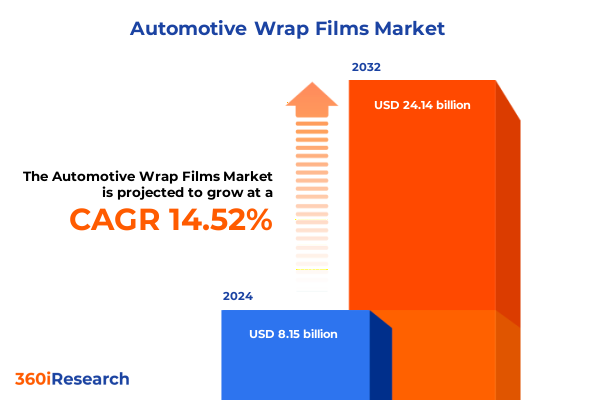

The Automotive Wrap Films Market size was estimated at USD 9.28 billion in 2025 and expected to reach USD 10.56 billion in 2026, at a CAGR of 14.63% to reach USD 24.14 billion by 2032.

Unveiling the Versatile World of Automotive Wrap Films and Their Growing Role in Vehicle Customization and Surface Protection

The automotive wrap films market has evolved beyond a simple decorative accessory, transforming into a multifaceted solution for customization, brand promotion, and surface preservation. Driven by consumer desire for personalization and protective technologies, wrap films now cater to a wide range of aesthetic and functional requirements. In recent years, increased acceptance among fleet operators and retail customers alike has reinforced the importance of wraps as both a marketing tool and a cost-effective means to safeguard vehicle exterior and interior surfaces.

Emerging printing technologies and advanced polymer formulations have dramatically expanded the design possibilities available to end users. The ability to produce photo-quality graphics, metallic finishes, and tactile effects has elevated the consumer experience, while the protective attributes of advanced vinyl and polymeric laminates have secured their role in paint protection systems. As adoption grows across commercial and passenger vehicle segments, wrap films are solidifying their position at the intersection of style, durability, and brand identity.

Examining the Transformational Forces Shaping the Automotive Wrap Films Landscape from Technological Advances to Consumer Demand Dynamics

Technological innovations have reset expectations for performance and design in the wrap films landscape. High-definition digital printing platforms now enable on-demand, photo-realistic graphics that seamlessly integrate with brand messaging campaigns, while proprietary polymer blends deliver enhanced UV and scratch resistance. Concurrently, sustainability imperatives have prompted manufacturers to introduce recyclable and low volatile organic compound formulations that resonate with environmentally conscious consumers.

Meanwhile, the growing prevalence of electric and autonomous vehicles is stimulating demand for lightweight protective films that do not compromise battery range or sensor functionality. As such, industry players are focusing on developing ultra-thin, high-bond adhesives that maintain film integrity without adding weight. In parallel, the shift toward e-commerce and digital purchasing channels has created new touchpoints for wrap film solutions, fueling partnerships between material suppliers, print providers, and installation networks to ensure a seamless end-to-end experience.

Assessing the Cumulative Effect of 2025 United States Tariffs on Automotive Wrap Films and Their Implications for Manufacturers and Distributors

In 2025, the United States implemented revised tariff structures affecting polymeric and vinyl substrates imported for wrap film applications. These cumulative duties have led manufacturers and distributors to reevaluate sourcing strategies, with some opting to increase domestic procurement to mitigate cost exposure. Consequently, supply chain realignment has emerged as a central theme, prompting collaboration between North American material producers and downstream converters to secure stable raw material access.

While the revised duty framework has introduced short-term price volatility, industry participants are leveraging those margins as an opportunity to invest in local capacity expansion and leaner inventory practices. Additionally, end users are showing a willingness to absorb moderate cost increases in exchange for enhanced supply security and reduced lead times. As tariffs continue to influence the competitive landscape, companies that proactively balance cost management with supply chain resilience will be best positioned to navigate evolving regulatory risks and maintain profitable growth.

