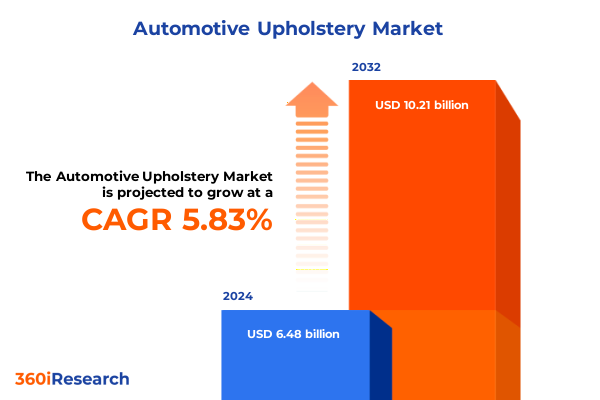

The Automotive Upholstery Market size was estimated at USD 6.79 billion in 2025 and expected to reach USD 7.12 billion in 2026, at a CAGR of 5.99% to reach USD 10.21 billion by 2032.

Exploring the Critical Role of Advanced Automotive Upholstery Trends in Shaping Passenger Comfort, Safety, and Brand Differentiation

The automotive upholstery sector has always been at the intersection of comfort, safety, and luxury, but today it stands at the frontier of innovation and sustainability within the broader mobility landscape. As vehicles evolve from purely mechanical conveyances into sophisticated mobile living spaces, upholstery transforms from a functional necessity to a strategic differentiator that shapes user experience across every journey. Understanding this transformation requires a close examination of emerging materials, advanced seat technologies, and evolving consumer expectations that collectively elevate the importance of interior aesthetics and ergonomics in modern vehicles.

In recent years, the convergence of stricter emissions regulations, electrification trends, and shifting consumer preferences has redefined how automakers approach cabin design. Lightweight, sustainable fabrics and composites are increasingly prioritized to improve energy efficiency while reducing environmental impact. Concurrently, electrified powertrains have opened new possibilities for integrating advanced features such as heated, cooled, and massaging seats powered by efficient thermal management systems. As a result, automotive upholstery professionals must navigate a rapidly changing matrix of design imperatives, material science breakthroughs, and technological integrations to deliver cabin solutions that align with both consumer desires and regulatory requirements.

Against this backdrop, this executive summary provides a foundational overview of the current state and future trajectory of automotive upholstery. It outlines transformative shifts reshaping material sourcing and application, analyzes the cumulative effects of recent tariff policies on supply chains, offers segmentation insights across critical market dimensions, and highlights regional characteristics driving localized growth. Together, these insights form a coherent introduction to the strategic considerations that industry leaders must address to remain competitive and innovative.

Uncovering the Major Transformative Shifts Revolutionizing Automotive Upholstery Through Sustainability, Electrification, and Digital Integration Trends

The landscape of automotive upholstery is undergoing transformative shifts that extend well beyond traditional fabric and leather selection. Sustainability has emerged as a foundational pillar, with manufacturers and suppliers collaborating to develop ecofriendly alternatives such as recycled textiles, plant-based leathers, and bioengineered Alcantara substitutes. This movement toward greener materials aligns with intensified consumer demand for products that reflect environmental stewardship, particularly in regions where carbon footprint and lifecycle assessments influence purchasing decisions.

Simultaneously, the rise of electric and autonomous vehicles is driving dramatic changes in cabin functionality and occupant expectations. Electrification not only reduces drivetrain complexity but also frees up interior space, encouraging designers to envision seats that offer enhanced lateral support, personalized climate control, and integrated infotainment modules. Autonomous driving prototypes further highlight the emerging role of seats as multifunctional living spaces, capable of reclining into relaxation modes or adapting to collaborative work configurations during transit.

Digital integration is another defining trend shaping upholstery innovations. Smart fabrics embedded with sensors enable real-time monitoring of occupant posture, body temperature, and vital signs, potentially feeding data into vehicle safety systems for proactive adjustments. Connectivity features now extend to seat interfaces, allowing passengers to personalize settings via mobile applications or in-car voice assistants. Together, these developments indicate a paradigm shift in which upholstery transcends passive comfort functions to become an active participant in overall vehicle performance and user wellbeing.

