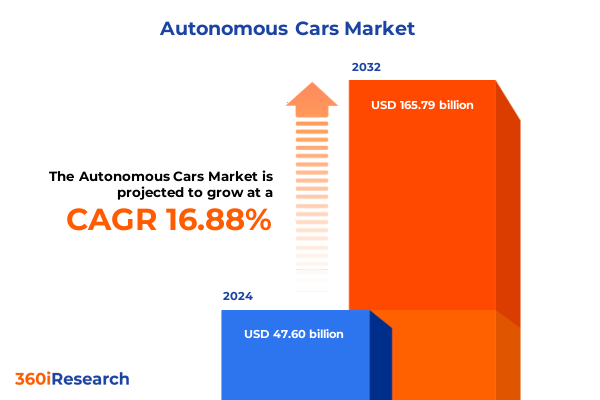

The Autonomous Cars Market size was estimated at USD 54.64 billion in 2025 and expected to reach USD 63.37 billion in 2026, at a CAGR of 17.18% to reach USD 165.79 billion by 2032.

Unveiling the Autonomous Car Revolution and Strategic Industry Drivers That Will Redefine Mobility Ecosystems Globally Amid Technological Marketization

The autonomous car industry stands at a pivotal juncture where decades of technological advancements converge with evolving regulatory landscapes to create unprecedented opportunities for innovators and investors alike. Artificial intelligence and sensor fusion technologies now enable vehicles to perceive and navigate complex environments with a level of precision that was once the realm of science fiction. At the same time, strategic partnerships between automakers, technology firms, and governments are accelerating the translation of research prototypes into commercial solutions. These developments have triggered a ripple effect across supply chains, spurring demand for specialized hardware components such as LiDAR and radar, as well as sophisticated software platforms capable of real-time data analysis and decision-making. As autonomous systems mature, they are beginning to demonstrate value beyond safety and convenience, unlocking new mobility-as-a-service models and redefining ownership paradigms for corporate fleets and individual consumers.

Moreover, the confluence of 5G connectivity and edge computing is establishing the infrastructure backbone needed to support vehicle-to-everything communication, while regulations in key markets are gradually adapting to accommodate higher levels of autonomy. Consumer acceptance is rising as pilot programs in urban centers showcase reliable, driverless ride-hailing and shuttle services. Against this backdrop, industry stakeholders must navigate complex technical, regulatory, and economic factors to secure a leading position in the evolving autonomous ecosystem.

How Converging Technological Breakthroughs and Evolving Consumer Expectations Are Catalyzing a Fundamental Shift in Autonomous Mobility Paradigms

Over the past decade, the autonomous car landscape has undergone transformative shifts driven by breakthroughs in machine vision, deep learning, and advanced driver-assistance systems. What began as lane-keeping prototypes has evolved into fully integrated Level 4 pilot programs operating in complex urban environments. These technological leaps have been catalyzed by dramatic cost reductions in high-resolution sensors and compute platforms capable of trillions of operations per second, making real-time perception and path planning commercially viable. At the same time, data aggregation and simulation tools have become more sophisticated, allowing developers to iterate rapidly and validate safety under millions of virtual scenarios.

In parallel, shifting consumer expectations are fueling demand for mobility solutions that prioritize seamless user experiences and sustainability. The emergence of electrified propulsion systems has dovetailed with autonomy, creating synergies that reduce total cost of ownership while delivering cleaner and quieter transportation. Strategic alliances are also reshaping the competitive landscape, as traditional OEMs collaborate with software vendors and startups to accelerate time to market. Finally, public sector initiatives are playing a critical role in enabling this progression; city-scale pilots, regulatory sandboxes, and infrastructure investments are bridging the gap between laboratory demonstrations and wide-scale deployment. Together, these converging shifts are redefining the rules of engagement for every stakeholder in the autonomous mobility value chain.

Assessing the Escalating Impact of United States Section 301 Tariffs on Autonomous Vehicle Supply Chains, Innovation, and Manufacturing Economics

Since the imposition of Section 301 tariffs on Chinese electric vehicles, batteries, and key components, U.S. automakers and suppliers have felt a growing cost burden. These measures, originally enacted in 2018 and adjusted through late 2024, have increased duty rates on electric vehicles to 100 percent and on lithium-ion EV batteries to 25 percent, alongside other hardware categories subject to 25 to 50 percent levies barring limited exclusions (White & Case LLP). Consequently, General Motors reported a $1.1 billion second-quarter hit in operating income attributable to tariffs, underscoring the compression of margins even as volumes expanded (Washington Post).

In response, manufacturers are accelerating localization efforts by shifting production lines to North American facilities and diversifying supply chains beyond China. While these strategies mitigate exposure over the mid to long term, the immediate impact includes increased unit costs passed through to tier 1 and tier 2 suppliers, who in turn are reevaluating procurement contracts and engineering specifications. Raw material sourcing, especially for LiDAR modules, radar elements, and advanced semiconductors, now factors in country-of-origin and tariff classification as primary decision criteria. As the tariff landscape continues to evolve, U.S. policy resets and trade negotiations will play a decisive role in the pace of autonomous technology adoption and the financial health of participating companies.

