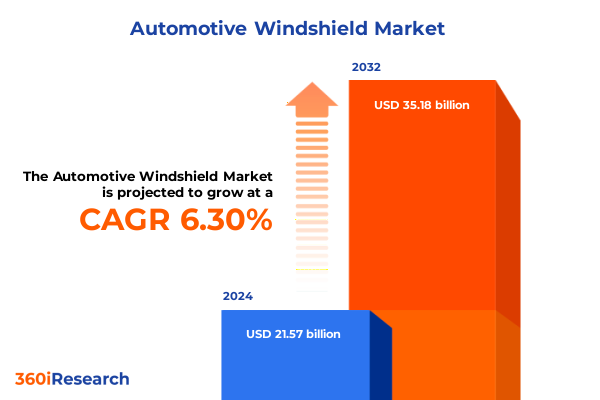

The Automotive Windshield Market size was estimated at USD 22.75 billion in 2025 and expected to reach USD 23.99 billion in 2026, at a CAGR of 6.42% to reach USD 35.18 billion by 2032.

Exploring the dynamic evolution of the automotive windshield market shaped by technological breakthroughs and shifting consumer expectations

The automotive windshield stands as more than a simple pane of glass; it represents a convergence point for safety, comfort, and cutting-edge innovation within modern vehicles. As the most prominent interface between driver and environment, windshields must withstand a spectrum of operational demands, from protecting occupants against debris to integrating advanced driver assistance systems that rely on camera arrays and sensors. In the face of tightening safety regulations worldwide and rising consumer expectations for convenience features such as acoustic insulation and windshield heating, the windshield has evolved into a multifunctional component that significantly influences vehicle design and performance.

Rapid advancements in materials science have ushered in new glass compositions capable of improving thermal management, ultraviolet protection, and impact resistance. These developments are complemented by the proliferation of sensor integration technologies, which underpin autonomous driving and enhanced safety capabilities. Simultaneously, we observe a growing aftermarket ecosystem offering retrofits and replacements for light commercial vehicles, heavy trucks, and passenger cars alike. This intricate interplay among regulation, technology, and market demand sets the stage for an in-depth analysis of how the automotive windshield segment is being reshaped. In light of these dynamics, this report presents a comprehensive executive summary that synthesizes the most critical trends, regional nuances, and strategic imperatives shaping the future trajectory of this essential automotive component.

Examining pivotal technological and regulatory shifts revolutionizing automotive windshields including ADAS integration and sustainability mandates

A wave of transformative shifts has redefined the landscape of automotive windshields in recent years. At the forefront is the ascendancy of advanced driver assistance systems, which rely on high-resolution cameras and lidar modules seamlessly embedded within the glass. This trend is paralleled by growth in rain-sensing wiper activation and ambient light sensors, which collectively elevate operational safety and comfort for drivers. As manufacturers race to meet the functional demands imposed by semi-autonomous driving frameworks, the windshield has become a primary locus for innovation at the intersection of optics and electronics.

Beyond integration of smart features, sustainability mandates are exerting pressure on glass producers to adopt greener manufacturing processes and lower carbon footprints. Lead-free lamination techniques, recyclable glass substrates, and energy-efficient furnaces have emerged as critical levers in meeting global emissions targets. Concurrently, enhancements in acoustic insulation performance through multi-layered laminates address noise pollution concerns, particularly in urban environments where electric vehicle adoption amplifies ambient sound levels. The combined impact of these technological and regulatory shifts underscores the windshield’s transition from a purely passive barrier to an active contributor in vehicle safety, environmental compliance, and passenger comfort.

Analyzing the cumulative repercussions of the 2025 United States tariffs on auto glass supply chains strategic sourcing and competitive dynamics

The introduction of elevated import duties on automotive glass in early 2025 has exerted a cumulative impact across industry value chains. Tariffs applied at the border have increased landed costs for tempered and laminated windshields sourced from key manufacturing hubs, prompting original equipment manufacturers to reevaluate sourcing strategies. In response, several Tier 1 glass suppliers have accelerated domestic capacity expansions to mitigate the cost pressures induced by higher duties.

These trade-driven shifts have disrupted long-standing logistics corridors, resulting in an uptick in nearshoring initiatives targeting North American facilities. By relocating assembly operations closer to vehicle production plants, manufacturers seek to preserve competitive pricing while ensuring compliance with cost-containment objectives. Meanwhile, the aftermarket channel has witnessed a recalibration of distribution networks, as service providers explore alternative glass procurement routes to balance price sensitivity against replacement cycle demands. Overall, the 2025 tariff landscape has acted as a catalyst for strategic realignment, compelling stakeholders to diversify supplier portfolios, strengthen domestic production capabilities, and optimize their supply chains for resilience in an era of geopolitical uncertainty.

