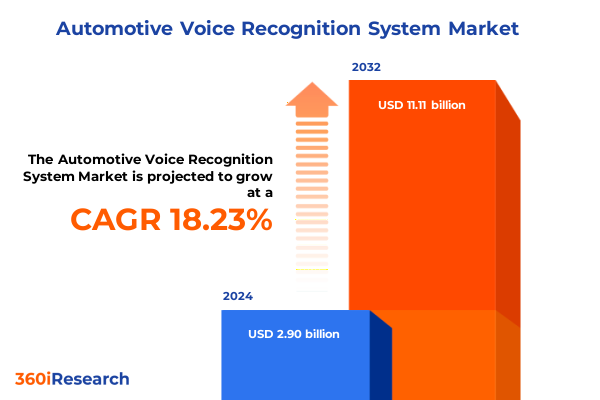

The Automotive Voice Recognition System Market size was estimated at USD 3.41 billion in 2025 and expected to reach USD 4.01 billion in 2026, at a CAGR of 18.37% to reach USD 11.11 billion by 2032.

Pioneering the Future of In-Vehicle Voice Interaction Through Seamless Integration and Emerging AI-Powered Conversational Interfaces

The rapid evolution of in-vehicle voice recognition is fundamentally transforming how drivers interact with their cars, elevating convenience, safety, and connectivity. As vehicles become ever more connected and software-driven, conversational interfaces are emerging as essential components of the modern driving experience. This report’s introduction outlines the critical role that voice-driven controls now play in reducing driver distraction, optimizing system accessibility, and delivering personalized digital services seamlessly integrated into cockpit architecture.

Against a backdrop of accelerating advances in natural language processing, speech recognition algorithms, and biometric verification, the automotive landscape is embracing voice as a primary human-machine interface. Meanwhile, regulatory bodies worldwide are emphasizing hands-free solutions to enhance road safety, compelling original equipment manufacturers and suppliers to innovate rapidly. By synthesizing recent technological breakthroughs with shifting consumer expectations, this overview sets the stage for understanding the strategic implications of voice recognition systems in next-generation vehicles.

Navigating the Convergence of Advanced Machine Learning, Edge Computing, and Consumer Expectations to Redefine Automotive Voice Recognition Experiences

Automotive voice recognition is undergoing a paradigm shift, driven by the convergence of advanced machine learning models and edge computing architectures that deliver instantaneous, context-aware responses. In recent years, innovation has accelerated milestones previously reserved for high-end luxury models, democratizing voice-activated features across all vehicle segments. Machine learning frameworks now enable systems to learn individual driver preferences over time, resulting in tailored interactions that extend beyond basic command execution to predictive and proactive assistance.

Concurrently, the advent of 5G connectivity and growing cloud infrastructure have paved the way for hybrid processing models that distribute workloads between onboard processors and remote servers. This duality ensures rapid performance for critical commands while leveraging the cloud’s expansive computational power for continuous updates. Moreover, alliances between automotive OEMs, technology vendors, and telecommunications providers are coalescing into strategic ecosystems that foster interoperability, drive economies of scale, and accelerate the deployment of sophisticated voice services across global markets.

Assessing the Wide-Ranging Consequences of 2025 United States Tariff Adjustments on Automotive Voice Recognition Supply Chains and Cost Structures

The implementation of new United States tariff measures in 2025 has introduced significant cost pressures and supply chain complexities for automotive voice recognition solutions. With levies applied to key electronic components, including microphones, sensors, and semiconductor chips often sourced internationally, manufacturers are reevaluating sourcing strategies and negotiating alternative supplier agreements. As a result, total system costs have experienced upward pressure, prompting both OEMs and tier-one suppliers to pursue component standardization and modular designs that mitigate tariff exposure.

In response, enterprises are increasing investments in domestic manufacturing capabilities and forging strategic partnerships with North American fabrication facilities to ensure greater control over critical semiconductor production. Parallel shifts toward software-centric architectures have gained further momentum, allowing for decoupling of hardware upgrades from iterative software enhancements. Consequently, while near-term cost challenges persist, these measures enhance long-term resilience and open pathways for future tariff-driven policy adaptations within the automotive value chain.

Unveiling Critical Segmentation Dynamics That Illuminate How Different System Types, Technologies, and Application Domains Shape Adoption Patterns

A nuanced understanding of system type reveals that cloud-based architectures excel at continuous learning and feature expansion, whereas embedded platforms offer low-latency response and offline reliability; hybrid implementations capture the strengths of both, enabling flexible deployment models in varying connectivity scenarios. From a component perspective, hardware innovations focus on miniaturized, high-fidelity microphones and dedicated digital signal processors, while software developments emphasize scalable architectures that integrate natural language processing engines, advanced speech recognition modules, and voice biometric verification for secure user authentication.

