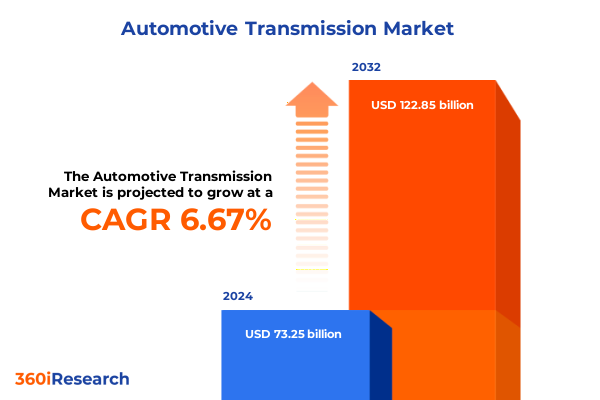

The Automotive Transmission Market size was estimated at USD 77.20 billion in 2025 and expected to reach USD 81.37 billion in 2026, at a CAGR of 6.86% to reach USD 122.85 billion by 2032.

Unveiling The Strategic Significance Of Automotive Transmission Innovation In Driving Performance, Efficiency, And Competitiveness Across The Industry

The automotive transmission industry has become a cornerstone of vehicle performance, reliability, and overall driving experience. As powertrains evolve in response to tightening emissions regulations and shifting consumer preferences, transmissions stand at the nexus of mechanical prowess and digital innovation. The introduction of multi-speed automated manuals, continuously variable transmissions, and the next wave of dual clutch systems has transformed the traditional gearbox into a dynamic enabler of efficiency and driving pleasure.

In recent years, the convergence of electrification and advanced software control has further elevated the strategic relevance of transmissions. Automakers and suppliers alike are investing heavily in adaptive shift logic, predictive gear selection algorithms, and lightweight materials to meet stringent fuel economy targets while preserving seamless operation. Moreover, the emergence of electric and hybrid propulsion architectures challenges conventional transmission design paradigms, prompting a reevaluation of gear ratios, torque management, and integration with electric motors.

Against this backdrop, industry decision-makers require an executive overview that captures the multifaceted drivers shaping the market. From global supply chain complexities to regional regulatory landscapes, understanding the forces at play is essential for steering product development, capital allocation, and strategic partnerships. This report’s introduction lays the groundwork for recognizing key trends, competitive dynamics, and stakeholder imperatives that will define the future of automotive transmissions.

Assessing The Paradigm Shift Within Automotive Transmissions As Electrification, Digitalization, And Autonomous Technology Reshape Market Dynamics

The transmission landscape is undergoing a profound transformation driven by several converging technological and market forces. First and foremost, electrification is reshaping the core architecture of drivetrains. Whereas traditional internal combustion platforms have historically demanded complex multi-speed gearboxes, battery electric vehicles often require fewer ratios and novel integration of electric motor torque with gear reduction stages. Simultaneously, full and mild hybrid systems introduce specialized power splits and seamless transition mechanisms, compelling suppliers to adapt or reinvent conventional transmission designs.

In addition to powertrain changes, software-defined vehicles are revolutionizing how gearboxes operate. Predictive analytics and machine learning models now inform real-time shift scheduling, leveraging vehicle connectivity and sensor inputs to optimize performance under varying road and traffic conditions. This digitalization wave extends to predictive maintenance solutions that monitor wear patterns within clutches, belts, and gear teeth, ultimately reducing lifecycle costs and unplanned downtime.

Autonomous driving developments add another layer of complexity, as transmissions must integrate smoothly with advanced driver assistance systems to deliver consistent, comfortable, and safe motion control. As a result, suppliers are forming cross-functional partnerships that blend mechanical expertise with software and electronics capabilities. In parallel, industry alliances and joint ventures are accelerating, pooling R&D resources to tackle the engineering challenges posed by next-generation transmission systems.

Through these transformative shifts, the transmission market is transitioning from a predominantly mechanical component to a sophisticated mechatronic system, where digital and electrified functions intersect to create new value streams for OEMs and end users alike.

Analyzing The Cumulative Economic And Supply Chain Impacts Of 2025 United States Tariffs On Automotive Transmission Components And Manufacturing

In 2025, the ongoing implementation of United States tariffs on automotive components under Section 301 and Section 232 has had a material impact on transmission manufacturing and supply chain economics. Steel and aluminum surcharges, coupled with levies on imported transmission subassemblies, have elevated input costs for both domestic and global suppliers. As a consequence, some Tier 1 manufacturers have renegotiated supplier contracts, while others have absorbed price increases-thereby squeezing margins and prompting a strategic reexamination of cost structures.