Unveiling critical segment-driven insights into glass type sensor integration technology vehicle class and distribution channel influences on market trajectories

Insight into the sector is deepened by examining market performance across various dimensions rooted in product attributes and channel structures. Based on Glass Type, the industry is segmented into laminated and tempered glass categories, each serving distinct safety and design requirements. Laminated variants dominate high-end and sensor-integrated applications due to their superior shatter resistance, whereas tempered windshields retain relevance in cost-sensitive retrofit scenarios.

Considering Sensor Integration, two broad streams emerge: products with sensor integration and those without. The former encompasses camera systems for lane-departure warnings, light sensors for adaptive headlamping, and rain sensors for automated wiper control. This subset commands a growing share as autonomous and semi-autonomous vehicle architectures proliferate. Products lacking embedded sensors continue to cater to basic safety needs and aftermarket replacements.

The Technology segmentation reveals a diversification into acoustic, heated, standard, and UV-protection glass technologies. Acoustic solutions respond to noise mitigation imperatives, heated windshields facilitate rapid deicing for cold-climate operations, and UV-protected glass addresses health and comfort concerns amid stringent exposure regulations. In terms of Vehicle Type, heavy commercial vehicles, light commercial vehicles, and passenger cars present unique windshield demands, from reinforced structural designs for trucks to lightweight composites in passenger EVs. Finally, distribution channels bifurcate into aftermarket and original equipment manufacturer pathways, each structured to meet specific pricing, warranty, and service requirements.

This comprehensive research report categorizes the Automotive Windshield market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Glass Type

- Sensor Integration

- Technology

- Vehicle Type

- Distribution Channel

Interpreting regional market dynamics across Americas Europe Middle East Africa and Asia Pacific with key drivers shaping regional windshield demand

Geographic dynamics play a pivotal role in modulating regional windshield industry performance and strategic priorities. In the Americas, robust automotive manufacturing hubs and a mature replacement market underpin steady demand for both OEM windshields and aftermarket components. The United States remains a focal point for domestic capacity expansions spurred by tariff-induced nearshoring, while Latin American countries present emerging prospects driven by growing light commercial vehicle fleets.

Within Europe, the Middle East and Africa, stringent EU safety standards continue to propel investment in sensor-integrated glass products and acoustic laminates, whereas the Middle East emphasizes extreme-climate adaptations such as high-performance UV protection. North African markets, still at nascent stages, are experiencing incremental aftermarket growth as vehicle parc sizes expand. Across Africa, opportunities exist for local assembly partnerships to address affordability barriers and reduce dependency on expensive imports.

The Asia-Pacific region displays the most pronounced growth trajectory, led by China’s rapidly advancing electric vehicle sector and India’s expanding commercial transport networks. Advanced glass manufacturers are leveraging regional free trade agreements to optimize cross-border supply, and local R&D centers are pushing next-generation technologies, including heads-up display integrations. As Asia-Pacific cements its role as both a major production hub and a key consumption market, regional strategies emphasize cost efficiencies, agile manufacturing, and deep collaborations with OEM partners.

This comprehensive research report examines key regions that drive the evolution of the Automotive Windshield market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading industry players and their strategic initiatives in innovation supply chain agility and competitive positioning within the windshield market

Industry leaders are deploying strategic initiatives to fortify their market positions and capitalize on emerging growth vectors. Major glass producers have prioritized capacity investments in high-value laminated and sensor-enabled products, aligning with OEM roadmaps for autonomous vehicle rollouts. At the same time, several companies are forging partnerships with technology firms to co-develop integrated vision systems and heads-up display solutions that blend glass surfaces with advanced electronics.

Supply chain resilience has also become a competitive differentiator, with top players instituting multi-sourcing strategies and digital tracking capabilities to ensure continuity amid trade fluctuations. Investment in smart manufacturing-leveraging robotics, real-time analytics, and additive processes-has accelerated, enabling rapid scaling of bespoke glass shapes and embedded sensor channels. In parallel, companies are expanding their aftermarket service networks, offering extended warranty packages and mobile replacement units to enhance customer retention and brand loyalty.

Additionally, environmental stewardship has surfaced as a key performance metric, prompting leading firms to adopt closed-loop recycling protocols and eliminate hazardous materials from lamination processes. By balancing technological innovation with operational excellence and sustainability commitments, these organizations are positioning themselves at the forefront of a market defined by safety, intelligence, and environmental responsibility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Windshield market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Glass Co., Ltd.

- Central Glass Co., Ltd.

- Corning Incorporated

- DURA Automotive Systems

- Fuyao Glass Industry Group Co., Ltd.

- Gentex Corporation

- Glaston Corporation

- Guardian Industries

- Magna International Inc.

- Nippon Sheet Glass Co., Ltd.

- NordGlass Sp. z o.o.

- Olimpia Auto Glass Inc.

- Pilkington Group Limited

- PPG Industries Inc.

- Saint-Gobain

- Sisecam Group

- T&S Autoglass

- Webasto Group

- Xinyi Glass Holdings Limited

Providing actionable guidance for automotive windshield industry leaders to navigate technological disruption supply chain challenges and emerging opportunities

Industry executives should consider a multipronged approach to sustain competitive advantage amidst rapid change. First, integrating robust sensor-ready glass platforms with modular electronics architectures will ensure compatibility with evolving autonomous and connectivity protocols. Firms that invest early in standardized sensor interfaces will benefit from streamlined OEM integration and lower customization costs.

