry and foster trust. Finally, sustainability commitments such as adopting recycled content targets and end-of-life recycling programs will resonate with environmentally conscious consumers and corporate fleet managers. By executing these actionable measures, industry players can secure competitive differentiation, optimize operational performance, and unlock sustainable growth in a rapidly evolving market.

Outlining the Comprehensive Multi-Source Research Framework Including Regulatory Review Expert Interviews and Quantitative Segment Analysis

The research underpinning this executive summary employs a multi-tiered methodology integrating primary and secondary sources to ensure comprehensive coverage and analytical rigor. Secondary research encompassed review of government publications, regulatory gazettes, industry white papers, and credible press releases- including U.S. tariff proclamations, ASTM and EN traction device standards, and leading smart textile trend analyses. Complementing this, primary research comprised in-depth interviews with OEM procurement executives, aftermarket distributors, and material science experts to validate emerging trends and assess real-world adoption barriers.

Quantitative analysis leveraged proprietary databases to segment demand drivers across product types, vehicle classes, materials, and distribution channels, while regional case studies illuminated geographic nuances. Expert panels provided scenario assessments on tariff trajectories and supply chain adjustments. Throughout, methodological rigor was maintained via triangulation of sources, iterative hypothesis testing, and continuous validation of qualitative insights against empirical data. This holistic framework ensures that the findings and recommendations presented here reflect a robust synthesis of industry knowledge and stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Tire Socks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Tire Socks Market, by Product Type

- Automotive Tire Socks Market, by Vehicle Type

- Automotive Tire Socks Market, by Material Type

- Automotive Tire Socks Market, by Distribution Channel

- Automotive Tire Socks Market, by Application

- Automotive Tire Socks Market, by End User

- Automotive Tire Socks Market, by Region

- Automotive Tire Socks Market, by Group

- Automotive Tire Socks Market, by Country

- United States Automotive Tire Socks Market

- China Automotive Tire Socks Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Insights on Climate Dynamics Material Innovation Tariff Impacts and Competitive Strategies Guiding Future Market Success

The automotive tire sock market stands at the intersection of climate-driven demand, material science innovation, and regulatory evolution. Textile-based traction aids have transcended niche emergency applications to become integral elements of winter safety and performance ecosystems. As U.S. tariffs reshape cost structures and smart textiles unlock new functionality, market participants must demonstrate agility in sourcing, certification and channel strategies. Segmentation insights reveal nuanced opportunities across product types, vehicle segments, materials and end-user contexts, while regional analysis highlights the importance of tailored approaches to capture growth in mature and emerging markets alike.

Key competitors-ranging from heritage innovators like AutoSock and Michelin to digitally native value entrants like K&K-exemplify divergent paths to differentiation through certification, design, and distribution tactics. Actionable recommendations emphasize the need for continued R&D investment, strategic tariff management, and deeper OEM integration, underpinned by robust digital engagement models and sustainability commitments. This convergence of factors points to a market poised for sustained expansion, where those who expertly navigate complexity will reap disproportionate rewards. The final imperative is clear: stakeholders must harness this intelligence to make informed investments that align with both immediate operational needs and long-term strategic objectives.

Connect with Ketan Rohom to Acquire Unparalleled Tire Sock Market Intelligence and Drive Strategic Decision-Making to Unlock Growth Opportunities

To gain a comprehensive understanding of market dynamics, competitive strategies, and emerging opportunities in the automotive tire sock industry, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. By partnering directly, you can secure the full executive brief, unrivaled strategic insights, and tailored consulting support. Engage today to equip your organization with the actionable intelligence required to navigate tariff complexities, leverage material innovations, and capture growth across diverse global regions. Unlock the full potential of this market by contacting Ketan Rohom to purchase the definitive tire sock market research report and elevate your decision-making to the next level

- How big is the Automotive Tire Socks Market?

- What is the Automotive Tire Socks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?