Assessing the Compounded Impacts of 2025 United States Tariffs on Global Supply Chains, Material Costs, and Strategic Sourcing Decisions in Automotive Upholstery

The cumulative impact of United States tariffs implemented in early 2025 has reverberated across global automotive upholstery supply chains, compelling stakeholders to reassess sourcing strategies and material portfolios. Tariffs on imported hides, synthetic leather fabrics, and key polymer precursors have increased input costs for both original equipment manufacturers and aftermarket suppliers. As a result, manufacturers have accelerated the exploration of domestic material production, including localized polymer blending facilities and partnerships with regional leather tanneries to mitigate exposure to cross-border duties.

Consequently, some industry players have reconfigured their supply chains by diversifying sourcing nodes. Strategic alliances have emerged between North American mills and Asian material innovators to establish joint production centers outside tariff jurisdictions, enabling the consolidation of value-added processes such as fabric finishing and embossing. At the same time, the heightened cost environment has incentivized the adoption of lower-cost vinyl alternatives with advanced wear and abrasion resistance, particularly in high-volume vehicle segments where margin preservation is critical.

Looking beyond immediate cost pressures, the tariff regime has also stimulated long-term investment in material innovation and capacity expansion within the United States. Domestic research initiatives focusing on advanced polymer recycling and bio-based fabric extrusion technologies are receiving increased funding, underscoring a broader commitment to supply chain resilience and strategic autonomy. While these developments may intensify competitive dynamics, they also present opportunities for suppliers and OEMs to differentiate through regional value creation and technological leadership.

Diving into Strategic Segmentation Insights Across Material Types, Applications, Vehicle Classes, Sales Channels, and Cutting Edge Seat Technologies

In automotive upholstery, material type remains a fundamental axis of differentiation, with a broad spectrum that spans Alcantara, diverse fabric blends, multiple leather grades, versatile synthetic leathers, and high-performance vinyl. Blended fabrics combining nylon and polyester continue to gain traction for their tensile strength and dye retention, while specialized full-grain and top grain leathers are prized in premium segments for their tactile richness and longevity. Synthetic leather segments, particularly PU and PVC variants, offer compelling cost-performance balance and have evolved to mimic natural grain textures, thereby appealing to both mid-range and high-end models. Vinyl alternatives, whether calendered or cast, are finding expanded application in light commercial vehicles due to rigorous cleaning requirements and simplified maintenance protocols.

Functionally, the division between carpets, dashboards, door panels, headliners, and seating underscores distinct performance and aesthetic criteria. Front seats demand ergonomic design with integrated heating, cooling, or massaging systems, whereas rear seats focus on multi-passenger comfort and modular configurations. Skilled craftsmanship in dashboard and door panel coverings enhances perceived cabin quality, creating seamless transitions between structural elements and soft surfaces. Headliners utilize lightweight yet flame-retardant substrates for both acoustics and safety compliance. Together, these applications reflect the nuanced interplay between design creativity and regulatory mandates.

Vehicle type segmentation further contextualizes upholstery requirements. Heavy and light commercial vehicles prioritize durability and ease of cleaning, often incorporating reinforced vinyl or corrected grain leather, while passenger vehicles embrace a wider palette of Alcantara, blended fabrics, and premium leather options across hatchbacks, sedans, and SUVs. The choice between aftermarket and original equipment channels shapes product lifecycle considerations, from initial fitment standards to long-term repairability. Finally, the emergence of cooled, heated, massaging, and memory foam seat technologies represents a technology-driven frontier, integrating microclimate control and adaptive cushioning to enhance occupant wellbeing on both short commutes and cross-country journeys.

This comprehensive research report categorizes the Automotive Upholstery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Vehicle Type

- Technology

- Application

- Sales Channel

Analyzing Dynamic Regional Characteristics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific Automotive Upholstery Markets

Regional dynamics in the automotive upholstery market are shaped by a confluence of regulatory frameworks, consumer preferences, and manufacturing ecosystems. In the Americas, North American producers benefit from mature supply chains and proximity to major automotive OEM hubs, fostering collaborative development of sustainable materials and advanced seating technologies. South America contributes through expanding light vehicle production, where affordability drives the proliferation of robust vinyl and cost‐effective synthetic leather solutions.

