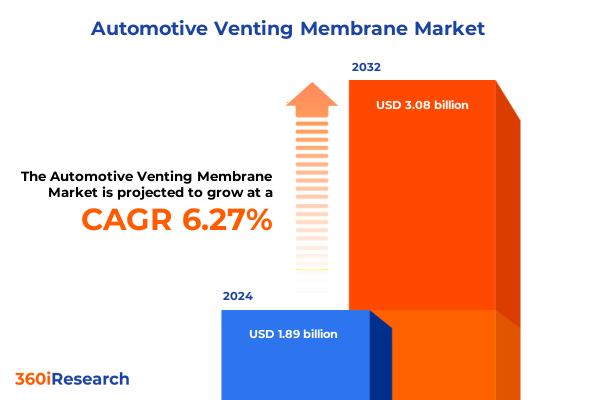

The Automotive Venting Membrane Market size was estimated at USD 2.00 billion in 2025 and expected to reach USD 2.11 billion in 2026, at a CAGR of 6.37% to reach USD 3.08 billion by 2032.

Navigating the Complexities of Automotive Venting Membranes as Critical Components in Vehicle Performance, Durability, Safety, and Environmental Sustainability

In the automotive industry, venting membranes have emerged as indispensable components that regulate pressure differentials, manage condensation, and protect critical systems against environmental contaminants. These advanced materials function as selective barriers that allow air and vapor to pass while preventing the ingress of dust, water, and other particulates. Over the past decade, improvements in membrane engineering have significantly enhanced vehicle performance and reliability, particularly in engine compartments, transmission housings, and fuel systems. Furthermore, the shift toward stricter emissions standards and higher performance expectations has intensified the focus on membrane precision and durability, driving research into novel polymer matrices and surface treatments.

Transitioning to a broader perspective, the evolution of automotive architectures-from conventional internal combustion setups to electrified powertrains-has elevated the role of venting membranes beyond traditional applications. Modern vehicles demand membranes that not only withstand harsh chemical exposure and high temperatures but also integrate seamlessly with compact battery enclosures and lightweight composite housings. In parallel, environmental regulations have become more stringent, compelling manufacturers to adopt materials that meet both performance and ecological requirements. Consequently, the development pipeline now prioritizes membranes that exhibit minimal outgassing, robust hydrophobic properties, and compatibility with recycled substrates. By addressing these emerging demands, venting membranes remain at the core of automotive system integrity and innovation.

Assessing the Impact of Electrification, Regulatory Evolution, and Material Innovations on the Automotive Venting Membrane Landscape

The landscape of automotive venting membranes is undergoing transformative shifts driven by three key forces: the electrification of vehicles, regulatory evolution, and breakthroughs in material science. As more automakers commit to electric vehicle (EV) production targets, membranes must adapt to new operational environments such as high-voltage battery compartments and thermal management systems. This shift involves balancing permeability with electrical insulation and ensuring long-term resistance to electrolyte vapors. Moreover, the reform of global emissions policies has raised the bar for containment of volatile organic compounds, compelling suppliers to innovate membrane architectures that guarantee zero leakage and maintain consistent porosity under varying pressures.

In tandem with regulatory and powertrain changes, advances in polymer chemistry and manufacturing processes have unlocked novel membrane solutions. Companies are increasingly exploring multi-layered membrane structures that combine expanded PTFE with engineered coatings or blended polymer networks. These developments offer a unique combination of mechanical strength, chemical resistance, and selective permeability. Additionally, the integration of nanofillers and surface patterning techniques has enhanced membrane robustness and tailored flow characteristics. Consequently, manufacturers can optimize membrane configurations to meet precise application requirements, whether for crankcase venting in high-performance engines, pressure regulation in EV battery modules, or humidity control in advanced fuel systems. Together, these shifts redefine the membrane value proposition, ensuring that automotive systems achieve new heights in efficiency, safety, and reliability.

