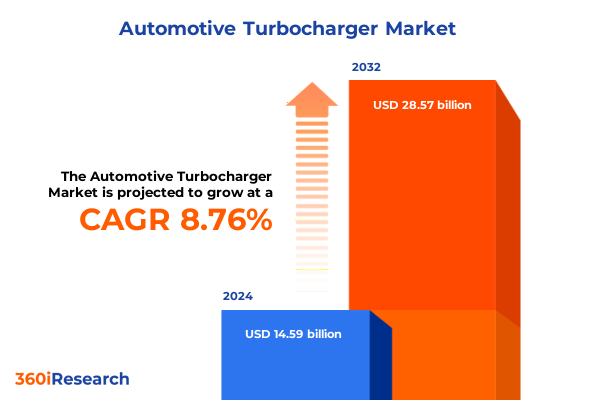

The Automotive Turbocharger Market size was estimated at USD 15.83 billion in 2025 and expected to reach USD 17.20 billion in 2026, at a CAGR of 8.79% to reach USD 28.57 billion by 2032.

Unveiling the Multifaceted Dynamics Driving the Evolution of Automotive Turbocharger Technologies in Response to Shifting Emissions Regulations Consumer Expectations and Performance Demands

The automotive turbocharger landscape has undergone profound transformation as global regulatory mandates, consumer expectations for performance, and advances in engineering converge to redefine forced induction. Once regarded primarily as a means of extracting greater power from internal combustion engines, turbocharger systems now play a pivotal role in balancing efficiency and emissions compliance. This executive summary lays the foundation for a comprehensive exploration of the factors shaping the market, from emerging technology paradigms to shifting geopolitical and trade environments.

In recent years, turbochargers have transcended their traditional performance niche, integrating with hybrid powertrains and 48-volt mild hybrid systems to deliver torque fill and downsized engine optimization. Meanwhile, the rise of electrified turbocharger solutions has introduced new avenues for performance augmentation in battery-electric vehicles, challenging legacy mechanical designs and demanding novel materials, control algorithms, and thermal management strategies.

Against this backdrop of rapid innovation, this report synthesizes the latest industry developments through a multi-angle lens. Each section delves into pivotal market drivers and challenges-ranging from tariff adjustments to end-user segmentation-equipping stakeholders with the nuanced understanding required to make data-driven decisions. By weaving together strategic insights and actionable recommendations, this introduction sets the stage for an in-depth journey through the future of automotive turbochargers.

Examining the Transformational Forces Reshaping Automotive Turbocharger Landscape Through Accelerated Electrification Integration Advanced Materials Adoption and Stringent Emissions Control Standards

The automotive turbocharger domain is experiencing a wave of transformative shifts that go beyond incremental improvements in compressor wheel designs or bearing technologies. Chief among these is the widespread push toward electrification: electric turbochargers, which use motor assist to eliminate lag and provide boost on demand, are emerging as a critical enabler for downsized engines and hybrid powertrains. This trend is reinforced by global emissions targets that require rapid reductions in CO₂ output, prompting OEMs to integrate advanced turbocharger systems in place of larger, naturally aspirated engines.

Simultaneously, the materials landscape is evolving through the adoption of advanced alloys and additive manufacturing techniques. High-temperature nickel-based superalloys and titanium aluminides are being explored to withstand elevated exhaust gas temperatures, while 3D-printed compressor housings reduce weight and optimize aerodynamic efficiency. These material innovations are intrinsically linked to the need for better thermal management, giving rise to liquid-cooled designs and sophisticated wasteheat recovery concepts.

On the regulatory front, stringent Euro 7 and equivalent emissions standards in key markets are compelling manufacturers to refine variable geometry turbochargers for ultra-precise control over boost pressure and exhaust backpressure. Furthermore, digitalization is playing a central role: real-time sensor integration and predictive analytics enable condition-based maintenance and performance optimization, extending component life and minimizing unplanned downtime. Collectively, these forces are not only reshaping product roadmaps but also redefining competitive positioning across the entire turbocharger value chain.

Assessing the Cumulative Impact of New United States Tariff Policies on Automotive Turbocharger Supply Chains Manufacturing Cost Structures and Global Competitive Positioning Dynamics

Since the beginning of 2025, a series of new United States tariffs on imported automotive components has exerted significant pressure on turbocharger manufacturers and downstream OEMs. These measures, targeting steel imports and select precision-machined parts, have driven a reassessment of global supply chains. Organizations must now balance the need to maintain low production costs with the imperative to comply with evolving trade regulations, leading many to explore nearshoring strategies and alternative supply partnerships.