Next, diversifying production footprints through nearshoring and flexible contract manufacturing can mitigate the financial impact of evolving trade policies. Securing strategic alliances with regional glass fabricators will further enhance agility in responding to tariff shifts and logistical disruptions. Concurrently, bolstering digital traceability across the supply chain using blockchain or IoT-enabled platforms will strengthen risk management and build transparency for end users.

Organizations must also prioritize sustainable material sourcing and manufacturing efficiency to meet tightening environmental regulations and consumer expectations. Embedding recycled content into laminated assemblies and deploying energy-efficient heat treatment processes will reduce ecological footprints while reinforcing brand equity. Finally, cultivating aftermarket service excellence through digital customer engagement portals and rapid mobile replacement services will unlock incremental revenue streams and deepen market penetration.

Detailing the comprehensive research methodology employed to ensure accuracy reliability and depth in automotive windshield market analysis

The findings presented in this report are grounded in a rigorous methodology that combines primary and secondary data sources, ensuring comprehensive coverage and analytical depth. Primary research included structured interviews with C-level executives at leading OEMs, Tier 1 glass suppliers, and aftermarket distributors, supplemented by detailed surveys targeting engineering and procurement professionals. These engagements provided firsthand perspectives on technological priorities, sourcing strategies, and competitive dynamics.

Secondary research encompassed a systematic review of global trade data, regulatory filings, patent databases, and technical publications from automotive and materials science journals. Market literature was critically assessed to extract insights on emerging glass compositions, sensor integration techniques, and sustainability practices. Data triangulation was employed through cross-validation of findings across multiple sources, ensuring consistency and reliability.

Quantitative data were analyzed using advanced statistical tools and scenario modelling to interpret tariff impacts, segmentation patterns, and regional demand drivers. Qualitative insights were synthesized into thematic frameworks that underpin our segmentation, regional, and company analyses. Rigorous quality control measures, including peer review and fact-checking protocols, were implemented throughout the research process to uphold the highest standards of accuracy and objectivity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Windshield market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Windshield Market, by Glass Type

- Automotive Windshield Market, by Sensor Integration

- Automotive Windshield Market, by Technology

- Automotive Windshield Market, by Vehicle Type

- Automotive Windshield Market, by Distribution Channel

- Automotive Windshield Market, by Region

- Automotive Windshield Market, by Group

- Automotive Windshield Market, by Country

- United States Automotive Windshield Market

- China Automotive Windshield Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing core findings and strategic imperatives that underscore the future trajectory of the automotive windshield landscape in a complex ecosystem

The executive summary encapsulates a pivotal moment for the automotive windshield market, characterized by rapid technological convergence, regulatory pressures, and evolving trade landscapes. Advanced driver assistance systems and sensor-integrated glass solutions are redefining safety and user experience, while heightened sustainability mandates are accelerating adoption of greener manufacturing processes. Meanwhile, 2025 trade policies have prompted strategic realignment across supply chains, driving near-shoring and multi-sourcing initiatives that enhance resilience in an increasingly unpredictable environment.

Segmentation analyses reveal that laminated and sensor-enabled windshields are spearheading the technology curve, offering acoustic, heating, and UV-protection functionalities that cater to diverse climatic and operational requirements. Regionally, Asia-Pacific leads in both production capacity and technological adoption, closely followed by the Americas and the EMEA bloc, each shaped by unique regulatory frameworks and market maturities. Leading companies are leveraging digital manufacturing, supply chain transparency, and sustainability commitments to solidify their competitive positions.

Looking ahead, the windshield market will continue to be shaped by the interplay of vehicle electrification, autonomous driving, and global trade dynamics. Industry stakeholders who embrace integrated platforms, sustainable practices, and agile operational models will be best positioned to capture value in this transformative phase.

Encouraging direct engagement with our expert sales team led by Ketan Rohom to access tailored market research insights and drive informed decision making

For a deeper exploration into actionable insights and comprehensive market intelligence tailored to the automotive windshield sector, please contact Ketan Rohom, Associate Director of Sales & Marketing. Ketan offers personalized consultations that align with your strategic objectives, ensuring you gain access to the full breadth of analysis, competitive benchmarking, and emerging trend evaluation contained within the complete market research report. Reach out today to secure your copy and leverage privileged insights that will empower your organization to make data-driven decisions, mitigate supply chain risks, and capitalize on key growth opportunities across glass types, sensor integration technologies, and regional dynamics. Engage directly with Ketan to discuss bespoke research add-ons, priority delivery timelines, and special enterprise licensing options that will equip your teams with the intelligence necessary to outpace competitors in this rapidly evolving landscape.

- How big is the Automotive Windshield Market?

- What is the Automotive Windshield Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?