Analyzing the Cumulative Effects of 2025 United States Tariffs on Material Costs, Supply Chains, and Strategic Sourcing Decisions in Automotive Venting

In 2025, the United States government implemented new tariffs on fluoropolymers and specialty polymer imports that have had a pronounced effect on the automotive venting membrane sector. The application of these duties has incrementally increased raw material costs for PTFE-based membranes, compelling manufacturers to reevaluate their supply chain strategies. As a result, some suppliers have shifted sourcing to domestic producers, while others have negotiated long-term agreements with non-U.S. partners to mitigate price volatility. This realignment has introduced fresh considerations around lead times, quality consistency, and inventory management.

Subsequently, companies have explored alternative materials such as polysulfones and polyetherimides to reduce reliance on tariff-affected imports. Although these polymers often exhibit different physical properties, tailored processing methods have enabled hybrid membrane constructions that leverage blends of PTFE with high-performance thermoplastics. Moreover, the tariff environment has spurred collaborative ventures aimed at localizing production capabilities. Joint efforts between membrane developers and automotive OEMs have focused on establishing manufacturing hubs within tariff-free zones, thus enhancing logistical efficiencies and reducing duty burdens.

Consequently, the cumulative impact of the 2025 tariff regime extends beyond immediate cost pressures to shape long-term strategic decisions regarding material selection, geographic footprint, and technology partnerships. Industry leaders are actively monitoring policy developments while investing in R&D programs designed to diversify the material base and build resilience against future trade disruptions. This proactive stance ensures that venting membrane solutions remain both cost-effective and performance-driven in a fluctuating regulatory milieu.

Uncovering Segmentation Dynamics Across Material Types, Application Scenarios, Vehicle Categories, and Distribution Channels in Automotive Venting Membranes

A nuanced examination of market segmentation reveals material preferences and application trends that are critical to strategic positioning. Membrane materials are largely categorized into expanded PTFE, PES membranes, and PTFE coated films. Within the expanded PTFE category, calendared variants provide consistent thickness and pore uniformity, while sintered types deliver elevated mechanical strength under high-pressure differentials. PTFE coated films, in turn, are differentiated by their backing layers: films with film backing offer exceptional chemical inertness, whereas nonwoven backing enhances physical abrasion resistance and support.

Turning to application-based segmentation, the automotive venting landscape extends across engine venting, EV battery venting, fuel system venting, and transmission venting. Engine venting applications are primarily divided between crankcase vents, which handle blow-by gases to maintain engine efficiency, and valve cover vents, which serve as critical safeguards against oil vapor buildup. In EV battery modules, membranes must facilitate moisture management while maintaining electrical isolation, a requirement that has elevated demand for high-purity polymer formulations. Fuel system venting focuses on vapor recovery and pressure regulation, ensuring optimal combustion and emissions control. Transmission venting, whether in automatic or manual configurations, addresses lubricant breather needs and prevents contamination under dynamic load conditions.

From the perspective of vehicle types, membranes find use in heavy commercial vehicles requiring robust, high-capacity solutions, light commercial vehicles where weight and cost considerations dominate, and passenger vehicles that prioritize noise attenuation and compact form factors. Distribution channels further refine the delivery model, with original equipment manufacturers integrating membranes directly into assembly lines under just-in-time frameworks, while the aftermarket segment demands versatile products suitable for retrofitting and replacement. This comprehensive segmentation insight underscores opportunities for tailored product development, channel-specific marketing strategies, and application-driven innovation.

This comprehensive research report categorizes the Automotive Venting Membrane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Application

- Vehicle Type

- Distribution Channel

Revealing Regional Variations in Automotive Venting Membrane Adoption, Growth Drivers, Regulatory Environment, and Technological Trends Worldwide

Regional analysis of the automotive venting membrane market uncovers distinct growth drivers and adoption patterns across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, particularly in the United States and Canada, membrane demand is propelled by stringent emissions regulations and a robust aftermarket ecosystem. Localized production capabilities coupled with a mature automotive infrastructure support rapid cycles of product iteration and technology adoption.