Delving into technology segmentation, natural language processing modules are enhancing semantic understanding, speech recognition algorithms are achieving near-human accuracy in noisy cabin environments, and voice biometrics are gaining adoption for personalized access control. Meanwhile, connectivity modalities vary from seamless Bluetooth pairings for smartphone-based assistants, cellular-based solutions offering broad coverage and cloud synchronization, to Wi-Fi-based systems that facilitate high-throughput data exchange during parked over-the-air updates. In terms of application domains, voice interfaces now manage climate control, enable driver assistance functions through intuitive commands, orchestrate infotainment experiences, bolster safety and security protocols, streamline telematics and navigation queries, and regulate core vehicle system controls with minimal driver distraction.

Vehicle type considerations indicate that passenger cars drive volume adoption of voice capabilities, while commercial vehicles-both heavy and light variants-leverage robust voice features to enhance fleet operations, driver compliance, and safety reporting. Finally, sales channel dynamics differentiate between aftermarket installations that retrofit existing vehicles with speech-enabled modules and original equipment manufacturer solutions embedded at the production stage, catering to diverse customer segments and service expectations.

This comprehensive research report categorizes the Automotive Voice Recognition System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Technology

- Connectivity

- Application

- Vehicle Type

- Sales Channel

Exploring Regional Trajectories Reveals Opportunities and Challenges Across Americas, EMEA Markets, and Asia-Pacific Automotive Voice Recognition Adoption

In the Americas, rising consumer demand for hands-free features is underpinned by stringent safety regulations that encourage voice-activated solutions. The United States market is characterized by early adopter behavior and rapid integration of advanced assistants, supported by robust telematics infrastructure and extensive partnerships between automakers and technology providers. Canada follows closely, leveraging bilingual and multilingual voice capabilities to serve diverse populations, while Latin American markets present growth potential through cost-effective embedded systems adapted to regional vehicle fleets.

Across Europe, Middle East, and Africa, regulatory harmonization around data privacy and in-vehicle connectivity standards is shaping the development roadmap for voice platforms. European Union directives emphasize user data protection, influencing system architectures toward on-device processing and edge-based analytics. In regions of the Middle East, premium segments seek cutting-edge interfaces aligned with luxury brand positioning, whereas parts of Africa are exploring aftermarket voice solutions to enhance safety in commercial fleets navigating evolving transportation networks.

Asia-Pacific continues to lead in volume deployment, with major automotive hubs in China, Japan, and South Korea pushing cloud-driven models and AI-powered assistants that integrate seamlessly with smart home ecosystems. Rapid urbanization and high smartphone penetration reinforce demand for voice services, while local OEMs and tech giants compete to embed regionally optimized language models. Australia and Southeast Asia represent emerging hotspots for hybrid architectures that balance connectivity reliability with offline performance in areas with variable network coverage.

This comprehensive research report examines key regions that drive the evolution of the Automotive Voice Recognition System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves of Leading Technology Innovators and Automotive OEMs Shaping the Competitive Landscape of Voice Recognition in Vehicles

Leading technology innovators have intensified efforts to differentiate through proprietary natural language processing frameworks and multimodal interfaces, fostering partnerships with automotive OEMs to integrate voice engines at the earliest design stages. Key software vendors are expanding SDK offerings that enable tier-one suppliers to embed voice capabilities seamlessly within infotainment subnetworks, while select semiconductor companies are optimizing neural processing units for in-cabin edge inference tasks. These collaborations underscore the shift from isolated voice modules to holistic, ecosystem-driven solutions.

Simultaneously, established automotive OEMs are moving beyond pilot deployments, embedding full-scale voice commands into climate control, navigation, and vehicle diagnostics workflows. Cross-industry alliances between mobility service providers and automotive brands are designing subscription-based voice services, unlocking recurring revenue models tied to continuous feature updates. Meanwhile, niche startups specializing in voice biometrics have secured strategic investments to integrate advanced authentication layers, addressing rising concerns around cybersecurity and in-vehicle data privacy.

As new entrants accelerate innovation cycles with agile development methodologies, incumbents are responding by consolidating through mergers and acquisitions to reinforce their technology stacks. The result is an increasingly sophisticated competitive landscape in which success depends on the ability to harmonize deep automotive expertise with state-of-the-art conversational AI capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Voice Recognition System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpine Electronics, Inc.

- Amazon Web Services, Inc.

- Apple Inc.

- Aptiv PLC

- Bayerische Motoren Werke AG

- Cerence Inc.

- Continental Aktiengesellschaft

- Denso Corporation

- Faurecia Clarion Electronics Co., Ltd.

- Ford Motor Company

- Google LLC

- Hyundai Motor Company

- iFLYTEK Co., Ltd.

- Magneti Marelli S.p.A.

- Mercedes-Benz Group AG

- Microsoft Corporation

- Nuance Communications, Inc.

- Panasonic Automotive Systems Company

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Sensory, Inc.

- SoundHound AI, Inc.

- Tesla, Inc.

- Visteon Corporation

- VoiceBox Technologies Corporation

Presenting Actionable Strategies Empowering Industry Leaders to Capitalize on Emerging Innovations and Navigate Complexities in Automotive Voice Recognition Markets

Industry leaders should prioritize the development of hybrid architectures that leverage onboard processing for latency-critical commands while tapping cloud resources for continuous learning and feature expansion. By adopting modular designs, they can future-proof hardware investments and streamline software rollouts, thereby mitigating the impact of evolving tariff regimes and supply chain disruptions. In addition, establishing strategic partnerships with regional semiconductor foundries can reduce dependency on cross-border component flows and strengthen resilience against policy shifts.

