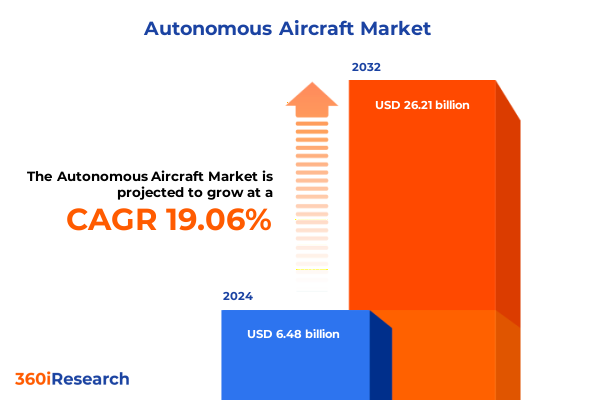

The Autonomous Aircraft Market size was estimated at USD 7.59 billion in 2025 and expected to reach USD 8.89 billion in 2026, at a CAGR of 19.35% to reach USD 26.21 billion by 2032.

Exploring the Emergence of Autonomous Aircraft as a Catalyst for Revolutionizing Modern Aerial Operations Across Commercial and Defense Sectors

Exploring the convergence of advanced sensor technologies artificial intelligence and unmanned aerial systems, this introduction delves into the transformative potential of autonomous aircraft. Over the past decade, enterprises across commercial military and civil sectors have intensified investments in pilotless flight capabilities, driven by promises of enhanced safety reduced operating costs and unprecedented operational reach. Emerging use cases such as precision agriculture assets inspection and last mile delivery underscore a rapid expansion of applications, while growing regulatory frameworks are aligning to support broader integration of these platforms into national airspace.

Throughout this landscape, the maturation of machine learning algorithms and onboard computing power has enabled complex autonomous behaviors that were once relegated to science fiction. As a result, stakeholders ranging from aerospace manufacturers to logistics providers are reevaluating traditional operational models, reshaping supply chains and spurring new partnerships. Underpinning these shifts, advancements in communication protocols and satellite connectivity have improved command-and-control reliability, fostering confidence in the safe deployment of UAVs across civil and defense domains. By examining the confluence of these technological policy and market drivers, this section lays the groundwork for understanding why autonomous aircraft stand at the forefront of the next aerial revolution.

Identifying Pivotal Technological Regulatory and Market Forces Driving a Fundamental Shift in Autonomous Aerial Mobility Paradigms

The autonomous aircraft landscape is undergoing fundamental transformations propelled by a convergence of technological regulatory and commercial forces. Cutting-edge sensor fusion architectures, combining lidar radar and optical imagery, now deliver real-time situational awareness beyond human pilot capabilities. Simultaneously, breakthroughs in edge computing have reduced the latency of onboard decision-making, enabling these platforms to navigate complex environments autonomously.

In parallel, regulatory authorities are progressively introducing frameworks that accommodate beyond-visual-line-of-sight operations and urban air mobility corridors. These policy evolutions are critical, as they address safety certifications data security and integration with existing air traffic management systems. Notably, the introduction of performance-based regulations has spurred industry collaboration, aligning manufacturers aeronautical service providers and standards bodies toward interoperable safety guidelines.

Moreover, shifting commercial models are democratizing access to autonomous aerial capabilities. Innovative service-as-a-platform offerings are emerging, allowing organizations to deploy unmanned systems on demand without substantial capital expenditures. Financial structures such as pay-per-flight and outcome-based contracts align vendor incentives with performance, further catalyzing adoption across sectors. Taken together, these technological regulatory and business model innovations represent a systemic shift, positioning autonomous aviation for rapid scale-up in the coming years.

Assessing the Combined Effects of Recent United States Tariff Policies on Supply Chains Component Costs and Competitive Dynamics

Since early 2025, the United States has implemented a series of incremental tariffs on imported aerospace components and materials, reflecting a strategic effort to reshape supply chain dependencies and protect domestic manufacturing. These duties, targeting items ranging from advanced composite airframes to microelectronic navigation modules, have collectively increased the landed cost of critical hardware. In turn, original equipment manufacturers and system integrators have faced upward pressure on procurement budgets, requiring cost mitigation through design optimization or the diversification of supplier networks.