Tariffs targeting components sourced from major manufacturing hubs in Europe and Asia have also led to a geographical realignment of production footprints. Several suppliers have expedited the expansion of localized manufacturing lines in Mexico and select U.S. states to mitigate duties. This shift toward nearshoring has improved lead times for OEMs with North American assembly plants, but it has also required capital investments in new facilities and workforce training initiatives. Meanwhile, compliance with country-of-origin regulations has become an increasingly critical consideration when orchestrating multi-tier supply networks.

Beyond direct material cost increases, the uncertainty surrounding tariff renewals and potential extensions has heightened risk perceptions among procurement and strategy teams. As a result, some original equipment manufacturers are pursuing dual sourcing strategies and expanding supplier diversity to safeguard against sudden duty escalations. Looking ahead, the interplay between trade policy and transmission innovation underscores the need for agile decision-making frameworks, ensuring that manufacturers can pivot rapidly in response to evolving government mandates.

Unlocking Key Market Segmentation Insights For Diverse Transmission Types, Vehicle Classes, Propulsion Systems, Drivetrains, And Sales Channels

Understanding the complexity of the transmission market requires a granular exploration of multiple segmentation dimensions. When examining the landscape by transmission type, the Automated Manual category divides into single and twin clutch configurations, each offering distinct advantages in terms of rapid gear shifts and fuel efficiency. Automatic transmissions continue to dominate in passenger vehicles due to their user-friendly operation, while continuously variable transmissions leverage chain belt, metal push belt, and toroidal designs to deliver seamless acceleration and optimal engine performance. Dual clutch systems, whether employing dry or wet clutches, have gained traction in performance and premium segments, providing lightning-fast shifts and high torque capacity. The traditional manual gearbox remains relevant, particularly in light commercial and certain enthusiast passenger car applications, with configurations spanning from five- and six-speed boxes to more advanced seven- and eight-speed variants.

Turning to vehicle type, the market divides into passenger cars, light commercial vehicles, and heavy commercial vehicles. Passenger cars prioritize smoothness and compactness, while light commercial vehicles demand robust gearboxes that withstand frequent stop-start cycles and heavy payloads. Heavy commercial segments, encompassing long-haul trucks and vocational vehicles, lean toward durable transmissions with specialized auxiliary gear ranges for maximum towing and hauling capabilities.

Propulsion-based segmentation underscores the rapid ascendancy of electrified powertrains. Diesel and gasoline engines still represent the bulk of current demand, but battery electric and fuel cell electric configurations are attracting significant R&D focus, particularly in multi-speed e-axle designs to enhance efficiency. Hybrid systems, spanning mild hybrids to full hybrids and plug-in variants, rely on sophisticated power split mechanisms and regenerative braking integration, thereby driving demand for tailored multi-mode transmission architectures.

Finally, drivetrain considerations-whether front-, rear-, or all-wheel drive-shape transmission housing designs, torque distribution logic, and integration with electronic stability and traction control systems. The sales channel dimension further distinguishes between original equipment manufacturers requiring high-volume, just-in-time deliveries and the aftermarket sector that values modular design for simplified servicing and replacement.

This comprehensive research report categorizes the Automotive Transmission market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Transmission Type

- Vehicle Type

- Propulsion

- Drivetrain

- Sales Channel

Examining Regional Market Dynamics And Growth Prospects Across The Americas, Europe Middle East & Africa, And Asia-Pacific Transmission Sectors

Regional market dynamics reveal distinct adoption patterns and regulatory influences across the Americas, EMEA, and Asia-Pacific. In the Americas, North America leads in the shift toward electrified and hybrid transmissions, driven by federal incentives and state-level zero-emission vehicle mandates. Mexico has emerged as a strategic manufacturing hub for both conventional and e-axles, benefiting from trade agreements and competitive labor costs. In South America, varying emission regulations and infrastructure challenges have resulted in a persistent reliance on diesel-centric powertrains, though hybrid penetration is steadily increasing in urban centers.

Europe, the Middle East, and Africa present a multifaceted picture. The European Union’s stringent CO₂ emission standards have accelerated the rollout of advanced dual clutch and high-ratio automatic transmissions in conventional powertrains, while battery electric vehicle mandates are fostering new partnerships between transmission specialists and electric drivetrain integrators. Middle Eastern markets continue to favor robust automatic gearboxes capable of withstanding high ambient temperatures and off-road conditions, whereas the African region shows growing aftermarket demand for durable manual transmissions that can cope with varied road surfaces.