Illuminating Market Dynamics Through a Comprehensive Segmentation Lens Spanning Vehicle Types, System Components, Autonomy Levels, Propulsion, Technologies, and End Users

A nuanced understanding of market segmentation illuminates where value is being created and where competitive tensions are most acute. When analyzed by vehicle type, passenger cars such as sedans-whether compact, mid-size, or luxury-intersect with growth in shared mobility services, while SUVs and hatchbacks remain essential for both individual customers and corporate fleets seeking flexibility. Among system components, hardware elements like cameras, LiDAR, radar, and sensors form the sensory network that fuels autonomy, yet they are deeply integrated with processing software, data management platforms, and AI algorithms that deliver real-time mapping, localization, and decision-making capabilities.

The stratification of autonomy levels from driver assistance to full automation further shapes R&D and commercialization roadmaps. Level 2 systems continue to generate revenue through advanced driver-assistance features, whereas Level 4 and Level 5 innovations are incubated within controlled operational design domains, including robotaxi deployments. Propulsion segmentation reveals that battery electric vehicles are at the vanguard of autonomous integration, complemented by hybrid and fuel cell variants in specialized applications. Cutting-edge technologies such as adaptive cruise control, blind spot detection, and pedestrian recognition enhance safety layers and user trust. Lastly, the spectrum of end users ranges from government transport authorities deploying autonomous shuttles to corporate logistics operators piloting driverless delivery, underscoring the diversity of business models and investment priorities in the autonomous space.

This comprehensive research report categorizes the Autonomous Cars market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Level of Autonomy

- Propulsion

- Technologies

- End User

- Vehicle Type

Deciphering Regional Variations in Autonomous Vehicle Adoption and Innovation Across the Americas, Europe Middle East and Africa, and the Asia Pacific Markets

Regional dynamics exert profound influence on the trajectory of autonomous vehicle development and deployment. In the Americas, extensive public-private collaborations are fostering dense test corridors and regulatory frameworks that accommodate Level 3 and Level 4 operations. North American OEMs have capitalized on advanced manufacturing capabilities and robust investment in EV infrastructure, positioning the region as a pivotal testbed for both consumer and commercial applications.

Europe, the Middle East, and Africa present a mosaic of regulatory environments, where the European Union’s harmonized safety standards coexist with emerging pilots in the Gulf Cooperation Council. The region’s emphasis on sustainability accelerates the convergence of electrification and autonomy, while localized incentives in countries such as Germany and the United Kingdom support R&D clusters. Meanwhile, infrastructural constraints and varied liability laws across member states challenge pan-regional scalability.

Asia-Pacific leads global adoption metrics, driven by concentrated urbanization, substantial public funding, and cooperative ecosystems between technology giants and national governments. China’s city-scale autonomous taxi services and renewable energy mandates provide a roadmap for accelerated integration, while Japan and South Korea emphasize precision sensor development and intelligent transport systems. Collectively, these regional distinctions define competitive advantages and guide investment strategies in an increasingly interconnected market.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Cars market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Pioneering Companies and Strategic Collaborations Driving Innovation, Competitive Differentiation, and Ecosystem Development in Autonomous Driving

Leading corporations have established differentiated positions through unique technological architectures, strategic alliances, and scale of operations. Waymo continues to expand its robotaxi footprint beyond U.S. flagship cities by leveraging partnerships with automakers to drive down vehicle costs and broaden service areas. Tesla, integrating a camera-first approach, focuses on full self-driving software delivered via over-the-air updates, and aims to monetize its existing fleet through ride-hailing services by the end of 2025 (Financial Times). Meanwhile, GM’s Cruise division has forged collaborations with local governments to deploy commercial fleets in select municipalities, underscoring the importance of stakeholder engagement in operational rollout.

In the hardware domain, Mobileye’s modular sensor stacks have become industry benchmarks, underpinning systems for both OEM and retrofit markets. NVIDIA’s DRIVE Thor platform, with its unprecedented compute density, is enabling manufacturers to embed advanced AI workloads on the vehicle, accelerating real-time perception and predictive analytics (Astute Analytica). Other notable players such as Mobileye, Baidu Apollo, and Aurora are differentiating through proprietary mapping data, sensor fusion algorithms, and fleet management software, creating fertile ground for consolidation as scale economies become paramount. These competitive dynamics illustrate how technology specialization and collaborative networks are shaping the autonomous mobility ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Cars market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Argo AI

- Aurora Innovation Inc.

- Baidu Inc.

- BMW AG

- Cruise LLC

- Ford Motor Company

- General Motors Company

- Honda Motor Co. Ltd.

- Hyundai Motor Company

- Kia Corporation

- Lucid Motors Inc.

- Mercedes-Benz Group AG

- Nissan Motor Co. Ltd.

- Nuro Inc.

- Rivian Automotive Inc.

- Stellantis N.V.

- Tesla Inc.