Importantly, these measures have catalyzed a resurgence in domestic component production. Established aerospace clusters and new technology startups are investing in local fabrication capabilities for avionics and propulsion subsystems, aiming to capitalize on a newly favorable tariff environment. While this transition enhances supply chain resilience, it also demands significant capital investment and development of specialized workforce skills.

On the demand side, elevated component costs are influencing procurement strategies, with end users prioritizing multi-mission platforms and modular architectures that can be upgraded in situ without full system replacement. Consequently, manufacturers are accelerating product roadmaps to deliver adaptable payload interfaces and swappable propulsion units. In addition, alliances with domestic research institutions are intensifying to address the technical and certification challenges of rapidly produced components. Together, these dynamics underscore the complex interplay between tariff policy and industrial strategy shaping the autonomous aircraft value chain.

Uncovering Strategic Insights from Application Platform Propulsion Component End User and Altitude Segmentation in the Autonomous Aircraft Landscape

Delving into the market through the lens of application reveals that autonomous aircraft have found traction across precision agriculture last mile delivery emergency response infrastructure inspection and geospatial mapping. In agriculture the integration of multispectral sensors with autonomous flight controls enables targeted crop health diagnostics and variable rate application, reducing resource consumption and increasing yield potential. For delivery services, AI-driven route optimization paired with vertical takeoff fixed wing hybrids has accelerated turnaround times in dense urban areas and remote regions alike. Emergency response agencies are leveraging unmanned systems to perform rapid situational assessments after natural disasters, while dynamic aerial platforms equipped with thermal cameras are gaining prominence in infrastructure inspections. Surveying professionals are harnessing high-altitude rotary wings to generate highly accurate digital twins of complex terrains.

Platform segmentation further highlights the unique roles played by fixed wing rotary wing and hybrid configurations. Fixed wing models excel in endurance missions spanning hundreds of miles, making them indispensable for long-range surveillance. Rotary wings offer unparalleled maneuverability for low altitude operations and confined spaces, driving adoption in urban mobility and inspection scenarios. Hybrid wing designs, including tilt rotor and multirotor variants, are bridging the gap by providing VTOL flexibility with cruise efficiency, underpinning emergent urban air mobility concepts.

Propulsion segmentation underscores a transition toward sustainability, as purely electric systems powered by battery or hydrogen fuel cells are reducing carbon footprints and noise signatures. Gasoline and jet fuel engines remain integral for high payload endurance missions, while parallel and series hybrid architectures are emerging as transitional solutions, blending renewable energy sources with conventional fuels. Component segmentation points to avionics communication navigation payload and propulsion subsystems as critical areas of innovation, with software-defined avionics stacks and modular payload bays enabling rapid customization. End user segmentation illustrates divergent adoption patterns, as commercial logistics firms value high throughput and cost efficiency, militaries stress mission-critical reliability and autonomy in contested environments, and recreational operators seek ease of use and regulatory compliance. Finally, altitude segmentation reveals differentiated regulatory and technical requirements, with low altitude platforms focusing on obstacle avoidance in urban airspace, medium altitude systems balancing endurance and payload capacity, and high altitude vehicles pushing the boundaries of persistent surveillance and atmospheric research.

This comprehensive research report categorizes the Autonomous Aircraft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Propulsion

- Component

- Altitude

- Application

- End User

Delivering Region Specific Perspectives on Drivers Challenges and Opportunities Across the Americas EMEA and Asia Pacific Markets

In the Americas, established aerospace ecosystems in North America are accelerating autonomous aircraft adoption through symbiotic partnerships between defense contractors and technology innovators. Canada’s expansive airspace has become a testing ground for cargo delivery and emergency medical response trials, while Latin American agricultural hubs are piloting unmanned crop management programs to address labor constraints and optimize yields. The convergence of robust regulatory support and private capital is nurturing a dynamic regional market.