In the Asia-Pacific, China leads both production and adoption of CVT and dual clutch solutions, supported by substantial domestic R&D funding and localized component ecosystems. Japan remains at the forefront of toroidal CVT development and twin-clutch innovations, while South Korea’s Jatco and Hyundai Mobis are expanding their footprint in electrified transmission portfolios. Southeast Asian markets, characterized by rapid urbanization and a burgeoning middle class, are experiencing growing interest in affordable automatic and CVT options, particularly for entry-level passenger cars.

These regional insights underscore the importance of nuanced strategies that align product offerings with local regulatory landscapes, consumer preferences, and manufacturing capabilities.

This comprehensive research report examines key regions that drive the evolution of the Automotive Transmission market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Transmission Suppliers And OEM Partnerships Driving Technological Innovation And Competitive Advantage In The Automotive Sector

The competitive landscape features a blend of established global suppliers and emerging specialists. ZF Friedrichshafen continues to lead with its broad spectrum of automatic and dual clutch systems, complemented by integrated electrified axle solutions. Aisin Seiki, supported by Toyota’s hybrid expertise, excels in multi-mode transmissions optimized for both combustion and electrified powertrains. BorgWarner has carved out a niche in dual clutch and e-Transmission modules, leveraging its robust thermal and torque management technologies.

Magna’s acquisition of Getrag has bolstered its credentials in high-volume manual and dual clutch manufacturing, while Allison Transmission remains the partner of choice for heavy commercial vehicle segments, offering proven torque converter systems. Jatco retains a dominant position in continuously variable transmissions, especially within Asia, whereas Hyundai Mobis is rapidly scaling its portfolio of electric drive units and multi-speed e-axles. Niche players, such as Schaeffler’s LuK brand, focus on clutch and mechatronic clutch actuator technologies, underscoring the growing integration of software controls with mechanical systems.

Strategic partnerships are reshaping the industry landscape. Collaborations between transmission suppliers and electric motor manufacturers have accelerated the development of compact e-drives. Alliances with software firms are driving the adoption of over-the-air shift logic updates and predictive maintenance platforms. Joint ventures aimed at localizing production in key growth markets are also proliferating, enabling suppliers to navigate regional content regulations and reduce exposure to tariff-related risks.

These competitive and collaborative moves highlight the ongoing realignment of capabilities and resources necessary to address the evolving demands of OEMs and end-user segments in the transmission market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Transmission market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- Allison Transmission Holdings, Inc.

- BorgWarner Inc.

- BorgWarner Transmission Systems LLC

- Dana Incorporated

- Getrag GmbH & Co. KG

- GKN Automotive Limited

- Hitachi Astemo, Ltd.

- Honda Motor Co., Ltd.

- Hyundai DYMOS Co., Ltd.

- Jatco Ltd.

- JTEKT Corporation

- Kumho Tire Co., Ltd.

- Magna International Inc.

- Mitsubishi Electric Corporation

- Nexteer Automotive Group Ltd.

- Schaeffler Technologies AG & Co. KG

- Toyota Motor Corporation

- TREMEC Corporation

- Yanmar Co., Ltd.

- ZF Friedrichshafen AG

Providing Actionable Recommendations For Industry Executives To Capitalize On Emerging Transmission Trends And Strengthen Market Positioning

Industry participants must adopt a forward-looking posture to capitalize on emerging opportunities within the transmission landscape. First, investing in R&D for electrified and software-driven transmission systems will be essential, given the accelerating shift toward battery electric and hybrid powertrains. Companies should prioritize modular architectures that can serve multiple propulsion configurations, reducing development lead times and enhancing cost efficiency.

Second, supply chain resilience must be bolstered by diversifying sourcing strategies and pursuing nearshoring initiatives in response to tariff uncertainties. Establishing dual sourcing arrangements and expanding regional manufacturing footprints will mitigate single-source dependencies and ensure continuity of supply under fluctuating trade policies.

Third, forging strategic alliances with software and electronics specialists will facilitate the integration of predictive maintenance, over-the-air updates, and artificial intelligence-driven shift optimization. These partnerships will create value-added services that extend beyond the physical gearbox, fostering recurring revenue streams and stronger OEM relationships.