In response, several tier-one suppliers have diversified their manufacturing footprints, increasing capacity in regional production hubs across North America. This shift helps mitigate tariff burdens but introduces complex logistical challenges, such as extended lead times for critical subcomponents and the need for robust quality control protocols across multiple facilities. As companies retool existing plants and invest in new machining centers, capital expenditure cycles have accelerated, underscoring the importance of long-term strategic planning.

Moreover, procurement teams are intensifying their focus on cost modeling and total landed cost analysis. By mapping tariff exposures and identifying opportunities for duty drawbacks or bonded warehouse utilization, firms can reclaim portions of their increased import costs. However, these workarounds demand specialized expertise in customs classification and regulatory compliance. Ultimately, the 2025 tariffs have not only raised immediate cost structures but have also catalyzed a shift toward more resilient, regionally balanced supply networks.

Unpacking Detailed Market Segmentation Insights to Illuminate Technology Preferences Usage Applications and Purchase Behaviors across Diverse Automotive Turbocharger Categories and Business Channels

Segmenting the automotive turbocharger market by technology reveals a spectrum of solutions, from conventional wastegate turbochargers to advanced electric-assisted systems. Electric turbochargers are gaining traction for their ability to eliminate lag and seamlessly integrate with hybrid drivetrains, while twin-turbo systems-whether deployed in parallel configurations for balanced boost distribution or sequential setups for broad torque coverage-continue to serve performance and heavy-duty applications. Variable geometry turbochargers further enhance efficiency by dynamically adjusting the turbine inlet geometry, optimizing exhaust gas flow under varying engine loads.

When examining cooling system distinctions, air-cooled turbochargers remain prevalent in cost-sensitive segments, but liquid-cooled designs are increasingly specified for high-performance and heavy-duty engines where thermal stability is paramount. Similarly, fuel type segmentation highlights diverging requirements: traditional diesel turbochargers emphasize durability under high compression ratios, gas-fuel turbochargers-whether running on compressed natural gas or liquefied natural gas-demand specialized materials to resist methane-induced corrosion, and petrol applications prioritize rapid spool-up and minimal backpressure.

Material choices also delineate market niches: aluminum compressor housings offer weight savings critical for passenger cars, whereas cast iron turbine housings deliver robustness for commercial vehicles. Steel alloys bridge the gap, providing resilience in both temperature extremes and corrosive exhaust environments. Across sales channels, offline distribution through established dealerships dominates the OEM replacement space, while online platforms are emerging as a convenient alternative for aftermarket customers seeking rapid fulfillment.

Finally, segmenting by vehicle type and end user underscores the market’s breadth. Commercial and light commercial vehicle operators gravitate toward heavy and light turbocharging solutions that maximize fuel efficiency and payload performance, while off-highway applications such as construction equipment and agricultural tractors demand rugged designs with extended service intervals. Passenger car segments-spanning hatchbacks, sedans, and SUVs-continue to drive innovation in compact turbocharging solutions, and original equipment manufacturers collaborate closely with suppliers even as aftermarket demand grows for retrofitting and upgrade kits.

This comprehensive research report categorizes the Automotive Turbocharger market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Cooling System

- Fuel Type

- Material

- Engine Displacement

- Sales Channel

- Vehicle Type

- End User

Exploring Critical Regional Insights to Highlight How Geopolitical Dynamics Regulatory Environments and Infrastructure Maturity Are Influencing Automotive Turbocharger Adoption across Major Global Territories

In the Americas, turbocharger adoption is influenced by a dual mandate for performance and stringent emissions requirements. The North American market has seen rapid uptake of mild-hybrid systems paired with electric turbochargers, propelled by federal and state-level incentives for cleaner vehicles. Meanwhile, commercial vehicle operators in heavy-duty trucking corridors are integrating liquid-cooled and variable geometry turbochargers to meet EPA greenhouse gas regulations while optimizing fuel efficiency on long-haul routes.

Across Europe, the Middle East, and Africa, regulatory frameworks such as Euro 7 and expanding low-emission zones in major cities are accelerating the shift toward electrified and advanced mechanical turbocharging solutions. OEMs headquartered in the region are pioneering wasteheat recovery systems that feed exhaust energy back into turbocharger drives, a trend supported by robust R&D incentives. In the Middle East and Africa, fleet renewal programs and infrastructure expansion drive demand for reliable turbochargers in both passenger and off-highway segments, although supply chain constraints have created pockets of short-term volatility.

