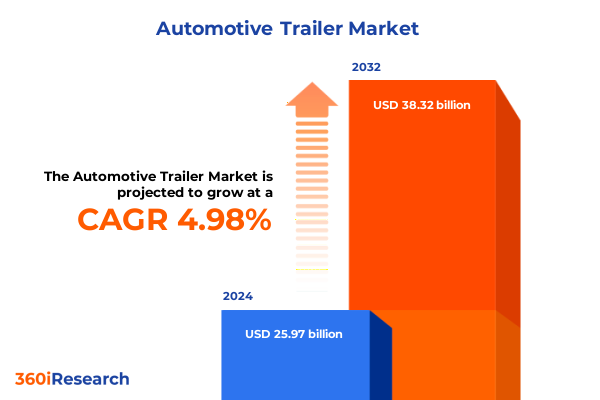

The Automotive Trailer Market size was estimated at USD 26.95 billion in 2025 and expected to reach USD 27.96 billion in 2026, at a CAGR of 5.15% to reach USD 38.32 billion by 2032.

A strategic framing that defines why material policy, product differentiation, and channel resilience will determine commercial winners in the trailer industry

The commercial trailer industry stands at an inflection point where shifting raw material policies, evolving customer requirements, and operational resilience priorities intersect. This executive summary introduces the strategic context that underpins the full report, setting out why leaders in manufacturing, fleet operations, aftermarket distribution, and project procurement must reassess assumptions about sourcing, material selection, and channel strategy. It frames the analysis through a lens of risk-adjusted decision-making rather than simple growth narratives, emphasizing that the coming 12–24 months will reward organizations that can translate regulatory intelligence and supplier agility into cost-competitive, reliable product offers.

Building from that context, the introduction outlines the scope and intent of the research: to evaluate how product types, load capacities, material choices, applications, and sales channels interact with regulatory shifts and regional dynamics. The aim is not merely to describe differences between car haulers, flatbeds, lowboys, enclosed units, dump trailers, and refrigerated platforms, but to show how these product distinctions link to manufacturing inputs, labor intensity, and aftermarket demand. This orientation primes readers to use segmentation-driven insights to prioritize investments in tooling, supplier development, and channel alignment as macro variables evolve.

How material innovation, modular production, telematics adoption, and supply chain reorientation are reshaping manufacturing and commercial strategies in trailer markets

Over recent quarters, the trailer landscape has experienced transformative shifts that go beyond cyclical demand. One clear dynamic is the acceleration of materials innovation; lighter and corrosion-resistant alloys and composite architectures are increasingly prioritized to meet payload efficiency, fuel economy targets, and longer service life under harsher operating cycles. At the same time, fleet operators are demanding shorter lead times and higher customization levels, prompting manufacturers to reconfigure production footprints and modularize assemblies to reduce changeover costs.

Concurrently, digitalization of fleet management and telematics integration are reshaping value propositions. Trailers that incorporate sensor-driven temperature control, load monitoring, and predictive maintenance capabilities command a strategic premium because they lower total cost of ownership for large buyers. Another major shift is the reorientation of supply chains: procurement teams are evaluating nearshoring and multi-sourcing strategies to reduce exposure to transit volatility and input-price shocks. Taken together, these shifts are prompting an evolution in go-to-market models where OEM relationships, aftermarket service bundles, and financing arrangements are increasingly inseparable from product design choices.

An assessment of the cumulative and evolving United States tariff measures in 2025 and the operational implications for steel- and aluminum-intensive trailer manufacturing

The United States tariff actions announced and modified in 2025 have materially changed the policy backdrop for any product with steel or aluminum content, and trailers are squarely within that scope given their heavy reliance on those base metals. In early 2025, presidential proclamations revised the treatment of steel and aluminum imports by ending prior exemptions and tightening coverage of derivative articles; these changes became effective in March 2025 and revoked earlier general approved exclusions and alternative arrangements that had previously limited the breadth of duties. These proclamations signaled a shift from selective protection toward a broader posture that treats steel and aluminum inputs as strategically sensitive to domestic industrial policy.