Revealing Key Segmentation Insights Highlighting the Range of Materials, Finishes, Installation Types, Applications, and Methods in Automotive Wrap Films

A nuanced understanding of market segmentation reveals the intricate ways consumer priorities shape material preferences and installation choices. Based on material type, the industry distinguishes between polymeric films and vinyl, with vinyl subdivided into calendered and cast varieties for applications requiring distinct conformability and longevity characteristics. In terms of finish, wrap films offer visual effects ranging from carbon fiber to chrome, gloss, matte, metallic, and satin, each catering to unique stylistic intents and durability expectations.

Regarding installation, the market divides into exterior wraps, which focus on vehicle exteriors for branding and paint protection, and interior wraps designed to enhance cabin components and trim. Applications further categorize into commercial and passenger vehicles. Commercial wraps encompass fleets of buses and trucks for advertising or identification purposes, whereas passenger wraps cover convertibles, sedans, and SUVs seeking aesthetic transformation or paint preservation. Finally, installation methods vary between do-it-yourself kits that appeal to enthusiasts and professional services that ensure precision for high-value installations.

This comprehensive research report categorizes the Automotive Wrap Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Finish

- Installation

- Applications

- Installation Method

Exploring Regional Nuances and Growth Drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific for Automotive Wrap Films

Regional dynamics play a decisive role in shaping both demand patterns and innovation trajectories. In the Americas, a mature aftermarket network and strong fleet wrap adoption drive adoption of advanced digital printing and protective film variants. Stakeholders in this region emphasize streamlined logistics and integrated service models to support rapid turnover for commercial operators. Meanwhile, in Europe, Middle East & Africa, regulatory emphasis on environmental sustainability fuels interest in eco-friendly film solutions, with emerging markets in the Middle East displaying robust appetite for luxury finishes such as chrome and metallic.

Across Asia-Pacific, rapid urbanization and rising disposable incomes are catalyzing growth in both professional installation services and consumer DIY segments. Markets such as Japan and Australia exhibit a strong preference for high-performance protective films tailored to harsh climatic conditions, while Southeast Asian markets favor vibrant design effects that enhance brand visibility amid competitive urban environments. The interplay between regulatory drivers, consumer tastes, and service infrastructure underlines the importance of region-specific strategies.

This comprehensive research report examines key regions that drive the evolution of the Automotive Wrap Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players and Their Strategic Moves Transforming the Competitive Landscape of the Automotive Wrap Films Industry

An analysis of leading players highlights a competitive landscape defined by innovation, integration, and strategic partnerships. Tier-one material suppliers continue to invest in proprietary polymer formulations that extend film longevity and reduce environmental impact, while print and installation service providers seek alliances to deliver turnkey solutions. Consolidation trends are evident as larger companies acquire niche converters and digital print specialists to broaden their service portfolios and streamline distribution.

Furthermore, smaller agile firms are leveraging specialized capabilities-such as custom print workflows and rapid production turnarounds-to carve out competitive advantages in targeted segments. As distribution channels evolve to include direct-to-consumer digital platforms alongside traditional wholesale and distributor networks, market leaders are optimizing omnichannel strategies and investing in advanced analytics to capture real-time demand insights. Those who align technical expertise with robust service ecosystems will likely sustain leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Wrap Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- APA S.p.A.

- Arlon Graphics, LLC

- Avery Dennison Corporation

- Dennison Technologies Pvt. Ltd.

- Flexcon Company, Inc.

- Grafityp Selfadhesive Products N.V.

- Hexis S.A.S.

- Inozetek Inc.

- KPMF Limited

- LG Hausys Ltd.

- Lintec Corporation

- Nekoosa Coated Products, LLC

- ORAFOL Europe GmbH

- Poli-Tape Klebefolien GmbH

- Ritrama S.p.A.

- TeckWrap International Inc.

- Vinyl Frog International Ltd.

- Vvivid Vinyl Inc.