Meanwhile, in Europe Middle East and Africa, regulatory frameworks such as the European Union’s End-of-Life Vehicles Directive and ongoing Middle Eastern environmental mandates are influencing membrane design priorities. OEMs in this region are investing heavily in lightweight materials and multipurpose membrane solutions that align with carbon reduction targets. At the same time, North African and Gulf markets are expanding as regional OEMs pursue cost-effective venting options to meet rising vehicle production.

Across Asia Pacific, rapid expansion of vehicle manufacturing in China and India is driving substantial membrane uptake. The electrification wave in these markets places a premium on membranes for battery enclosures and thermal management. Additionally, Japan and South Korea continue to lead in advanced material technologies, fostering partnerships that accelerate commercialization of next-generation membranes. Across all regions, the interplay of regulatory requirements, local manufacturing capabilities, and technology-driven application needs defines a dynamic landscape for venting membranes.

This comprehensive research report examines key regions that drive the evolution of the Automotive Venting Membrane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators, Collaborations, and Strategic Moves Shaping the Future of the Automotive Venting Membrane Market

Leading participants in the automotive venting membrane arena are forging collaborations and advancing proprietary technologies to capture emerging opportunities. Several membrane producers have established joint ventures with polymer manufacturers to co-develop hybrid materials that combine PTFE’s chemical resistance with the toughness of advanced thermoplastics. These alliances accelerate time-to-market and enhance supply chain integration, enabling rapid scaling of specialized membrane grades for electric and conventional powertrains.

Furthermore, key OEMs are partnering with membrane suppliers to co-engineer systems-level solutions, optimizing port designs and housing geometries for seamless integration. This co-development approach reduces assembly complexity and ensures that membranes perform reliably under extreme thermal and mechanical stresses. Meanwhile, research institutions in North America, Europe, and Asia are collaborating on open innovation platforms, focusing on next-generation surface modifications and nano-enabled membrane architectures.

Competitive differentiation also arises through intellectual property portfolios that protect novel polymer blends, lamination techniques, and microstructure engineering processes. Companies with robust patent families are positioned to negotiate licensing arrangements and expand their technology reach across multiple vehicle platforms. Collectively, these strategic moves underscore a market defined by technological leadership, ecosystem partnerships, and a relentless drive toward performance and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Venting Membrane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Donaldson Company, Inc.

- IPRO

- Oxyphen

- Pall Corporation

- Parker Hannifin Corp.

- Porex Corporation

- Prostech

- Rogers Corporation

- SABEU GmbH & Co. KG

- Schreiner Group

- Sterlitech Corporation

- Sumitomo Electric Industries, Ltd.

Providing Actionable Recommendations to Enhance Competitiveness, Drive Innovation, and Strengthen Supply Chain Resilience in Automotive Venting Membrane

Industry leaders should prioritize a multifaceted strategy that balances innovation, supply chain diversification, and sustainability. First, investing in advanced R&D initiatives to develop membranes with tunable pore structures and enhanced multifunctionality will address evolving demands from both internal combustion and electric vehicle segments. By aligning research efforts with application-specific requirements-such as moisture management in battery modules and hydrocarbon filtration in fuel systems-firms can swiftly introduce differentiated products.

Concurrently, diversifying raw material sourcing by establishing strategic partnerships with domestic and regional polymer producers will mitigate risks associated with trade disruptions and tariff fluctuations. Implementing dual-sourcing frameworks and collaborative inventory management programs can enhance supply flexibility and reduce lead-time uncertainties. Moreover, integrating sustainability criteria into material selection and production processes will resonate with OEMs and end-users increasingly focused on eco-friendly mobility solutions.