Finally, companies should align their product roadmaps with evolving regulatory requirements by participating in standards-setting bodies and leveraging market intelligence to anticipate policy shifts. By embedding compliance considerations early in the design process, suppliers can avoid costly design revisions and maintain agile product development cycles.

Taken together, these recommendations will empower organizations to sustain competitive advantage, drive innovation, and unlock new revenue opportunities in a rapidly evolving market.

Outlining A Rigorous Multi-Stage Research Methodology Combining Primary Interviews, Secondary Sources, And Data Validation For Transmission Market Analysis

This study employs a robust, multi-stage research methodology designed to ensure accuracy, relevance, and actionable intelligence. The secondary research phase involved a comprehensive review of industry publications, regulatory filings, patent databases, and quarterly reports from leading OEMs and tier-one suppliers. These sources provided foundational market context, historical trends, and an understanding of global trade and tariff structures.

Primary research complemented these insights through structured interviews with key stakeholders, including product development leads at major transmission suppliers, powertrain engineers at OEMs, and procurement specialists overseeing global supply chains. These interviews were conducted across North America, Europe, and Asia-Pacific to capture regional nuances and operational challenges.

Quantitative analysis techniques were applied to verify cost impacts, production volumes, and adoption rates across the transmission typologies. Data triangulation was performed to reconcile discrepancies between secondary data points and interview findings, ensuring that the resulting insights reflect both market realities and forward-looking expectations.

Throughout the research process, quality assurance checks were implemented via peer reviews, data validation workshops, and methodological cross-checks. This rigorous approach underpins the credibility of the segmentation frameworks, competitive assessments, and strategic recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Transmission market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Transmission Market, by Transmission Type

- Automotive Transmission Market, by Vehicle Type

- Automotive Transmission Market, by Propulsion

- Automotive Transmission Market, by Drivetrain

- Automotive Transmission Market, by Sales Channel

- Automotive Transmission Market, by Region

- Automotive Transmission Market, by Group

- Automotive Transmission Market, by Country

- United States Automotive Transmission Market

- China Automotive Transmission Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Insights Emphasizing Agility, Technological Adaptation, And Resilience In Navigating The Evolving Automotive Transmission Ecosystem

As the automotive industry accelerates toward a more electrified and software-centric future, the role of the transmission is evolving from a purely mechanical assembly to a sophisticated, digitally enabled system. Agility in product development, supply chain adaptability, and technological integration will determine which suppliers thrive in this dynamic environment. The confluence of electric propulsion, autonomous mobility, and shifting trade policies demands a holistic perspective that blends engineering prowess with strategic foresight.

In this context, companies that can seamlessly integrate mechatronic functionalities-such as predictive shift logic and real-time health monitoring-will stand out. Moreover, a resilient supply chain that can navigate tariff cycles and regional regulatory requirements will prove critical in safeguarding profitability and delivery timelines. Finally, forging cross-industry partnerships, whether with software innovators or electric drive specialists, offers a pathway to new value streams beyond traditional transmission sales.

Ultimately, success in the evolving transmission ecosystem hinges on a proactive, integrative approach that anticipates market trends and delivers solutions aligned with the mobility landscape of tomorrow. By embracing the insights and recommendations outlined herein, industry participants will be well-positioned to capture growth opportunities and secure a leadership position in a rapidly transforming market.

Transforming Insights Into Action By Connecting With Ketan Rohom To Secure The Automotive Transmission Market Research Report And Unlock Strategic Value

To transform the strategic insights you have gained into tangible business outcomes, contact Ketan Rohom, Associate Director of Sales & Marketing, to secure the automotive transmission market research report. Engaging with Ketan Rohom ensures that your team receives a comprehensive analysis tailored to your objectives and priorities. His expertise will guide you to select the most relevant modules, whether you are focused on advanced dual clutch systems or emerging electric vehicle transmission architectures. By partnering with him, you gain direct access to in-depth proprietary data that will inform your decision-making, optimize your product roadmaps, and sharpen your competitive positioning.

Seize this opportunity to harness the full potential of the report’s actionable recommendations, regional breakdowns, and segmentation insights. Ketan Rohom will walk you through supplementary services such as customized data workshops, one-on-one strategic briefings, and ongoing market updates. Reach out today to convert the intelligence contained in this report into profitable strategies, ensuring you stay ahead in a landscape defined by rapid technological change and evolving trade policies. Empower your leadership with the clarity and confidence needed to drive sustainable growth and innovation in the automotive transmission sector.

- How big is the Automotive Transmission Market?

- What is the Automotive Transmission Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?