Those actions were followed by further tariff adjustments in June 2025 that increased headline rates applied to steel and aluminum articles. The June proclamation specifically raised certain tariffs and clarified the treatment of derivative products, creating an environment in which trailered products that include imported steel or aluminum components face higher landed costs and greater classification risk at customs. This step change requires procurement and cost-accounting teams to re-evaluate supplier contracts, material substitution options, and pass-through mechanisms to customers.

Practically, the cumulative policy moves mean that suppliers relying on imported flat-rolled steel, structural sections, aluminum extrusions, or certain downstream components may see abrupt cost escalations or disruptions if they have limited domestic sourcing. Moreover, frequent policy updates and ongoing legal and political contestation of tariff authority introduce uncertainty that favors flexible manufacturing footprints and diversified vendor lists. Companies should therefore treat tariff risk as a material operational variable and incorporate tariff scenario analysis into capital planning and pricing strategies. For context on market-level implications and public debate about tariffs’ impact on prices and trade, recent national reporting has highlighted the inflationary pressures and legal challenges tied to the administration’s tariff program, emphasizing the need for contingency planning.

Segmentation-driven insights linking trailer type, load capacity, material selection, application context, and sales channel to sourcing and commercial priorities

Segmentation provides the analytical backbone for translating macro forces into product- and channel-level decisions. When the market is viewed through trailer type distinctions such as car hauler, dump, enclosed, flatbed, lowboy, and refrigerated, different input sensitivities and service models emerge: heavy-structure types and refrigerated platforms often have higher exposure to steel framing, aluminum bodies, or specialized thermal components, and thus respond differently to raw-material shocks and regulatory friction. In terms of load capacity bands-below 10 tons, 10–20 tons, and above 20 tons-capital intensity, axle configurations, and component durability expectations change materially, which in turn affects supplier qualification cycles and warranty provisioning. Material choice-Aluminum, Composite, and Steel-creates divergent lifecycle cost profiles; aluminum and composites can reduce weight and fuel consumption but typically require different fabrication capabilities and repair networks compared with traditional steel builds.

Application-driven segmentation-covering agriculture, construction, defense, and general cargo with construction further split into building materials and heavy equipment-reveals demand-side heterogeneity and procurement behavior. For instance, construction customers purchasing building-material platforms prioritize payload and deck robustness, while heavy-equipment-focused buyers emphasize structural reinforcement and integration with lifting gear. Sales channel segmentation between aftermarket and OEM business models further clarifies revenue cadence: OEM channels often require synchronized capacity planning and design-for-manufacturability commitments, whereas aftermarket channels rely on distribution density, spare-parts availability, and service contracts. Integrating these segmentation lenses enables leaders to identify where to concentrate sourcing investments, which product lines merit engineering rework for alternative materials, and where channel partnerships can mitigate near-term tariff-driven cost pressure.

This comprehensive research report categorizes the Automotive Trailer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Trailer Type

- Load Capacity

- Material

- Application

- Sales Channel

How regional supply chains, procurement practices, and regulatory environments in the Americas, Europe Middle East & Africa, and Asia-Pacific will shape competitive positioning and sourcing choices

Regional dynamics will continue to shape supplier ecosystems, regulatory exposure, and customer demand patterns. In the Americas, proximity to North American steel and aluminum mills as well as continental supply agreements historically reduced lead times, but recent policy shifts and tariff reinstatements have reintroduced trade frictions that require manufacturers to reassess cross-border production flows and tariff classifications. This creates both near-term cost challenges and long-term incentives to localize critical fabrication steps or develop bonded-warehouse strategies that allow for staged processing and duty mitigation.

Across Europe, the Middle East & Africa, the interplay between regulatory harmonization, logistics infrastructure, and defense procurement cycles produces a mosaic of opportunities. OEMs and suppliers working in EMEA must balance regional standards, localized specification requirements, and variable access to lightweight material suppliers to compete effectively in both public-works and private-sector programs. In Asia-Pacific, manufacturing scale, supplier specialization in aluminum extrusion and composite layup, and integrated component ecosystems make the region a critical node for complex subassemblies, but rising labor and logistics costs coupled with customers’ preference for shorter lead times have strengthened the case for hybrid manufacturing models that combine regional final assembly with imported subcomponents. Understanding these regional contrasts is essential for prioritizing capital allocation, timing market entries, and structuring inventory buffers against tariff- and transit-related volatility.