Within Europe, the Middle East, and Africa, stringent emissions and waste management policies propel a shift toward bio-based fabrics and recycled polymer composites. Luxury automakers headquartered in Western Europe set premium upholstery benchmarks, influencing material adoption across adjacent markets. In the Middle East, high ambient temperatures accelerate the demand for cooled seat systems and UV-resistant coverings, while Africa’s emerging commercial vehicle sector emphasizes functional upholstery designed for rugged operating conditions.

Asia Pacific remains a growth engine, characterized by a broad spectrum of vehicle types and a dynamic supplier landscape. Japanese and Korean OEMs are pioneers in integrating sensor-embedded textiles and connected seat modules, whereas Chinese producers leverage scale to rapidly deploy cost-competitive synthetic leather alternatives. Regional free trade agreements and production incentives have enabled the establishment of cross-border upholstery centers, which service both local demand and export markets. Together, these regional nuances underscore the importance of tailored strategies to address specific regulatory mandates, climatic considerations, and evolving consumer expectations.

This comprehensive research report examines key regions that drive the evolution of the Automotive Upholstery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovations of Leading Automotive Upholstery Suppliers Driving Industry Excellence and Differentiation Worldwide

Leading participants in the automotive upholstery sector have pursued differentiated strategies centered on vertical integration, material innovation, and strategic alliances. Major global suppliers leverage proprietary finishing techniques and advanced coating technologies to enhance the performance of synthetic leather and vinyl offerings. These companies invest heavily in research and development, collaborating with raw material providers to co-create bio-based alternatives that meet both aesthetic and sustainability targets.

In parallel, select seating system manufacturers are expanding their value propositions by integrating thermal management, massage actuators, and intelligent sensor arrays directly into seat architectures. By embedding electronics and microfluidic pathways within foam substrates, these enterprises deliver turnkey seating modules that simplify OEM assembly and reduce platform complexity. Some have also formed joint ventures with automotive technology firms to accelerate the commercialization of sensor-embedded coverings capable of biometric monitoring and adaptive posture control.

Meanwhile, regional players in emerging markets focus on cost leadership and supply chain agility to capture aftermarket opportunities. These firms optimize production lines for high-volume output and rapid changeover, enabling them to serve diverse vehicle segments-from commercial fleets to mass-market passenger cars-with tailored upholstery kits. Their localized footprint and deep customer relationships provide a competitive moat against imports, particularly in regions where tariff barriers and logistics constraints heighten the appeal of near-market manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Upholstery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient plc

- Aisin Seiki Co., Ltd.

- BASF SE

- DK Leather Corporation Berhad

- Faurecia SE

- Grupo Antolin-Irausa, S.A.

- GST AutoLeather Inc.

- Henniges Automotive Holding LLC

- Lear Corporation

- Magna International Inc.

- Tachi-S Co., Ltd.

- The Haartz Corporation

- Toyota Boshoku Corporation

- Yanfeng Automotive Interiors Co., Ltd.

Delivering Targeted Actionable Recommendations for Industry Leaders to Navigate Tariffs, Innovate with Materials, and Strengthen Supply Chain Resilience

To navigate the evolving upholstery landscape, industry leaders must coalesce around sustainable material strategies that align with emerging regulatory and consumer demands. Investing in local polymer recycling and bio-based fabric extrusion capabilities can buffer organizations against tariff volatility while strengthening environmental credentials. In parallel, cross-functional teams should pursue digital integration roadmaps that embed sensor fabrics and connectivity modules into standard seating platforms, unlocking new value streams in occupant comfort and data-driven safety features.

Supply chain resilience also demands proactive diversification of sourcing footprints. Leaders should evaluate nearshore manufacturing options to offset rising logistics costs and mitigate geopolitical risks associated with single-region dependencies. Establishing multi-tier partnerships with tanneries, polymer suppliers, and technology firms will enable agile responses to material shortages and cost fluctuations. Furthermore, embedding advanced analytics into procurement workflows can deliver early warning signals on commodity price shifts and capacity constraints.

Finally, executives must champion a customer‐centric innovation ethos, leveraging co-creation workshops with OEM design teams and end‐users to iterate rapidly on upholstery prototypes. By employing virtual reality visualization and haptic feedback tools, development cycles can be compressed, and user acceptance validated before committing to high‐volume production. This integrated approach will accelerate time‐to‐market for premium seating solutions while safeguarding brand reputation through unwavering quality and performance standards.