Formulating Actionable Recommendations for Industry Leaders to Navigate Disruption and Capitalize on Emerging Opportunities in Automotive Wrap Films

Industry leaders should prioritize investment in next-generation digital printing technologies that enable cost-effective short runs and custom graphics, thereby addressing the growing demand for personalized vehicle customization. At the same time, strengthening upstream partnerships with North American polymer producers will mitigate tariff-driven supply risks and reinforce local capacity. Meanwhile, developing modular training programs for professional installers can standardize quality and expand service reach, particularly in underpenetrated regions.

To capture emerging segments, companies should pilot eco-certified film lines that resonate with environmentally conscious consumers and leverage sustainability credentials in marketing campaigns. Additionally, integrating data-driven forecasting tools to align production schedules with seasonal and regional demand fluctuations will reduce inventory holding costs. By marrying operational excellence with targeted product innovation, stakeholders can navigate market headwinds and unlock new revenue streams in an increasingly dynamic environment.

Detailing the Rigorous Research Methodology Underpinning the Analysis to Ensure Robustness and Credibility of Findings and Transparency

This analysis is grounded in a rigorous research methodology combining primary interviews with executives, technical experts, and installation professionals across major regions. Secondary data collection involved an extensive review of industry publications, regulatory filings, and company disclosures to contextualize market trends and policy impacts. The insights were further validated through triangulation techniques, comparing multiple data sources to ensure consistency and eliminate bias.

In addition, the research incorporated case studies of successful wrap implementations and a detailed assessment of material performance metrics under diverse environmental conditions. A structured peer review process engaged cross-functional stakeholders to critique and refine the findings, ensuring both depth and relevance. Ultimately, this methodology ensures the robustness and credibility of the analysis, as well as transparency in data sources and analytical frameworks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Wrap Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Wrap Films Market, by Material Type

- Automotive Wrap Films Market, by Finish

- Automotive Wrap Films Market, by Installation

- Automotive Wrap Films Market, by Applications

- Automotive Wrap Films Market, by Installation Method

- Automotive Wrap Films Market, by Region

- Automotive Wrap Films Market, by Group

- Automotive Wrap Films Market, by Country

- United States Automotive Wrap Films Market

- China Automotive Wrap Films Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthetizing Conclusive Insights from Multidimensional Perspectives and Summarizing Key Takeaways to Guide Stakeholders in the Automotive Wrap Films Arena

Synthetizing conclusive insights from multidimensional perspectives underscores the strategic importance of innovation, supply chain agility, and customer-centric service models in the automotive wrap films arena. Technological advances in polymer science and digital printing have unlocked new aesthetic and protective capabilities, while evolving regulatory landscapes, such as 2025 tariff adjustments, continue to influence sourcing decisions and profitability structures.

Key takeaways reveal that success hinges on aligning product portfolios with region-specific preferences-whether that means offering eco-certified films in Europe, luxury finishes in the Middle East, or durable protective laminates in harsh climates of Asia-Pacific. Equally critical is the cultivation of integrated service ecosystems that combine material supply, print technology, and professional installation support. By focusing on these imperatives, stakeholders can anticipate market shifts, optimize operational resilience, and achieve sustainable growth in a competitive environment.

Inviting Engagement with Ketan Rohom to Acquire Comprehensive Automotive Wrap Films Research and Empower Strategic Decision Making

To explore tailored insights, competitive intelligence, and strategic frameworks designed specifically for decision-makers in the automotive wrap films arena, reach out to Associate Director, Sales & Marketing, Ketan Rohom, to discuss how this comprehensive market research report can empower your organization’s next move. By leveraging this meticulously crafted analysis, you can gain unparalleled visibility into evolving market dynamics, optimize investment priorities, and ensure your strategies align with emerging opportunities. Contact Ketan Rohom today to secure your copy of the report and unlock the competitive advantage necessary to excel in an industry marked by rapid innovation and shifting regulatory landscapes.

- How big is the Automotive Wrap Films Market?

- What is the Automotive Wrap Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?