Across Europe the Middle East and Africa, regulatory harmonization efforts led by pan-European aviation authorities are laying the groundwork for cross-border operations. The introduction of unified drone corridors and standardized certification processes has reduced operational friction, encouraging deployment in areas ranging from infrastructure inspection in Scandinavia to solar farm monitoring in the Middle East. African governments are exploring autonomous aerial solutions to improve disaster relief and wildlife conservation, leveraging partnerships with international NGOs and commercial providers.

Asia-Pacific markets are distinguished by a dual focus on innovation hubs and large-scale pilot programs. In China and Japan, state-sponsored initiatives are fast-tracking urban air mobility networks, while Southeast Asian nations are adopting autonomous platforms to bolster connectivity in archipelagic regions. Australia’s vast agricultural landscapes are serving as real-world testbeds for precision farming, with advanced sensor-integrated UAVs demonstrating significant efficiencies in water management and pest control. Across these regions, infrastructure investment and supportive policy frameworks are key enablers of rapid technology diffusion.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Aircraft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Landscapes Partnerships Innovations and Growth Strategies of Leading Players in Autonomous Aircraft Sector

Leading players in the autonomous aircraft domain are pursuing diverse strategies to secure competitive advantage. Established aerospace OEMs are leveraging their manufacturing scale and certification expertise to launch heavy-lift unmanned cargo systems, while software innovators are concentrating on advanced autonomy frameworks that can be retrofitted onto existing airframes. Collaborative ventures between avionics specialists and propulsion firms are accelerating the integration of electric and hybrid-electric powertrains, targeting both urban air mobility and commercial logistics segments.

Simultaneously, emerging disruptors are carving out niches through rapid prototyping and agile development cycles. These companies are fielding purpose-built platforms tailored to specific use cases such as medical supply delivery and disaster response, often securing early contracts with governmental agencies. Strategic partnerships between startups and academic institutions are fueling breakthroughs in energy-dense battery chemistries and AI-driven flight control algorithms. Mergers and acquisitions are reshaping the landscape as larger incumbents acquire nimble innovators to augment their technology portfolios.

In addition, cross-industry alliances are expanding the ecosystem beyond traditional aerospace boundaries. Logistics giants, telecom providers and satellite operators are integrating autonomous aircraft into their service offerings, enabling seamless last mile networks and beyond-visual-line-of-sight command infrastructures. These multi-stakeholder collaborations are essential for overcoming interoperability hurdles and driving scalable deployments at a global level.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Aircraft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroVironment, Inc.

- Airbus S.A.S.

- Archer Aviation Inc.

- Da-Jiang Innovations Science and Technology Co., Ltd.

- Elbit Systems Ltd.

- General Atomics Aeronautical Systems, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Systems Corporation

- Saab AB

- Skydio, Inc.

- Textron Inc.

- The Boeing Company

Proposing Actionable Strategies for Industry Leaders to Enhance Operational Resilience Efficiency and Regulatory Compliance in Autonomous Aviation

To navigate the evolving autonomous aviation landscape, industry leaders should prioritize the development of interoperable platforms that adhere to emerging global standards for safety and data exchange. By investing in modular avionics and plug-and-play payload interfaces, manufacturers can offer flexible solutions that adapt to varied mission profiles without incurring extensive redesign costs. Collaborative engagement with regulatory bodies is critical to shape performance-based certification frameworks that balance innovation with rigorous safety oversight.

Furthermore, leaders must cultivate strategic partnerships across the value chain, aligning with technology providers specializing in edge computing communication networks and advanced sensor suites. Such alliances can expedite time-to-market for new capabilities while distributing risk across multiple stakeholders. In parallel, strengthening supply chain resilience through diversified sourcing strategies and localized production hubs will mitigate exposure to geopolitical uncertainties and tariff fluctuations.