Finally, industry players should deepen engagement through co-development agreements with OEMs and tier-one suppliers, fostering early-stage feedback loops and ensuring seamless integration of membrane components. Embracing digitalization in manufacturing-through real-time process monitoring and predictive maintenance-will further improve quality control and operational efficiency. By executing these recommendations, companies can strengthen their competitive positioning and foster long-term growth in a rapidly evolving automotive venting membrane market.

Detailing the Comprehensive Research Methodology Integrating Primary Interviews, Secondary Analysis, and Data Triangulation for Market Intelligence Excellence

This research report is underpinned by a rigorous methodology that integrates both primary and secondary research approaches. Primary data was gathered through in-depth interviews with key stakeholders, including membrane manufacturers, automotive OEM technical leads, and materials scientists. These conversations provided granular insights into technology roadmaps, application-specific performance criteria, and strategic priorities across the value chain.

Secondary research involved comprehensive analysis of industry publications, regulatory filings, patent databases, and trade association reports. Through systematic cross-referencing of public and proprietary data sources, the study validated trends in material innovation, tariff impacts, and regional adoption patterns. Data triangulation was employed to reconcile divergent estimates and ensure the highest level of accuracy and reliability.

Furthermore, quantitative inputs were supplemented with expert panel discussions, where thought leaders evaluated emerging membrane technologies and forecast potential disruptions. The final findings were subjected to multiple rounds of internal review and quality checks, guaranteeing robust, actionable insights for decision-makers. This holistic approach ensures that the conclusions drawn and recommendations offered reflect the latest industry dynamics and stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Venting Membrane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Venting Membrane Market, by Material Type

- Automotive Venting Membrane Market, by Application

- Automotive Venting Membrane Market, by Vehicle Type

- Automotive Venting Membrane Market, by Distribution Channel

- Automotive Venting Membrane Market, by Region

- Automotive Venting Membrane Market, by Group

- Automotive Venting Membrane Market, by Country

- United States Automotive Venting Membrane Market

- China Automotive Venting Membrane Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing Key Takeaways and Strategic Imperatives for Stakeholders Navigating the Evolving Automotive Venting Membrane Ecosystem

In summary, the automotive venting membrane market stands at a crossroads defined by rapid technological evolution, shifting regulatory landscapes, and strategic supply chain realignments. The transition to electric mobility, combined with tightening emissions standards, demands membranes that deliver superior performance while meeting new safety and sustainability benchmarks. At the same time, the implementation of U.S. tariffs in 2025 has reshaped sourcing strategies and spurred innovation in alternative materials and manufacturing footprints.

Segmentation insights highlight the importance of material specialization, application-driven design, and channel-specific delivery models. Regional nuances underscore how local regulations, production capabilities, and market maturity influence adoption rates and product development priorities. Moreover, strategic collaborations and intellectual property leadership are key differentiators for companies vying for market share.

Ultimately, industry participants that proactively embrace innovation, diversify their supply base, and foster close alignment with OEMs and material partners will secure a competitive edge. The actionable recommendations provided serve as a roadmap for navigating the complexities of this dynamic market. By leveraging comprehensive research methodologies and engaging with expert stakeholders, organizations can chart a course toward sustainable growth and technological leadership in automotive venting membranes.

Engaging with Ketan Rohom to Access Comprehensive Insights and Secure Your Definitive Market Research Report on Automotive Venting Membrane Innovations

To explore the full depth of this detailed market study and capitalize on untapped opportunities, reach out to Ketan Rohom, Associate Director of Sales and Marketing, to secure your exclusive copy of this comprehensive research report. By engaging directly, you will gain immediate access to the latest intelligence, strategic analyses, and actionable insights necessary to drive innovation and achieve a competitive advantage. Act now to transform your understanding of automotive venting membranes and position your organization at the forefront of industry developments by partnering with our dedicated market insights team.

- How big is the Automotive Venting Membrane Market?

- What is the Automotive Venting Membrane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?