This comprehensive research report examines key regions that drive the evolution of the Automotive Trailer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Why vertical integration, supplier partnerships, telematics-enabled co-development, and aftermarket service networks are decisive factors for competitive advantage

Competitive dynamics in the trailer sector remain anchored by established OEMs, specialized fabricators, and a diverse aftermarket ecosystem, but recent shifts have amplified the strategic importance of vertical integration and supplier partnerships. Companies that control critical fabrication steps-such as chassis welding, aluminum extrusion finishing, or refrigeration unit integration-enjoy greater ability to negotiate around tariff shocks and to protect margin through in-house value capture. At the same time, a number of agile mid-sized specialists are leveraging modular design, flexible tooling, and digital sales channels to capture niche pockets of demand where speed and customization trump scale.

Another notable trend is the intensifying collaboration between OEMs and large fleet customers to co-develop telematics-enabled platforms and service contracts that embed life-cycle value. These partnerships reduce fragmentation and create recurring revenue streams through uptime guarantees and parts-as-a-service offerings. The aftermarket remains a competitive battleground: distributors that can offer rapid parts fulfillment, certified repair networks for aluminum and composite repairs, and warranty-friendly spare kits will gain durable advantages as customers seek to protect utilization rates. Finally, financing partners and lessors that can structure attractive total-cost-of-ownership models will play a pivotal role in decisions by fleet operators to trade up to higher-specification trailers despite near-term price pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Trailer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aluma, Inc.

- ANG Industries Limited

- Big Tex Trailers

- Brian James Trailers Limited

- Bäckmann Fahrzeugwerke GmbH

- CIMC Vehicles Co., Ltd.

- Dennison Trailers Ltd.

- Dutch Lanka Trailer Manufacturers Ltd.

- Fontaine Trailer Company

- Great Dane Limited Partnership

- Hyundai Translead, Inc.

- Hödlmayr Trailer Leasing GmbH & Co. KG

- Ifor Williams Trailers Ltd.

- Kögel Trailer GmbH & Co. KG

- Manac Inc.

- MAXXD Trailers

- Miller Industries, Inc.

- Pace American (Subsidiary of Utility Trailer Manufacturing)

- Randon Implementos e Participações S.A.

- Schmitz Cargobull Aktiengesellschaft

- Utility Trailer Manufacturing Company

- Vanguard National Trailer Corp. (CIMC USA)

- Wabash National Corporation

- Wielton S.A.

- York Transport Equipment (Asia) Pte Ltd.

Practical and prioritized actions procurement, engineering, commercial, and operations leaders should implement now to protect margins and build supply resilience

Industry leaders must move beyond static cost-cutting and adopt a set of targeted, executable measures that protect margin and strengthen resilience. First, procurement teams should deploy a multi-scenario sourcing playbook that includes validated domestic suppliers for core structural inputs, contractual clauses that allow price indexation for metal inputs, and prequalified secondary sources to be activated if an importer faces new duties or classification disputes. Engineering groups should prioritize design-for-substitution workstreams to accelerate validated alternatives-such as replacing specific structural sections with aluminum or composite reinforcements-while maintaining repairability and regulatory compliance. This parallel product-engineering and supplier-development approach reduces vendor lock-in and shortens time-to-qualification.

Commercial and channel leaders should renegotiate OEM and aftermarket agreements to share material-cost risk where possible, introduce value-based service bundles, and accelerate sales of telemetry-enabled offerings that justify premium pricing. Operationally, companies should invest in classification and customs expertise to manage tariff claims, duty drawback opportunities, and bonded-warehouse strategies. Finally, organizations should create a governance cadence that brings procurement, engineering, sales, and legal teams together to review tariff scenarios on a monthly basis and to translate policy movements into executable contract and pricing adjustments. These steps prioritize agility and protect customer relationships while preserving long-term industrial capability.