Detailing a Rigorous Multi Stage Research Methodology Combining Primary Interviews, Secondary Intelligence, and Data Validation for Upholstery Market Analysis

This market research leverages a dual-approach methodology combining comprehensive secondary data gathering with extensive primary engagement. Secondary intelligence was sourced from public corporate disclosures, regulatory filings, and authoritative trade association reports to establish baseline industry parameters and identify historical trends. Concurrently, proprietary patent analyses and scientific literature scans informed material innovation trajectories and emerging technology adoption patterns.

Primary research efforts encompassed in-depth interviews with C-level executives, procurement managers, and R&D heads across tier-one suppliers, OEM interiors divisions, and specialty upholstery manufacturers. These dialogues provided first-hand perspectives on supply chain disruptions, tariff mitigation strategies, and investment priorities. Complementing interviews, targeted surveys captured quantifiable insights on material preferences, technology adoption rates, and regional sourcing plans, ensuring that all stakeholder voices were incorporated.

Data validation protocols involved triangulating findings through a bottom-up approach, cross-referencing company‐level production data with market activity indicators and aftermarket replacement volumes. This rigorous process was reinforced by expert panel reviews, enabling iterative refinements to both qualitative interpretations and quantitative frameworks. The result is a robust and transparent research foundation designed to empower strategic decision making across the automotive upholstery ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Upholstery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Upholstery Market, by Material Type

- Automotive Upholstery Market, by Vehicle Type

- Automotive Upholstery Market, by Technology

- Automotive Upholstery Market, by Application

- Automotive Upholstery Market, by Sales Channel

- Automotive Upholstery Market, by Region

- Automotive Upholstery Market, by Group

- Automotive Upholstery Market, by Country

- United States Automotive Upholstery Market

- China Automotive Upholstery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding Synthesis of Automotive Upholstery Market Dynamics Emphasizing Strategic Priorities, Competitive Imperatives, and Emerging Industry Opportunities

In synthesizing the multifaceted dynamics of the automotive upholstery market, it is clear that material innovation, regulatory pressures, and evolving vehicle architectures are reshaping industry priorities. Stakeholders who align their strategies with sustainability imperatives and tariff mitigation measures will be best positioned to capture emerging opportunities. The introduction of advanced sensor‐embedded fabrics and adaptive seat technologies underscores a broader transition toward intelligent interiors that enhance both occupant wellbeing and vehicle safety.

Regional variances highlight the necessity of localized approaches, from leveraging North American supply chain strengths to embracing bio‐based material mandates in Europe and capitalizing on scale efficiencies in Asia Pacific. At the same time, the rise of premium and aftermarket segments demands agility in production capabilities and customer engagement strategies. Leading companies are those that seamlessly integrate vertical capabilities, from material sourcing to finished seat assembly, while fostering cross-industry partnerships that accelerate time to market for next-generation upholstery solutions.

Looking ahead, the convergence of electrification, autonomy, and personalization will continue to elevate upholstery as a strategic focal point within vehicle design. Organizations that invest in resilient supply networks, co-innovation frameworks, and data-driven product development will secure a competitive moat in an increasingly complex market. This analysis offers a roadmap for executives to prioritize investments, optimize operations, and deliver upholstery solutions that resonate with tomorrow’s mobility landscape.

Engaging with Ketan Rohom to Secure Comprehensive Automotive Upholstery Insights and Propel Strategic Decision Making with Exclusive Market Research Report Access

Take action now by partnering with Ketan Rohom, Associate Director of Sales & Marketing, to secure this indispensable market research report and gain a decisive industry edge

Don’t let competitors outpace you in the fast-evolving automotive upholstery arena. Reaching out to Ketan Rohom as soon as possible ensures that you tap into exclusive insights encompassing material innovations, tariff impacts, regional nuances, and strategic recommendations. With a deep understanding of emerging seat technology trends, regulatory landscapes, and supply chain resilience strategies, you are poised to make informed decisions that enhance profitability and brand positioning.

Access to this comprehensive research report provides you with the clarity and foresight needed to navigate complex market dynamics. Whether you are evaluating the incorporation of sustainable fabrics, assessing the implications of United States tariffs, or exploring new growth opportunities in Asia Pacific, engaging directly with Ketan Rohom will provide tailored guidance and support. Secure your copy today and accelerate your organization’s path toward sustainable growth, operational efficiency, and competitive differentiation.

- How big is the Automotive Upholstery Market?

- What is the Automotive Upholstery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?