From an operational perspective, adopting outcome-based contracting and pay-per-use models can align stakeholder incentives and foster broader market adoption. By demonstrating clear return on investment through pilot programs and case studies, providers can accelerate decision-making cycles for end users. Finally, organizations should invest in workforce development initiatives, ensuring that engineers and technicians possess the specialized skills required for autonomous system integration and maintenance in both commercial and defense contexts.

Outlining a Robust and Transparent Research Methodology Integrating Qualitative and Quantitative Approaches for Autonomous Aircraft Analysis

This study integrates qualitative insights from executive interviews with aerospace OEM leaders regulatory officials and technology innovators, combined with a comprehensive review of publicly available policy documents technical standards and industry white papers. Primary research was conducted through targeted stakeholder discussions, providing nuanced perspectives on certification timelines supply chain constraints and mission-specific performance requirements.

Complementing these interviews, secondary research encompassed analysis of patent filings corporate filings and conference proceedings to track the evolution of autonomy technologies. Cross-referencing these data points with regional regulatory announcements and partnership announcements enabled triangulation of market dynamics. Additionally, in-depth case studies were developed to illustrate best practices in platform design test methodologies and operational deployment across diverse environments.

The research process adhered to rigorous validation protocols, ensuring that all findings were corroborated by multiple sources. Methodological transparency was maintained by documenting data collection approaches and analytical frameworks, allowing for reproducibility and critical review. This blended qualitative and quantitative methodology offers a robust foundation for strategic decision-making in the rapidly evolving autonomous aircraft ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Aircraft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Aircraft Market, by Platform

- Autonomous Aircraft Market, by Propulsion

- Autonomous Aircraft Market, by Component

- Autonomous Aircraft Market, by Altitude

- Autonomous Aircraft Market, by Application

- Autonomous Aircraft Market, by End User

- Autonomous Aircraft Market, by Region

- Autonomous Aircraft Market, by Group

- Autonomous Aircraft Market, by Country

- United States Autonomous Aircraft Market

- China Autonomous Aircraft Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Imperatives from the Autonomous Aircraft Study to Guide Future Investments and Policy Directions

In summary, autonomous aircraft are poised to reshape aerial operations across a variety of sectors by delivering enhanced operational efficiency safety and mission flexibility. Technological advancements in sensor fusion edge computing and propulsion are converging with progressive regulatory frameworks to unlock new use cases, while shifting commercial models are democratizing access to these capabilities. Tariff-driven supply chain realignments have invigorated domestic manufacturing but also underscored the need for cost optimization and design modularity.

Segmentation analysis reveals that diverse applications from agriculture to emergency response are driving differentiated platform requirements, while propulsion and altitude categories are dictating technology trajectories toward sustainable and high-endurance solutions. Regionally, the Americas EMEA and Asia-Pacific each present unique adoption drivers, regulatory landscapes and investment priorities, highlighting the importance of tailored market entry strategies. Competitive dynamics are intensifying as established aerospace players and agile startups vie for leadership through partnerships innovation and M&A activity.

Looking ahead, industry leaders must embrace collaborative ecosystem-building, prioritize regulatory engagement and invest in adaptable architectures to maintain momentum. By aligning product roadmaps with evolving certification standards and end user needs, organizations can realize the full potential of autonomous aviation. This conclusion encapsulates the strategic imperatives essential for stakeholders to navigate complexities and capitalize on emerging opportunities in the autonomous aircraft domain.

Encouraging Decision Makers to Connect with Ketan Rohom to Access the Comprehensive Autonomous Aircraft Market Research Report

To explore deeper insights into autonomous aircraft technologies and discover how strategic intelligence can unlock growth opportunities, we invite you to reach out directly to Ketan Rohom. As the Associate Director for Sales and Marketing, he can guide you through the comprehensive research report tailored to address your organizational needs and support data-driven decision-making in this dynamic landscape. Engage today to secure access to detailed analysis, strategic recommendations, and proprietary data that will empower your team to stay ahead of emerging trends and regulatory shifts in the evolving autonomous aviation market.

- How big is the Autonomous Aircraft Market?

- What is the Autonomous Aircraft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?