A transparent mixed-methods research approach combining primary interviews, technical validation, and official policy analysis to ensure robust and actionable findings

This research combines qualitative interviews, primary-supplier mapping, technical product-dissection, and secondary-source policy analysis to generate actionable conclusions. Primary inputs included structured interviews with manufacturers, OEM procurement executives, large fleet operators, and aftermarket distributors to capture on-the-ground impacts of lead-time variability, material substitution tests, and service expectations. Technical validation was achieved through product dissections and engineering reviews that assessed material composition, fabrication complexity, and repairability across representative trailer types and load-capacity classes.

Secondary analysis incorporated official government proclamations, customs guidance related to tariff classification, industry press, and legal analyses that explain recent policy changes and outline potential compliance pathways. Where possible, source documents and proclamations were cross-referenced with customs agency notices to verify effective dates and the scope of derivative-article coverage. The methodology emphasizes triangulation: multiple independent inputs were required to validate high-impact findings, and sensitivity checks were performed to ensure recommendations remain robust across different tariff and regional scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Trailer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Trailer Market, by Trailer Type

- Automotive Trailer Market, by Load Capacity

- Automotive Trailer Market, by Material

- Automotive Trailer Market, by Application

- Automotive Trailer Market, by Sales Channel

- Automotive Trailer Market, by Region

- Automotive Trailer Market, by Group

- Automotive Trailer Market, by Country

- United States Automotive Trailer Market

- China Automotive Trailer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

A conclusive synthesis that frames 2025 policy shifts and operational imperatives as a strategic opportunity to strengthen resilience and capture durable value

In conclusion, the trailer industry must treat 2025 as a structural pivot rather than a temporary shock window. Policy decisions affecting steel and aluminum tariffs have raised the premium on supply-chain agility, material flexibility, and integrated service propositions. Companies that anticipate these shifts and act through coordinated procurement-engineering-commercial programs will protect margins and create defensible differentiation; those that maintain single-source dependencies or delayed reaction plans will face compressed profitability and customer churn. The combination of regional supply-chain variance, product-level input sensitivity, and the growing importance of telematics and service bundles means that winners will combine technical excellence with commercial execution.

Leaders should therefore prioritize near-term measures that preserve operational continuity-such as validated secondary suppliers, indexed supplier contracts, and customs-classification capabilities-while pursuing medium-term investments in lightweight materials, modular manufacturing, and service-led pricing. Doing so will convert regulatory turbulence into a strategic advantage by aligning product performance with evolving customer expectations and by creating repeatable, defensible channels for aftermarket revenue.

Secure a tailored executive briefing and purchase pathway with the Associate Director of Sales & Marketing to obtain a prioritized, actionable market research package

For decision-makers ready to move from insight to action, a tailored market research package will accelerate procurement, competitive planning, and go-to-market timing. The report synthesizes technical, regulatory, and commercial analysis into a concise deliverable suited for commercial teams, strategy leads, procurement, and investor relations. It pairs strategic narrative with source-level evidence and appendices that document tariff proclamations, customs classifications, and supplier footprints so stakeholders can validate conclusions and model local cost impacts quickly.

To secure a customized briefing, licensing options, or enterprise access to the full market research report, contact Ketan Rohom (Associate Director, Sales & Marketing). A direct dialog will enable a scoped deliverable that addresses product-level sensitivity to input-cost shocks, prioritized regional scenarios across the Americas, Europe, Middle East & Africa, and Asia-Pacific, and an implementation timeline aligned to procurement cycles. The engagement can include an executive briefing, a technical appendix for supply-chain teams, and a bespoke workshop to translate insights into a 90-day action plan.

Prompt engagement ensures your organization gets prioritized delivery, early access to any post-publication updates, and a structured handover that transfers analytical models and scenario tools needed for rapid decision-making.

- How big is the Automotive Trailer Market?

- What is the Automotive Trailer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?