Furthermore, advancing natural language processing pipelines to support dialectal variations and multilingual command sets will unlock significant user engagement, especially in markets with diverse linguistic profiles. Implementing robust voice biometrics not only enhances security but also enables personalized user experiences that build brand loyalty. To capitalize on these opportunities, providers should integrate privacy-by-design principles, ensuring compliance with global data protection standards and fostering consumer trust.

Stable collaborations between automotive OEMs, telematics operators, and cloud service providers can accelerate the rollout of advanced voice services. By co-investing in shared development platforms and unified standards, industry stakeholders can reduce fragmentation and drive interoperable ecosystems. Lastly, cultivating aftermarket retrofit programs alongside OEM integrations will broaden market reach, enabling fleet operators and individual consumers to benefit from voice-enabled safety and telematics solutions across a wider range of vehicle vintages.

Detailing the Rigorous Multi-Source Research Methodology Employed to Ensure Accuracy, Reliability, and Comprehensive Insights in the Report

This report employs a rigorous multi-source methodology, beginning with extensive secondary research across automotive journals, technology whitepapers, regulatory filings, and patent databases to identify prevailing trends in voice recognition. Insights from these sources were supplemented by primary interviews with senior executives at leading original equipment manufacturers, tier-one suppliers, and specialized voice AI developers to validate key hypotheses and enrich qualitative understanding.

Quantitative data were gathered from proprietary industry surveys and telemetry datasets capturing system performance metrics across diverse vehicle fleets. Analytical frameworks were applied to segment technologies by type of voice recognition system, component, underlying AI technology, connectivity modality, application domain, vehicle class, and sales channel. These segments were meticulously mapped against regional adoption patterns, tariff developments, and competitive dynamics to ensure comprehensive coverage.

The synthesis process included cross-validation of findings through expert panels and third-party workshops, ensuring robustness and minimizing bias. Throughout the analysis, emphasis was placed on transparent documentation of data sources, assumption rationales, and methodological limitations, providing stakeholders with a clear audit trail and confidence in the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Voice Recognition System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Voice Recognition System Market, by Type

- Automotive Voice Recognition System Market, by Component

- Automotive Voice Recognition System Market, by Technology

- Automotive Voice Recognition System Market, by Connectivity

- Automotive Voice Recognition System Market, by Application

- Automotive Voice Recognition System Market, by Vehicle Type

- Automotive Voice Recognition System Market, by Sales Channel

- Automotive Voice Recognition System Market, by Region

- Automotive Voice Recognition System Market, by Group

- Automotive Voice Recognition System Market, by Country

- United States Automotive Voice Recognition System Market

- China Automotive Voice Recognition System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Concluding Insights That Reinforce the Transformative Impact of Advanced Voice Recognition Technologies on Future Mobility Experiences

The transformative potential of voice recognition in the automotive sector is undeniable, as it reshapes driver engagement, safety protocols, and digital connectivity within modern vehicles. As machine learning, edge computing, and network advancements converge, voice interfaces are evolving into intelligent, proactive assistants that extend far beyond simple command execution. The strategic integration of these systems will be a defining factor in the competitive positioning of both technology providers and automakers.

Moreover, the interplay of regional regulatory imperatives, tariff landscapes, and segmentation dynamics underscores the need for agile strategies that align technological innovation with supply chain resilience. By comprehensively addressing hardware and software evolution, connectivity options, and differentiated application use cases, stakeholders can craft solutions that cater to diverse market demands while safeguarding against external disruptions.

In conclusion, embracing a forward-looking approach-characterized by modular architectures, strategic partnerships, and a steadfast commitment to user privacy-will enable organizations to harness the full value of automotive voice recognition. This report’s insights and recommendations provide a clear roadmap for navigating the complexities of this rapidly advancing domain and capturing the opportunities ahead.

Engaging Your Organization to Leverage Comprehensive Automotive Voice Recognition Insights Through Direct Collaboration with Our Dedicated Sales Leadership Team

To explore how this comprehensive analysis of automotive voice recognition can empower your strategy, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan’s expertise in translating deep market insights into actionable growth plans ensures seamless alignment between emerging industry dynamics and your organization’s objectives. Starting a conversation today will provide you with a tailored demonstration of the full report’s potential to unlock new opportunities in voice-activated in-vehicle systems.

By engaging with Ketan, you’ll gain priority access to exclusive data, in-depth regional breakdowns, and strategic recommendations customized for your unique challenges. His collaborative approach facilitates clear roadmaps for technology adoption, partnership formation, and competitive positioning. Connect now to schedule a one-on-one consultation and discover how this specialized market research can advance your automotive voice recognition initiatives.

- How big is the Automotive Voice Recognition System Market?

- What is the Automotive Voice Recognition System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?