The Asia-Pacific region remains the fastest-growing arena, with expanding automotive production in China and India fueling demand for cost-effective turbochargers that address both performance aspirations and fuel economy mandates. Local manufacturers are investing heavily in parallel twin-turbo setups for premium sedans, while sophisticated wastegate and variable geometry units are gaining ground in commercial vehicles. Government policies on natural gas utilization have also spurred growth of CNG-capable turbochargers, particularly in fleet applications that seek to balance environmental goals with operational cost savings.

Taken together, these regional variations underscore the need for a nuanced market entry strategy, tailored to distinct regulatory landscapes, infrastructure maturity levels, and customer preferences across the globe.

This comprehensive research report examines key regions that drive the evolution of the Automotive Turbocharger market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Industry Players Strategic Collaborations Innovation Pipelines and Market Positioning Efforts that Are Driving Competitive Dynamics and Shaping the Future of Automotive Turbocharger Technologies

The competitive landscape is defined by a core group of global suppliers that continually invest in product innovation, strategic partnerships, and capacity expansion. Established players leverage decades of design expertise to refine mechanical turbocharger architectures, integrating advanced ceramics and friction-reducing coatings to extend service life and enhance thermal resilience. At the same time, these incumbents are forging alliances with electric motor specialists and power electronics firms to co-develop electric-assisted turbocharger modules tailored for hybrid and battery-electric platforms.

Mid-tier manufacturers are carving out niches through specialization in segment-specific applications. Some focus on lightweight aluminum designs optimized for passenger cars, while others concentrate on heavy-duty variable geometry turbochargers for commercial fleets. A limited number of emerging challengers are differentiating on digital offerings, embedding sensors and telematics modules that provide predictive maintenance alerts and performance analytics as a value-add to fleet operators.

Across the board, merger and acquisition activity has accelerated as companies seek to bolster technological portfolios and secure regional market access. Joint ventures between OEMs and turbocharger specialists are becoming increasingly common, particularly in Asia-Pacific markets where local content requirements incentivize collaborative manufacturing arrangements. Collectively, these strategic maneuvers are intensifying competition around innovation cycles, customer service models, and near-term capacity ramp-ups.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Turbocharger market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accelleron Industries AG

- Apex Turbo

- Banks Power

- BMTS Technology GmbH & Co. KG

- BorgWarner, Inc.

- BTS Turbo GmbH

- CARDONE Industries, Inc.

- Cloyes Gear & Products, Inc.

- Continental AG

- Cummins Inc.

- Eaton Corporation PLC

- Garrett Motion Inc.

- Honeywell International Inc.

- IHI Corporation

- MAHLE GmbH

- Mitsubishi Heavy Industries Ltd.

- Ningbo Motor Industrial Co. Ltd.

- Nissens Automotive A/S

- Robert Bosch GmbH

- Solar Turbines

- SPA Turbo USA

- Toyota Motor Corporation

- Turbo Concepts, LLC

- Turbo Dynamics Ltd.

- TURBO ENERGY PRIVATE LIMITED

- Turbonetics, Inc.

- Turbosmart Pty Ltd

- Valeo SA

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Supply Chain Disruptions Leverage Technological Innovations and Capitalize on Emerging Market Opportunities in Turbocharger Sector

To navigate the evolving turbocharger landscape, industry leaders should prioritize supply chain resilience by diversifying sourcing across multiple regions and investing in dual-sourcing strategies for critical components, such as precision machined steels and high-temperature superalloys. This approach will help mitigate exposure to tariffs and geopolitical disruptions. At the same time, strategic partnerships with local manufacturers can streamline production footprints and unlock duty alleviation programs.

Furthermore, organizations must accelerate their electrification roadmaps. Allocating R&D resources toward electric motor integration and control electronics will position firms to capitalize on the growing demand for hybrid and battery-electric vehicle turbo systems. Simultaneously, embracing digitalization through telematics and predictive maintenance platforms will enable aftermarket differentiation and strengthen customer loyalty among fleet operators.

Material innovation is another critical lever. Collaborating with advanced alloy and additive manufacturing specialists will yield lighter, more durable turbocharger components capable of withstanding elevated thermal loads. These design improvements not only enhance performance but also reduce life-cycle costs, a key consideration for commercial and off-highway users.

Finally, companies should cultivate end-user engagement by developing tailored service agreements and performance guarantees. Offering comprehensive lifecycle management, including installation training and condition-based maintenance plans, will drive sustained aftermarket revenue streams and solidify brand reputation. By implementing these actionable measures, leaders can secure competitive advantage in an increasingly complex market.