- Toyota Motor Corporation

- Volkswagen AG

- Volvo Car Corporation

- Waymo LLC

- Zoox Inc.

Strategic Actions and Tactical Roadmaps That Industry Leaders Can Implement to Navigate Disruption, Drive Growth, and Capitalize on Emerging Autonomous Mobility Trends

Industry leaders aiming to sustain momentum and capture long-term value must adopt a proactive approach that balances technological advancement with strategic partnerships. First, investing in modular hardware architectures and scalable software stacks will enable rapid feature deployment across multiple vehicle platforms while managing R&D costs. At the same time, creating multi-stakeholder consortiums that include regulators, suppliers, and city planners can accelerate the establishment of testing corridors and secure first-mover advantages in key markets.

Second, companies should prioritize supply-chain resilience by diversifying component sourcing and developing near-shore manufacturing capabilities for critical sensors and compute modules. This reduces exposure to geopolitical disruptions and mitigates tariff impacts on imported goods. Third, developing robust data-governance frameworks that emphasize cybersecurity, privacy compliance, and transparent risk mitigation will foster consumer trust and meet evolving regulatory requirements. Furthermore, forging alliances with telecom providers to enable V2X and edge computing infrastructures will position organizations to leverage real-time connectivity advantages. Lastly, embedding sustainable practices-such as circular-economy programs for battery and hardware recycling-will align autonomous mobility strategies with corporate ESG objectives and strengthen brand value.

Methodological Framework Underpinning Rigorous Data Collection, Expert Consultations, and Quantitative and Qualitative Analyses Supporting Autonomous Car Market Insights

The insights presented are derived from a rigorous multi-stage research methodology designed to ensure validity and relevance. Secondary research included a comprehensive review of regulatory filings, white papers, technical standards, and patent databases to map the evolution of core technologies. Concurrently, quantitative data from government agencies and industry associations were triangulated to identify adoption patterns and infrastructure investments across regions.

Primary research encompassed structured interviews with senior executives, engineers, and policymakers, providing firsthand perspectives on commercialization timelines, safety validation protocols, and future R&D priorities. To enhance reliability, responses were cross-verified through follow-up consultations and corroborated against published pilot program results. Advanced analytics, including scenario modeling and sensitivity analysis, were employed to stress test assumptions and quantify risk factors associated with tariffs, supply chain disruptions, and regulatory shifts.

Finally, qualitative frameworks such as SWOT analysis and Porter’s Five Forces were integrated to contextualize competitive dynamics and assess long-term strategic imperatives. This blended approach of quantitative rigor and expert insights underpins the detailed segmentation, regional, and company profiles that drive the report’s actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Cars market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Cars Market, by Level of Autonomy

- Autonomous Cars Market, by Propulsion

- Autonomous Cars Market, by Technologies

- Autonomous Cars Market, by End User

- Autonomous Cars Market, by Vehicle Type

- Autonomous Cars Market, by Region

- Autonomous Cars Market, by Group

- Autonomous Cars Market, by Country

- United States Autonomous Cars Market

- China Autonomous Cars Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Critical Findings and Strategic Takeaways That Frame the Autonomous Car Industry’s Path Forward in an Era of Rapid Technological Transformation

The autonomous car industry is poised for accelerated transformation as a result of converging innovations, supportive policies, and evolving consumer mindsets. With sensor and AI costs declining and regulatory frameworks adapting, the deployment of Level 4 and Level 5 systems is becoming economically feasible beyond pilot programs. Strategic segmentation reveals that while software and data management solutions capture significant value, hardware advancements in LiDAR, radar, and compute platforms remain critical enablers of safety and reliability.

Regional analysis underscores the competitive interplay between the Americas, EMEA, and Asia-Pacific, each offering distinct advantages in regulatory support, funding ecosystems, and infrastructure maturity. Meanwhile, companies that effectively blend proprietary technologies with open partnerships are securing leading positions in robotaxi services, fleet automation, and shared mobility models. Nevertheless, stakeholders must remain vigilant of geopolitical headwinds, tariff pressures, and evolving data privacy norms that could shape market trajectories.

Looking ahead, those that integrate resilient supply chains, robust governance structures, and sustainable lifecycle strategies will differentiate their offerings and mitigate risk. Ultimately, the ability to pivot swiftly in response to technological breakthroughs and policy changes will determine which organizations emerge as the architects of a driverless mobility future.

Take the Next Step Toward Autonomous Vehicle Market Leadership by Engaging with Ketan Rohom for Exclusive Access to Our Comprehensive Market Research Report

Don’t let opportunity pass as autonomous mobility reshapes the automotive world. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your exclusive copy of the comprehensive market research report on the autonomous car industry. Empower your strategic decision-making with granular insights, validated data, and forward-looking analyses that illuminate emerging technologies, competitive dynamics, and regional nuances. Contact Ketan Rohom to unlock the knowledge that will accelerate your roadmap, refine your go-to-market strategies, and position your organization at the forefront of this transformative era.

- How big is the Autonomous Cars Market?

- What is the Autonomous Cars Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?