Outlining the Comprehensive Research Methodology Combining Primary Stakeholder Engagement Secondary Data Synthesis and Advanced Analytical Techniques for Robust Automotive Turbocharger Market Intelligence Insights

This analysis integrates a structured research methodology combining primary and secondary data to ensure comprehensive market intelligence. On the primary side, in-depth interviews were conducted with senior executives at OEMs, tier-one suppliers, and leading aftermarket distributors. These conversations provided direct insight into product development roadmaps, procurement strategies, and service models across diverse regions.

Secondary research drew upon a broad array of sources, including technical publications, patent databases, and regulatory filings. Emissions standards documentation and trade policy announcements were systematically reviewed to map current and forthcoming compliance requirements. Industry conference proceedings and academic journal articles supplemented these findings, offering a window into emerging technology breakthroughs and deployment case studies.

Analytical frameworks such as PESTEL and Porter’s Five Forces were employed to contextualize macroeconomic and competitive dynamics. Segmentation matrices were developed to cross-reference technology variants with cooling systems, fuel types, materials, sales channels, vehicle categories, and end-user profiles. Scenario modeling was applied to evaluate the potential impact of tariff shifts and regulatory changes under different market conditions.

Quality assurance measures included triangulation of interview data with published financial and operational metrics, as well as validation workshops with subject matter experts. Together, this rigorous approach underpins the strategic insights and recommendations presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Turbocharger market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Turbocharger Market, by Technology

- Automotive Turbocharger Market, by Cooling System

- Automotive Turbocharger Market, by Fuel Type

- Automotive Turbocharger Market, by Material

- Automotive Turbocharger Market, by Engine Displacement

- Automotive Turbocharger Market, by Sales Channel

- Automotive Turbocharger Market, by Vehicle Type

- Automotive Turbocharger Market, by End User

- Automotive Turbocharger Market, by Region

- Automotive Turbocharger Market, by Group

- Automotive Turbocharger Market, by Country

- United States Automotive Turbocharger Market

- China Automotive Turbocharger Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2226 ]

Synthesizing Comprehensive Findings and Strategic Implications to Provide a Cohesive Roadmap for Stakeholders Seeking to Drive Growth and Innovation in the Global Automotive Turbocharger Arena

Through this comprehensive examination, we have uncovered the multifaceted forces driving the automotive turbocharger market-from technological innovations such as electric-assisted boost systems and additive manufacturing materials to the reshaping effects of new tariff policies on global supply chains. Our segmentation analysis has highlighted the nuanced preferences across technology types, cooling methods, fuel applications, materials, sales channels, vehicle categories, and end-user segments, demonstrating the market’s inherent complexity and growth potential.

Regional insights further underscore that no single strategy will suffice: while the Americas prioritize mild-hybrid integration and aftermarket service enhancements, EMEA markets are advancing wasteheat recovery and stringent emissions compliance. The Asia-Pacific arena, in contrast, is characterized by rapid production scaling and cost-sensitive turbocharger designs that cater to expanding commercial fleets and passenger car demands.

Key industry players are reacting through strategic collaborations, capacity expansions, and innovation pipelines that span both mechanical and electric turbocharger realms. By implementing the actionable recommendations outlined-such as supply chain diversification, targeted R&D investment, and digital service offerings-organizations can fortify their market position and capture emerging opportunities.

In conclusion, the automotive turbocharger sector stands at a pivotal juncture. Stakeholders who embrace agility, technological foresight, and customer-centric strategies will be best positioned to lead in this dynamic environment.

Engage Directly with Ketan Rohom to Access Customized In-Depth Turbocharger Market Intelligence Tailored to Your Strategic Objectives

To access the full depth of analysis encompassing the most critical insights on tariffs, technological evolution, and strategic opportunities within the automotive turbocharger sector, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a wealth of experience in guiding executive teams and procurement leaders through complex market landscapes, ensuring that each recommendation is tailored to your organization’s strategic priorities and operational realities.

By partnering with Ketan, you can secure a customized research package that delves into the granular data driving regional disparities, supplier dynamics, and end-user preferences. He will collaborate with you to identify the specific market segments most relevant to your growth objectives-whether that involves advanced electric turbocharger technologies for next-generation powertrains, lightweight materials integration for improved fuel economy, or aftermarket strategies to capture aftermarket share.

Take the next step toward informed decision-making by scheduling a one-on-one consultation with Ketan Rohom. He will work alongside your team to refine your go-to-market strategy, align your supply chain with emerging policy environments, and uncover competitive advantages through bespoke analysis. Reach out today to transform high-level findings into actionable initiatives that will position your organization at the forefront of the rapidly evolving turbocharger market.

- How big is the Automotive Turbocharger Market?

- What is the Automotive Turbocharger Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?